Physician Wellness and Financial Literacy Conference aka the “White Coat Investor Conference” in Park City, UT. I got to meet WCI and many “online” friends that I had interacted with on Facebook, Messenger, and on the WCI Forums.

Jim opened the conference with “The State of Physician Financial Literacy.” He implored physicians to create the job we want now where we can work for a long time. Career longevity is more important vs. trying to “retire/reach FI ASAP.” As the conference unfolded we had two great lectures by my friend Nisha Mehta on physician burnout and what we can do about it. What I took away from the conference was to start an inquiry into what my ideal life would look like if money was not an issue. What changes can I make now to get there? (After all, I will not be FI for at least a decade.) And how feasible is it to create my ideal life now vs. “when I reach FI?“

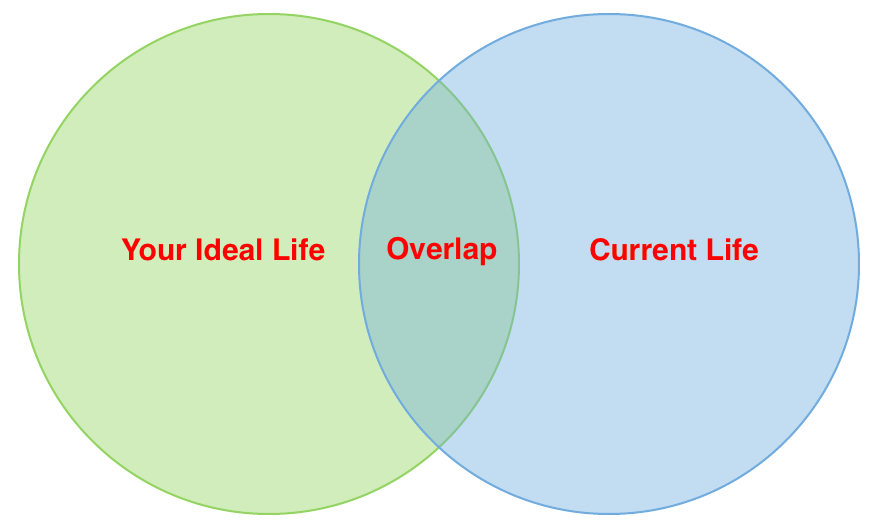

I subsequently stumbled upon this post by WCI where he presented a Venn Diagram as a visual to visualize the discrepancy between your actual life and ideal life. Obviously the higher the overlap the happier you will be. 60% is the % overlap to “be happy.”

Like WCI, I started thinking what my ideal life would like (the green circle on the left):

Like WCI, I started thinking what my ideal life would like (the green circle on the left):

- See patients 3 days a week with no weekends or holidays

- Walk to work or commute less than 15-20 minutes

- Start the work day after Eggy gets up and be home in time to play with him for a few hours before he goes to bed (and when he is older, start work after he goes to school and be able to pick him up from school)

- See no more than 4 patients an hour and run on time

- Work out 3 days a week

- Cook most meals for my family

- Have the freedom to take trips with my family 2-3 times a year

- Work on my blog ~ 10 hours a week to keep up with regular blog posts and such

- Since my current and ideal life has M & Eggy in it, I'd like M to also work 3-4 days a week and home by 4-5pm if he wishes to work that is.

- See patients 4 days a week with no weekends or holidays – Almost there!

- Commute 30-40 minutes by car – This is a HUGE improvement from my old job where the commute was 1-2 hrs each way

- 3 days a week I work 7-3pm – so I am up around 5:30am. Eggy gets up around 7:30am. 1 day a week I work 10-6pm so I get to spend part of the morning with him.

- The job is new so I am not fully booked yet but will likely schedule 6 patients an hour and I do generally run on time

- I work out 1-2 times a week

- Cooking has become almost non-existent

- We probably have the freedom to take trips but they need to be scheduled in advance and M's job isn't as flexible as mine

- Right now I struggle to put in regular time into the blog

- Right now, M works too much and works too late and for someone who isn't a physician is “on-call” quite a bit

Get the bestselling book - Defining Wealth for Women.