Student Loans

View from my previous apartment in Williamsburg, Brooklyn, NY on Christmas Eve[/caption] It's definitely easier to attain financial independence (FI) faster when you live in a LCOL (low cost of living) with a high income. Is it out the window when you live in a HCOL (high cost of living) – like Brooklyn, NYC (where I live) or the San Francisco Bay Area? Of course not. But some thing(s) need to give if you want to reach it in a reasonable amount of time. So, how are we able to put away > $80,000 a year towards FI, pay down loans aggressively, be able to afford child care in this expensive city AND still be able to enjoy life? 1. We keep housing costs as low as possible This is probably the largest ticket item for those of us in a HCOL. A modern (meaning it includes a dishwasher and laundry in-unit) 2 bedroom apartment in a great part of Brooklyn will be a minimum of $4,000 for likely < 1,000 sq. ft. Manhattan? Try $5,000 and likely much more for any decent neighborhood. What about buying? Try $1 mill for a tiny 1 bedroom (again, if you're lucky) and upwards to $2 million+ for a 2+ bedroom apartment. That doesn't include the monthly maintenance fee. Want a parking spot? Extra.

“If you will live like no one else, later you can live like no one else.” – Dave Ramsey

I am not a huge fan of Dave Ramsey, but his basic mantras will serve most people very well. M and I live in a tiny apartment (730 sq ft). M owns this apartment and luckily bought in the early 2000s for a whopping down payment of < $20,000. No, there isn't a missing zero. It is a true two bedroom, one bathroom apartment. We have a dishwasher and our own laundry – which in NYC is a luxury. With the upcoming baby (and our bonus son that we have sporadically during the school year), many have told us that we have to upgrade. Nope. My brother and I attended high school living in a similar apartment (sharing a room). This won't be “forever” but we are doing our best to stay here until my student loans are paid off by end of 2020 or earlier. We will finish paying off M's car loan (I drive to work) in the next month or so leaving just the mortgage on his end. We street park (free). Our total housing costs (mortgage + taxes + condo fee) is ~5% of our 2017 annual gross income.

2. We chose a financially like-minded partner

Aka choose your spouse wisely. OK, so we didn't exactly do this on purpose, but sorta (at least on my end)? About 1-2 months into dating M, I asked him about his finances. Specifically, I asked him how much money he had in his retirement accounts and what debt(s) he had. I also knew that he wasn't a big spender. As things became more serious we discussed our shared financial goals for the present and future. We did this before we got engaged.

2. We make savings automatic

My 403(b) and 457(b), and his 403(b) contributions are automatically deducted from our paychecks. We never see the money. Since these are all pre-tax contributions, we don't really miss it vs. not doing this automatically and seeing if “we can afford to save.” We do our best to fund the Roth IRAs early in the year so we don't miss it and are not tempted to spend the money instead.

3. We (mostly) stick to a budget

I use YNAB to budget. I haven't added M's expenses yet but I am able to track our overall spending in eMoney (web based software we use with our FA). I've been using YNAB for over 2 years now. I was a spendaholic and this is my rehab.

4. We don't buy (much) stuff

We aren't minimalists, but we both agreed that stuff does not make us happy. We also don't have room for the stuff anyway (see above).

5. We have decided on the 1-2 things we really enjoy and don't hesitate to spend on it

Luckily, we both really enjoy eating out & cooking good food and traveling. Sure, we could nix all vacations and eat rice and beans until loans are paid off but it's important to enjoy life now too. We do try to meal plan for the week and we generally bring lunch to work. We budget for all of this.

[caption id="attachment_1137" align="aligncenter" width="402"] Lots of wristbands to get into Panorama 2016[/caption]

Lots of wristbands to get into Panorama 2016[/caption]

Another thing we both really enjoy is attending live concerts of our favorite bands (mainly indie pop/rock/some electronic). Luckily, NYC is almost always a stop on anyone's tour. Not to mention home of some of the big summer festivals. Confession: I have not paid for a single concert since M & I met. One of the big perks of M's job is free (and VIP) access to almost any concert we want to go to. We attended Panorama last summer. In the past several months, we have seen the Shins, the xx, Sigur Ros, Frightened Rabbit, M83, Tame Impala, Sia, the 1975s, Mumford and Sons, and Flume to name a few.

Bottom line – we live well below our means.

How are you making it in a HCOL? Comment below.

]]> Read MoreM and I are pleased to announce that we are expecting a baby boy this fall. We have nicknamed him “Eggy” – it means baby in Korean. As you know, you cannot exactly plan when you become pregnant. Honestly, we were not sure if things would happen au naturel due to my age so IVF was a possibility. Luckily my current job includes 3 cycles of IVF as a benefit but it is still not 100% covered. I know many ladies who have spent a small fortune on getting pregnant. So here are a few things I have learned, financially, about trying to get pregnant and trying to plan for leave and childcare:

- Insurance coverage: Make sure you know what your insurance plan will cover and not cover and what deductible you'll need to meet, if any. Even if your insurance says “maternity is covered,” it may not cover all the tests. My costs: $40 (co-pay for the first visit only) is what my total out of pocket costs will be, including the delivery. This assumes I use an ob-gyn within my health system (I am) and that I deliver at one of their hospitals (I plan to).

- Maternity Leave: Think about how long you'll want to take for leave and what leave, if any, will be paid. This is a highly personal decision, but I have yet to meet someone who said they took too much time off. Unfortunately, paid maternity leave is not the norm in the U.S. If you have unpaid leave at least you'll have approximately 9 months to save up for this. My leave: I get 6 weeks paid leave (at my base salary) or 8 weeks (c-section). I can also use unused vacation. I will have at least 2-3 weeks of unused vacation to get to at least 8 weeks paid. I am taking at least 3 months off. So that means at least 1 month unpaid, possibly more. Since I only really need ~60% of my take home base salary, this won't be a huge burden on us and we will have more than enough saved to cover this unpaid time.

- Maternity clothes: Unless you only wear stretchy pants and dresses, you'll need at least a few staples. I do wear scrubs a few times a week to work so I did not have to buy a whole new work wardrobe. Gap Maternity is pretty inexpensive and I was able to use a 20-40% off coupon when ordering online. It also helps that it'll be mostly warm weather during my pregnancy so I can keep wearing dresses.

- Baby stuff: I am totally cool with second-hand everything. And due to space limitations of an NYC apartment, we definitely do not want too much “stuff.” Between a baby shower, a very excited grandmother-to-be, M's sister's hand me downs – we should have most of the basics for almost free. I have even scored a free Mamaroo and Ergo carrier already. I won't be shopping at baby boutiques for clothes.

- Post-partum help: If you don't have family around you may want to look into outsourcing certain things (clean and cook, etc) so you can focus on mothering. Baby nurses and night nannies are common in NYC – definitely a luxury – but a savior when you're sleep-deprived. Post-partum doulas are also a great idea, especially for first time moms, to show you the ropes, help you ease into breastfeeding (most are breastfeeding certified counselors), and help you take care of you while you recover from delivery. The U.S. is a bit strange in that moms are expected to recover and go back to work ASAP. Too bad there aren't any post-partum spas here like Korea. My plans: M will take 2 weeks off to help. I'm planning on hiring a post-partum doula for a few sessions for the above reasons. After 2 weeks, I'll be with my mom for a few weeks – letting her carry out a Korean tradition of taking care of a new mom. Slightly modified as I'll be able to shower :).

- Childcare: This blog is geared towards female professionals, so most of us probably won't be stay at home moms. I'd be lying if I said I wasn't worried about the cost of childcare! The going rate in my neighborhood is ~ $17/hr for a nanny. At this time, I prefer having a nanny for the first 6-12 months after I return to work. The convenience of someone coming to us vs. one of us packing up the baby and walking to a daycare (at least a 10-15 min walk – won't be fun during winter). Also, babies and kids often get sick in daycare and although M's work is more flexible, we don't want to deal with that. Right now, we are planning to have a nanny for 40 hours a week over 4 days and my mom for 1 day a week and for backup. We are *gulp* preparing to spend at least $3,000 a month in childcare. Unfortunately, daycare isn't much cheaper and with the convenience and flexibility of a nanny, this was a no brainer for us. After 6 months or so, we will reassess.

- Saving for college: It's never too early to start saving for a little one's college. You may recall that I started a 529 last year in anticipation of starting a family. I get a small state tax break for funding one so it was a no brainer to get started.

- Part 1 covered the license designations an FA can and should have.

- Next, Part 2 covered how FAs should get paid.

- Then, Part 3 explored what real financial planning is.

- In Part 5, I discuss why I fired mine.

Today is Part 4 – How to find and vet a financial planner. I will also share how I found and vetted mine.

How to Find a Financial Advisor

You want to find a financial advisor, but you've got a question. Where do I start?

A personal recommendation is always helpful, but you'll still need to do your own vetting.

Step 1 – Do Your Initial Vetting

If you're convinced that a fee-only FA is the only way to go, a good place to start is NAPFA – the National Association of Personal Financial Advisors. They are a leading organization of fee-only advisors. Now, just because someone isn't listed here does not mean they are not good. To make the list, members must:

- Be CFP’s

- Sign a pledge to serve as their clients’ fiduciary

- Submit a financial plan for review and approval (they are not rubber stamped)

- Complete 30 hours of approved CE annually

Now, what if there isn't anyone in your location?

In my opinion, your FA does not need to be local. You can conduct meetings in the comfort of your own home via video conference. Personally this seems much more convenient than scheduling in person meetings, but I do understand that some folks prefer the one-on-one meetings.

Many FAs also have a blog or a podcast. This is a great way to peruse their content and to see if their philosophy and personality meshes with you.

Step 2 – Review Form ADV

Let's say you have a few names of FAs. After browsing their website and reviewing their fee structure and what is included, you're now ready to for the next step. Review their Form ADV. Form ADV is the informational document that the SEC (Securities and Exchange Commission) requires all investment advisors to file and update annually. It contains a lot of information and you'll need to know what to look for.

My former FA wrote an excellent post on how to decipher a Form ADV. Go ahead, take your time to read it. Did your potential FA pass?

Step 3 – Set Up a Consultation

Now you're ready to set up a consultation. Almost all FAs will conduct a consultation for free. This is your chance to “meet” (virtually, phone call, or in person) and get your other questions answered.

Step 4 – Take Your Time

After this meeting you should have enough information to make a decision. Take your time – this decision will affect you – your net worth, positively or negatively.

What I Did to Find a Financial Advisor

Now that you know the basic steps, you're probably wondering how I found my financial advisor. I first heard of Johanna through the White Coat Investor Forums. I was a semi-active member and found her posts not only helpful but she clearly knew what she was talking about. When I found out she was going to be in NYC for a conference, I private messaged her if we could meet.

At that time, I was not really thinking of hiring her let alone any FA. But I wanted to take the opportunity since she was in town. So M and I got to meet her in person at one of my favorite bars in Brooklyn, Hotel Del Mano.

Afterwards, she sent us a copy of Nick Murray's Simple Wealth, Inevitable Wealth. I skimmed it. Then I had questions.

At this time, I did not know what a Form ADV was (nor did I know such a thing existed), but I knew that fee-only was the way to go.

I emailed her these questions:

Are you a fiduciary?

Yes and we sign a statement to that effect for every client.

Is the portfolio you recommend to your clients (I know you rec 1/6 each to 6 categories) also YOUR personal allocation?

We use this portfolio for myself, Michelle, my mom and my sons, along with the rest of our clients. I would not recommend something that I wouldn’t do for my own family.

How long have you been recommending this?

For the last 7 years, at least.

How long have you been doing this allocation for yourself?

Almost that long. Like some, I had trouble giving up on funds that I was in love with (YACKX, in particular). I finally got rid of the others except for YACKX and just worked it into the portfolio as part of my LC Value funds. As I tell Michelle, we eat our own cooking here and practice everything we tell our clients. (Well, I’m better at planning for my clients than I am for myself, but that’s a different story, kind of like the doctor who can’t quit smoking).

And what is the past performance of this?

I looked up the client who has been with us the longest and her average annual return is 10.31%. Of course, this has been during a bull market, with only 1 down year (2015 although 2016 hasn’t been exactly fabulous so far) so I can’t take a lot of credit. We don’t benchmark and we tell our clients to expect about 8% during the long term and to have no expectations during the short term (next 5 years).

How did you handle 2008?

I began my business in 2008/2009 (had only the CPA firm before that) and so I had only my own and kids’ funds in the bear. I did nothing different. However, I didn’t hear Nick Murray speak for the 1st time until (I think) 2009, and my world changed at that point.

Personally and for your clients, how did you handle clients who panicked and sold?

N/A.

Did you lose a lot of clients during this time?

N/A. Btw, I was investing for myself in the dot.com crash in 2000. I made all of the mistakes that could be made on my own account during that crash. Truthfully, I am so thankful that I have not done anything like that for our clients and never will. Unlike many investment advisors, we don’t experiment with our clients’ accounts.

Can you talk about the last 2 clients that left and why?

The only large client we have lost (about $400k) was 1.5 years ago. She decided to use the trust department of a bank because her family’s trust was there and she wanted to consolidate. A couple of years ago, a client (<$100k) moved to Edward Jones because her cousin owns the office. Because we handle SIMPLE plans for a few CPA clients, employees periodically leave and cash out, but it is a relief to lose a small account. We only handle these plans because the business owners have large accounts and as a convenience for them.

Tell me about a client that you let go and why?

I don’t know of any we’ve let go. We are extremely careful about who we work with and try to ensure that they deselect themselves by educating them on what we do at the beginning of a relationship.

Who is your ideal client?

Flat-fee doctor planning clients. We just started this model about 6 months ago and it is proving pretty popular. I like this (rather than our AUM model that the clients who started with us before this year are under) because it focuses on the plan and it doesn’t focus on performance, which is aligned with our values. Since we model the stock market, returns are going to be similar to long-term market returns.

How many do you take on a year?

Can’t say at this point. I’ve been bad about enforcing minimums in the past and we are going to have to let some clients go in the next year to focus on doctors. We are planning ahead to add another team member next year.

What will happen if something happens to you?

(Michelle is 16 years younger and the main reason I asked her to work with me and eventually become partner was for succession planning.

How long have you been doing this?

See above. I had been making recommendations to clients as a CPA for many years, but sending them to brokers. The reason I decided to become a CFP was because I did not like the way our CPA clients were treated and the results. I thought I could be a better advisor than what they were getting. When I first began, I did not know what fee-only was or how important it was to be a fiduciary. I found out soon after starting and knew I’d found my home (same as with Nick Murray).

Have you been sued by a client or have had any legal action against you from a client?

Never.

What is the average size portfolio you manage?

Around $75k because of all the SIMPLE accounts. Our sweet spot is $400k – $750k.

Smallest?

Because of the SIMPLEs, a few hundred dollars.

Largest?

Around $3M. Please note that the size of the portfolio is really not an issue except for AUM clients. With flat-fee planning, we concentrate on your plan and build a portfolio that will sustain the plan rather than the other way around. A portfolio is not a plan – big difference. Think about it – some people prefer to invest in their businesses or real estate as part of their retirement. Their stock market portfolios will be smaller, but they will not be “smaller” clients (actually more complicated).

What is the average length of a time a client stays with you?

I don’t have those figures. If we took out the SIMPLE accounts (which I have nothing to do with), it is pretty much since they have begun with us.

Are you able to provide any references that would be willing to talk to me?

Maybe. I guard my clients’ privacy and have only asked once for someone to give a referral. The prospect decided to keep managing his own money at the time (although he took a recommendation I made that kept him from making a huge mistake) so I bothered a busy client business owner needlessly.

I know you are not the biggest fan of Vanguard, so which funds do you prefer and why?

The funds we prefer are those that stick to the terms of their prospectuses and have really good managers. The prospectus is the rule book for how a fund manager or committee is to allocate the dollars that flow into and out of the fund and run the fund. Because we have such definite terms on our client portfolio allocation, it is important that we can trust the manager to play by the rules he was hired to follow. Not all do.

Have they outperformed similar funds in Vanguard?

I have no idea and I don’t care. We are not in a performance game. If we can mirror long-term market performance, using behavior management (which is most important – proper investing is really quite simple), then our clients will be quite successful. I hate to keep saying this, but low-cost funds do not guarantee you a successful portfolio.

The cost is but one aspect of investing. Yes, if everything else is equal, we will choose the lower cost fund. But a fund can’t simply hire a manager and tell him/her to keep the costs down and expect the fund to perform up to its peers. I think that is overemphasized on WCI and is actually a detriment to the investing results of many doc’s. It sets up a false premise – that cost is 90% of results. The examples that are given of the long-term extra costs of a fund that has a quarter of a point more cost over 20 years assume everything else is equal. It never is.

My job is not to outperform. Instead, my job is to ensure that our clients build optimal wealth over the long term given their resources, goals, and life events. It is a bit more complicated than “Let’s go to Vanguard and choose low-cost funds.” We use a few Vanguard funds, but I am not of the opinion that Vanguard is the absolute best fund family to the mutual exclusion of all others. That’s just not rational.

Does working with you/firm also include discrete events like death of a spouse? buying a home? etc? Or is that extra?

Clients never pay extra unless there is a reason to change the engagement and prices don’t go up without notice. Being someone’s financial planner means that I am integrated into his/her life. Everybody has a different path.

I mentor several people and was telling a young man yesterday that it is important to have processes that make planning consistent, keeps us accountable, and surpasses our clients’ expectations while maintaining the individual experience for each client. So, yes, specific life events are what I am here for. Everyone is unique – we don’t do cookie cutter planning here. Not every doctor is paying down student loans.

And finally, is there anything else you think I should know about you?

Like I yelled at my dog this morning? Seriously, there probably is. I’m not hiding anything, but I don’t know what else to tell you right now – may think of something later.

I will tell you that I’ve seen a lot of the crap that passes for financial planning out there and you could do a lot worse than to hire someone who has 35 years of experience as a CPA combined with 9 as a CFP who is also fee-only and works with doctors. I’m not even sure if I’ve run across myself before.

Actually, here’s something: you won’t work exclusively with me. You would work mostly with me, but you would also meet sometimes with Michelle. She trains clients how to use our software, eMoney, and handles all investing functions. And that’s a good thing because we back each other up. You should also know that we custody with TD Ameritrade (which is not the same as TD Bank).

Here is Our Process page. I’ve also attached a draft copy of our Expanded Agenda page. It’s not ready to go online yet but I thought you might find it useful to read. That’s it for now. Thanks for asking some good questions. I haven’t proofed for errors, so please be lenient lol. Let me know if you have any other questions.

Read More This is a guest post by Liz Stapleton. She is a recovering attorney and freelance writer focusing on personal finance, entrepreneurship, and issues facing lawyers. Since starting her personal finance blog, Less Debt More Wine in 2014, Liz has paid off all of her credit card debt (over $10k), raised her credit score from 640 to 800+, and paid off one of her many student loans.

I had written a post already on my own save vs. pay off loan debacle. Liz does a nice job guiding you on how to make your decision.

What to do when you want to save for your future, but you are still paying for your past?

After spending so many years in school to get a professional degree, chances are you are already behind on saving for retirement. At the same time, along with a big shiny degree, you have a ton of student loan debt that will hamper your ability to save.

The problem is time. As you know from your student loans, interest can make a big difference in what you owe, or in the case of saving what you earn. The longer your money is in a retirement account, the more time it will have to grow.

Unfortunately, the same goes for your debt, the longer you have it, the more you pay. So which should you focus on first?

Why You Should Prioritize Debt Repayment

I recommend prioritizing debt repayment for two reasons but also with some exceptions. First, the interest rate on your debt is likely higher than the amount of interest you would earn on any investments. Second, if you are on an income-driven repayment plan and are planning on loan forgiveness, you may be in for a big tax bill.

Debt Usually Costs You More

Interest rates for debt can vary widely. Student loans for professional degrees usually range from 6% – 8%. The return on retirement investments usually ranges from 5% – 8%. However, that is over the long term, and you never know what is going to happen with the market.

For example, if you have a student loan (one of many I’m sure) with a current balance of $50,000 and an interest rate of 8%, you are paying $4,000 in interest in a year. If you were to max out a 401(k) retirement account, meaning you contributed $18,000 and earned interest at 6%, you would earn $900 from interest.

While $900 is nothing to sneeze at, to prioritize saving at a lower or even equal interest rate would require you to pay to save.

Loan Forgiveness through Income-Driven Repayment Plans isn’t Forgiveness

As the current law stands, any forgiven amount after the repayment terms ends for income-driven repayment plans such as Income-Based Repayment, Income-Contingent Repayment, PAYE, and REPAYE is considered taxable income.

This means that if worst case scenario, your monthly payment does not even cover the amount of interest that accumulates each month, then your loans could be growing. If your loans grow for 20-25 years, you are going to be taxed as if you made potentially hundreds of thousands more.

There is one exception to the loan forgiveness tax bill, and that is Public Service Loan Forgiveness (PSLF). Under PSLF after 120 qualifying payments, your loans are forgiven and not considered taxable income.

Why You Shouldn’t Forgo Saving for Retirement Entirely During Debt Repayment

While it’s likely a good idea to prioritize debt repayment now, it doesn’t mean you shouldn’t set aside some money for retirement. There are three reasons you should save for retirement while paying off debt.

First, time is money, the longer your money sits in your retirement account, the more compound interest you will earn. Second, you could potentially save free money; many employer-sponsored retirement accounts offer matching contributions. Third, saving for retirement could lower your tax liability.

When it comes to compound interest, every little bit counts

Let’s say you put $100 per month towards retirement savings. If your investment of $1200 earns a conservative 5% then at the end of the year it will become $1,260. If you stopped contributing that $1,260 would turn into $1,531 after five years. In 15 years it would become $2,494, doubling your money. If you had kept contributing just $100 a month, you would have saved $28,389 after 15 years.

Even if you aren’t maxing out your retirement contribution during debt repayment, just a small monthly contribution done consistently can go a long way.

You Never Want to Lose Out On Free Money

If you have an employer-sponsored retirement account such as a 401(k), you should educate yourself on any matching contributions they are willing to make. For example, my old company used to match a 5% contribution 100%. If I put in $5, my company would put in $5. I essentially doubled my money just be contributing to my retirement account.

You Could Pay Less in Taxes

While it is true that you can deduct up to $2,500 of the interest you pay on your student loans from your taxes [Editor's note: Almost all doctors are over the income limit for this deduction]. You can lower your taxable income even more by saving for retirement. While there are lots of different retirement accounts (401k, 403b, TSP, IRA, Roth IRA, etc.), some of them are pre-tax contributions.

Pre-tax contributions allow you to put money that has not been taxed aside for your future in a retirement account. The government will tax those funds when you withdraw the funds from the account. If you make $75,000 per year and you put a total of $5,000 of pre-tax dollars into your 401(k) you will be taxed as if you earned $70,000.

The Exceptions to Prioritizing Debt Repayment

There are some circumstances where you might want to prioritize saving for retirement over paying off debt. For example, if your debt interest rates are in the 2%- 3% range your money might be better-used saving. Alternatively, if you can afford the loan’s standard repayment plan then paying that standard monthly payment and saving more for retirement will likely put you ahead on savings, without losing too much money to interest on your debt.

What do you think? Comment below.

]]>

I had written a post already on my own save vs. pay off loan debacle. Liz does a nice job guiding you on how to make your decision.

What to do when you want to save for your future, but you are still paying for your past?

After spending so many years in school to get a professional degree, chances are you are already behind on saving for retirement. At the same time, along with a big shiny degree, you have a ton of student loan debt that will hamper your ability to save.

The problem is time. As you know from your student loans, interest can make a big difference in what you owe, or in the case of saving what you earn. The longer your money is in a retirement account, the more time it will have to grow.

Unfortunately, the same goes for your debt, the longer you have it, the more you pay. So which should you focus on first?

Why You Should Prioritize Debt Repayment

I recommend prioritizing debt repayment for two reasons but also with some exceptions. First, the interest rate on your debt is likely higher than the amount of interest you would earn on any investments. Second, if you are on an income-driven repayment plan and are planning on loan forgiveness, you may be in for a big tax bill.

Debt Usually Costs You More

Interest rates for debt can vary widely. Student loans for professional degrees usually range from 6% – 8%. The return on retirement investments usually ranges from 5% – 8%. However, that is over the long term, and you never know what is going to happen with the market.

For example, if you have a student loan (one of many I’m sure) with a current balance of $50,000 and an interest rate of 8%, you are paying $4,000 in interest in a year. If you were to max out a 401(k) retirement account, meaning you contributed $18,000 and earned interest at 6%, you would earn $900 from interest.

While $900 is nothing to sneeze at, to prioritize saving at a lower or even equal interest rate would require you to pay to save.

Loan Forgiveness through Income-Driven Repayment Plans isn’t Forgiveness

As the current law stands, any forgiven amount after the repayment terms ends for income-driven repayment plans such as Income-Based Repayment, Income-Contingent Repayment, PAYE, and REPAYE is considered taxable income.

This means that if worst case scenario, your monthly payment does not even cover the amount of interest that accumulates each month, then your loans could be growing. If your loans grow for 20-25 years, you are going to be taxed as if you made potentially hundreds of thousands more.

There is one exception to the loan forgiveness tax bill, and that is Public Service Loan Forgiveness (PSLF). Under PSLF after 120 qualifying payments, your loans are forgiven and not considered taxable income.

Why You Shouldn’t Forgo Saving for Retirement Entirely During Debt Repayment

While it’s likely a good idea to prioritize debt repayment now, it doesn’t mean you shouldn’t set aside some money for retirement. There are three reasons you should save for retirement while paying off debt.

First, time is money, the longer your money sits in your retirement account, the more compound interest you will earn. Second, you could potentially save free money; many employer-sponsored retirement accounts offer matching contributions. Third, saving for retirement could lower your tax liability.

When it comes to compound interest, every little bit counts

Let’s say you put $100 per month towards retirement savings. If your investment of $1200 earns a conservative 5% then at the end of the year it will become $1,260. If you stopped contributing that $1,260 would turn into $1,531 after five years. In 15 years it would become $2,494, doubling your money. If you had kept contributing just $100 a month, you would have saved $28,389 after 15 years.

Even if you aren’t maxing out your retirement contribution during debt repayment, just a small monthly contribution done consistently can go a long way.

You Never Want to Lose Out On Free Money

If you have an employer-sponsored retirement account such as a 401(k), you should educate yourself on any matching contributions they are willing to make. For example, my old company used to match a 5% contribution 100%. If I put in $5, my company would put in $5. I essentially doubled my money just be contributing to my retirement account.

You Could Pay Less in Taxes

While it is true that you can deduct up to $2,500 of the interest you pay on your student loans from your taxes [Editor's note: Almost all doctors are over the income limit for this deduction]. You can lower your taxable income even more by saving for retirement. While there are lots of different retirement accounts (401k, 403b, TSP, IRA, Roth IRA, etc.), some of them are pre-tax contributions.

Pre-tax contributions allow you to put money that has not been taxed aside for your future in a retirement account. The government will tax those funds when you withdraw the funds from the account. If you make $75,000 per year and you put a total of $5,000 of pre-tax dollars into your 401(k) you will be taxed as if you earned $70,000.

The Exceptions to Prioritizing Debt Repayment

There are some circumstances where you might want to prioritize saving for retirement over paying off debt. For example, if your debt interest rates are in the 2%- 3% range your money might be better-used saving. Alternatively, if you can afford the loan’s standard repayment plan then paying that standard monthly payment and saving more for retirement will likely put you ahead on savings, without losing too much money to interest on your debt.

What do you think? Comment below.

]]>

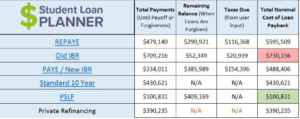

Dealing with student loans is difficult. Being a doctor with student loan debt can be particularly challenging. 76% of doctors graduate with debt, and the median is $192,000. This is a guest post by Travis Hornsby, creator of Student Loan Planner, where he offers one-on-one student loan advice. As female physicians with student loans, if you need help navigating them, contact him.

I got into helping people understand their student loans thanks to my beautiful and brilliant fiancée Christine. She’s a urogynecologist, and like most physicians, she was more focused on learning and caring for her patients than understanding arcane federal student loan rules. Unfortunately, female physicians earn less than their male counterparts. To help tip the scales back in favor of people like Christine, here’s how to maximize student loan strategy as a female physician.

I got into helping people understand their student loans thanks to my beautiful and brilliant fiancée Christine. She’s a urogynecologist, and like most physicians, she was more focused on learning and caring for her patients than understanding arcane federal student loan rules. Unfortunately, female physicians earn less than their male counterparts. To help tip the scales back in favor of people like Christine, here’s how to maximize student loan strategy as a female physician.

Tips for Female Physicians with Student Loans

First things first. Women doctors are more likely to be employees. That's a big advantage when it comes to student loans. About three-quarters of all women in medicine work as employees instead of in private practices. That means women are more likely working at not for profit hospitals than men. That’s why female physicians need to know about Public Service Loan Forgiveness (PSLF) like the back of their hand. Under PSLF, A doctor must work for 10 years in a not for profit setting. Most hospitals qualify. You must receive your actual paycheck from a not for profit entity too. Occasionally I’ve seen some hospitals that pay their physicians out of a private sector entity. That would cause you to lose your PSLF eligibility. Make sure that doesn’t happen to you when you become an attending. Your residency counts towards this 10-year period until PSLF forgiveness. If you play your cards right, you could pay $300-$500 a month on your loans during this period, which all counts towards the 10 years required under PSLF. Virtually all physicians who manage their loans the optimal way will graduate residency with 3-7 years of credit towards the 10 years they need. What happens when you become an attending?Keep Your Payments Low to Maximize Forgiveness

Under current rules, you can use either PAYE or IBR to cap what you must pay on your student debt. That means if you owe $150,000 in med school loans but start out at $200,000 as an attending, you can keep your payments at no higher than the standard 10-year monthly amount you had to pay when you left med school. Using this cap to your advantage, you could conceivably train for several years to become a surgeon, then cap your payments on 10-year standard repayment plan. That would allow you to pay a fraction of what you originally borrowed for medical school. A lot of my clients make payments based on the Income Based Repayment plan (IBR). If that describes you, you’re probably paying too much on your student debt. You should look into switching to Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE). The reason? You get to pay 10% of your income instead of 15% as with IBR.Make Sure Your Loans Qualify

Only Direct Federal student loans qualify for this forgiveness benefit. That covers most loans issued after 2010. If you happen to have loans from before this that are on the older FFEL loan program, you can consolidate them into a Direct loan. That consolidation makes them eligible for PSLF, but it also resets the repayment clock to zero. Make sure your loans don’t qualify for PSLF before submitting a consolidation request. Call your loan servicer and ask them what loans qualify for PSLF. They should be able to tell you.How Would This Work in Real Life?

Here’s an Example. Meet Jane. She’s a pediatric cardiologist. Her total length of training between residency and fellowship is six years. During that period, she’ll start out at $55,000 and end up at $70,000 in salary. When she becomes an attending, she’ll start at $225,000 and get inflation level raises after that. Jane has $300,000 in student loans. She doesn’t know what to do with such a large burden, but she’s passionate about medicine. In a perfect world, here’s how she would manage her student loans.Start paying on REPAYE as soon as possible

While in residency and fellowship, Jane can pay only a few hundred a month but receive interest subsidies of thousands of dollars a year. The reason is that REPAYE covers half of the leftover interest she doesn’t pay each month. Since she’s going for tax free loan forgiveness but also wants to keep the loan balance low just in case, REPAYE is probably a great option. A possible exception to that rule of thumb is if her spouse makes a lot more money than she does and then it’s worth talking to an expert.File the PSLF Certification form

After her first payment on REPAYE during training, Jane can submit the PSLF employment certification form. She should receive a response in a couple months showing her progress towards loan forgiveness. Once she’s being tracked for the program, she should resubmit this free form every year at least to create a well-documented paper trail.Minimize Taxable Income

Loan servicers calculate what Jane owes every month based on her taxable income. If she will receive forgiveness on her student loans then she wants to minimize what she pays wherever possible. The best way to do that is to save in pre-tax retirement accounts. She can use a pre-tax 403b plan to put away up to $18,000 per year, which will directly reduce what she has to pay towards her student loans.Here’s What the Numbers Look Like

A few things might complicate this picture, particularly if Jane had a spouse who also earned an income. If a spouse has student debt then it doesn’t matter as much. However, if a spouse has no loans but a substantial income then it would be worthwhile to rerun these numbers using my calculator. So to review, Jane makes $55,000 at the beginning and $70,000 at the end of training. We’ll say she puts away $5,000 in her 403b during training and $18,000 as an attending. Her interest rate is 7%.

Jane borrowed $300,000, and she’s going to be able to pay just over $100,000 on her student loans and save a lot of money for retirement along the way. Student loan interest is generally not tax deductible except for a small amount at low incomes. That means over that 10 years, Jane receives a benefit worth about $20,000 annually after tax for optimizing her student loans. On a before tax basis, that benefit is more like $30,000 in salary value. That’s a great benefit considering many people enjoy working at academic hospitals over private practices.

So to review, Jane makes $55,000 at the beginning and $70,000 at the end of training. We’ll say she puts away $5,000 in her 403b during training and $18,000 as an attending. Her interest rate is 7%.

Jane borrowed $300,000, and she’s going to be able to pay just over $100,000 on her student loans and save a lot of money for retirement along the way. Student loan interest is generally not tax deductible except for a small amount at low incomes. That means over that 10 years, Jane receives a benefit worth about $20,000 annually after tax for optimizing her student loans. On a before tax basis, that benefit is more like $30,000 in salary value. That’s a great benefit considering many people enjoy working at academic hospitals over private practices.

What if Jane Wanted to Start a Family?

One cool feature of the PSLF program is that payments made while on maternity leave count towards the 10 years of payments needed for forgiveness. If Jane worked at an academic hospital, she could take off up to three months per birth and if she makes payments on REPAYE, PAYE, or IBR, she gets credit towards tax free loan forgiveness. As I mentioned, if Jane had a spouse, then that could make things a bit more complex. Keep in mind you’re married for the entire year for tax purposes once you submit your marriage certificate. I’ve met many couples who have three to four years of credit towards PSLF while they’re planning their wedding. If Jane had fallen into this category, she could probably count on at least a year for the student loan servicers to incorporate her spouse’s income into the payment calculation. If she uses PAYE once she gets married if that’s in her life plan, she can cap the required payment at no more than what’s required under the 10-year Standard plan. That capping feature allows most physicians to qualify for substantial loan forgiveness even if they’re a high-income surgeon like my fiancée.Plan for PSLF, but Prepare for an Alternative Plan Just in Case

If you’re in training right now, there’s no harm in tracking progress towards loan forgiveness on the PSLF program. If you decide to go private practice, you can refinance and get a lower interest rate with a private lender. If you decide to stay with a hospital, it will probably be a not for profit employer. You might as well set yourself up for this benefit as it’s worth tens of thousands if not hundreds of thousands of dollars. In case PSLF gets repealed, which is probably not going to happen for folks who already have loans, you’ll owe less by using an intentional strategy for loan repayment. Female physicians with student loans like my fiancée Christine deserve a fair shake. Hopefully, you’ll take advantage of free content on Miss Bonnie MD’s blog and my site Student Loan Planner to save every dollar you deserve. If you wanted help coming up with a loan repayment strategy, I’d love to help.]]>

Read More

Female physicians with student loans like my fiancée Christine deserve a fair shake. Hopefully, you’ll take advantage of free content on Miss Bonnie MD’s blog and my site Student Loan Planner to save every dollar you deserve. If you wanted help coming up with a loan repayment strategy, I’d love to help.]]>

Read More

YNAB aka You Need a Budget. I bought this in Dec 2014 on some Christmas sale when it was still only available in the desktop version. Now it is a fancier web driven app.

Before using YNAB, I, like many, was a regular ol' excel spreadsheet gal. I made myself feel good by having all the budget categories add up nicely to my monthly paycheck. If you recall, I never saved any money and always ran out of money before the next paycheck.

My spending kind of went like this – do I have money in my checking account? Yes, I'll spend it. Meanwhile, I wasn't paying attention to the other categories I needed to set aside money for. I needed some serious help!

YNAB is not super easy to use right out of the box. I can almost promise you that you'll have some growing pains. The good news is that YNAB has a robust support center and tons of educational videos and webinars to teach you how to use their software optimally. When I switched from YNAB desktop to web version, they changed a few rules and I was emailing with their support team quite a bit.

My first few months with YNAB were interesting. I still went over budget, but each month got better and better. I slowly re-trained my spending habits. Remember that $20,000 credit card debt I used to have? Not only is it gone but I pay my cards IN FULL every month.

I can also confidently say today that I no longer go over budget and am saving quite a bit of money now (becoming an attending helped that part for sure). Learning how to use YNAB efficiently helped quite a bit as well.

Living within your budget revolves around clarity of the budget presentation and self-discipline. YNAB is a vital tool with which I feel I am able to keep disciplined and focused.

People ask all the time whether they should use YNAB vs. Mint. They are completely different programs. It really depends on what your needs are. If you are already great at spending within your means and budget (if you have one) – then Mint is a good option for you.

Mint gives you a snapshot of how you did. If you need serious help (like I did) and need to literally re-train yourself about budgeting and spending, then there is nothing better out there than YNAB.

YNAB is forward and proactive budgeting. You will know whether you can actually afford something in real time and not worry that your money will be taken away from other necessary categories. YNAB focuses on your cash flow. You can also add loans and investments for tracking purposes, but I don’t believe this function works too well. I’d recommend sticking to what YNAB was made for – cash flow. I use Personal Capital to get a more complete snapshot for all my accounts. We use eMoney with our FA as well.

I hope you're in a better place than I was when I first started YNAB. Even if you are I’d recommend checking it out. It is free for the first 34 days. Use this link to get 1 month free.

Read MoreMonet's lilies @ Musée de l'Orangerie, Paris, France[/caption] This is a very frequent question and topic on the finance blogs. I like how the White Coat Investor made a nice and easy to follow order of things. Basically pay off any consumer debt and other high interest loans first. Then he prioritizes saving for retirement over lower interest loans. Then in this post he says most docs should have their loans paid off within 5 years of graduating. I've struggled with how fast I should be paying off my student loans. If I really wanted to, I could wipe them out in 3 years (possibly less with bonuses) but would require more than a decent amount of sacrifice. How awesome would it be to be student loan free in < 3 years? I've changed my mind countless times about this. At least I was maxing out all of my available tax-advantaged accounts while flip-flopping. Currently, I fully fund my job's 403(b) (+ generous employer contribution), 457(b), and a backdoor Roth IRA. This amounts to $62,300 this year. I don't have a taxable account yet. I think for the average physician (although even this definition is quickly changing) who becomes an attending physician around age 30 (and funded a Roth IRA during residency) the WCI's general plan is a good one to follow. For folks like me however, who became an attending much later in life (38)- I've lost valuable time. Remember, time is a huge part of how compound interest works. If you have less time, then you need more money (saved) to make up for it. The same could be said for folks who have children and other priorities that require money. This late in the game, brute savings is what will get me to financial independence. Instead of the suggested 20% saved for docs, I need to save at least 30%. I recently took advantage of First Republic Bank's amazingly low interest rates for student loan refinancing. This forced me into a 5 year maximum pay off period with a fixed interest rate of 2.25%. I'm ok with that. I also have another $80K loan with my mom and will pay this off in < 5 years. What am I doing with my “extra” cashflow? Saving. We hope to start a family soon and will need to pay for childcare and the kid him/herself. NYC daycare can be between $2,000-$3,000 a month easily! We also need to beef up our emergency fund with more at stake. M and I have picked $5 million as our FI number. We probably don't need that much. I prefer to save more, just in case, to be prepared for medical costs, possible long term care etc. Picking $5 million puts us in the position to help our children and our parents too if need arises and still remain secure. We want to get there in 20 years (2037) or less. Not a small feat. The first milestone – the first million – is set for June 1, 2023. I'll let you know how that's going year to year. What do you think? How fast are you paying off your loans? Have you picked your FI number? Comment below.]]>

Read MoreThis is part 3 in a series of posts on Financial Advisors.

Part 1 covered the license designations an FA can and should have. Part 2 covered how FAs should get paid. Part 4 – How to find and vet a financial advisor Part 5 – I fired my financial advisor Today, we’re going to discuss another area of confusion – when you think you want a financial advisor but what you really need is a financial planner. Wait, aren’t they the same thing? All financial planners are financial advisors. But very few financial advisors (FAs) are financial planners (FPs). Most FAs don’t do much but manage your retirement funds. A financial planner incorporates your savings and retirement funds into your overall plan, but only as one of the necessary components needed to help you meet your goals. In other words, your portfolio is not a financial plan! The term Financial Advisor is part of the problem. Most people are looking for a Financial Planner, not an FA. It’s partially semantics, but most FAs seem to be mainly portfolio managers ± commissioned salesmen. Building a proper portfolio and managing it is actually quite simple and takes little time once a year once set up. Really. It boggles me that people are paying someone 1% or more to do this and nothing else. OK, so maybe you don’t understand how to invest (index funds, stocks, real estate, etc.) – you won’t do badly by following a simple portfolio that the Bogleheads recommends or try one of these portfolios until you learn more. Let’s look at it in familiar terms:

- A typical financial advisor is like a doctor who always writes the same prescription to every patient. No history, no vitals, no work up and no follow up.

- A financial planner, on the other hand, never prescribes without a complete history (your money history and habits – your psychology) and work-up. Expect to spend the first several meetings with your FP to delve into you and your goals and then together, develop the right plan for you.

To break it down into more detail, what can you expect when you hire a fee-only financial planner? Here is what s/he will do for you:

- Clarify goals. Sure, we all want to retire at some point but, what about between now and your retirement? What happens after you retire? What does “being retired” mean to you? A financial planner will help you have these conversations and ask the “what if?” questions such as “What kind of lifestyle do you plan in retirement?”, “How much do you plan to save for your kids’ college?”, “Do you plan to work part-time at some point?” and so forth.

- Coordinate your financial decisions with your taxes. A financial planner, especially one who is a CPA, is trained to help you minimize taxes as they include tax planning in your ongoing plan.

- Make sure your assets are PROTECTED. This includes a review of not just your insurance policies but a discussion about other areas in your life that may be exposed, such as side businesses, your legal documents, things your kids may be involved in, property, etc.

- Discuss your cash flow (a fancy term for budgeting). If you find that you and your significant other are having trouble seeing eye-to-eye with your spending habits, having an impartial planner to mediate can help you work on a realistic spending plan. Seeing as many arguments between significant others revolve around money this also will help the longer-term health of your relationship.

- Help you adjust for course corrections. How often does living in the now distract one from their goals? Financial planning is not a report you get once a year. Your planner is engaged in your life so that when you get pregnant, change jobs, buy a new house, move your parents into assisted living, etc. your planner is there to adjust your projections and help you absorb the impact on both your short- and long-term plans. This allows you to make course corrections early when it can make the most difference for the long term. Taking a few extra shifts now or driving your car a couple of years longer while you’re in your 30s and 40s is a lot easier to swallow than finding out you’re way behind on your retirement goals when you’re bumping up on age 60!

- Remind you of your goals when you start to veer off course. Almost all (or ALL?) investing mistakes are due to behavior (selling during market corrections for example) and having an FP there to stop you is priceless. Almost all of us will want to veer off course at some point.

- See into the future! Yes, a financial planner will take a look at how you are spending your money today, your goals, your savings habits, your work habits and your retirement benefits and project your chances of being able to have that bungalow on the beach with the little umbrella drink at age 55. Sure, it’s an educated guess, but having a guide is very motivating.

- You and the FP will create a financial plan that will guide you on decisions. Of course, the plan is dynamic and will change over time. Circumstances and goals change more often than you think.

To sum things up, a good financial planner will go over your financial house with a fine-toothed comb. Real financial planning is not cheap and you must be willing to dedicate time and energy to the process – it is your money and your future, after all! I consider full service financial planning a luxury service. I see a lot of people asking isolated questions such as “Should I max out my 401(k) or pay down my loans?” “Should I pay down my student loans first or buy a home?” This is a symptom that there is no financial plan. They are asking for a temporary Band-Aid instead of a true assessment of their needs and a well thought out prescription or financial plan. A good FP will teach you as well instead of blindly taking care of your finances. You need to have a baseline knowledge base to get the most out of this relationship. Here is a sample start-up agenda that a good FP will go through with you. Next, is the the next part of this series. What do you think? Did you know that financial planners did all this and more?

Read More 44 million borrowers owe over $1.5 trillion as of 2019. And we know medical school loans are especially high. So how do you take off some of the pressure? Look for better interest rates! If you live near First Republic Bank, you can use them to refinance for a better student loan rate. Here's how I took advantage of what First Republic Bank offers and how you can do the same, plus snag $200!

How to Refinance with First Republic Bank

First things first. Check your location. Do you live in one of the cities marked above?- New York City

- Greenwich, CT

- Portland, OR

- Palm Beach, FL

- Various cities in Northern and Southern Calfornia

OK, so what's the catch?

You must:- Live near a physical branch.

- Meet their salary requirements and may need a certain % of your debt liquid in your main checking account.

- Open a checking account with them and use it as your main checking. That means your main source of income must be direct deposited there.

- Maintain a minimum balance of $3,500 a month and you must auto-debit the loan payment from this account.

- Pass a credit check.

More Considerations When You Refinance with First Republic Bank

- The minimum loan is $40,000 and the maximum is $300,000.

- Their checking account refunds ATM fees!

- They will refund you up to 2% of paid interest if you pay back the loan in 2 years!

- If you get approved for this loan but move away from a physical branch, this does not affect the loan as long as you keep your primary checking account with them.

How Do I Get Started?

This is an amazing deal if you meet their requirements. If you're ready to take the plunge, contact Kerry Berchtold at kberchtold at firstrepublic dot com or 339-235-0419. Don’t forget to mention Miss Bonnie MD to get your $200 once you’re approved!Final Thoughts on Refinancing with First Republic Bank

In March 2017, First Republic Bank approved my refinance! I chose the 5-year term at 2.25% fixed for $88,000 of my loans. My strategy was to”force” myself into a 5-year repayment, since I do my best financially when things are automated. If you're ready to tackle your student loans and you want to refinance to lower your interest rates, reach out to First Republic Bank today.]]> Read MoreThis post is sponsored by Lawrence Keller, CFP®, CLU®, ChFC®, RHU®, LUTCF, an independent agent for several insurance companies. He has earned his reputation as the “go-to” agent for life and disability insurance for doctors and other high–income professionals. If you wish to contact him you can call (516) 677-6211 or email [email protected]

Do you have life insurance? You need to unless you'll never have dependents – children, a spouse, parents perhaps. One of my mantras is to insure yourself against the top 4 financial catastrophes – death, disability, divorce, and liability.

There's a lot of confusion as to what life insurance product to buy, how much to buy, and for how long. For the overwhelming majority, term life insurance is the right product. Term life insurance is a product where you buy a certain amount for a certain amount of time (or term). If you die during the term, your beneficiaries receive the amount purchased tax-free. Typical terms are 10, 20 or 30 years.

You can also “ladder” policies meaning that you stack multiple policies with varying terms. For example, you purchase three policies: $1 million x 10 years, $1 million x 20 years, and $1 million x 30 years. If you die in the first 10 years, your beneficiaries receive $3 million, if you die in the 2nd 10 years they get $2 million(as the $1 million x 10 years policy has expired), and if you die in the 3rd 10 years, they get $1 million.

You could just buy one $3 million x 30 year term but this is a lot more expensive and likely not necessary. The reason to decrease the payout amount over time is because your wealth will build and you will have enough to self-insure (retirement accounts, cash savings, debt elimination). Many factors determine your rate, here are a few:

- Gender

- Age

- Health – personal and family medical history (cardiac disease, cancer)

- Smoking status

- Activities – rock-climbing, skydiving enthusiast, etc

How to buy term life insurance:

1. Determine how much you need and for how long The amount you need depends on what you want the life insurance money to be used for. If you die, you want enough money to cover funeral costs, any debts (mortgage, student loans, etc.), kids' childcare and college costs, or any other dependents that rely on your income. If you're married, do not underestimate the toll your death will take on your partner and other dependents; they may need to take some time off and get things in order. Wouldn't you want to give your partner (and kids) the time and freedom to do that? Also keep in mind that inflation will eat away at the amount as well. A good starting point is 7-10x of your income. For those who are divorced and have to cover multiple family interests please consult any divorce decree requirements and factor those requirements in as well. A sample calculation for someone who makes $250K:

- $500K mortgage

- 2 kids, $250K each for college

- Funeral costs $10K

- Income loss for remaining partner: depends if they work or not. Even if they work, their lifestyle and budget likely included your income too. So let's say you'll want $100K per year to reflect that (remember this money is tax-free). So this comes out to $1 million for every 10 year term.

This comes out to just over 2 million for a 10 year term. This amount may decrease as you build up retirement and other savings, 529 accounts, etc. Using the 7-10x rule of thumb this amount falls in that range ($1.75 to 2.5 million). A stay at home spouse needs to be insured as well. You may have heard that life insurance is only needed for those that make income. But a stay at home spouse is providing childcare and likely other household duties. You'll want to account for how much childcare would cost in the event of their death.

2. Get an idea of how much it will cost on www.term4sale.com You'll see that the price of the policy will differ widely depending on whether you are female or male, the term amount, the dollar amount, and health class.

3. Talk to a broker or agent You want to work with an independent agent or broker vs. an agent that only represents one company. If you are working with a financial advisor it is wise to reach out and receive their input as well.

4. Seriously consider purchasing disability insurance if you don't have it already to save you another work-up. You will likely need medical underwriting to determine your health class. This involves blood work and a physical exam. These can also be used for disability insurance so that you don't need to repeat this again if you apply for it within a year (generally speaking).

Other caveats:

- If you're a woman, I strongly recommend purchasing some as early as possible if you know you'll want children. If you wait until you're pregnant you may get dinged with a rider that any pregnancy related death won't be covered (same applies for disability insurance), or you may develop a pregnancy related condition such as gestational diabetes that will ding your health rating from the top class to the 3rd or 4th class. This will result in a significant increase of your annual premium. For example a 35 year old who applies for a $2 million x 30 year term would go from an annual premium of $1,265 to $2,105 if she develops gestational diabetes (numbers for Prudential).

- Same advice applies to men since life insurance premiums are higher for men. This stuff is already cheap and cheaper the younger and healthier you are. You'll never be as young and healthier than now.

- Banner (William Penn in NY) offers laddering within one policy vs. buying multiple policies to form a ladder. This saves you about $60 per policy bought.

- You may hear of a “Waiver of Premium Rider”. This waives the premium on a term life insurance policy if the insured is disabled. Unless the insured plans on converting their term policy to Whole Life (and most insureds won't), one should not consider this rider as it can, generally, add 10-25% to the cost of the annual premium. I would recommend just getting enough disability insurance instead.

I've purchased 2 policies: $1 million x 20 year term, bought at age 38 (Banner, $496/year) with preferred health plus rating (the highest health rating). I also have $1 million x 15 year term bought at age 39 (William Penn, $382/year). And yes, I bought both from Lawrence Keller.

Read More