This is the guest post by Travis Hornsby of Student Loan Planner. He's an expert in student loans and is married to a physician. Today, he's stopping by to discuss how PSLF might impact your career choices as a physician. Check out Travis’ ultimate (and free) student loan calculator here. If you’d like to learn more, check out how you can get student loan help here. Many new physicians are planning their lives around the PSLF program. They’re terrified if anything happens to this program, and they’re afraid of working part-time or switching jobs to a private practice. You know the old saying “don’t let the tail wag the dog”? Physicians can and should be choosing their career paths and their employers based on their passions, not their finances or PSLF. To see why, it helps to take a look at the math.

Why Physicians Should Leave Training with Lots of Credit Towards Loan Forgiveness

Unless you are positive you want to go to private practice, you should not refinance your student loans as a resident. The reason is because REPAYE will give you subsidies and cover part of your interest while you’re still in training. That’s why I see REPAYE being a good in-between option if you’re unsure if you want to work private practice or at a not-for-profit hospital once you’re an attending. My wife is a urogynecologist. She had a lot of issues with our loan servicer FedLoan Servicing, so we weren’t able to go for loan forgiveness. That’s one of the main reasons I started Student Loan Planner. That said, the physician graduating today should be leaving training with between three and seven years of credit towards Public Service Loan Forgiveness on average. That’s because most residencies and fellowships take place at qualifying employers.How Much is PSLF Actually Worth to an Attending Physician?

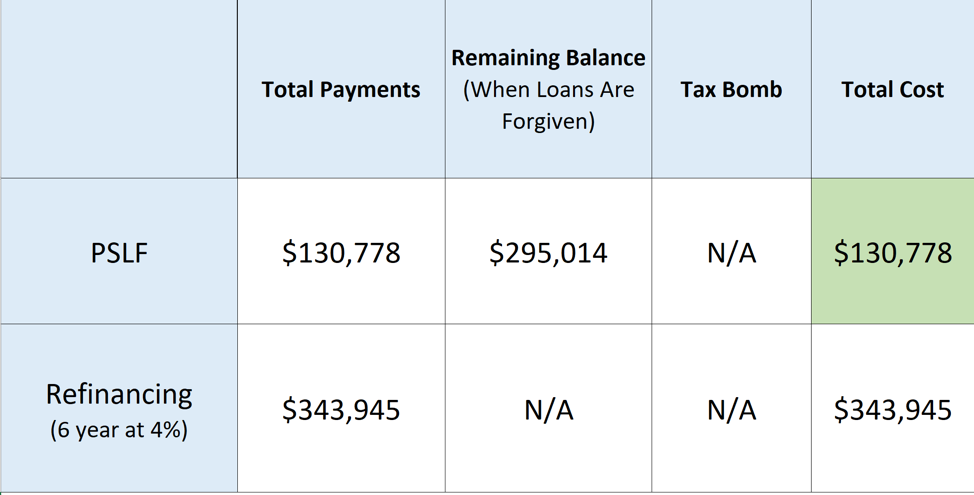

If you get a great job in private practice like Miss Bonnie MD, then pay off your debt quickly and refinance. However, pretend you are a rising OBGYN attending looking for a job. You have two options, one is a private practice paying $250,000 and the other is a giant university health care system paying $220,000. Let’s say you have $300,000 of med school loans. How much is the value of PSLF in this case? You’d spread the PSLF value over six years, since you’d be leaving training with four years of credit. Hence, the difference in payments is a bit over $213,000. Divide that by 6 (you need 6 more years as an attending to get PSLF), and you’d have an after-tax PSLF value of $35,500. You would need to adjust this for pretax salary value to see how much this benefit is worth.

To pick a round number, let’s say after adjusting for taxes, $35,500 a year in take-home pay benefit for PSLF is worth $50,000 in salary.

Hence, a $220,000 salary in the not-for-profit world would be equivalent to a $270,000 salary in private practice.

Since the private practice salary was $250,000 in this example, the extra value you get from PSLF is only about 20k a year.

Would you take a job that paid an additional 20k per year if there was something about it you didn’t like that much? Probably not.

Hence, the difference in payments is a bit over $213,000. Divide that by 6 (you need 6 more years as an attending to get PSLF), and you’d have an after-tax PSLF value of $35,500. You would need to adjust this for pretax salary value to see how much this benefit is worth.

To pick a round number, let’s say after adjusting for taxes, $35,500 a year in take-home pay benefit for PSLF is worth $50,000 in salary.

Hence, a $220,000 salary in the not-for-profit world would be equivalent to a $270,000 salary in private practice.

Since the private practice salary was $250,000 in this example, the extra value you get from PSLF is only about 20k a year.

Would you take a job that paid an additional 20k per year if there was something about it you didn’t like that much? Probably not.

Working Part-Time vs Full-Time as a Physician

Another thing to keep in mind is as a PSLF eligible physician, you don’t lose your credit if you decide to reduce your hours temporarily. You can even gain credit while on maternity leave for example (3 months per calendar year). Additionally, you could even go for the 20-25 year version of loan forgiveness if you were in a lower paying specialty and desired part-time hours for an extended period of time. If you decided to be full time again, you could pick up from where you left off on the PSLF clock. Don’t feel like if you don’t rush and get PSLF that it’s going away. It’s way too enshrined in loan promissory notes to be going anywhere in the near future.Get a Plan for Your Med School Student Debt

Miss Bonnie MD has paid off her student debt, and if you want to be like her, you’re going to need a plan. You could refinance it or go for forgiveness, but you better hope you’re making the right choice. Too many physicians are making decisions casually about the biggest financial decision they’ll make besides retirement and buying a home. Once you’ve got a solid plan in place, you can relax and focus on making your career all you want it to be. If you prefer not to spend time reading books on med school debt, then we’d certainly love to help you make a custom student loan plan. Regardless of whether you choose the Do It Yourself option or get a professional to help you, please pursue the path in medicine that you truly want. You shouldn’t feel pressure to work at a not for profit hospital just to get loan forgiveness anymore than you should work at a private practice just because it pays more money.Final Thoughts on PSLF and Med School Career Choices

Medicine is too rife with burnout and stress not to be in an employment situation where you can be happy with the results you’re getting for your patients. If that’s not the case, just make sure you know what you’re doing with your student loans and switch employers. Some huge percent of the physician workforce changes jobs in the first few years of practice. Take charge of your life and career and don’t let student debt or the promise of PSLF hold you back.]]>

Get the bestselling book - Defining Wealth for Women.