One of the first financial to do's is to protect your income and dependents through life and disability insurances. But do you have a will? Would your spouse and loved ones know what to do when you pass? Do they know how to access your accounts and other important documents? That's why you need a legacy binder. Death planning is, unfortunately, the high priority item that rarely gets done before your loved ones need it. It's probably due to a combination of thinking you will have plenty of time to get to it and avoiding thinking about your demise.

Start Your Legacy Binder with a Letter of Instruction

Your loved ones will reel from your death. Hopefully, you are adequately insured so they can take enough time to grieve and sort out your matters (and pay for counseling). Do you want them to be mired in tracking all your accounts, passwords, and other important paperwork? I'm guessing no. Make those logistics the easy part of dealing with your death. How? I recommend creating at the minimum a “Letter of Instruction.” This is an informal document (not the will) to guide the executor of your estate and your loved ones on important information that is in addition to your will. You can create this document yourself to ground your loved ones in all of the essentials.

What goes in a Letter of Instruction?

Make sure it includes the following information:

- Legal documents. Specify the location of all important legal documents they may need to handle your estate. These include the will (the original copy), social security card, birth certificate or passport, marriage and/or divorce papers, property deeds, automobile titles, etc.

- Financial information. Provide a list of all your financial accounts and account numbers: bank accounts, brokerages, retirement accounts.

- Passwords to your accounts. Make sure to include passwords for financial information, email, social media. I highly recommend using a password manager such as LastPass. This is what we use. In case you didn't know, Facebook allows you to name your legacy contact.

- Burial instructions. Tell your loved ones the exact details, including the name of the cemetery and plot location. Or if you desire to be cremated, be sure to include instructions as to how you want your ashes distributed. If you are a veteran, you may wish to look into being buried at a National Cemetery.

- Contacts. A list of family members (and your relationship to them–basically a family tree) and friends you would like to be notified of your death. Phone numbers and addresses are helpful in addition to email addresses.

- Policies. List all life insurance policies. Keep a copy of the policy page and the beneficiary designations. We use LastPass to store all our important policy pages.

- Tax information. Give the location of recent income tax returns and any necessary accounting information.

- Debts. Make a list of any outstanding debts.

- Professional contacts. Provide contact information for your CPA, attorney, insurance agents, etc.

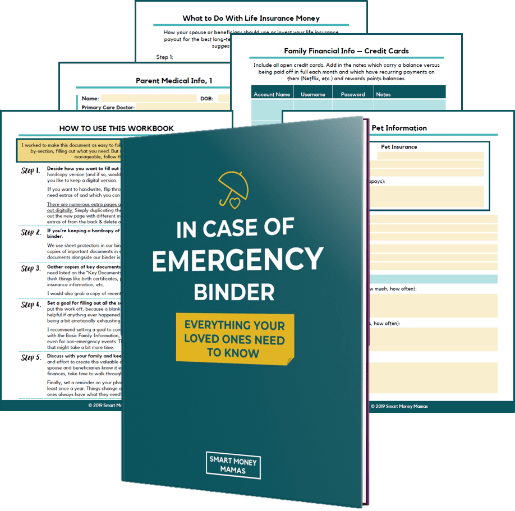

The In Case of Emergency Binder

If you're like me, you'd be more likely to do this with a fill-in-as-you-go workbook:

Chelsea of Smart Money Mama's developed this In Case of Emergency Binder (ICE) for her own family to get organized in the event of, well, an emergency. Emergencies include not only death, but a natural disaster or severe illness. I purchased her ICE binder last year and, of course, have been slow to finish this important document. Only a few weeks ago did I finally get in touch with an attorney about having our estate plan documents reviewed since we moved states over a year ago.

Make this one of your family's financial goals for 2019. And once it is completed, store this document in your estate plan binder and digitally. LastPass is not only a password manager for your whole family but it can store digital documents securely.

Final Thoughts on the Importance of a Legacy Binder

Whether you purchase a pre-made legacy binder, work with a legal professional to create one, or design your own, get it done. Not next year, not in the next six months. Make a commitment to yourself and your family to start your legacy binder right away. No one wants to think about their death, but it is a fact of life. A legacy binder protects your loved ones and should offer you the ultimate peace of mind knowing that your wishes will be respected and your loved ones will be cared for after you're gone.

Is your family prepared in the event of your untimely death? If not, get started!

Get the bestselling book - Defining Wealth for Women.