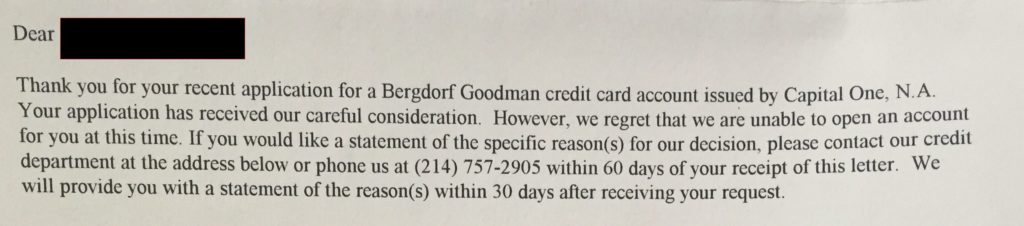

I was almost a victim of identity theft.

I did not apply for this card:

For those of you not familiar with Bergdorf Goodman – it is a high-end luxury department store in NYC – think Gucci, Prada, Chanel. Unfortunately, not a place I will be shopping at anytime soon.

I checked on Credit Karma and there it was – a hard inquiry on Equifax dated around the same time of the above letter from this department store. I also found another hard inquiry that I did not initiate. I took this opportunity to thoroughly review what accounts are open and make sure they were actually mine. Phew – all good. But I did find 3 old store cards that I haven't used in years. I went ahead and closed them.

I then froze my credit at all 3 agencies – Equifax, Transunion, and Experian.

What does freezing credit do? It prevents unauthorized use of your credit to open credit cards, mortgages, etc. unless you/they have your pin. This pin is issued when you freeze your credit. When you need to open a new card or mortgage you simply unfreeze or thaw your credit. Best if you call the bank or institution and find out which agency they will use first so you only need to thaw one agency. There may be a fee to thaw – but negligible compared to the headache and time needed to undo fraudulent activity.

So, even if someone does get your information they will not be able to open any lines of credit without this pin. Guard this pin! You will not be able to do anything without it. Make copies, upload to a secure cloud etc.

Freezing your credit has no impact on your credit score. Freezing and thawing credit is also state specific in terms of how long it will stay frozen and fees to freeze or thaw.

Check out this excellent freeze/thaw guide for links and info on how to easily freeze your credit. Please note that freezing credit does not affect a theft's ability to steal and use your actual credit card. Thankfully, this is much easier to deal with.

And, don't forget to freeze your children's credit! Yes the thieves are even going after them.

If you're eligible, you can take things further and obtain a pin from the IRS so that no one else can file in your name. Yes it happens, and I can assure you this is a much bigger PITA to deal with. Unfortunately, at this time, you need to be eligible to obtain one:

- You receive CP01A Notice containing your IP PIN, or

- You filed your federal tax return last year as a resident of Florida, Georgia or the District of Columbia, or

- You received an IRS letter inviting you to ‘opt-in' to get an IP PIN.

I am not eligible at this time. Hopefully the IRS will soon let anyone obtain a pin to protect themselves.

Get the bestselling book - Defining Wealth for Women.