Protect Yourself

This page will be updated as information changes. Please let us know if you find any errors and we will update this page.

[ Disclosures: Please note that some of the links below are affiliate links. This means that I may receive a commission if you purchase through one of my links. I highly recommend all of the products & services because they are companies that I have found to be helpful and trustworthy. I use many of these products & services myself. ]

During these unprecedented times, there are several temporary changes that can affect you financially. In addition, the pandemic has highlighted for many of you the importance of being adequately insured and to make sure your estate plans are in place. We can never know when we will pass, but we do know it will happen at some point. The best time to do estate planning is now.

General

Breaking: Coronavirus Aid, Relief, and Economic Security Act, or the CARES Act was signed into law on 3/27/2020

Highlights:

- Ability to withdraw up to $100,000 from IRAs before age 59.5 without penalty and tax-free IF you re-contribute it within 3 years. If you do not pay it back within 3 years you will owe income taxes only and no 10% penalty.

- Ability to take up to $100K loan from your 401(k), previous limit was $50K. It looks like you can defer repayments until 2021.

- Suspension of RMDs (Required Minimum Distributions) for 2020

- Student Loan relief for federal loans (see below)

- Cash checks for qualifying individuals/families (most attending physicians will not qualify based on income). This phases out between $75,000 and $99,000 ($150,000 and $198,000 married) in adjusted gross income.

- Increased unemployment benefits, including self-employed & contractors

Taxes

Now updated to include CARES Act that passed on 3/27/2020

The federal deadline for filing, making estimated payments, and extension payments is now 7/15/20 (from 4/15/20).

$300 above the line deduction for charity, even if you not itemize. This is for 2020 only.

Roth IRA contributions are also extended until 7/15/20. It also looks like this includes HSA contributions.

There are other provisions that are unlikely to affect most of my readers (real estate investor benefits, etc).

States are slowly deciding if they will extend their deadline or not, so be sure to check in with your respective state(s).

Insurances

Life Insurance

No changes for obtaining term life insurance except that some companies are waiving some or all of the physical exam and laboratory requirements depending on your application.

I’ve gotten questions from readers about whether the pandemic will affect term life insurance payouts. The answer is probably not. This is due to two major factors – the majority of the deaths will be older adults who no longer carry term life insurance and because most people are not insured.

Disability Insurance

Principal is currently waiving physical and laboratory exams for policies up to $10,000 (attendings only).

Guardian is also waiving physical and laboratory exams for those age 45 and younger.

Regardless, if you’re reading this and do not have your own-occupation disability policy, now is the time to obtain it. Here is a primer on disability insurance.

My recommended agents are:

Lawrence Keller of Physician Financial Services – (516) 677-6211

And

Stephanie Pearson, MD of Pearson Ravitz – (610) 658-3251

Estate Planning

Estate planning is top of mind for many folks. Here are some resources to guide you:

In Case of Emergency binder is 40% off right now.

What is this? Would your spouse and loved ones know what to do when you pass? Do they know how to access your accounts and other important documents? That’s why you need a legacy binder. Death planning is, unfortunately, the high priority item that rarely gets done before your loved ones need it. It’s probably due to a combination of thinking you will have plenty of time to get to it and avoiding thinking about your demise.

Here is a blog post on the basics of estate planning.

I’ve partnered with Anderson Advisors for estate planning, specifically with creating a living trust. As a special bonus to my readers you will get free unlimited amendments to your trust.

Student Loans

Certain federal loans will have some reprieve, specifically:

- Direct Student Loans (Direct Stafford Subsidized, Direct Stafford Unsubsidized, Direct Grad PLUS, Direct Parent PLUS, Federally Held FFEL, Federally Held Perkins)

- FFEL if federally held

- Perkins Loans if federally held

- 6 months suspension of loan payments and NO interest through September 30, 2020

- These 6 months still count towards PSLF and other Income Driven Forgiveness programs

If you're pursuing PSLF – basically do nothing, payments will automatically stop (supposedly). If you're not but still have federal loans that qualify…then sit tight and DO NOT refinance privately…take advantage of 0% interest! This is a good source of extra cash right now.

No reprieve for those with private loans but rates are low now, so if it's been a while since you refinances, it's not a bad idea to see if you can get a lower rate. Get an additional 0.25% off when you refinance with SoFi and check out the other bonuses I have negotiated for you here.

On March 20, 2020, it was announced that student loan payments (for certain federal loans only) can be suspended for 60 days. You must contact your student loan servicer to put your loans into a 60-day forbearance with no payments as this is not done automatically.

Interest on federal loans are waived for 60 days as well.

There is no change for privately held student loans (most refinanced loans). However, with all loans you can apply for forbearance if you need to.

In proposal: The Student Debt Relief Act, would cancel $30,000 in student debt for borrowers. The forgiveness would also be tax-free, meaning it would not be taxed as income. For those who owe more than $30,000, the government would assume their monthly payments. Additionally, all efforts by the Department of Education to collect debts would be suspended.

Mortgage Refinancing

Rates are not going down and many lenders are experiencing bottle-necks due to increased demand and COVID-19.

It’s not a bad idea to take out a HELOC if you’re qualified, to have cash on hand.

Small Businesses

Here is a resource for those of you with small businesses (private practices included) detailing the recent changes to help you: https://gusto.com/blog/business-finance/coronavirus-relief-resources

Please contact me if anything is incorrect or if I should add anything to this page.

Read MoreDisclaimer: Please note that some of the links below are affiliate links. This means that I may receive a commission if you purchase through one of my links. I highly recommend all of the products & services because they are companies that I have found to be helpful and trustworthy. I use many of these products & services myself.

This is a repost about creating a Legacy Binder for your family and loved ones. Every year, the ICE binder goes on sale (25% off) the first week of January to encourage you to take action. This year the sale begins January 1, 2020 and ends January 8th.

One of the first financial to do's is to protect your income and dependents through life and disability insurances. But do you have a will? Would your spouse and loved ones know what to do when you pass? Do they know how to access your accounts and other important documents? That's why you need a legacy binder. Death planning is, unfortunately, the high priority item that rarely gets done before your loved ones need it. It's probably due to a combination of thinking you will have plenty of time to get to it and avoiding thinking about your demise.

Start Your Legacy Binder with a Letter of Instruction

Your loved ones will reel from your death. Hopefully, you are adequately insured so they can take enough time to grieve and sort out your matters (and pay for counseling). Do you want them to be mired in tracking all your accounts, passwords, and other important paperwork? I'm guessing no. Make those logistics the easy part of dealing with your death. How? I recommend creating at the minimum a “Letter of Instruction.” This is an informal document (not the will) to guide the executor of your estate and your loved ones on important information that is in addition to your will. You can create this document yourself to ground your loved ones in all of the essentials.

What goes in a Letter of Instruction?

Make sure it includes the following information:

- Legal documents. Specify the location of all important legal documents they may need to handle your estate. These include the will (the original copy), social security card, birth certificate or passport, marriage and/or divorce papers, property deeds, automobile titles, etc.

- Financial information. Provide a list of all your financial accounts and account numbers: bank accounts, brokerages, retirement accounts.

- Passwords to your accounts. Make sure to include passwords for financial information, email, social media. I highly recommend using a password manager such as LastPass. This is what we use. In case you didn't know, Facebook allows you to name your legacy contact.

- Burial instructions. Tell your loved ones the exact details, including the name of the cemetery and plot location. Or if you desire to be cremated, be sure to include instructions as to how you want your ashes distributed. If you are a veteran, you may wish to look into being buried at a National Cemetery.

- Contacts. A list of family members (and your relationship to them–basically a family tree) and friends you would like to be notified of your death. Phone numbers and addresses are helpful in addition to email addresses.

- Policies. List all life insurance policies. Keep a copy of the policy page and the beneficiary designations. We use LastPass to store all our important policy pages.

- Tax information. Give the location of recent income tax returns and any necessary accounting information.

- Debts. Make a list of any outstanding debts.

- Professional contacts. Provide contact information for your CPA, attorney, insurance agents, etc.

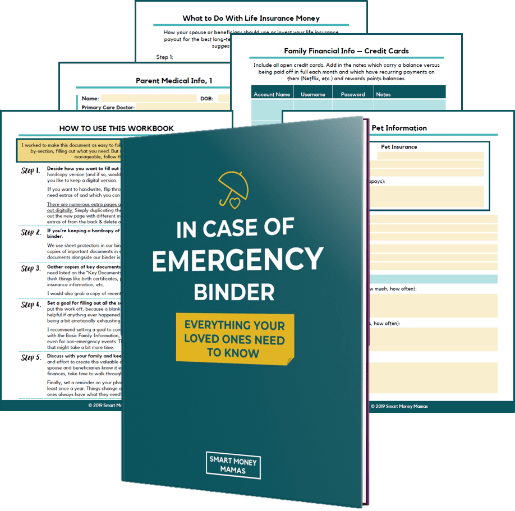

The In Case of Emergency Binder

If you're like me, you'd be more likely to do this with a fill-in-as-you-go workbook:

Chelsea of Smart Money Mama's developed this In Case of Emergency Binder (ICE) for her own family to get organized in the event of, well, an emergency. Emergencies include not only death, but a natural disaster or severe illness. I purchased her ICE binder in 2018 and, of course, have been slow to finish this important document. I did finally get in touch with an attorney about having our estate plan documents reviewed since we moved states over a year ago and have since moved states again.

Make this one of your family's financial goals for 2020. And once it is completed, store this document in your estate plan binder and digitally. LastPass is not only a password manager for your whole family but it can store digital documents securely.

Final Thoughts on the Importance of a Legacy Binder

Whether you purchase a pre-made legacy binder, work with a legal professional to create one, or design your own, get it done. Not next year, not in the next six months. Make a commitment to yourself and your family to start your legacy binder right away. No one wants to think about their death, but it is a fact of life. A legacy binder protects your loved ones and should offer you the ultimate peace of mind knowing that your wishes will be respected and your loved ones will be cared for after you're gone.

Is your family prepared in the event of your untimely death? If not, get started!

Read MoreEditor’s note: This is a guest post from a fellow business owner, Johanna Fox. Johanna is a CPA, CFP®, RLP® and senior partner at Fox and Company Wealth Management Services. Her woman-owned firm is fee-only and provides comprehensive portfolio and tax management services to physicians. Johanna is also a forum moderator and frequent contributor to The White Coat Investor. We have no financial relationship. Enjoy!

One of the most common questions we receive from solo business owners (physicians who either moonlight, have a side business, or are starting a business) is: which entity should I choose?

Let’s look at the three most popular choices:

- Sole proprietor – A sole proprietorship is the simplest form of entity. If your services are covered by an appropriate malpractice policy, it’s also probably the best choice for you. In essence, there are no special filings except maybe a local business license. You’ll file your business results (income and expenses) on a Schedule C with your Form 1040 and you’ll pay FICA taxes (Social Security + Medicare) on your profits. If this is just a side gig, chances are you’re paying only Medicare taxes of 2.9% (with an above-the-line deduction for half of that amount). Set up a home office and deduct mileage from your home to all business-related activities.

- Limited Liability Co (LLC) An LLC has an added layer of complexity. You’ll have to set up your LLC with the state where your business is located and in any other states in which you do business (think traveling locums). This will cost whatever the Secretary of State dictates. You’ll also have to file an annual or bi-annual license renewal in the same states and pay an annual fee or risk having your LLC administratively dissolved. As a physician, you will be licensed as a “SMPLLC” or “Single Member Professional LLC”.

The benefit of an LLC is your personal assets are protected from activities of the business. However, your activities as a doctor are not protected by an LLC, even if you do business as an LLC – you must have adequate malpractice insurance coverage. Beyond that, you report your activities the same as you do as a sole proprietor: Schedule C filed with your Form 1040 and pay FICA taxes on the profits. (A SMLLC is perfect for the piece of rental property you own, by the way. You also won’t owe FICA taxes because the income is “passive”, not “earned”.)

When would you want to file as an LLC?

- When you are doing work beyond the scope of your professional work as a doctor, such as when you write a blog and give advice.

- When you have employees whose actions could get you sued. For example, if you own a practice and your PA gives the wrong medication to a patient.

- The third time is when you own real estate. This is to protect you personally from accidents on your property. (You may be able to accomplish a similar level of protection with umbrella insurance.)

- See more in this article I wrote about LLC's.

California does not allow doctors to operate as LLCs so you’ll have to choose to be either a Sole Proprietor or an S-corporation.

- S-corporation An S-corporation provides the same level of liability protection as an LLC, but with the most complexity. You will register your corporation with the Secretary of State and pay a setup fee and an annual fee, same as with a SMPLLC – but the similarity stops there.

An s-corp requires you to file a separate income tax return, which will cost a minimum of $1,000 to $1,500 and up to $2,500 or more. In addition, because you are both the “owner” and “employee” of the corporation, you as the corporate owner will have to hire you, the employee.

The result is that you must pay yourself W2 wages, along with all requisite local, state, and federal tax forms and required payments. For example, you will have to pay into your state’s unemployment fund in case you ever fire or lay yourself off. Crazy, isn’t it? This, of course, is either going to cost you a lot of extra time or money for payroll administration.

If you have a home office, you’ll also have to set up an “accountable plan” to be able to deduct your home office expenses. More hassle…but not enough to bypass the home office deduction!

So why would anybody want to go the S-corp route? Because you may be able to save taxes. That’s a totally different article, which is in my rotation to post soon. However, my general rule of thumb (unless you live in CA) is that you shouldn’t even consider setting up as an S-corp until:

- Your gross receipts are at least $300k – $400k, and/or

- You have other employees besides yourself (meaning you’ll have payroll administration besides yourself).

Otherwise, stick with a sole proprietorship or a SMPLLC.

A final consideration beginning in 2018 is the Section 199A deduction. Before you make a final choice, you should definitely determine if Section 199A is available to you and, if so, which business entity (either sole prop/LLC or S-corp) will yield optimal results.

A common myth states that you must have a corporation in place in order to set up a retirement plan, such as a SEP or Solo-401(k). Not true. You have access to the same retirement plans regardless of entity. In addition to the contribution limits, businesses with multiple employees should consider cost and complexity when choosing a retirement plan.

Read Morelife and disability insurances. But do you have a will? Would your spouse and loved ones know what to do when you pass? Do they know how to access your accounts and other important documents? That's why you need a legacy binder. Death planning is, unfortunately, the high priority item that rarely gets done before your loved ones need it. It's probably due to a combination of thinking you will have plenty of time to get to it and avoiding thinking about your demise.

Start Your Legacy Binder with a Letter of Instruction

Your loved ones will reel from your death. Hopefully, you are adequately insured so they can take enough time to grieve and sort out your matters (and pay for counseling). Do you want them to be mired in tracking all your accounts, passwords, and other important paperwork? I'm guessing no. Make those logistics the easy part of dealing with your death. How? I recommend creating at the minimum a “Letter of Instruction.” This is an informal document (not the will) to guide the executor of your estate and your loved ones on important information that is in addition to your will. You can create this document yourself to ground your loved ones in all of the essentials.

What goes in a Letter of Instruction?

Make sure it includes the following information:

- Legal documents. Specify the location of all important legal documents they may need to handle your estate. These include the will (the original copy), social security card, birth certificate or passport, marriage and/or divorce papers, property deeds, automobile titles, etc.

- Financial information. Provide a list of all your financial accounts and account numbers: bank accounts, brokerages, retirement accounts.

- Passwords to your accounts. Make sure to include passwords for financial information, email, social media. I highly recommend using a password manager such as LastPass. This is what we use. In case you didn't know, Facebook allows you to name your legacy contact.

- Burial instructions. Tell your loved ones the exact details, including the name of the cemetery and plot location. Or if you desire to be cremated, be sure to include instructions as to how you want your ashes distributed. If you are a veteran, you may wish to look into being buried at a National Cemetery.

- Contacts. A list of family members (and your relationship to them–basically a family tree) and friends you would like to be notified of your death. Phone numbers and addresses are helpful in addition to email addresses.

- Policies. List all life insurance policies. Keep a copy of the policy page and the beneficiary designations. We use LastPass to store all our important policy pages.

- Tax information. Give the location of recent income tax returns and any necessary accounting information.

- Debts. Make a list of any outstanding debts.

- Professional contacts. Provide contact information for your CPA, attorney, insurance agents, etc.

The In Case of Emergency Binder

If you're like me, you'd be more likely to do this with a fill-in-as-you-go workbook:

Chelsea of Smart Money Mama's developed this In Case of Emergency Binder (ICE) for her own family to get organized in the event of, well, an emergency. Emergencies include not only death, but a natural disaster or severe illness. I purchased her ICE binder last year and, of course, have been slow to finish this important document. Only a few weeks ago did I finally get in touch with an attorney about having our estate plan documents reviewed since we moved states over a year ago.

Make this one of your family's financial goals for 2019. And once it is completed, store this document in your estate plan binder and digitally. LastPass is not only a password manager for your whole family but it can store digital documents securely.

Final Thoughts on the Importance of a Legacy Binder

Whether you purchase a pre-made legacy binder, work with a legal professional to create one, or design your own, get it done. Not next year, not in the next six months. Make a commitment to yourself and your family to start your legacy binder right away. No one wants to think about their death, but it is a fact of life. A legacy binder protects your loved ones and should offer you the ultimate peace of mind knowing that your wishes will be respected and your loved ones will be cared for after you're gone.

Is your family prepared in the event of your untimely death? If not, get started!

Read MoreThis is a guest post by Platinum Sponsor Lawrence Keller , CFP®, CLU®, ChFC®, RHU®, LUTCF that explores issues in a group disability insurance plan for physicians.

As you know, I am a board certified dermatologist. Unfortunately, like many medical specialty groups, mine offers a “discounted” disability insurance plan. I'm sure the American Academy of Dermatology does not purposely offer bad products for their members – I will just assume they are uninformed like many physicians.

I actually called the underwriting company to ask for their policy certificate and they would not send it to me until I actually purchased their plan. Lawrence explains why this group disability plan is flawed. In case you need a primer on disability insurance for physicians, read this.

The American Academy of Dermatology’s (AAD) Group Disability Income Insurance Plan: Caveat Emptor

As an insurance agent that specializes in disability insurance for physicians, I am often asked to review and comment on the AAD’s group disability income insurance policy. This policy which is available to all AAD members who meet the following criteria:

- They are in good standing who are under age 60,

- A resident of the United States or Puerto Rico,

- and actively working full-time (at least 30 hours per week).

Unfortunately, there are many potential problems/issues associated with this policy, as well as, similar offerings from other professional associations. This article will focus on the specifics of Plan 1 (there are two plans available), including a Residual Disability Benefit, which is underwritten by New York Life Insurance Company.

1. It is not Non-Cancelable and Guaranteed Renewable

“Insurance will end at the earliest of: the date the group policy ends, the date insurance ends for your class, the end of the period for which the last premium has been paid for you, the date you attain age 70, the date you cease to be actively at work full-time (30 or more hours) for reasons other than disability, the date you cease to be a member in good standing with AAD, or the day before you begin active duty in the armed forces.”

A policy that is Non-Cancelable and Guaranteed Renewable provides the greatest degree of protection to you as a consumer. Meaning, as long as required premiums are paid, the policy can’t be cancelled, premiums increased, or coverage terms changed until the policy expiration date (typically age 65).

2.The Premium Rates Are Not Guaranteed

“Premium rates are based on your actual age as of the effective date of your insurance; scheduled increases will occur as you enter each new age bracket (under age 30, 30-39, 40-49, 50-59, 60-64*, 65-69*)”.

3. It Does Not Have an “Own-Occupation” Definition of Total Disability

Total disability means during the waiting period and next 60 months, your complete inability to perform the material duties of your regular job. “Your regular job” is that which you were performing on the day before total disability began. After such 60 months, total disability means your complete inability to perform the material duties of any gainful job for which you are reasonably fit by training, education or experience”.

In any case, “To be considered totally disabled, you must also be under the regular care of a physician, and must not be performing the duties of any gainful job”.

At this time of this writing, depending upon your state of residence, there are only six companies that potentially offer this definition to physicians – Berkshire Life (a Guardian Company), Standard, MassMutual, Principal, Ameritas and Ohio National.

4. The Number of Days Required to Meet the Elimination Period Must be Consecutive

“The waiting period is only satisfied if you are not working in any occupation”. Individual policies do not require this and, for example, might specifically state that “You must be Disabled before benefits begin to accrue and starts on the first day that You are Disabled. The days within this period need not be consecutive but they must occur within the Accumulation Period. Benefits will not accrue or be payable during the Elimination Period”.

The waiting period is defined as the period of time from the start of total disability during which no benefits are payable. The Waiting Period is the number of consecutive days you must be Totally Disabled by a covered illness or accident before benefits begin. This is another aspect of a group disability insurance plan to explore fully.

5. You Must Be Totally Disabled Before You Can Collect Residual Disability Benefits

“If you become residually disabled within 31 days after a period of total disability for which monthly benefits are payable, the insurance company will pay residual benefits”.

In his article “What to Look for in Disability Income policies”, the late Peter C. Katt, CFP®, a fee-only insurance adviser located in West Bloomfield, Michigan, stated, “Do not buy a disability income policy that has a qualification period. There are too many diseases that are progressive and have no total disability at the beginning. Under such circumstances, a qualification period of, say, 30 days would prevent the insured from receiving any residual benefits.”

Ideally, your disability insurance policy should not require that you be totally disabled prior to collecting Residual Disability benefits. A good example of this might be a physician that has not been feeling great and, as a result, has been working sporadic hours. They have their good days and their bad days. Due to their symptoms, they have and continue to consult with various medical specialists in hope of getting a differential diagnosis.

This goes on for years and, as a result, they are working fewer days per week, fewer hours per day, seeing fewer patients and/or performing fewer procedures – causing a (potentially substantial) loss of income. Finally, they are diagnosed with Multiple Sclerosis and told they can no longer work in their medical specialty.

Only at this point, after the waiting period is satisfied and they meet the definition of total disability in the policy, can they potentially qualify for Residual benefits under the AAD’s policy.

6. There is No Recovery Benefit

While any policy you purchase must include a Residual or Partial Disability Rider, what happens if you have physically recovered and returned to work on a full-time basis but continue to experience a loss of income? A Recovery Benefit is designed to do more to assist with your financial recovery following a disability – especially if your practice has been built on referrals from existing patients and/or other physicians. Should you continue to suffer a loss of income of 15-20 percent or more, compared to your pre-disability income, and there’s a demonstrable relationship between your current loss of income and your prior disability, some companies will continue to pay benefits to the age of 65 or longer.

Other companies continue to pay for a limited period of time (typically 12, 24 or 36 months), which may or may not properly support your financial recovery. Therefore, if some or all of your compensation is tied to productivity, you should make certain that the policy you purchase contains a liberal recovery benefit.

7. Limitations Exist for Claims Related to Mental and Nervous Disorders

“Limited monthly benefits will be paid for disability due to alcoholism, drug addiction and mental, nervous or emotional disorders. If total disability is due to alcoholism, drug addiction or a mental, nervous or emotional disorder, the maximum payment period while such disability continues will be limited to 24 months”.

While some carriers will cover claims for mental and nervous conditions in the same way as other disabilities, the majority of companies limit these claims to a maximum of 24 months (either per period of disability or over your lifetime). This limitation is invoked if the primary cause of disability was solely a psychiatric or substance abuse disorder or diagnosis including, but not limited to, post-traumatic stress syndrome, anxiety, depression and or alcohol abuse/addiction.

Although many physicians will opt to purchase a policy with the least amount of restrictions, some willingly accept a policy with this limitation in order to take advantage of the cost savings associated with it.

8. There is No Cost Of Living Adjustment (COLA) Rider Available

A COLA Rider is designed to help your benefits keep pace with inflation after your disability has lasted for 12 months. This adjustment can be a flat percentage or tied to the Consumer Price Index. Although costly, this rider can provide significant increases to your monthly benefit if you are disabled early in your career.

9. There is No Increase Option Available

This rider is a must for young physicians. It allows you to apply for additional disability insurance coverage, regardless of your health, as your income rises.

Essentially, you’re paying for the right to increase your policy’s monthly benefit without undergoing another exam, blood test, urine test, or answering any medical questions. This guarantees that any medical conditions that develop after your original policy’s purchase would be fully covered, and not subject to new medical underwriting.

10. The Monthly Benefit May Not be Adequate

“You can choose monthly benefit amounts ranging from $500 to $10,000, in $100 increments. Total benefits you receive from this plan and from any other income replacement plans (including Worker’s Compensation, Social Security, employer-sponsored salary continuation, group or franchise plans or retirement programs) may not exceed 70% of your basic monthly pay. Basic Monthly Pay means the monthly rate of pay from your employer and does not include commissions, bonuses, overtime pay or other extra compensation”.

Individual disability insurance companies will typically issue policies with monthly benefits from $15,000-$20,000 month. However, by combining companies, you can potentially reach a total of up to $30,000 month of individual disability insurance coverage (or up to $35,000 month with group LTD coverage).

As a result, for high income specialties, I often combine two companies to allow them to potentially reach this higher amount, subject to their income and other disability insurance coverage inforce, if any.

11. You Are Not the Policyowner

“The group policy is issued to the American Academy of Dermatology under Group Policy No. G-30378-0/GMR-FACE. New York Life reserves the right to change rates on any premium due date and on any date which benefits are changed but it may only do so on a class-wide basis (a group of insureds with the same age, gender and/or waiting period). Changes to the group policy are subject to agreement between New York Life and the group policyholder.”

Although initially low in cost, association plans, such as the AAD’s Group Disability Income Insurance Plan, do not provide the customized benefits that can be achieved by purchasing a high-quality individual disability insurance policy.

In my opinion, this offering is best summed up by the old adage “you get what you pay for”. Keep in mind that many insurance companies make discounts available on individual disability insurance policies through hospital affiliation or professional associations. While this can provide male Dermatologists with a savings of 10%-20% off of their policies, female physicians can save as much as 60% off of the normal female rates if a gender neutral or “unisex” rate is available.

Agents that specialize in working with physicians should know of and have access to them. Otherwise, establishing one requires that 3-5 employees working for the same employer purchase policies from the same insurance company.

Ideally, you want to purchase your group disability insurance plan policy from an agent that represents several insurance carriers, provide you with illustrations of coverage from each and will review the differences between them with you in detail. You can then make a decision based upon the policy or policies that best meet your individual needs, goals, and budget.

Lawrence B. Keller, CFP®, CLU®, ChFC®, RHU®, LUTCF is the founder of Physician Financial Services, a New York- based firm specializing in income protection and wealth accumulation strategies for physicians. He can be reached at (516) 677-6211 or by email to [email protected] with comments or questions.

* For renewal purposes only. Coverage terminates at age 70.

The AAD group LTD plan is not available in Alaska, Deleware, Florida, Louisiana, Maine, Maryland, Missouri, Montana, New Hampshire, New Mexico, North Carolina, Nevada, Ohio, Oregon, South Dakota, Texas, Utah, Vermont, Virginia, Washington and Wyoming.

These are the personal views of the author and may not represent the views and opinions of The Guardian Life Insurance Company of America or its subsidiaries or affiliates thereof.

Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS), 355 Lexington Avenue, 9th Floor, New York, N Y 10017-6603, 212-541-8800. Securities products and advisory services are offered through PAS, 1-516-677-6200. Financial Representative, The Guardian Life Insurance Company of America, New York, NY (Guardian). PAS is an indirect wholly owned subsidiary of Guardian. Physician Financial Services is not an affiliate or subsidiary of PAS or Guardian.

PAS is a member FINRA, SIPC

2018-54235 Exp. 02/19

Do you have a group disability insurance plan? Make sure you understand the terms and limitations.

Read More This is a guest post by Jamie K. Fleischner, CLU, ChFC, LUTCF.

This is a guest post by Jamie K. Fleischner, CLU, ChFC, LUTCF.

Jamie is President of Set for Life Insurance. She started in the business in 1993 and has received numerous awards and recognition as being among the top disability brokerages in the country. As an independent broker, she seeks the most suitable products at the best rates for her clients. Set for Life has the largest portfolio of discounts nationwide, including unisex discounted rates for women. For more information, visit www.setforlifeinsurance.com. Set for Life is a sponsor of Wealthy Mom MD.

Women now exceed the number of men in medical school and residency. Furthermore, many women physicians are the breadwinners in their families. This makes it even more important for them to ensure their income is properly protected.

As a woman physician, what do you need to know when it comes to protecting yourself and your income? If you are dependent on your income to pay your bills and support yourself and/or others, it is imperative that you protect yourself with a proper individual disability insurance policy.

Here’s a short primer on what to look for in an individual disability insurance policy:

1) Definition of disability

It is critical that your policy will cover you if due to sickness or injury, you can’t work in your medical specialty even if you can work in another specialty or occupation. Be sure your policy will not reduce benefits if you either are capable of or choose to work elsewhere.

Without a good definition, the company can determine whether you can work or may not have to pay benefits if you are capable of being gainfully employed. This is especially true for group policies through your work or association policies. Look for definitions called “own occupation” or “regular occupation.”

Also, make sure your policy pays you own occupation for the full benefit period. Some policies only pay own occupation for two years and then change the definition to total disability not working.

2) Noncancelable, guaranteed renewable

This means that once you have your policy, the company can never modify the contract or raise the premiums. Most association policies don’t have this language and people are shocked when they reach their 40s or 50s and their premiums skyrocket.

3) Riders

These are extra benefits on your policy. Important riders include residual which covers partial disability, increase options which allow you to increase benefits in the future and inflation riders which keeps your benefits up with inflation when you are on claim.

Even if you have a group disability policy in force, it is still important to consider supplementing with an individual policy:

1) If you leave your employer, your group policy is (likely) not portable. You may need to go out and purchase your own benefits. If you have an adverse health condition, this may be difficult.

2) Most group policies only cover you if you are totally disabled and are not working. It won’t pay for partial disabilities.

3) If your employer is paying the premiums, the benefits are taxable.

4) Most group policies have a cap on the benefits. If you have a larger income, this can make a large gap between the benefits paid and the amount of benefit you need.

For example, a typical group policy will pay 60% of your income to a maximum benefit of $10,000/month. This $10,000/month benefit is taxable. Therefore, your after tax benefit would be about $7,000/month.

What’s the difference in disability insurance for men and women? Individual policies cost close to twice as much for women than men. According to the companies, women are not only more likely to file a claim, but their claims last almost twice as long as those of men. As a result, disability insurance can be very expensive to purchase for a woman.

Here are some important considerations for women when it comes to purchasing disability insurance:

1) Unisex rates

Some insurance companies offer unisex discounted rates. This means that both women and men pay the same rate. This can help reduce the rate significantly for women, in some cases up to 70%.

Here is how to obtain a unisex rate:

a. Work with a broker who already has unisex rates available for you.

b. Find other people in your practice or at your place of employment who also want coverage. With three or more people applying for coverage, the company can issue the policy at unisex rates. Some people even purchase a policy on a staff person for a small amount and this results in significant savings.

c. If you are a resident, some companies already have unisex discounts available. Some companies don’t offer unisex rates for residents but offer it for attending physicians. If you are close to finishing your residency, you may be better off waiting to purchase your policy.

2) Discounts

There are several other types of discounts available including AMA discounts, employer sponsored discounts and other association discounts.

3) Prioritize

If you are trying to trim costs, consider what is most important. For example, is it worth it to you to pay the extra premium for the inflation rider? Do you need to cover your full income if your spouse or partner also brings in an income?

4) Work with an experienced independent broker

If you work with an agent of a company, they have a financial incentive to only show you their company’s product which may or may not be the best fit for you or in your best interest. If you work with an experienced independent broker, they can shop around for you and find the most suitable product at the best rates. Look for a broker with credentials such as CLU (Chartered Life Underwriter) which is a master’s level degree in insurance.

5) Determine how much benefit you need

Calculate your fixed costs and determine how much after tax benefit you need.

Other considerations:

1) If you already have an individual policy but are paying female rates, see if you may have access to a unisex policy. This will require new underwriting (medical questions). If you have significant health conditions, this may not be a good idea. If you are healthy and can save more than 10%, it may be worth considering a replacement policy.

2) It is important to review your overall financial situation. Once you are in a position of financial independence, you may no longer need the coverage or can remove riders or reduce the benefits.

For more information about disability insurance for women, visit http://www.setforlifeinsurance.com/disability-insurance/disability-insurance-women

Read MoreThis is a post about independent insurance broker Lawrence Keller, CFP®, CLU, ChFC, RHU, LUTCF. He is a sponsor of Wealthy Mom MD.

Besides disability insurance, do you sell other insurances?

Yes, besides disability insurance, I also sell term life insurance.

Are there any particular insurances that you think us physicians should be aware of?

When purchasing term life insurance, as you discussed previously, carriers look many factors. These may include height, weight, blood pressure, pulse, personal medical history, and family history. Ideally, you want to apply to for your life insurance with a company in which you have the best chance of receiving the most favorable underwriting classification and, thus, the lowest premium rate.

For example, if one has an immediate family history of Coronary Artery Disease (in a parent prior to age 65), they should consider which company they apply to. For instance, a company may not care if the family member was diagnosed with CAD; instead, they focus on if the individual passed away as a result. If they are alive and the proposed insured meets all of the other criteria, they would typically still qualify for the best underwriting classification. The same is true for cancer. Some carriers will take this family history into consideration and others will not.

While I do not sell Property & Casualty Insurance, physicians, in most cases, should have more coverage here. Specifically, they should carry an Umbrella or “Excess Liability” policy – especially if they drive a car. This extends the liability limits of your automobile and/or homeowner's insurance policies. You would likely want to purchase all of these from the same insurance company. In doing so, you can have them integrated and coordinated with each other, as well as, qualify for discounts.

How do you differ from other brokers?

I'm an academic at heart and understand the nuances of each policy available in the marketplace. I also have access to discounts, in many cases, including unisex rates for females. However, unlike other brokers, I don't advertise this or use it as a way to bring me new clients. If I find myself in a situation where I know that the potential client needs a product or discount that is “exclusive” and I cannot provide it, I will refer them to the “endorsed” agent. I do this knowing that I will not be compensated.

You never have a second chance at a first impression. I have found that the “goodwill” that this provides has done more for me than any commissions that I could have earned selling a product that was not in the best interest of the potential client.

Do you have any advice on how to choose an independent insurance broker and what makes someone a good broker?

I think a “good broker” possesses certain qualities. A good broker:

- has a deep understanding of the marketplace,

- represents several companies,

- provides illustrations of coverage from each of them,

- and takes the time to thoroughly review the differences.

An independent insurance broker who does these things helps clients make a decision that best meets their individual needs, goals and budget.

Beware of agents that are “captive” and can only offer policies to you from one company or have a strong financial incentive in to do so. The client should never feel that they were “sold” something or pressured to make a buying decision. The client should feel that their broker was a resource throughout the process. They should feel that they had their best interest in mind and made the process as enjoyable and informative as it could be.

I would also look an independent insurance broker with credentials and/or certifications in the insurance and/or financial planning industry. This shows dedication to the industry and the desire to learn. More so, these brokers usually have a good understanding of the financial planning process, not just disability and life insurance policies.

Finally, you will not be paying more for purchasing your policy from an experienced insurance agent than you would from an inexperienced insurance agent.

What are the top 3 things you see that physicians don’t understand about disability insurance?

Understanding Premium Pricing

If policies are structured the same way and all agents are showing policies with the same discounts, the premium rate will be the same. This industry is heavily regulated and the premium rates and contractual language must be approved by each state. Therefore, if the plan parameters are the same, the only way that one agent can provide a lower price to the consumer is by having access to or knowing of a discount plan that another agent does not.

Association Plans v. Individual Policies

Association plans (not individual policies that include an association discount) are inferior compared to individual policies. Typically, the policy can be cancelled by the association or insurance company. Also, premium rates can increase every five years (generally when your age ends in a “0” or a “5”). Plus, the definition of total disability is not “Own-Occupation” and you don't receive a policy. You simply receive a certificate that evidences that you are part of a larger group.

Understanding LTD Plans

When it comes to group LTD plans and individual policies, there is no such thing as a “primary” or “secondary” company. If you meet the definition of total disability under both policies, you can potentially collect full benefits under both policies.

Additionally, with the exception of those eligible to purchase coverage under “New In Practice” limits, generally, if you are going to be eligible for group LTD coverage with a new employer, it must be taken into consideration when determining the amount of individual coverage available and deferring enrollment into a mandatory group LTD plan to potentially allow you to purchase a larger amount of individual coverage does not work. If you submit a copy of your employment contract in order to purchase coverage based upon your “new” salary and it mentions that you will be provided with Long-Term Disability insurance, the underwriter will ask about this and, again, it will be taken into consideration when determining the amount of individual coverage available for purchase.

Finally, it does not matter if the group plan's definition of total disability is “Own-Occupation” or not. Instead, the insurance company must assume that if you are disabled, you can potentially collect under the group LTD plan. After all, the insurance companies to not want to give you an incentive not to work. That would allow you to make more money not practicing than if you continued to practice medicine.

Is there anything else you would like to tell us as an independent insurance broker?

The time to ask your questions is when you are researching the policies available. You don't want to find out that you purchased the wrong policy and then start doing your homework.

All too often, I see physicians in this situation that could have easily been avoided if they took the time to really understand what they were purchasing. Unfortunately, they don't have the ability to make changes based upon medical or financial issues that arise subsequent to the purchase of the policy or policies they no longer feel to be adequate.

I hope you enjoyed learning a bit more about Lawrence and independent insurance brokers!

Read MoreEggy on the way, we've had to do some estate planning. I'll be honest: I found trying to understand and interpret estate planning and legalese way more challenging than learning personal finance. If you feel the same way, then you'll want to stay tuned for my series on estate planning in “plain English” starting with this post. Today, I'm going to discuss the estate plan basics and define some basic terms you need to become familiar with.

The Vocabulary of Estate Plan Basics

Below, you will find some of the most frequently used terms in estate planning. In addition to breaking them down in simplified English, there are also helpful links for additional reading.

Know Your Situation

Before we dive into the estate plan basics, the first thing you need to do is take inventory of yourself. Specifically, you need to understand your personal situation. Who exactly are you looking to protect? Someone who is single is going to have a very different estate plan than someone who is married with a blended family.

Let's start with me for an example. Our situation is more complicated than the common “(first) marriage with kids” scenario, meaning first marriage, no prior divorce and all the kids are theirs.

Our situation: We are not married. I've never been married. M has been married before and has a son from that marriage. Eggy will be our first child together. We do plan on getting married, just not in the near future.

We just finished drafting wills, power of attorney, living wills and healthcare proxies with a lawyer in NY. Please note and keep in mind that estate laws are state specific and some or all documents will need to be updated/redone if you move states and as your reach life milestones.

Last Will & Testament

All couples with minor children need a Last Will & Testament or Will. Why? Because in the Will you name a guardian in the (highly) unlikely event both you and your spouse pass before your kid(s) are adults. Otherwise the court makes that decision for you!

So, if you don't have a Will (and both spouses each need their own wills, they generally mirror each other), then you are basically saying you're OK with having the court decide guardianship for your minor children. I am pretty sure you wouldn't be OK with this.

You can also name a backup guardian in case the first named guardian cannot carry out the duties.

Executor

Your executor is also named in your Will. That is the person who will carry out the wishes of your Will. If you're single (kids or not), you'll want a Will unless you have little to no assets or only assets that bypass probate (discussed below).

Intestate

If you die without a Will, this is called intestate, and your “stuff” will be divided up according to state law.

Probate

Most Wills will needs to go through probate. Probate is the name of the legal process for settling a testator's (the deceased) estate.

The probate process involves a probate court, your named executor and a lawyer.

A lot of things do not need to go through probate, however. You may have heard that it is “good” to avoid probate. Probated wills incur costs against the estate – court fees, lawyer fees, executor fees (if applicable) and time.

Every state's probate process is different so you'll want to become familiar with the general probate process in your state. Retirement accounts (401(k)s, 403(b)s, IRAs, Roth IRAs, etc) DO NOT go through probate unless no beneficiary has been named. The same is true for bank accounts and life insurance proceeds.

Beneficiaries

Definitely make sure you have named your beneficiaries correctly. This is not as straightforward as it sounds.

For 99.9% of us, our spouse will be the primary beneficiary for all of these. In fact, if your spouse is not the primary beneficiary of your 401(k) (or a similar work qualified retirement plan), then you need notarized permission from your spouse to do so.

Let's say you have 2 children named Amy and Tom for the next example. The secondary or contingency beneficiary is logically 50/50 split between your two children.

Let's go a bit further and say Amy has 1 child and Tom has 2 children.

If, at the time of your death, Amy has passed as well, then guess what? All of it goes to Tom and Amy's child is effectively cut out of the estate. This is probably not what was intended. The intention was for Amy's share to pass on to her kid.

Per Stirpes

In order to do this, you need to name Amy and Tom and add the phrase per stirpes after their names. Per stirpes means that items are distributed to each family branch. Some states do this slightly differently so be sure to understand your state law on this.

Final Thoughts on Estate Plan Basics

Hopefully, the first post in this estate plan series took out some of the guesswork behind vocabulary that is often used with estate plan basics.

A much needed addition to the official documents is a “crib sheet” for your loved ones such as In Case of Emergency binder. In the meantime, check out this great book on estate planning:

[ Disclaimer: Please note that some of the links above are affiliate links. This means that I may receive a commission if you purchase through one of my links. I highly recommend all of the products & services because they are companies that I have found to be helpful and trustworthy. I use many of these products & services myself. ]

Read MoreStephanie Pearson, MD, FACOG, an ob-gyn turned disability insurance broker for Women Physicians. How? After sustaining a career changing injury during a difficult patient delivery, Stephanie became quite passionate about physician disability insurance and risk management planning. In this post, we hope to demystify disability insurance and convince you why you need it!

Note: Pearson Ravitz is a sponsor of the 2024 Money & Wellness Conference.

Your ability to make a great income is one of your greatest assets. Have you considered how a serious illness or accident could jeopardize your financial security?

As a physician, I definitely have seen things change in a blink of an eye – a new cancer diagnosis, a car accident, or a fall to name a few. You're much more likely to use disability insurance than life insurance and you know I always recommend insuring against the 4 financial catastrophes: Death, disability, liability and divorce.

Why would you not want to protect that asset with disability insurance? Here are the top causes of disability, in descending order:

- Musculoskeletal

- Cancer

- Accidents

- Mental disorders

- Cardiovascular

The issue with disability insurance is that disability is very gray and subjective. With life insurance, you're either dead or alive. There is no “time of disability” like there is a “time of death.”

The three things Stephanie Pearson hears most as reasons not to obtain private disability insurance:

- “It won’t happen to me.”

- “I am healthy. I have no family history.”

- “I have coverage through work.”

It happens, and it happens a lot.

According to the Labor of Statistics, one in seven people will suffer a disability requiring time off from work during their working years. The average disability lasts from 3-5 years.

Can you afford to have no income for that long especially if you are the breadwinner for your family?

Many illnesses are NOT genetic. Many cancers and other illnesses do not discriminate. Accidents are called accidents for a reason. Stephanie certainly never thought a patient kick would end her clinical career.

And as a woman physician, disability insurance has some special considerations as discussed below.

Group Coverage is Often Inferior

Coverage through work is often not as much as one believes. When Stephanie asks clients if they know what the coverage through their employer truly is, she is met with blank stares or silence (on the phone). Group benefits are certainly better than nothing; however, there are typically many shortcomings or holes. Stephanie’s did not cover work related injuries – so she was denied benefits.

Often, group benefits are paid for by the employer, which makes the benefit taxable income. There is often a maximum benefit (i.e. 50% to 15K). Many employees are unaware of the max, and falsely believe that more of their income is covered.

Also, it is often only the base salary that is covered, not bonuses, teaching stipends, etc. which DO count as part of your compensation package.

Group policies are typically “Own Occupation” (see below for definition) for 2-3 years, and then switch to “Any Occupation.” You do not want to be told that you can teach, consult, or answer phones. There are often many exclusions and stipulations to group benefits that make them far inferior to private individual plans.

Most importantly, most group plans are often NOT portable. Very few physicians start and end their careers in one place. Many find themselves unable to secure good coverage if they leave one job only to find out the next one does not offer benefits. They are now older and potentially have more morbidities.

How to Buy Disability Insurance for Women Physicians

Ok, so now you may be convinced that you need to look into getting some.

Let's go over how to buy a disability insurance policy.

- Determine how much disability insurance you need

When you buy a policy, the policy amount is by monthly income replacement. This monthly income benefit is tax-free provided you pay for it with after-tax dollars (vs. deducting from your taxes – generally not recommended). You won't be able to recover 100% of your income (the underwriting company doesn't want you to be more valuable disabled than working). Each carrier has a participation limit usually around $17,000/month. For the really high earners, you may need to have more than one policy with more than one carrier.

How much do you need? That answer is very person specific. Are you the sole provider, primary or secondary provider, or do you have an equal double income household? What are your fixed expenses? What could you live without? All carriers have an algorithm to determine your qualifying benefit. The factors that go into this number are your salary, other earned income, and other group or personal benefits currently owned.

The magic number for what you need, usually falls somewhere in the 60-80% of your pre-tax income. Remember, your private benefits are tax-free income. I always tell people, just because you qualify for “X” does not mean you have to purchase “X.” You need to figure out what your family would need if you were not bringing in a paycheck in order to maintain your quality of living.

Keep in mind that even if your spouse makes enough for both of you, there may be extra costs associated with your disability like medications and care.

- Determine what riders you need

Almost everyone will need more than the barebones policy. Unfortunately, there is no standardization of language in the insurance industry. Carriers have similar riders with very different definitions, or the same concept called by different names. It is important to understand the definitions in each illustration that you review. The riders you should seriously consider (really, in my opinion, are “necessary”):

- Specialty specific or True Own Occupation – True own occupation stipulates that you are disabled if you can no longer perform “the material and substantial duties of your job”, regardless if you are gainfully employed. Some carriers will state that you can NOT be gainfully employed. This is a huge difference.

- Future Purchase Option – This allows you to purchase more insurance as your income grows.

- Non-Cancelable/Guaranteed Renewable – This means the company cannot cancel the policy on you and must guarantee that it can be renewed every year.

- Residual Disability – Aka partial disability. The policy will pay you a portion of your monthly benefit if you're partially disabled. Each carrier has a different definition. Again, the devil is in the details. An important note: there are more claims paid for residual/partial disabilities a year than total disability.

- Cost of Living Adjustment – This adjusts your payout to index for inflation. I would get this early in your career and cancel it about 10-15 years later.

- Catastrophic Coverage – This rider pays you an additional benefit in the event your disability leaves you unable to perform two of your activities of daily living (ADLs) without assistance or you are severely cognitively impaired. There are a few nuanced differences amongst the different carriers.

- Talk to an independent agent – someone who can broker from one of these companies: Guardian (Berkshire), Mass Mutual, Ameritas, Principal, Ohio National and Standard.

Met Life no longer issues new policies. I (Wealthy Mom MD) recommend you avoid any policy from Northwestern Mutual. They have an inferior definition of “Own Occupation” among other shortcomings. I recommend talking to at least two independent agents.

- Since women are more likely to be disabled than men (pregnancy related claims are on the rise) our premiums are higher than men. At least we get a break on life insurance !

Unfortunately, disability insurance is more expensive for women than men. Women are more likely than men to leave the workforce secondary to illness and injury, some in part to our ability to make babies. Men tend to die younger and more often at their own hands. Carriers are moving away from covering pregnancy at an alarming rate.

Things that are not viewed as an abnormal outcome of pregnancy by ob-gyns, are viewed that way by insurance carriers! Please secure coverage before your first attempted pregnancy. Recurrent miscarriages, infertility treatments, cesarean sections are all viewed as abnormal outcomes (!). Gestational diabetes, pre-eclampsia, postpartum hemorrhage, are as well.

You also may have heard that it's “cheaper” to purchase DI as a resident. This is only “true” because you'll be buying a smaller policy since you're not making attending income, as a resident you're part of a large hospital system offering institutional/group discount, and you’re younger. Women, look for a unisex policy to save on premiums. Principal offers one.

- Seriously consider purchasing life insurance if you don't have it already to save you another work-up.

You will likely need medical underwriting to determine your eligibility for DI. This involves blood work and a physical exam. These can also be used for life insurance so that you don't need to repeat this again if you apply for it within a year (generally speaking).

What You Also Need to Know

- If you're a woman, I strongly recommend purchasing this before you have children. If you wait until you're pregnant you may get dinged with an exclusion that any pregnancy related disability won't be covered, or you may develop a pregnancy related condition such as gestational diabetes that will ding your eligibility.

- The state you purchase DI matters. Everything is different in CA and FL. Texas also has some differences. Not only is coverage more expensive, but certain riders offered elsewhere are not offered there. CA has the highest premiums. If you are doing residency there, and staying there, then you have no choice. One way to get around this is to purchase disability insurance before moving to CA if your medical school is another state. Also, if you're doing residency in CA but know that you're moving to another state, you may want to wait until you move to the new state – or better yet, purchase a policy now in CA then get a new one when you move (then cancel the CA policy). Conversely, if you're training in one state and moving back to CA, definitely purchase a policy before moving!

- Disability insurance generally pays out after 90 days of disability (“elimination or waiting period”) and until age 65, so you'll need enough income replacement to save for retirement.

- Once you reach financial independence, you can cancel disability insurance.

- If you’re really trying to save on the premium cost two riders you can consider forgoing are: COLA and CAT. You can also extend the elimination period to 6 months or a year as well.

- Guardian is considered the “best” insurance carrier and the premiums reflect that. They have unlimited coverage for mental/addiction disorders. If this is not a deal-breaker for you (i.e. no personal or family history of mental disorders or substance abuse) then consider another carrier. Most other carriers have a two year limit.

My current policy is a $15,500 monthly benefit with Principal.

Bottom line: Be sure to reach out to an insurance agent to get started with obtaining your policy now. You cannot rely solely on your employer's policy.

is a proud sponsor of the 2024 Money & Wellness Conference for Women Physicians.

Read MoreThis post is sponsored by Lawrence Keller, CFP®, CLU®, ChFC®, RHU®, LUTCF, an independent agent for several insurance companies. He has earned his reputation as the “go-to” agent for life and disability insurance for doctors and other high–income professionals. If you wish to contact him you can call (516) 677-6211 or email [email protected]

Do you have life insurance? You need to unless you'll never have dependents – children, a spouse, parents perhaps. One of my mantras is to insure yourself against the top 4 financial catastrophes – death, disability, divorce, and liability.

There's a lot of confusion as to what life insurance product to buy, how much to buy, and for how long. For the overwhelming majority, term life insurance is the right product. Term life insurance is a product where you buy a certain amount for a certain amount of time (or term). If you die during the term, your beneficiaries receive the amount purchased tax-free. Typical terms are 10, 20 or 30 years.

You can also “ladder” policies meaning that you stack multiple policies with varying terms. For example, you purchase three policies: $1 million x 10 years, $1 million x 20 years, and $1 million x 30 years. If you die in the first 10 years, your beneficiaries receive $3 million, if you die in the 2nd 10 years they get $2 million(as the $1 million x 10 years policy has expired), and if you die in the 3rd 10 years, they get $1 million.

You could just buy one $3 million x 30 year term but this is a lot more expensive and likely not necessary. The reason to decrease the payout amount over time is because your wealth will build and you will have enough to self-insure (retirement accounts, cash savings, debt elimination). Many factors determine your rate, here are a few:

- Gender

- Age

- Health – personal and family medical history (cardiac disease, cancer)

- Smoking status

- Activities – rock-climbing, skydiving enthusiast, etc

How to buy term life insurance:

1. Determine how much you need and for how long The amount you need depends on what you want the life insurance money to be used for. If you die, you want enough money to cover funeral costs, any debts (mortgage, student loans, etc.), kids' childcare and college costs, or any other dependents that rely on your income. If you're married, do not underestimate the toll your death will take on your partner and other dependents; they may need to take some time off and get things in order. Wouldn't you want to give your partner (and kids) the time and freedom to do that? Also keep in mind that inflation will eat away at the amount as well. A good starting point is 7-10x of your income. For those who are divorced and have to cover multiple family interests please consult any divorce decree requirements and factor those requirements in as well. A sample calculation for someone who makes $250K:

- $500K mortgage

- 2 kids, $250K each for college

- Funeral costs $10K

- Income loss for remaining partner: depends if they work or not. Even if they work, their lifestyle and budget likely included your income too. So let's say you'll want $100K per year to reflect that (remember this money is tax-free). So this comes out to $1 million for every 10 year term.

This comes out to just over 2 million for a 10 year term. This amount may decrease as you build up retirement and other savings, 529 accounts, etc. Using the 7-10x rule of thumb this amount falls in that range ($1.75 to 2.5 million). A stay at home spouse needs to be insured as well. You may have heard that life insurance is only needed for those that make income. But a stay at home spouse is providing childcare and likely other household duties. You'll want to account for how much childcare would cost in the event of their death.

2. Get an idea of how much it will cost on www.term4sale.com You'll see that the price of the policy will differ widely depending on whether you are female or male, the term amount, the dollar amount, and health class.

3. Talk to a broker or agent You want to work with an independent agent or broker vs. an agent that only represents one company. If you are working with a financial advisor it is wise to reach out and receive their input as well.

4. Seriously consider purchasing disability insurance if you don't have it already to save you another work-up. You will likely need medical underwriting to determine your health class. This involves blood work and a physical exam. These can also be used for disability insurance so that you don't need to repeat this again if you apply for it within a year (generally speaking).

Other caveats:

- If you're a woman, I strongly recommend purchasing some as early as possible if you know you'll want children. If you wait until you're pregnant you may get dinged with a rider that any pregnancy related death won't be covered (same applies for disability insurance), or you may develop a pregnancy related condition such as gestational diabetes that will ding your health rating from the top class to the 3rd or 4th class. This will result in a significant increase of your annual premium. For example a 35 year old who applies for a $2 million x 30 year term would go from an annual premium of $1,265 to $2,105 if she develops gestational diabetes (numbers for Prudential).

- Same advice applies to men since life insurance premiums are higher for men. This stuff is already cheap and cheaper the younger and healthier you are. You'll never be as young and healthier than now.

- Banner (William Penn in NY) offers laddering within one policy vs. buying multiple policies to form a ladder. This saves you about $60 per policy bought.

- You may hear of a “Waiver of Premium Rider”. This waives the premium on a term life insurance policy if the insured is disabled. Unless the insured plans on converting their term policy to Whole Life (and most insureds won't), one should not consider this rider as it can, generally, add 10-25% to the cost of the annual premium. I would recommend just getting enough disability insurance instead.

I've purchased 2 policies: $1 million x 20 year term, bought at age 38 (Banner, $496/year) with preferred health plus rating (the highest health rating). I also have $1 million x 15 year term bought at age 39 (William Penn, $382/year). And yes, I bought both from Lawrence Keller.

Read More