As a parent, you've got the future on your mind. You want the best for your child, and sometimes that means private school. Of course, that came come with a hefty price tag. Here's everything you need to know about how to save for private school and beyond.

You likely already know that 529 plans allow you to save and invest money tax-free for college. Some states also give you a tax break incentive to contribute. But you may not be familiar with the Coverdell ESA.

What is an ESA?

The ESA is similar to the 529 plan in that you contribute after-tax money. It also grows tax free and is tax free on withdrawal if used for qualified educational expenses. Unlike the 529 account, you can purchase a computer with an ESA.

There are a few other key differences:

- There is no federal or state tax deduction for contributing to one

- The annual contribution limit is $2,000

- The ESA can be used for private school (pre-college) and college and graduate school

- There is a income limit to contribute to one: $110,000 single or $220,000 if filing a joint return*

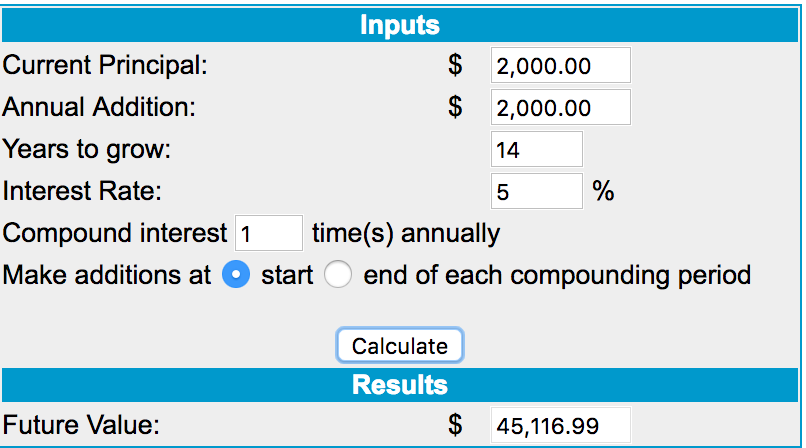

The main reason to open is if you plan to send your kid(s) to private school. $2,000 a year does not sound like much. but if you start early and let compound interest do its magic,you might be surprised:

By the time your kiddo enters high school, you'll have a decent amount saved (depending on where you are – this may pay for 1 year of private high school in NYC …).

What about the income limit? There is a backdoor way of course. You won't be able to open one up yourself but your kiddo can!

How to do a Backdoor ESA to Save for Private School

You gift the money to your child usually through a UTMA account. The $2,000 counts towards the annual gift tax limits, so keep that in mind when you're also funding a 529.

In any given year, the beneficiary can only receive $2,000 a year towards an ESA. So unfortunately, Grandma can't open one for your kiddo and contribute an additional $2,000 annually.

Also, the money must be used by the time the beneficiary turns age 30. A tip is that the money can be rolled over to another beneficiary within the same family. So if you wanted more money for your kiddo over the $2,000 annual limit, you could fund another family member's ESA (they must younger than 30) and then roll it over in the future.

Where should you open a Coverdell ESA? As with any investment account, you want to minimize account and trade fees and have flexibility with how to invest the money.

At this time, I recommend etrade and TDA for no account fees and low to no cost trade fees to help you start to save for private school.

Final Thoughts on How to Save for Private School and Beyond

Using a combination of a 529 savings plan and a Coverdell ESA can help make the costs of private school, college, and beyond a bit more manageable. While it might not seem like enough, the earlier you start, the better. In fact, you can even open a 529 before your child is born. By taking the first step outlined here on the Backdoor Coverdell ESA, you can let compounding help you save for private school starting today!

Do you have an ESA? Comment below!]]>

Get the bestselling book - Defining Wealth for Women.