Student Loans

This is the guest post by Travis Hornsby of Student Loan Planner. He's an expert in student loans and is married to a physician. Today, he's stopping by to discuss how PSLF might impact your career choices as a physician. Check out Travis’ ultimate (and free) student loan calculator here. If you’d like to learn more, check out how you can get student loan help here. Many new physicians are planning their lives around the PSLF program. They’re terrified if anything happens to this program, and they’re afraid of working part-time or switching jobs to a private practice. You know the old saying “don’t let the tail wag the dog”? Physicians can and should be choosing their career paths and their employers based on their passions, not their finances or PSLF. To see why, it helps to take a look at the math.

Why Physicians Should Leave Training with Lots of Credit Towards Loan Forgiveness

Unless you are positive you want to go to private practice, you should not refinance your student loans as a resident. The reason is because REPAYE will give you subsidies and cover part of your interest while you’re still in training. That’s why I see REPAYE being a good in-between option if you’re unsure if you want to work private practice or at a not-for-profit hospital once you’re an attending. My wife is a urogynecologist. She had a lot of issues with our loan servicer FedLoan Servicing, so we weren’t able to go for loan forgiveness. That’s one of the main reasons I started Student Loan Planner. That said, the physician graduating today should be leaving training with between three and seven years of credit towards Public Service Loan Forgiveness on average. That’s because most residencies and fellowships take place at qualifying employers.How Much is PSLF Actually Worth to an Attending Physician?

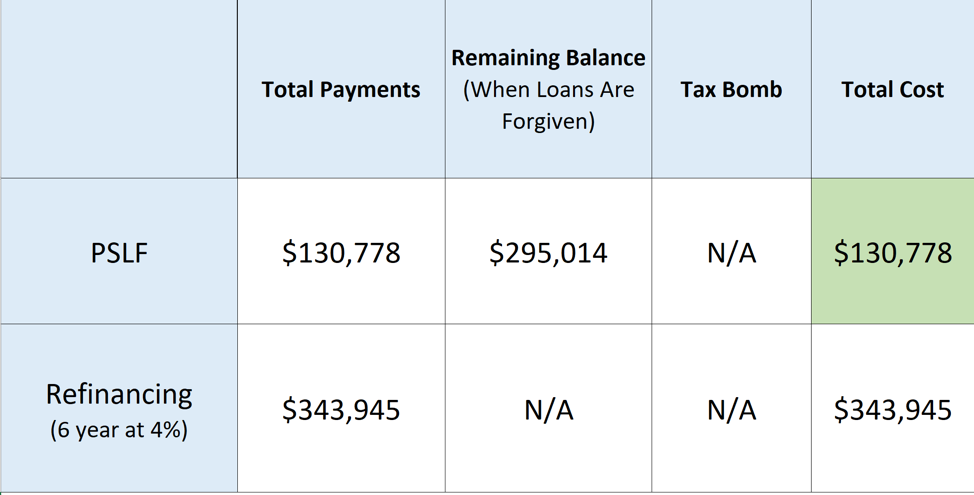

If you get a great job in private practice like Miss Bonnie MD, then pay off your debt quickly and refinance. However, pretend you are a rising OBGYN attending looking for a job. You have two options, one is a private practice paying $250,000 and the other is a giant university health care system paying $220,000. Let’s say you have $300,000 of med school loans. How much is the value of PSLF in this case? You’d spread the PSLF value over six years, since you’d be leaving training with four years of credit. Hence, the difference in payments is a bit over $213,000. Divide that by 6 (you need 6 more years as an attending to get PSLF), and you’d have an after-tax PSLF value of $35,500. You would need to adjust this for pretax salary value to see how much this benefit is worth.

To pick a round number, let’s say after adjusting for taxes, $35,500 a year in take-home pay benefit for PSLF is worth $50,000 in salary.

Hence, a $220,000 salary in the not-for-profit world would be equivalent to a $270,000 salary in private practice.

Since the private practice salary was $250,000 in this example, the extra value you get from PSLF is only about 20k a year.

Would you take a job that paid an additional 20k per year if there was something about it you didn’t like that much? Probably not.

Hence, the difference in payments is a bit over $213,000. Divide that by 6 (you need 6 more years as an attending to get PSLF), and you’d have an after-tax PSLF value of $35,500. You would need to adjust this for pretax salary value to see how much this benefit is worth.

To pick a round number, let’s say after adjusting for taxes, $35,500 a year in take-home pay benefit for PSLF is worth $50,000 in salary.

Hence, a $220,000 salary in the not-for-profit world would be equivalent to a $270,000 salary in private practice.

Since the private practice salary was $250,000 in this example, the extra value you get from PSLF is only about 20k a year.

Would you take a job that paid an additional 20k per year if there was something about it you didn’t like that much? Probably not.

Working Part-Time vs Full-Time as a Physician

Another thing to keep in mind is as a PSLF eligible physician, you don’t lose your credit if you decide to reduce your hours temporarily. You can even gain credit while on maternity leave for example (3 months per calendar year). Additionally, you could even go for the 20-25 year version of loan forgiveness if you were in a lower paying specialty and desired part-time hours for an extended period of time. If you decided to be full time again, you could pick up from where you left off on the PSLF clock. Don’t feel like if you don’t rush and get PSLF that it’s going away. It’s way too enshrined in loan promissory notes to be going anywhere in the near future.Get a Plan for Your Med School Student Debt

Miss Bonnie MD has paid off her student debt, and if you want to be like her, you’re going to need a plan. You could refinance it or go for forgiveness, but you better hope you’re making the right choice. Too many physicians are making decisions casually about the biggest financial decision they’ll make besides retirement and buying a home. Once you’ve got a solid plan in place, you can relax and focus on making your career all you want it to be. If you prefer not to spend time reading books on med school debt, then we’d certainly love to help you make a custom student loan plan. Regardless of whether you choose the Do It Yourself option or get a professional to help you, please pursue the path in medicine that you truly want. You shouldn’t feel pressure to work at a not for profit hospital just to get loan forgiveness anymore than you should work at a private practice just because it pays more money.Final Thoughts on PSLF and Med School Career Choices

Medicine is too rife with burnout and stress not to be in an employment situation where you can be happy with the results you’re getting for your patients. If that’s not the case, just make sure you know what you’re doing with your student loans and switch employers. Some huge percent of the physician workforce changes jobs in the first few years of practice. Take charge of your life and career and don’t let student debt or the promise of PSLF hold you back.]]> Read MoreWelcome to another installment of Interviews with Real Female Physicians. The goal of this series is to share their story so that you, the reader, may learn and be inspired from their experiences – good and bad. We all come from different backgrounds and have different situations. Some of you are married, some are not, some with kids, some with blended families. Let’s show other women that any of these can work financially! So let's introduce our next woman physician rockstar – Dawn.

Tell us about yourself:

I’m a 44 year old anesthesiologist living with my husband, almost 3 year old daughter, and almost 10 year old whippet dog in Salt Lake City, UT. I’ve lived in Salt Lake for 17 years, initially drawn here by a passion for rock climbing and outdoor sports, but my husband and I are originally from Arizona. We met in college and both pursued engineering degrees. After some experience working as engineers, we both decided to take different paths (he chose JD and I chose MD). I’ve been an attending anesthesiologist for over 7 years now. My practice is unique in that I am a non-academic faculty member of a large group at an academic hospital. I do all my own cases and see a wide variety of patients, but I have no call, weekend duties, research, or administrative duties. I also provide anesthesia for our university fertility clinic, a “side gig” which is near and dear to my heart because I was an IVF patient at the same clinic! I currently work two full days in the OR and 1-2 mornings a week at the fertility clinic.

Did you graduate with student loans?

My husband and I were both fortunate to have full-ride scholarships to a state university for our undergraduate degrees. He also attended the same state university for law school, where the tuition was heavily subsidized because his father works there as a professor. I attended a state university for medical school and did take out some loans, but my husband was working as a lawyer during that time so he was able to provide a majority of the financial support.

How fast (or not) are you paying them off?

Upon finishing residency, I had a relatively low amount to pay off. Despite a ridiculously low interest rate, I paid the loans in full within a few years of working as an attending.Financial aspects of kids

When did you have them?

For years my husband and I spent all our free time rock climbing and traveling, and we weren’t sure that we wanted to have children. That changed somewhere mid-residency, around the time that I turned 35. Suddenly, we felt differently about wanting to add to our family. Only I was experiencing some unusual symptoms and hadn’t had a period in over a year, all of which I attributed to the stress of being a resident. To make a long story short, I embarked on a diagnostic odyssey that lasted several months, included FMLA time, and culminated in the finding of a large pituitary adenoma. After resection (still during residency), complications, ICU stays, going on lifetime pituitary hormone replacement, and in vitro fertilization, I finally had my “miracle baby” at age 41!

Are you planning to fund their college expenses?

Although we were quite late at becoming first-time parents, we felt very mentally – and financially – prepared for the arrival of our daughter. In fact, around the time she was born, we started reading about the Financial Independence movement and realized that we were already financially independent. We were living well below our means and were used to flexible spending – being able to modulate our lifestyle and live cheaply if necessary – from many periods on the road as climbers in our twenties. In addition, we have a relatively frugal do-it-yourself type of outlook on most things.

Regarding our daughter, we opened a Utah 529 Plan at her birth, and we’ve been funding it modestly ever since. We also encourage our parents to give money to her 529 instead of giving cash (or other) gifts whenever possible.We could put more into her 529 each year, but we currently elect to fund it with the minimum yearly contribution necessary to get tax credits and invest our money in other ways. Although we see the importance of the 529 fund, we don’t plan to send her to private schools and we don’t plan to demand that she attend university. With the vast entrepreneurial opportunities brought by the explosion of the internet and social media, she could end up finding something she loves to do without a college degree. By that time, there should be a considerable chunk of $ in the account, but we hope to teach her lots of lessons about financial responsibility and value along the way. Both of us attended public schools and state universities for all of our education, and in the end, we had the same (or better) career opportunities as those who spent tens of thousands of dollars on their respective degrees.

What are your child care expenses? Are your kids in private or public school? What is the cost including after care if needed.

Although my husband and I both work part time, we spend money on opportunities for our daughter to have abundant social interactions with other children and adults. She currently attends one conventional full-day preschool daycare program two days a week and one decidedly unconventional outdoor play-based preschool two half-days a week. We love that she gets this mix of home time and away time, and we were never interested in hiring a nanny who is with her all day, every workday. Mornings when I work in the OR can be fairly hectic, so we also hired a regular babysitter who comes to our house for two hours on those mornings. She plays with, feeds and dresses our daughter before taking her to her preschool. It’s so helpful!

My husband and I both try to make our days off coincide with my daughter’s half-day outdoor preschool. That way, we get some personal time to spend alone or with each other while she’s playing in the forest. Also, we are very savvy about using our gym’s short-term daycare hours on the other days of the week. For all these permutations of childcare, I estimate that we pay about $1000-1200 per month. Every penny is worth it. Eventually as she gets older, we hope to convert all her preschool time to the outdoor play-based program, as it is more in line with our educational values. We also plan to unschool her when she reaches elementary school age, while continuing to expose her to whatever sports or artistic programs she takes an interest in.

Financial aspects of marriage

Are you married?

I’ve been married to my husband for 19 years, and we started dating near the beginning of college. We’ve truly “grown up” together and become more aligned in our values over the years.We have separate bank accounts. We dated for a long time before getting married and just never merged the accounts. There’s no regimented system, but we transfer money back and forth between accounts and take turns paying for various expenses depending on account balances. He makes more money than I do, but as an owner of his own law practice, his income is quite variable. He also allocates retirement money differently than I do, given that he is a business owner and I am a W2 employee. While we decide on big-picture money management issues together, he actually manages all of our finances in a Quicken program that combines all of our money transactions. He also does the taxes every year.

Do you and your husband agree on finances?

At first, my husband and I had very different views about spending. Overall, we agreed on the larger financial priorities, but I was much more of an emotional spender and he very logically saw money as “life energy” early on – before it was trendy. I wrote extensively about this in a recent post on my blog; my conversion to a more minimalist/valueist spending style didn’t happen until I became a mother and saw the simplicity and decreased stress that it brought to our household.Are you the breadwinner?

Interestingly, we’ve taken turns being the “breadwinner” of the household. I made the money straight out of undergrad that allowed us to buy our first home while he was in law school. Later, the tables turned when I was in medical school and he was establishing himself as a lawyer.Have you experienced a financial catastrophe?

When I was fresh out of undergraduate school working as an engineer, I made the mistake of succumbing to lifestyle inflation and spending most of my earnings rather than saving them. I elected to rent an expensive apartment and spent lots of money on clothes – things that don’t matter as much to me today. I had a 401k with corporate matching, but I didn’t even come close to maximizing my pre-tax contributions. I wish I had done this and continued to “live like a college student”, because that fund would be worth a lot more today (20 years later)! Now I make the maximum contributions to my retirement accounts and never even see the money before it’s allocated.

While I’ve been fortunate to not suffer a financial catastrophe, I have experienced a significant health crisis (see above). It changes your outlook on everything in your life – what’s important to you, how you want to spend your time, your money, etc. Because of my tumor, I no longer qualify for individual disability insurance, but we basically self-insure. We’re flexible enough in our spending to be able to deal with such a financial loss. We self-funded $50k in IVF fees over a three–year period by being financially flexible and cutting back on some unneeded expenses.

General Finances

What’s your FI (financial independence) number?

We consider ourselves FI by the 4% rule with a very reasonable yearly living amount, but neither of us are actually retired. We both enjoy our respective work in the capacity that we’re currently doing it – very part time and with ample vacation sprinkled in. The one thing we’d like to do in the near future is travel more with our daughter. My husband’s work is completely location-independent, but mine currently is not. So I might be adjusting things soon to accommodate for that. This may mean taking a sabbatical from my current position, going seasonal, or doing some locum tenens work. Also, I hope to grow my blog and social media presence, and potentially do more writing and speaking gigs.What is your net worth? How are you saving for FI/retirement?

Overall, our asset allocation is roughly 60% equities, 30% real estate, 10% cash. Simplicity is my theme word; it’s what I’m constantly striving for in many areas of my life, finances included. We are completely debt free, we self-insure for life and disability, we recently downsized our living space and also sold one of three properties. Most of our money is in the VTSAX index fund, and we don’t look at the gains and losses too frequently.What does FI/retirement mean to you? What does it look like?

I see our FI as a combination of good financial decisions, high income potential for both partners from a young age (given that we started out as engineers), and the ability to spend flexibly. Not everyone will have all of these factors in their FI equation, but figuring out your financial strengths and weaknesses can help to clarify and refine your own path to FI.

Any parting words of wisdom?

Tell readers a fun/random fact about you

When I meet people, they always want to know how tall I am. I’m 6’1” with no shoes on. And I have rock climbed in seven different countries.

And finally, where can people connect with you?

I blog at PracticeBalance.com. I’ve been writing more about money issues (mainly the mindset side of things) after meeting Bonnie this year, so check out my most recent posts and then work backwards from there to read about wellness, work-life balance, parenting, anesthesia, infertility… you name it. I’m also on Instagram @PracticeBalance, Twitter @DLBakerMD, and Facebook as Dawn Baker.

And … that's a wrap! If you're interested in doing this please send me an email – I'd love to hear from you!

I'm so excited more women physicians are blogging about money and living a life of their own choosing. Definitely head over to Dawn's blog!]]> Read More… (or Smart ways to fund your children’s education) This is a guest post by Platinum Sponsor Johanna Fox of Fox & Co. Wealth Managementt, a fee-only financial planning firm. Until recently, she was also our financial planner. Saving for college is on the minds of most of our clients since around 75% either have young children, are pregnant, or both. The amount you need to save for education depends upon the choice of college, how many children you have, how much your funds grow, and the percentage of college, grad school and/or med school you want to fund. For a family with even two young children, you can easily looking at a need of $1M – $2M by the time they are ready to start college, especially if you plan to fund post-grad. Of course, that’s not even considering private school for K-12. Planning ahead and doing it right will both save taxes and increase your long-term net worth. But planning so far into the future for little creatures with minds of their own is a daunting and expensive challenge. To explain how to build an education savings plan for your own family, let’s review a case study. I’ve built a composite family, the Varkeys, using details from several clients’ plans:

- Dual physician family earning $680k/yr with children ages 2 and 6 plus another on the way

- Want to save enough for 4 years at Georgetown University, their dad’s alma mater, and maybe medical school.

- Hope to send children to private high school @$15k/yr/child.

- Student loans of $150k, refinanced @3.875%

- 2 mortgages: $850k on a $1.3M house and $450k on a rental duplex

- One spouse has access to a 401k and the other has access to a 403b/457b combo, and they both do annual backdoor Roth IRAs.

- And by the way: they hate debt

Prioritize

One of the biggest challenges of planning is prioritizing how to allocate limited resources to achieve your goals. The first rule in saving for education is not to sacrifice your own future: there are no scholarships for retirement and you will not be doing your children a favor by providing for nice educations at the expense of having to rely on them in retirement. However, you may be able to forego some retirement savings in the near term in favor of early education savings, and then get back on schedule. So, if your projections show that you will be able to skip a few years of 457b and backdoor Roth IRA contributions and have a few million dollars left at death, and that’s the only way you can fund your education accounts, then we might consider frontloading education to launch early tax-free growth and then return to maximizing all retirement space possible. Save for school or pay off debt? Since the debt feels so burdensome, I wouldn’t have a problem attacking the student loans heavily for 3 years but not the mortgage or rental interest. The reason is that student loan interest is not deductible, and lingering student loans are oppressive to many graduates because it represents nothing tangible. The interest on the mortgage is deductible as an itemized deduction and the interest on the rental will be deductible at some point – either when their rental begins to show a profit or when they sell it. And having tangible assets that are appreciating in value mitigates the emotional aspect of paying for “nothing”. Note: If you have access to an HSA, I would not forego contributing – ever (but that’s another article.)]]> Read MoreWelcome to another installment of Interviews with Real Female Physicians. The goal of this series is to share their story so that you, the reader, may learn and be inspired from their experiences – good and bad. We all come from different backgrounds and have different situations. Some of you are married, some are not, some with kids, some with blended families. Let’s show other women that any of these can work financially!

So let's introduce our next woman physician rockstar – Eliza from Minimal MD.

Tell us about yourself:

I'm Eliza from Minimal MD. I love my life as a 35 year old retired dermatologist, living in the Midwest with my husband and two kids. I'm really into minimalism and travel.

Did you graduate with student loans?

Yes, I went to a private medical school. The total payback over a ten year term was projected at $250,000, including interest with rates of 1-9%.

I paid off my first small loan during my intern year to avoid the terrible 9% interest rate. Then I got serious about the loan with the next highest rate. I graduated from residency in 2012, and made my last loan payment in April of 2017.

Financial aspects of kids

I had both kids during residency.

The out of pocket cost for two kids at our on campus daycare was $2,400 a month. Luckily, they had a financial hardship program. It brought the cost for our first child down from $1,200 to $400. The amount varied every few months. As soon as I graduated, I went to a part time position, working 2.5 days a week.

We tried a highly rated Montessori school for our daughter. It was $9,000 for a half day program that didn't really meet her academic needs. That disaster, on both the educational and financial fronts, has made me really skeptical about paying lots of money for private school tuition. I think carefully now about the opportunities I could provide with a similar amount of money.

We currently live in an area that doesn't even have private schools. Most recently, we have decided to homeschool because I really like the flexibility to be able to travel with the kids now that I am retired. We will take off for several weeks at a time to explore the U.S. or Europe.

Financial aspects of marriage

I am very happily married. My husband is loving his career right now, so he continues to work. Retiring early isn't for everyone. Luckily, he is a teacher, so we have been able to just relax and travel together all summer.

What financial mistakes have you made?

I've already mentioned the private school fiasco. Our second big financial mistake was living apart during five of our early years of marriage. Having separate households and commuting frequently across the country is not a way to build wealth. For the record, it isn't a fun way to parent two small children either.

Our next mistake was regarding our home purchase. When we bought our first home, we wanted to live in a certain public school district. We also wanted a fenced in yard for the kids and a basement to protect us from tornadoes. The only house that fit those specifications was a 4,700 square feet custom built home. We had no money for a down payment because we spent so much paying down my student loan debt, so we financed 100% of the purchase price and took an adjustable rate loan.

In addition to the loan terms, the house was a lot to take care of and many repairs were more costly because of the size of the home.

The saving grace to the situation was that we then bought a home well within our price range. We took on only 25-33% of the loan that the bank would have allowed us to qualify for. Also, rather than accepting the loan as a part of life, we paid as much as we could each month and knocked out the entire mortgage in 2.5 years. We moved recently and used the equity from the first house to pay cash for a smaller home.

What’s your FI (financial independence) number?

We used the general advice of 25x yearly expenses to achieve financial independence. I don't include home equity or the 529 account money in that number.

Do you have disability insurance?

I did have own occupation disability when I worked. I have cancelled that since the policy only applied when I was working anyway and was the largest line item in our monthly budget. I also canceled my husband's primary life insurance this year since we are financially independent. We do have some other umbrella and supplemental life insurance policies that are just so inexpensive that they barely register. I'm constantly adjusting the coverage.

If you are FI or “retired” – what are you doing?

I left my clinic job in June 2017 and have spent the last year traveling with my homeschooled kids across the U.S. and to England, France, Iceland, Scotland, Sweden, and Denmark. To keep my license active and engage with peers, I have done some free skin cancer screenings and locums work averaging one to two days a month. I've also downsized from the 4700sf house to a 1350sf house plus basement on 5 acres of forest.

With so many changes this year, I'm still adjusting and growing into this phase of my life. You can read more about my minimalism, financial story, and travel experiences at MinimalMD.com, or connect with me via Facebook.

And … that's a wrap! If you're interested in doing this please send me an email – I'd love to hear from you!

I totally agree that minimalism and simplifying life has great rewards. Kudos to Eliza for achieving FI!]]>

Read MoreFire Your Financial Advisor course.

Part 1 covered the license designations an FA can and should have.

Part 2 covered how FAs should get paid.

Part 3 – What's the difference between a financial advisor and planner?

Part 4 – How to find and vet a financial advisor

Part 5 – I fired my financial advisor

Johanna and I separated after about two years of working together. Before I go into why, I thought I would first discuss why a financial blogger would hire one in the first place. I mean, if I am giving information shouldn't I know what I am doing and not need one?

Why I Hired a Financial Advisor

Curiosity … and blog research!

I noticed that the other finance blogs were mainly (perhaps all?) staunch DIY and anti-FA. Curiously, many also give advice about financial advisors yet have never worked with a true financial advisor or planner. So, I became curious and thought working with one would be great research for my blog and I may learn a thing or two!

Afraid to make any more big mistakes

I finished residency at age 38 with ~$200,000 in student loans and barely $1,000 in retirement accounts. That was a huge hill to climb. I could not afford to make any more big financial mistakes if I ever wanted to “retire”.

Combining finances

Things were getting serious with M. Although I felt pretty comfortable managing my own money, managing our money made me feel a bit uneasy as making mistakes would now affect two instead one.

What I Loved About Having a Financial Advisor

During the time that I worked with a financial advisor, I actually realized there were some great benefits. Here's what I loved:

Systematically going over our financial houses

The part of reviewing finances that takes the longest (at least for us) is gathering lots of important documents, scanning them, then uploading them into a secure website for them to review. These include all of our insurance policies, retirement plans, etc.

Our planner made sure we were adequately insured. Perhaps one of the most important things we accomplished was getting our estate plan done: wills, power of attorneys, and health care proxies. Too often this becomes a non-urgent to-do item that never gets done and then it is too late.

Advice (duh)

Johanna and her team had their work cut out for them. Their brand new clients get engaged then pregnant and then decide to move cities with new jobs. All of this happened within half a year!

I was unemployed for about 16 weeks during my maternity leave. Additionally, I was freaking out about not bringing in any money while I watched my checking account only go down. Lots of impulse shopping on amazon.com didn't help either. Perhaps it was all postpartum hormones but Johanna had to talk me down a few times. Having someone you trust say “you will be ok” is and was priceless.

The big picture

We discussed our goals and dreams. After all the information gathering, we received snazzy reports and graphs comparing different scenarios (renting vs. buying, etc). I also learned that we would and could reach financial independence a lot sooner than I thought.

Why I Fired My Financial Advisor

I guess you could say I am a true DIYer. Honestly, I love creating and updating spreadsheets with our numbers. I love crunching the numbers. And I am comfortable managing our money.

Our FA custodied some of our accounts and I did not like not being able to manage them myself. I suspect most people who hire FAs want to delegate these tasks. And perhaps lastly, I drank the FIRE Kool-Aid. We are currently optimizing and minimizing our expenses to reach FIRE. All of these factors combined meant that it was time for me to fire my financial advisor.

What Should You Do?

There are two schools of thought when it comes to money. Some people prefer to DIY their own finances. Other people choose to work with financial advisors.

There are so many variables to consider when choosing which path to take. If you do decide to work with an advisor, make sure you pick an advisor that you can trust. Working with a fee-only financial advisor is one way to ensure that your planner has your best interests in mind. Also, remember that your relationship with that advisor doesn't have to last forever.

What did you think? Were you surprised that I fired my financial advisor? Have you worked with a financial advisor? What worked and didn't work?

Read MoreWelcome to another installment of Interviews with Real Female Physicians. The goal of this series is to share their story so that you, the reader, may learn and be inspired from their experiences – good and bad. We all come from different backgrounds and have different situations. Some of you are married, some are not, some with kids, some with blended families. Let’s show other women that any of these can work financially! So let's introduce our next woman physician rockstar –Teddi.

Tell us about yourself:

I’m almost 34 and am a community based academic Emergency Medicine attending. I’m from a blue-collar background in Oklahoma. Worked full time and moved out in high school and barely graduated. Became an ICU nurse. Applied to 1 med school and was accepted (University of Oklahoma), had a big chip on my shoulder, and went into General Surgery at Northwestern in Chicago. Met my husband who’s an academic Neuroradiologist while we were both in training. I found new perspective about the balance that I wanted in my life. I quit for that reason and many more. During my PGY3 going to PGY4 year I lucked out into a spot in emergency medicine at the same institution. I did not consider the financial impact at the time, but I ended up with shorter training, no fellowship and a specialty with reasonable pay. Now I’m loving my 0.8 FTE ER nocturnist life and have a little 3-year-old daughter. We live super local and frugally because I want riches and financial independence in like 3-5 years. I’ve been investing small amounts since college, but got really into personal finance as I finished my training. I like to learn absolutely everything about a subject, so definitely can be pushy with my excitement in my activities. I love to travel and traveled extensively, pre kiddo, but we all go somewhere on a plane every month or so. I love hosting elaborate get togethers, so am working towards a dream home as soon as I can convince my hubs. Cook at least 5 nights a week and am an avid city gardener. I’m not really crafty, but more of a person that thinks they can learn anything and don’t like to pay for something I can do myself. I think financial literacy is very important and we’ve been short changed during our medical training, so I try to get the word out as best I can.Did you graduate with student loans?

I had around $237,000 at 6.8% from medical school. Nursing school was essentially free. Had made several years headway into PSLF and was kicked out on a technicality that I didn’t understand at the time. I finished training in 2016. Spouse had around $300k at 1.8%. He finished training in 2012. We didn't even keep track at first as we paid them, but from late 2015 to NYE 2017, paid off all of the remainder of initial debt around $550,000.

Financial aspects of kids

When did you have them?

Had my daughter during my second year of Emergency Medicine residency (PGY-5), which was rough, and I wouldn't recommend. Planning on having a second, which will greatly affect our home capacity and probably child-care costs.Are you planning to fund their college expenses?

We plan on paying for most, if not all. I hated starting life so in debt. Started saving the annual max last year when our daughter was 2, so only have to save for another couple of big years, then we hope the market takes care of the rest.What are your child care expenses?

We pay $1300/mo. for 3 day a week daycare and then frequent babysitting.Financial aspects of marriage

Are you married?

Yes we are married.Did you get a pre-nuptial or post-nuptial agreement?

No, didn't even really consider it but both were in massive debt.Do you and your husband agree on finances?

We are both very motivated to see some money accumulate in our bank account, but do go about things differently. He found the blogger Mr. Money Mustache first, but was already an anti-consumer and rides his bike to work. My husband prefers to play it safe with investing, and is tough to make plans with since he could live in a shack and be a radiologist forever on a w2 salary. It helped to get used to living on a fraction of my spouse’s new attending paycheck while paying down loans and using my resident salary to help fund retirement accounts early. Then we saved 100% of my new income for over a year that I’ve been out of training.Have you experienced a financial catastrophe?

Our house caught fire my second year of EM residency, but we were able to spend about 50k above the 400k-600k insurance claim to renovate it to our liking. It was very stressful at the time, but no real financial hit. Two years of a gut renovation later- we have a great townhome.

General Finances

What’s your FI (financial independence) number?

We haven’t decided. I feel pretty financially independent now without debt other than our mortgage. Maybe around 2.5 mil if we wanted to quit working completely.Who handles the finances in your relationship? Are you DIY or do you have a financial advisor?

I handle the money and we have a CFP that sold us our insurance and disability, but doesn't manage our investment accounts. We also have a CFP/CPA that does our taxes and gives us annual strategy/pep talk that is extremely helpful.What is your net worth?

$1.1 million. We include retirement accounts and the equity that we’ve paid into our mortgagesHow are you saving for FI/retirement?

Other than destroying debt with gazelle intensity – we currently have two 401(k)s, two Roth IRAs and two 457(b)s plus I have a solo 401k. We both get almost the full employer match allowed. I started a custodial account last year that we contribute to after our 529 contribution goal is met. Then we have a taxable account that I contribute to every time I make a wise financial decision like cleaning my own house or grooming my dog, etc. 90% index funds plus individual stocks. I have one 6-unit rental property that was amazing income during residency but lately has been just breaking even. We also pay extra on our mortgage every month. Now that we are done with loans, we will be ramping up our FIRE savings to work however we find most enjoyable.One thing you wish you knew:

The power of compound interest. I had student loan money sitting in a no interest savings account for like 5 years, accumulating 6.8% interest in debt. I used the money for a fancy wedding, fancy cars and multiple European vacations before I thought about financial independence. You can never out earn bad spending habits!Do you have insurance?

We are probably over insured, and now have to figure out how to back down a little since our debt is more manageable. We have disability, life, auto and umbrella insurance.What does FI/retirement mean to you? What does it look like?

One, I love to entertain and hope to have a beautiful home somewhere that is probably not Chicago one day. Two, I would like to contribute more to the future of medicine and to support women advancing in politics. I think having money lets you be totally free.Do you give to charity? If so, where and why?

I got extra interested in personal finance around the time that our current president unexpectedly took office. I’ve been concerned about the decrease in public funding of charities, so right now I donate all the profit from one side gig to different charities each month. I hope to be able to make more meaningful change when I am done with the child-creating and wealth-building phase of my career. I don’t think our taxes are required to pay for everything, so I don’t mind funding some things privately.Any parting words of wisdom?

When considering a job, things that can be readily measured get too much attention, for example, salary and vacation time. Aspects that are hard to evaluate like an interesting work environment, stress and morale are more important. Have a longer, more productive career without burnout. You can live well in an expensive area if you balance a short commute and manageable job so that you don’t have to subcontract out all the adulting (cooking, cleaning, grocery shopping, parenting) of your life. My take is to skip the fancy car, house and country club but consider living somewhere great that your day-to-day is really full of vibrant people and activities.And … that's a wrap! If you're interested in doing this please send me an email – I'd love to hear from you!

I loved reading Teddi's story and I hope you did too. I couldn't agree more with her advice about seeking a long career without burnout.]]> Read MoreWhenever I saw posts from “other people” asking how to handle a windfall, I always thought “Wow, lucky them.” I never thought we would be in a position where I would need to read the Bogleheads article on How to Manage a Windfall or the White Coat Investor's version and how he personally handled his. I like how WCI puts windfalls into 3 categories:

- Spare Cash – around 10K-200K

- Enough to make you financially independent – 1-3 million

- Ridiculous Money (think lottery)

- First, we chose to pay off my student loans and become debt free. What a feeling!

- We bought a car in cash.

- We beefed up our emergency fund.

- Set aside money for new furniture for our new home.

- Frontloaded 529 for M's first son.

- Started Eggy's ESA.

- Started a taxable brokerage account at Vanguard.

If you're interested in learning more about finances and don't have the time or interest to wade through books, blogs, and online forums then this course is for you. I wish this course was available when I first got interested a few years ago. I had to read several books, read a ton of blog articles, and post a lot of questions online to learn what I know now.

When you finish the course, you’ll feel confident that:

If you're interested in learning more about finances and don't have the time or interest to wade through books, blogs, and online forums then this course is for you. I wish this course was available when I first got interested a few years ago. I had to read several books, read a ton of blog articles, and post a lot of questions online to learn what I know now.

When you finish the course, you’ll feel confident that:

- You have all the insurance you need at the best possible price and none of the insurance you don’t need

- You are managing your student loans the right way, maximizing the benefits of government programs, minimizing interest paid, and getting out of debt as soon as possible

- You are either capable of managing your investments yourself, or you are paying a competent advisor a fair price to do it for you

- You are saving enough money to reach your goals and can spend the rest on whatever you like without feeling guilty

- You aren’t paying any more taxes than you need to

- Your children and your assets will be taken care of if something should happen to you

- Your assets are protected from lawsuits as much as possible with a simple, straightforward, and inexpensive plan

- You have a written plan to follow that will guarantee your financial success

Click here to find out more details and to purchase with code: MATCHDAY18 for 15% off

As an affiliate for this course (the course is the same cost to you regardless of who you purchase from) I was able to take the course for free. It is quite comprehensive and I cannot think of a more time efficient way to learn this stuff. Have you taken the course? Comment below! ]]> Read Morepush presents are a thing. And it turns out that I got the best push present ever!

About a year ago, M asked me to marry him and promised to keep our net worth positive. At that time, I was dragging us down with my student loans.

Well, not anymore! M paid them off!

Yup, I no longer have student loans. Happy dance in order:

And, we are now officially DEBT FREE !!!!!!!!!!!!

The Case to Wait to Pay Off Debt

I hear people say all the time that you don't “need” to pay off low interest debt quickly. I see their point and I wasn't planning on paying off these loans for another 3 years. Right out of residency, I favored maxing out my tax advantaged retirement accounts over making extra payments towards my student loans.

Why No Debt Is the Best Push Present Ever

Despite this argument, having no debt really feels fantastic. And it comes with some really significant perks too.

Being debt free means:

- No extra monthly payments

- A lower monthly operating budget

- Any extra money we get goes to us, not debt

Final Thoughts on Being Debt Free

Existing loans and taking on new ones (mortgage, car loans, etc) give you the illusion that you can afford something you actually can't.

Like 0% interest car loans – trust me, they aren't doing that to be nice to you. They know you will buy a more expensive car on credit even if you aren't paying interest. After all, it's just another monthly payment, right?

Couples who pay off debt together stay together. Of course, not every couple might have the means or the desire to pay off debt in one fell swoop like this. The most important thing is to make sure that you're on the same page financially, or at least taking steps to get there. Having solid financial footing before bringing a baby into the world truly feels like the best push present.

Read MoreHaving a baby and becoming a mom is stressful. There's no denying that. Planning for a maternity leave can be stressful, too. If you're expecting your first baby (or even a second or a third!), you might be wondering what a longer maternity leave looks like. Here's how I spent (and funded!) 16 weeks of maternity leave.

A Word About Stress

Everyone handles stress differently. No two births are the same. There are so many variables when it comes to maternity leaves.

For me, well, my leave was pretty stressful.

There was moving and almost dying along the way. At some point (OK, multiple points), I was overwhelmed and probably met criteria for postpartum anxiety. I spoke to a psychiatrist friend who pointed out that I pretty much experienced all the top life stressors except death of a loved one (and let's keep it that way!) within a 4 month period:

- New baby (especially the first one)

- Moving

- New Job

- Serious illness

She also pointed out that what's especially hard for new mothers is that no one is taking care of us. We are always taking care of baby (and spouse).

A Look at 16 Weeks of Maternity Leave

I feel lucky that my mother lives nearby enough and has been with us most weeks.

Breakfast of Champions – home cooked Korean food

So, I decided to give myself a pass on pretty much everything. For me, that meant a lot of stopping.

I stopped worrying about…

- Posting consistently on this blog.

- My new postpartum figure (well, kind of).

- Every single bit of what I was eating.

- Spending too much especially if it made my life easier during this time.

I am still trying to worry less about the not fully unpacked apartment.

Oh, and I finally figured out the biggest fallacy of “maternity leave” — nothing gets done despite not “going to work.”

Funding a Longer Maternity Leave

Throughout my leave, I was often asked how are we able to afford taking 16 weeks of mostly unpaid leave.

Let's back up and actually look at my leave. I took 16 weeks of leave, and it was only very partially paid. 6 weeks paid at my old base salary was all I got.

So how did we swing the full 16 weeks of maternity leave?

The answer is simple: We lived below our means, and we saved for it. Remember, you have about 9 months to save for maternity leave!

Let's go back to the idea of living below our means. In other words, we do not need our whole paycheck to get by. While I was pregnant, I stopped making extra payments to loans in favor of saving for this time.

Then, I had a cushion to pay for my maternity leave.

It definitely didn't feel good to watch my checking account balance only decrease during my leave, but seeing his face daily more than made up for it.

What are you looking at?

Final Thoughts on 16 Weeks of Maternity Leave

Isn't this what it's all about, Moms? I hope everyone about to have a baby can have the freedom to spend more than the typical 4-6 weeks of doctor maternity leave.

Look hard at your budget while your expecting, and see what you can do to save a bit extra. Even if you can't fund 16 weeks of leave, anything extra counts. You won't regret it.

What do you think of funding a longer leave? Comment below!]]>

Read More