Enrollment is currently closed.

More money, time and financial security without seeing more patients.

This is what happens inside Money for Women Physicians.

12-WEEK PROGRAM

Jan 24 - April 14, 2024 | CME ELIGIBLE

You work hard, year after year. You show up, give your all, change so many lives, and before you know it, another year is done.

You’ve been through so much, given so much, and yet you are so far from where you want to be financially.

Being there so much for others and feeling like you haven’t come very far for yourself.

I get it - and you’re not alone.

If you were as confident with money as you are with putting your patients at ease, you’d be financially free by now.

Money feels confusing for a few reasons:

You weren’t taught money like you were taught medicine.

There isn’t “money school” which speaks to what you personally need to make more.

Most people talk to one-size-fits-all solutions that aren’t relevant for high income women like us.

Women are socialized to believe that money is hard and complicated (they couldn’t own property or get a credit card until this past century). So it’s normal to have internalized money beliefs that impact your financial goals.

Most financial education comes from men, and so their situation is different to yours. Most of the time, he is the breadwinner, and has a wife at home with the children and taking care of the house. That isn’t the case for you potentially. You are the breadwinner *and* mom too, and so it’s a whole different ballgame.

There is nothing wrong with that, but you know you need a different solution.

One that works for *you*. For your life, your career and your family.

It's easy for money to be something else that goes on the back burner, but you know that it should be easier than this.

You know if you did a few things differently you’d have way more money and you wouldn’t have to work as much.

You know the key to more money isn’t longer hours, it’s working smarter.

This is where I come in.

I will help you:

Grow other streams of income so that you are no longer solely dependant on your clinical income.

Confidently ask for a raise because you know the value you provide.

Spend money purposefully instead of over or under spending based on what you see in your account.

Confidently make money decisions and no longer rely on your financial advisor to tell you what to do.

Feel calmer and relaxed about money no matter what the numbers are.

Have the courage to pursue what your heart really desires - whether that’s starting your dream practice, going part time or pivoting to something completely different.

I'll help you make money and life much easier.

How do I know?

Because I’ve done it and I’ve witnessed hundreds of women physicians, just like you, do the same.

Hi! I'm Bonnie Koo. I’m a master certified life & money coach, author of Defining Wealth for Women, a dermatologist, mom and partner.

Hi! I'm Bonnie Koo. I’m a master certified life & money coach, author of Defining Wealth for Women, a dermatologist, mom and partner.

I know what it's like to have "made it" and secretly struggle with money. (Despite making multiple six figures I never seemed to have enough money.)

When I learned that the way I think about money affects how much money I have AND learned what really grows money – it changed everything. And now?

I’ve replaced my physician salary doing something I love more 🥰.

I have money coming in from multiple income sources.

And now I only do what’s fun and meaningful to me as a physician - teach and staff resident clinics.

I’ve since taught thousands of women to completely change their relationship with money and have more of it.

I’ve witnessed women fall back in love with their job, go part time, create businesses, become real estate investors – and most importantly, I watched woman after woman step into confidence and peace of mind around her money.

This is what happens in my world - you can do it too.

"If you have dreams to achieve, you need this course!"

“I’ve always worked for organizations that wanted physicians to see a certain number of patients per day, toe the line, etc. I dreamed of opening my own private practice, where I could practice medicine in an integrative way that really helped people, but I had no idea how to get that off the ground.

“So when I discovered Bonnie, her message about ‘you should have choices about the way you practice medicine’ really resonated with me. Because of what I learned in the course, I was able to purchase commercial office space, which is something I wouldn’t have known about if not for Bonnie. I’m about a month away now from opening my own practice and I couldn’t be more thrilled.

“Bonnie shifted my mindset about so many things, which is helping me follow my dreams. She’s just so relatable and inspirational, and the course community is full of supportive, like-minded people who all want to achieve similar things.”

Dr. Val C.

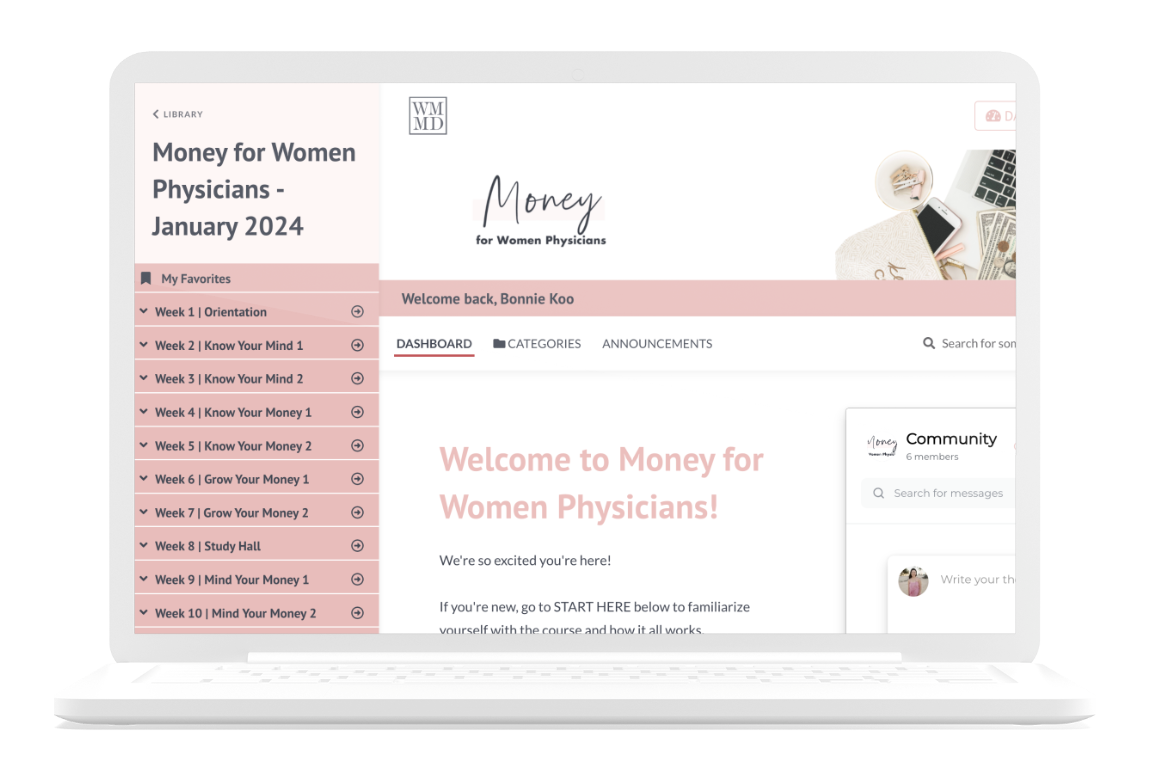

Here's what you need to know

We meet on Zoom twice a week (most weeks) starting January 24-April 10, 2024:

- Wednesdays 8pm EST

- Sundays 1pm EST

Every call is recorded if you can't make them all.

I've distilled the 4 essential steps to creating financial freedom on your terms:

1 - Know Your Mind: Learn the truth behind 90% of your money struggles - how you think about money. You'll examine where you are now and how to think differently so you can have more confidence around money.

2 - Know Your Money: Look at your numbers so you can know where your money's been going and learn how to spend purposefully.

3 - Grow Your Money: Make decisions on how to make your money work for you not the other way around.

4 - Mind Your Money: You'll make sure your money is protected. You'll continue to grow your mind - your best incoming producing asset and watch your material assets grow as well.

When you master these core skills, financial freedom is inevitable.

“Money for Women Physicians is a course every woman physician needs to take, ASAP."

"You’ll notice your bank account, investment portfolio, and your mind just exploding with growth! That’s what happened to me. If you’re thinking about signing up for Bonnie’s course, you will not be disappointed. Just. Do. It.”

Dr. Kate M.

Here's what's included:

January 2024 Cohort Dates: Wed 1/24/24 - 4/10/24

Core Money Lessons

Money Dashboard Spreadsheet, Money Glossary and PDF Worksheets

Twice a Week Live Teaching and Q&A Calls

Private Members-Only Online Community

Up to 20 AMA PRA Category 1 Credits

Luxurious Welcome Gift

In our 3 months together, you'll get your money organized and grow your money for years to come.

Here’s what you will learn and take action on:

MONEY MINDSET

Before we ever get into the nuts and bolts of personal finance, we’ll get to the root cause of your financial woes: your money mindset.

Most of us grow up thinking about money in a way that prevents us from ever becoming wealthy. You'll learn the secrets behind changing that mindset so you can become wealthy.

CASHFLOW

A big piece of the money stress puzzle is simply not knowing what’s happening with your money (aside from the grief of watching all of it go toward paying your monthly bills!). We don’t like to use the “b” word (budget) around here, so instead we call it your Spending Plan.

We don't focus on frugality -- you won't scrimp, save or feel deprived here.

No matter what, you need to understand those numbers before you can even begin addressing them. Again, this is where mindset changes can help you. You’ll learn to see all of those numbers as just numbers. This subtle psychological shift will have a huge impact on your spending.

INVESTING

Is your paycheck your only source of income? If so, you’ve set yourself up to fail. The real secret to wealth is to take that money and put it to work making more money via a strategic investing plan that will create long-term, money-making machines for you. In other words, you'll start creating and growing other streams of income.

ASSET PROTECTION

Don’t make all of that money only to lose it! You absolutely need to insure yourself against financial catastrophes. This step is so critical and often-overlooked. I’ll show you exactly which insurances you need and how to prioritize them.

ESTATE PLANNING

Death is inevitable but also unpredictable. What will happen to your family and loved ones after you die? What impact do you want to have in this world? Do you want to create generational wealth? Planning for your estate is the last piece of financial “adulting” you need to learn before we put it all together.

Bonus content includes how to invest money for your kids.

“Money for Women Physicians was the first time someone explained to me what was happening in terms of my money.”

“Based on what I’ve learned in Bonnie’s course, I did a Roth conversion for my retirement accounts and started investing in passive real estate. There’s a lot of high-yield information.

“As doctors, our patients depend on us to explain what is happening to them medically. Bonnie’s course was the first time someone explained to me what was happening in terms of my money. If you have zero financial knowledge like I did, this course can be life-changing.”

Dr. Jyoti B.

"You will not be disappointed!”

“This course invigorates and motivates women to understand that we can have control and it can be easy to understand despite our busy schedules. I am more motivated to take care of every aspect of my wealth. In addition, this is a wonderful resource for networking!!! You will not be disappointed!”

Dr. Kristina K.

Meet some of our amazing clients

Jessica (Pediatrician)

Agnes (Dermatologist)

Christina (Cardiologist)

Heidi (Obgyn)

Lea (Family Medicine)

"Since starting in the course, I've invested in an index fund, identified another bond fund I want to invest in for longer term goals, and also identified a passive income real estate investment company I'm interested in working with. I've contacted a lawyer for estate planning and bought umbrella insurance."

Dr. Alanna L.

“I told myself that as a physician, I had plenty of time to deal with it later. “

“I took the “ostrich” approach to debt--especially student loans. I told myself that as a physician, I had plenty of time to deal with it later. Now that I’ve taken the course, I realize I have to take control of my finances if I want a good future for my family.

“I’m no longer afraid of my debt and I have a plan to get it under control! I’ve already started investing – something which used to scare me. I highly recommend this course.”

Dr. Kelly

You might be wondering ...