Dealing with student loans is difficult. Being a doctor with student loan debt can be particularly challenging. 76% of doctors graduate with debt, and the median is $192,000. This is a guest post by Travis Hornsby, creator of Student Loan Planner, where he offers one-on-one student loan advice. As female physicians with student loans, if you need help navigating them, contact him.

I got into helping people understand their student loans thanks to my beautiful and brilliant fiancée Christine. She’s a urogynecologist, and like most physicians, she was more focused on learning and caring for her patients than understanding arcane federal student loan rules. Unfortunately, female physicians earn less than their male counterparts. To help tip the scales back in favor of people like Christine, here’s how to maximize student loan strategy as a female physician.

I got into helping people understand their student loans thanks to my beautiful and brilliant fiancée Christine. She’s a urogynecologist, and like most physicians, she was more focused on learning and caring for her patients than understanding arcane federal student loan rules. Unfortunately, female physicians earn less than their male counterparts. To help tip the scales back in favor of people like Christine, here’s how to maximize student loan strategy as a female physician.

Tips for Female Physicians with Student Loans

First things first. Women doctors are more likely to be employees. That's a big advantage when it comes to student loans. About three-quarters of all women in medicine work as employees instead of in private practices. That means women are more likely working at not for profit hospitals than men. That’s why female physicians need to know about Public Service Loan Forgiveness (PSLF) like the back of their hand. Under PSLF, A doctor must work for 10 years in a not for profit setting. Most hospitals qualify. You must receive your actual paycheck from a not for profit entity too. Occasionally I’ve seen some hospitals that pay their physicians out of a private sector entity. That would cause you to lose your PSLF eligibility. Make sure that doesn’t happen to you when you become an attending. Your residency counts towards this 10-year period until PSLF forgiveness. If you play your cards right, you could pay $300-$500 a month on your loans during this period, which all counts towards the 10 years required under PSLF. Virtually all physicians who manage their loans the optimal way will graduate residency with 3-7 years of credit towards the 10 years they need. What happens when you become an attending?Keep Your Payments Low to Maximize Forgiveness

Under current rules, you can use either PAYE or IBR to cap what you must pay on your student debt. That means if you owe $150,000 in med school loans but start out at $200,000 as an attending, you can keep your payments at no higher than the standard 10-year monthly amount you had to pay when you left med school. Using this cap to your advantage, you could conceivably train for several years to become a surgeon, then cap your payments on 10-year standard repayment plan. That would allow you to pay a fraction of what you originally borrowed for medical school. A lot of my clients make payments based on the Income Based Repayment plan (IBR). If that describes you, you’re probably paying too much on your student debt. You should look into switching to Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE). The reason? You get to pay 10% of your income instead of 15% as with IBR.Make Sure Your Loans Qualify

Only Direct Federal student loans qualify for this forgiveness benefit. That covers most loans issued after 2010. If you happen to have loans from before this that are on the older FFEL loan program, you can consolidate them into a Direct loan. That consolidation makes them eligible for PSLF, but it also resets the repayment clock to zero. Make sure your loans don’t qualify for PSLF before submitting a consolidation request. Call your loan servicer and ask them what loans qualify for PSLF. They should be able to tell you.How Would This Work in Real Life?

Here’s an Example. Meet Jane. She’s a pediatric cardiologist. Her total length of training between residency and fellowship is six years. During that period, she’ll start out at $55,000 and end up at $70,000 in salary. When she becomes an attending, she’ll start at $225,000 and get inflation level raises after that. Jane has $300,000 in student loans. She doesn’t know what to do with such a large burden, but she’s passionate about medicine. In a perfect world, here’s how she would manage her student loans.Start paying on REPAYE as soon as possible

While in residency and fellowship, Jane can pay only a few hundred a month but receive interest subsidies of thousands of dollars a year. The reason is that REPAYE covers half of the leftover interest she doesn’t pay each month. Since she’s going for tax free loan forgiveness but also wants to keep the loan balance low just in case, REPAYE is probably a great option. A possible exception to that rule of thumb is if her spouse makes a lot more money than she does and then it’s worth talking to an expert.File the PSLF Certification form

After her first payment on REPAYE during training, Jane can submit the PSLF employment certification form. She should receive a response in a couple months showing her progress towards loan forgiveness. Once she’s being tracked for the program, she should resubmit this free form every year at least to create a well-documented paper trail.Minimize Taxable Income

Loan servicers calculate what Jane owes every month based on her taxable income. If she will receive forgiveness on her student loans then she wants to minimize what she pays wherever possible. The best way to do that is to save in pre-tax retirement accounts. She can use a pre-tax 403b plan to put away up to $18,000 per year, which will directly reduce what she has to pay towards her student loans.Here’s What the Numbers Look Like

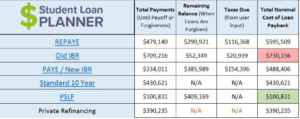

A few things might complicate this picture, particularly if Jane had a spouse who also earned an income. If a spouse has student debt then it doesn’t matter as much. However, if a spouse has no loans but a substantial income then it would be worthwhile to rerun these numbers using my calculator. So to review, Jane makes $55,000 at the beginning and $70,000 at the end of training. We’ll say she puts away $5,000 in her 403b during training and $18,000 as an attending. Her interest rate is 7%.

Jane borrowed $300,000, and she’s going to be able to pay just over $100,000 on her student loans and save a lot of money for retirement along the way. Student loan interest is generally not tax deductible except for a small amount at low incomes. That means over that 10 years, Jane receives a benefit worth about $20,000 annually after tax for optimizing her student loans. On a before tax basis, that benefit is more like $30,000 in salary value. That’s a great benefit considering many people enjoy working at academic hospitals over private practices.

So to review, Jane makes $55,000 at the beginning and $70,000 at the end of training. We’ll say she puts away $5,000 in her 403b during training and $18,000 as an attending. Her interest rate is 7%.

Jane borrowed $300,000, and she’s going to be able to pay just over $100,000 on her student loans and save a lot of money for retirement along the way. Student loan interest is generally not tax deductible except for a small amount at low incomes. That means over that 10 years, Jane receives a benefit worth about $20,000 annually after tax for optimizing her student loans. On a before tax basis, that benefit is more like $30,000 in salary value. That’s a great benefit considering many people enjoy working at academic hospitals over private practices.

What if Jane Wanted to Start a Family?

One cool feature of the PSLF program is that payments made while on maternity leave count towards the 10 years of payments needed for forgiveness. If Jane worked at an academic hospital, she could take off up to three months per birth and if she makes payments on REPAYE, PAYE, or IBR, she gets credit towards tax free loan forgiveness. As I mentioned, if Jane had a spouse, then that could make things a bit more complex. Keep in mind you’re married for the entire year for tax purposes once you submit your marriage certificate. I’ve met many couples who have three to four years of credit towards PSLF while they’re planning their wedding. If Jane had fallen into this category, she could probably count on at least a year for the student loan servicers to incorporate her spouse’s income into the payment calculation. If she uses PAYE once she gets married if that’s in her life plan, she can cap the required payment at no more than what’s required under the 10-year Standard plan. That capping feature allows most physicians to qualify for substantial loan forgiveness even if they’re a high-income surgeon like my fiancée.Plan for PSLF, but Prepare for an Alternative Plan Just in Case

If you’re in training right now, there’s no harm in tracking progress towards loan forgiveness on the PSLF program. If you decide to go private practice, you can refinance and get a lower interest rate with a private lender. If you decide to stay with a hospital, it will probably be a not for profit employer. You might as well set yourself up for this benefit as it’s worth tens of thousands if not hundreds of thousands of dollars. In case PSLF gets repealed, which is probably not going to happen for folks who already have loans, you’ll owe less by using an intentional strategy for loan repayment. Female physicians with student loans like my fiancée Christine deserve a fair shake. Hopefully, you’ll take advantage of free content on Miss Bonnie MD’s blog and my site Student Loan Planner to save every dollar you deserve. If you wanted help coming up with a loan repayment strategy, I’d love to help.]]>

Female physicians with student loans like my fiancée Christine deserve a fair shake. Hopefully, you’ll take advantage of free content on Miss Bonnie MD’s blog and my site Student Loan Planner to save every dollar you deserve. If you wanted help coming up with a loan repayment strategy, I’d love to help.]]>

Get the bestselling book - Defining Wealth for Women.