Money

I grappled with productivity and efficiency in 2018.

“I don't have time,” came out of my mouth too often. And, I had lots of proof that I didn't have a lot of time. I work as a dermatologist, it was my first year with a new baby who needed my attention, I do all the meal planning and other household management. Oh, and I work on this blog.

Yet, I had plenty of time.

I've spent the past several months trying to figure out how I couldmake 2019 more productive, so I can have more free time with myself and my family. I've spoken to friends and coaches, read blog posts and listened to podcasts on productivity.

Productivity is your ability to increase your effectiveness and efficiency – not just working more. Don't we all want to work smarter and not harder?

So here are my top 5 tips to make 2019 more productive.

#1. Commit to being productive

The first step is to get your mindset right. Get to it or stay unproductive.

Your choice.

#2. Find a system that works

This is the part that may take some time and tweaking. It took me several months to figure out what would work for me.

I use google calendar, a journal, and Asana to organize my life and business.

I've always used google calendar to organize appointments so that part was easy. It syncs to my iPhone's native calendar. I have 3 calendars: personal, work, and joint (with Matt).

The next two parts took time and effort to learn and use optimally. I initially tried a beautiful templated paper planner by Ink & Volt. I loved the planner and the templates – but I never used the planner. In fact, I have two of these beautiful planners with very little writing in it. Failure indeed.

I next tried the bullet journal. It seemed like the perfect solution! I would no longer “waste” pretty templated pages since I created the template. I even purchased some pretty washi tape and colored gel pens. The bullet journal works for many people. But for folks juggling a zillion things including a business, it just didn't scale well. I also would forget to bring my journal with me sometimes and then not have any clue what I should be working on.

At #FINCON18 two friends (Ryan Inman of Physician Wealth Services and Travis Hornsby of Student Loan Planner) told me I have to check out Asana. They told me I could use it not just to keep my to-do list in order but to also organize and plan my blog post calendar. Best of all? It's free for most people. And the free version doesn't suck.

So I immediately signed up for an account and watched their tutorials. But I still didn't really know how to use it effectively. I was pretty good about entering tasks into the app but then quickly forgot about the tasks since they weren't organized. A few months went by. Then I watched this video by productivity master Paul Minors of New Zealand (complete with awesome accent).

I use Asana as my digital bullet journal. It keeps all of my personal and business to-do's in order. My podcast buddy Carrie Reynolds also uses it and we are able to collaborate and plan our podcasts much more efficiently now. I also use Asana for my virtual assistants.

Before hopping onto Asana, I recommend watching this introductory video on why Asana is so awesome.

#3. Start a weekly planning session

I now use my paper journal for my weekly planning sessions and general scratch paper. Every Sunday, I take about 30 minutes and plan my week. I first start with a few minutes reflecting on the previous week. I acknowledge what I accomplished the previous week. And I acknowledge what didn't work.

I then review my tasks in Asana by browsing the “Calendar” project. This project contains all of my tasks.

The key to never forgetting about a task in Asana is to assign it a “due date” and add it to the “Calendar” project as soon as you enter it. I use the due date as a start date instead. Every task is in at least 2 projects – the project it belongs to and “Calendar”. Calender is a repository of all tasks assigned by quarter. I also have a “Soon” and “Later” sub-category within Calendar as well. I basically use the Asana system outlined in the video above.

During this weekly review, I move the tasks I want to work on this week into my “In Progress” project. I use the board view here so I can visually see all the tasks I need to work on this week.

Regardless of what system you use to organize your tasks, use this weekly session to review tasks, re-prioritize and plan the week. This is also when I meal plan for the week.

#4. Limit distractions

In the age of screens and social media, this step is absolutely pivotal to if you want to make 2019 more productive.

Want to be productive? Turn off notifications. Close the Facebook tab in your browser. Unplug.

Warning — it may feel uncomfortable to do this. You may feel anxious. You will soon appreciate this quiet time and be amazed at what you can accomplish.

Did you know that our smartphones are specifically designed to keep us using them? Ever feel a little anxious when you don't check your phone (or email or that notification that just popped up?). Screens are the new addiction and ruining productivity.

Take the time to really consider how to use technology vs. letting it use you.

#5. Take care of your body and mind

It's pretty hard to be productive if you're tired, hungry or not feeling well.

So yes, you need to get enough high-quality sleep, eat well and exercise regularly.

Final Thoughts on Tips to Make 2019 More Productive

Change is hard. But if you're committed to your goals this year, you need to boost your productivity. Take one tip from this list and work on implementing it for a month. Then, see if you can add another. As you feel your productivity increase, so will your motivation. That's a cycle you want to get caught in.

What are your top productivity tips? How do you plan to make 2019 more productive? Comment below!

Read MoreJoin the Wealthy Mom MDs Facebook Group to continue the conversation!

This is a guest post from my fellow woman physician blogger, Dr. B.C. Krygowski. She's a palliative medicine physician who discovered FI & Frugality as a way of life. She blogs at bckrygowski.com, and she has ten tips that any high-income earner should try out to add more frugality to their lives.

# 1. Look into Home Exchange.

Home exchange saves me serious money because I can swap homes and cars with other families for overseas vacations.

# 2. Schedule a half-day to sit down and figure out your priorities.

Do you say you want to be mortgage-free more than anything, yet you continue to take four (or more) exotic trips a year? Your life actions say something different than your words. Maybe consider cutting the exotic trips down to one or two a year and put the money you’ve saved towards paying off your mortgage instead.

# 3. Track your expenses.

Doing this helped me to find acceptable, but less expensive ways to achieve the same quality of life.

# 4. Commit to one month of decluttering your house.

Seriously, this is guaranteed to make you spend less money. You’ll be horrified at all the stuff you toss, give away or donate during a one-month declutter binge. In the future you will stop buying so much stuff.

# 5. If you have an Aldi near you, learn to embrace Aldi.

Shopping at Aldi helped us slash our food bill The trick is to stock the car with bags and quarters so you can get a shopping cart and bag your own groceries. Aldi saves us time too: it’s the quickest grocery store to get in and out of. They also now deliver with Instacart.

# 6. Learn to cut hair—don’t be afraid, you can do this!

When my husband started to read Mr. Money Mustache, he went to Walmart and bought a color-coded, foolproof hair trimmer. It came in a plastic container with instructions. I discovered that after a few tries I could cut men’s hair. I estimate this $22 investment saved us about $6,000 over the years of cutting not only his but our two boys hair. Plus it’s saved us time because I don’t have to wrestle the kids into the car.

# 7. Stop shopping.

Send your significant other into the store instead. My husband goes in with a list and only exits the store with what’s on the list. It’s like he has blinders on when it comes to impulse purchases.

# 8. Embrace the Instant Pot.

Not only will this fantastic device save you time, but oodles of money too!

# 9. Learn how to store food properly, so you waste less.

I have to admit though, I’m a visual person, so the mushrooms kept going bad when we’d put them into brown paper bags. Out of sight, out of my epicurean mind. I’ve taken to propping them on their side on the shelves at eye level, so they’re the first things I see when I open the fridge door.

# 10. Periodically examine your expenditures sheet with your significant other.

This falls under “What are your goals/priorities?” We sit down a few times a year to examine our spreadsheet and analyze where we should spend not only less but also more money.

Girlfriends, I have faith in you taking control of your finances—you got this!

Yours,

Final Thoughts on Frugal Tips for High-Income Earners

It's easy to fall into the trap of allowing a high income to dictate high spending. You certainly don't have to use all these tricks all of the time. However, by making frugality a priority in your life as B.C Krygowski does, you'll be surprised how much money you can save and invest without feeling like you're making huge sacrifices.

Join the Wealthy Mom MDs Facebook Group to continue the conversation!

Did any of these frugal tips surprise you? What do you do as a high-income earner to keep more money in your bank accounts each month?

Read Morepregnancy, delivery and my first year with baby in tow I've learned a thing or two about the financials of having a baby as a woman physician.

You’ll need to accept the fact that you will likely make less during pregnancy, during your leave, and even after you return to work. This is due to how practices usually pay you and adjust your pay for time not seeing patients. Brace for impact.

Read my top financial tips on KevinMD.

Read More2018 can be summed up with one word – growth.

We moved to a new city with a new baby at the end of 2017. M and I started new jobs. We are still settling into Philadelphia and it does not feel like home yet. We are renting. We were not ready to commit to buying so we renewed our lease for one more year.

After plugging in some numbers in a rent vs. buy calculator it is clear that we need to buy after our lease is up. Financially, our net worth stayed about the same despite both of us maxing out all available tax advantaged accounts (401(k)s, backdoor Roth IRAs, HSAs, funding a brokerage account at Vanguard and investing in a real estate syndication.

How? We sold M's condo in NYC and after taxes and other selling fees–we lost a good chunk of the equity. The market wasn't so hot in 2018 either. We parted ways with our financial advisor and I'll admit that since then I have not been as organized about our investments. I can't even really tell you how our investments did this year! But we continued to invest in the market and ignored what was going on. While many folks are worried about the market downturn, I see it as a sale. With Physician On FIRE and 39point6's help I did my first tax loss harvest.

Our biggest financial accomplishment was paying off my student loans in early 2018! We are debt-free. Obviously, we could not predict the market but I think we made the right choice. I admit it was somewhat anticlimactic but I think being a brand new mom in a new city had something to do with that.

Later in 2018 we had an unexpected loss of income and being debt-free and living below our means was pivotal in weathering that storm.  Jack turned 1 and has a positive net worth! He has a UTMA, ESA and a 529. He will be opening up a Roth IRA soon.

Jack turned 1 and has a positive net worth! He has a UTMA, ESA and a 529. He will be opening up a Roth IRA soon.

Miss Bonnie MD In 2018

I somehow managed to continue working on MissBonnieMD.com and be active on the various physician finance Facebook groups.

In March, I had the honor of speaking at the inaugural White Coat Investor Conference–The Physician Wellness and Financial Literacy Conference in Park City, Utah. I spoke about some of my favorite topics–outsourcing and prenups in addition to estate planning.

All the speakers and topics were fantastic. The best part of the conference was hanging out with online friends “in real life” including my podcast buddy Carrie Reynolds, Dawn Baker, Nisha Mehta, Peter Kim of Passive Income MD and his wife, Hatton1 and so forth. I had already met Physician on FIRE in NYC previously. Oh and of course I got to meet Jim Dahle! In case you missed it, you can purchase the virtual conference and watch every lecture.

During the summer I connected with some of the awesome physician podcasters at Podcast Movement in Philadelphia. I met Nii from Docs Outside The Box, David from Doctors Unbound, Taylor from The Happy Doc, Tarang from Doctor Money Matters and Ryan Gray from Med School HQ. Carrie and I attended the ChooseFI meetup and got to chat a bit with Jonathan. In September I attended FINCON and had the pleasure of hanging out with my physician finance blogger friends. We had quite a group convene in Orlando! One of my favorite parts was meeting british woman doc Nikki from The Female Money Doctor.

I left the conference totally inspired to keep working on this website and help women find financial freedom. I was featured on two podcasts last year:

I had a blast recording this podcast with Nii at FINCON in Orlando, FL. Not often do I get to “see” who I am chatting with. Nii graciously included my blog in his “Top 5 Personal Finance Blogs for Physicians” episode.

One “dream goal” came true when I got to chat with Farnoosh Torabi about my blog and finances on her So Money podcast. I love her book When She Makes More and highly recommend this book to all breadwinning women! Too bad we didn't get to connect when we were neighbors in Brooklyn! Carrie and I recorded 10 podcasts in 2018! One of them included an interview with Jim Dahle. We hope to do them more often. I wrote a Christopher Guest Post for Physician On FIRE where you can read about my favorite wines. I wrapped up the year by giving two local talks–I spoke to dermatology residents at Jefferson and young Barnard alums about personal finance. I have some big goals for Miss Bonnie MD in 2019:

- Complete redesign of the website

- Write a book

- Increase readership and traffic by 100%

- Increase revenue by 100%

I'm excited about 2019! I hope you've created some written goals to go after this year!

Read MoreLife Hacks post. She blogs at PracticeBalance.com about finding balance as a physician mom. She and her husband are financially independent. You can read her interview here. The other day, my 2 year old daughter asked, “Who gave us this house?” We both paused and looked at each other. “Um… No one. We bought it with our own money that we made ourselves.” This is the first time we had talked to her about anything related to money, and I’m sure it won’t be the last. As she grows up, she’ll no doubt deal with the marketing of products directly to her, comparisons to friends, cases of the “I wanna’s”… then ultimately management of her own earnings and debts.

Always creating and learning

Unlike some families where money is a taboo subject, we hope to have many money conversations with our daughter as she matures, because financial responsibility is very important in our family. We’ve worked hard over our adult years to become financially independent and free from any debt or mortgage, which has allowed us to both work part time. When I was a young girl, I never felt that my family was in a state of lack. But I also never grasped the mathematics side of money, the finiteness of it. That all changed when I became a mother. Although my husband had been equating money with life energy for many years at that point, I didn’t see it until I had this being in front of me that I wanted to spend all my time with. I had spent years, tears, money, and life energy to have her (due to infertility), yet she was priceless. Any time at work was suddenly time away from her.

One of the lessons I really want to teach my daughter is the idea of value. Value is relative and individual, as one person’s prized possession can be another’s throw-away item. Likewise, the way we prefer to spend our time (which ultimately equates to money) can vary drastically from person to person. I cringe when I hear people use the words, “We can’t afford it.” Kind of like saying, “I can’t eat that cupcake” or “I don’t have time to do ______”, it’s rarely true in a literal sense. You can if you want to, but you choose not to, for whatever reason. It’s a mistake made often by people in all financial situations, both wealthy and poor.

What harm is done in saying “we can’t”? It sets a tone of scarcity vs. abundance. The scarcity mindset keeps us from feeling we have choices or control over our financial situation. It places issues in a negative light, such that we make decisions out of fear and compare ourselves to others. On the flip side, being valueist means that we see the potential abundance in things. We make decisions from a place of optimism, because again, anyone can afford anything they inherently value.

Taking time to find the rainbows

Affording anything, however, must come with financial sacrifice in other areas of our lives. We’ve all seen examples of people driving around in very fancy cars despite meager earnings. I’ve been to third world countries where a family shack contains a large screen TV. Everything we buy is a choice and is conversely a choice in the opposite realm (against saving or spending on something else). How much is an extra hour a day with your child worth to you? Is it worth not having a cleaning lady, taking a 30% pay cut, moving to a smaller house? In addition, there are degrees of choice here; you can choose to NOT buy the nicest item you can afford. The common belief that everyone buys the nicest things “they can afford” leads to a false evaluation of success based on material goods.

Of all the things I value, time with my family sits at the top of the list. I hope someday my daughter will understand this concept when she wants me to buy her something that I choose not to buy. The best thing we can do is to live our lives in alignment with our respective values and provide an example for our children.

Don't miss out on future blog content, join my email list!

Read MoreThis past year has been an amazing year of growth and change for me. It left me realizing I had to find a way to optimize my life.

In one year, I became a mom, I moved to support my fiancé's career and to get our family into a better place financially. I left my academic practice in New York and joined a private practice. Moving to a new city with a newborn in tow means leaving all your friends behind. Meeting new friends as a new mom is challenging.

I’ve learned a lot about myself. For one thing, I’ve learned to be honest with myself. I’ve also learned that I can’t do everything. Being a mom, a physician, running the household, and trying to run a side business – well that’s more than enough to make anyone go a little crazy.

I spent a lot of time and trial and error trying to optimize my life. One mantra I really took to heart is that time is our most precious resource. It truly is.

Time Is Our Most Precious Resource

How I Optimize My Life

So I’d like to share my 5 life hacks and tips I’ve implemented to optimize my life so that I am freed up to spend time where I want.

# 1. Outsource _________ .

I love to cook. However, in the immediate postpartum and beyond, I found that I really couldn’t find time to cook. In fact, I found it it quite stressful to think about meal planning. I went through several iterations of how to get help in this area initially. Truthfully, I felt a little guilty for not wanting to cook for my family (and I know how to cook so it wasn't a skill issue).

I had to give myself permission to spend on something that would make my life easier. It may not be forever.

My mother took care of me and baby Jack until he was six and half months old. Picture home cooked Korean food every day while I could focus on breastfeeding and recovering from childbirth. Once that ended and I was back at work, I found it challenging to feed myself and my fiancé good food. I initially used a prepared meal service that cooked all the food and delivered it. I would just need to heat them up in the oven or microwave. It was not the cheapest option but it filled a need, so we did that for a month or two.

When I felt that I could devote more time to this area I then turned to meal planning. We have an instant pot. In case you’re not familiar – how could you not know about this already? – it is an electric pressure cooker. You can make “dump and cook” meals. I still found it challenging to actually plan meals for the week and finish up all the food we purchased. You can only have so many taco nights ….

I ran out of steam in the meal planning area. Our current situation is that we now subscribe to a meal prep service such as Sun Basket and Marley Spoon (our current favorites). We usually choose the paleo-like options and get 3 meal kits a week. This combined with hack #2 below has been a killer combination for us.

# 2. Hire A Part-Time Wife

Why do women physician moms think they have do everything? Most of us work full time in our demanding jobs as physicians then come home to immediately transition to being mom and housewife. Combine that with a maybe not so equal partner (in terms of division of labor)- this is surely a recipe for lots of unhappiness. Thankfully, Matt likes to cook and do laundry (!). But the truth of the matter is we both work, so this is an area that we could use some help.

We have a cleaning service that comes every two weeks to do a thorough cleaning of our apartment. That was a no brainer.

But the best hack I have found to date in this area is who I called my part-time wife. She is a part-time nanny for another local physician mom. She comes to our place 2 to 3 times a week. When she comes by, she organizes & tidies up (puts away all of Jack's toys, folds blankets), unloads the dishwasher, wipes down counter tops, removes garbage & boxes, waters plants, and does tasks like get the coffee pot ready for the next morning. Additionally, she’ll do the laundry and fold it and put it away. Magic.

We come home to a clean and tidy home. It is mentally calming and relaxing to come home to this!

# 3. Take Care Of Your Body

Like many moms, I gained a little too much weight while I was pregnant. And my body was a bit of a wreck after childbirth. It was also in the middle of northeast winter when Jack was a newborn. I have a gym downstairs in my building. But I know myself and know that I work best in a class where someone is literally telling me what to do. Previously, I used to work out at Orange Theory in New York – when it was across the street.

I hired a personal trainer. I worked with him 1-2 times a week over several months. Eventually, I got back my strength and core training with Mike. Hiring Mike was probably one of the best decisions I ever made for myself. (And if you’re in the Philly area you should definitely look him up!).

# 4. Clear Your Mind

I don't know about you, but my mind is always buzzing with ideas and thoughts. And my to do list. And that patient I saw yesterday. It's enough to drive most people mad.

I started using Headspace to start my day. It's a phone app that walks you through a guided meditation. Also, I started using Asana to organize my business and my personal life. Think bullet journal in a digital format. I tried using a traditional bullet journal but it just didn't work for me.

# 5. Invest in YOU

And finally, my latest and what I consider my best gift to myself is working with a coach. Life coaches work with you to remove the barriers to your best authentic self. Our dreams and reality are limited by our thoughts. I guess you could call Sunny my thought coach. She's also my business coach. She points out when my thoughts aren’t serving me and encourages me to transform them into something that will call me into action. My first few calls with her were all about me feeling completely overwhelmed with everything on my plate. I mean there’s just no time to do all the things I want to do and that’s just the truth!

And finally, my latest and what I consider my best gift to myself is working with a coach. Life coaches work with you to remove the barriers to your best authentic self. Our dreams and reality are limited by our thoughts. I guess you could call Sunny my thought coach. She's also my business coach. She points out when my thoughts aren’t serving me and encourages me to transform them into something that will call me into action. My first few calls with her were all about me feeling completely overwhelmed with everything on my plate. I mean there’s just no time to do all the things I want to do and that’s just the truth!

Well clearly it's not. It's just a thought. She doesn't let me indulge in thoughts that don't serve me. Although sometimes I really want to.

Final Thoughts on How I Optimize My Life

Using these five hacks has really helped me optimize my life despite all of the new challenges and commitments I've taken on. As time changes, I know that I'll continue to rely on these same strategies and come up with new ones. If you find yourself looking to get more from your day, week, and month, try out one of these tips today.

What life hack or tip have you implemented to free up your free time? Comment below!

Don't miss out on future blog content, join my email list!]]>

Read Morepaid off my student loans earlier this year. But I finally took the plunge into real estate syndications, and I wanted to share how that unfolded.

Where I Started

As I mentioned, when I first got started with my financial goals and plans, I was laser-focused on my student loans. This is the first year I opened up a regular brokerage account at Vanguard. Up until now, I've been resisting all the advice to learn more about real estate and get some money in the game. Like many of you, learning about finances is a journey and requires continuing education. What's great about being in this physician finance space is having access to folks who have experience with real estate investing. But, even with offers of direct mentoring to buy my first rental property, there was also this fear of the unknown. I was filled with thoughts like, “Ugh, it seems so complicated and a lot of work,” and that kept me from taking that first step. Then I discovered real estate syndication and decided to take another look.

Real Estate Syndications for Dummies

First, what is a syndicate? A syndicate is a way for multiple investors to pool their money into an entity to purchase real estate. Why? This allows them to invest in much bigger properties than any individual investor could do on her own. Think large apartment buildings, self-storage facilities, senior resident living homes – these are examples of commercial real estate.

Sponsors and Investors in Real Estate Syndications

Syndicates consist of a sponsor and investors. The sponsor is the one person or company that has experience and manages the deal on behalf of the investors. They generally have skin in the game too, often putting up between 5-20% of the total equity. The investors are people like you and me who would like to invest in this type of real estate, but prefer to be a passive investor, or what’s called a limited partner. Syndications are generally set up as an LLC and the investor owns an interest in the LLC. Let me back up a bit, though. You may be wondering why these seem “new” – at least I did. Up until recently, general solicitation for private offerings was prohibited (meaning no public advertising of securities to investors – like through the internet). You basically had to know someone–a friend, a neighbor, and so on–who did these deals. That’s where the term “country club” equity comes from. The JOBS Act of 2012 relaxed general solicitation rules as long as certain conditions were met, including that each investor is accredited. An accredited investor is an investor who meets 1 of the following criteria:

- She has annual income of at least $200,000 for the last two years with the expectation of earning at least $200,000 in the current year or

- If she's married, they have a combined income of at least $300,000 each year for the last two years with the expectation of earning at least $300,000 in the current year or

- She has a net worth of at least $1 million, excluding her primary residence, either individually or jointly with her spouse.

As you can see, many physicians will qualify to be an accredited investor a few years after residency.

The Pros and Cons of Real Estate Syndications

Investing in real estate syndications is relatively passive, making it attractive for busy folks like us. Like all investments, however, the investor should do their own due diligence and understand what they are investing in. Another attractive feature of this type of investment is its favorable tax treatment. Real estate sponsors can use depreciation to offset income and reduce the amount of current taxes on cash distributions. The taxes can be deferred until the property is sold, at which point gains on the sale would be taxed at a lower capital gains rate versus ordinary income rates. These tax benefits are passed on to investors in a real estate syndication. Investing in real estate also provides increased diversification, given that real estate has a low correlation with other major asset classes like stocks and bonds. There are other important considerations to investing in real estate syndications. A major con is the illiquidity of the investment as the money is often tied up for several years. You cannot just sell your part of the investment if you want to. You'll have to wait until the property is sold. You also don't own any actual real estate outright; you own a share. For a real estate newbie like me, investing in syndications is the perfect introduction to real estate. Put some skin in the game and learn along the way in a relatively passive way. Trusting the sponsor is paramount. So one may ask, how do I know if I can trust a sponsor? There is no easy answer. Spend time talking to sponsors and asking about their experience in putting together deals. A vetted introduction by someone you trust is probably how most people start.

How I Got Started with Syndications

So whom did I ask when I was ready? My friend Dr. Peter Kim at Passive Income MD. He introduced me to Alpha Investing. What I love about Alpha Investing is that you'll always talk to a senior partner of the firm. They are a private group of experienced investors with strong relationships with high-quality sponsors. Alpha Investing aggregates investments from its members into a syndicate and invests into sponsor projects. This structure allows members to access exclusive real estate projects at significantly reduced minimum investments. So I jumped in. I invested in an equity deal through Alpha Investing where the sponsor acquired a $260 million high-rise 20 miles outside of the heart of Manhattan.

Are you ready to jump in? Alpha Investing is an invitation-only private capital network but readers of Wealthy Mom MD can request access here.

[ Disclosure: This blog post contains affiliate links. If you click through and use a service or purchase a product, I may receive a commission at no extra cost to you. Thank you for your support. ]

Is there anything that surprised you about real estate syndications? Have you made real estate part of your portfolio?

Read MoreMost of the time I feel like I am running around like a chicken with my head cut off. Juggling being a dermatologist 4 days a week, mom to a toddler, fiancé and running this website (& podcasting !) can be challenging to say the least.

Wednesdays are my “day off” from seeing patients. I initially took Fridays off to have a 3 day weekend. But I found that with a new baby, traveling on the weekends stopped happening. I also found that many businesses and appointments I needed to do were difficult to schedule on Fridays either due to them closing early or being closed or Friday being so popular I could never get in. I also found that my patients wanted Friday appointments. I guess not too many dermatologists are open on Fridays.

So how do I spend my non-clinical week day? Here is how I spent it a few weeks ago.

6:30am Alarm goes off. I snooze too many times (Every Wednesday, my plan was to get up around 6am and do some writing for my blog before Jack wakes up. It has yet to happen.)

I finally get up around 7:30am. I make coffee.

I sit in front of my powerbook to see what I could work on writing wise by checking into Asana. I recently started using Asana to organize my whole life. Got this awesome tip from Travis of Student Loan Planner and Ryan Inman of Physician Wealth Services while I was at FinCon recently.

Jack starts cooing and babbling. He greets me standing in his crib. I change his diaper and bring him to dad who is still snoozing. They share some morning snuggles.

Jack starts cooing and babbling. He greets me standing in his crib. I change his diaper and bring him to dad who is still snoozing. They share some morning snuggles.

I make breakfast for Jack – 1 egg omelet with cheese, slices of oatmeal cake (from the Baby Lead Weaning Cookbook), sliced grapes and a cup of whole milk.

I skip breakfast as I do intermittent fasting most days.

8:45am I drop off Jack to daycare. His daycare is across the street – priceless.

I walk back home and half write a blog post, respond to some emails and comment on Facebook posts.

11:30am I head out to have lunch with Camilo of the Finance Twins. We met at FinCon and turns out we are both in Philadelphia. We chat about how we started our blogs and exchange ideas and tips for our budding businesses.

I uber back to my neighborhood for a 2:30pm dentist appointment. I get gently scolded for not flossing the back teeth. He suggests I use a waterpik.

I uber from the dentist to happy hour at Double Knot with a friend. In case you live in Philadelphia – this is the best happy hour deal in town.

I’m home by 6:30pm. Jack is eating dinner. Neither of us feel like cooking so it’s pizza night.

7:15pm Jack gets a bath. Then playtime with mom and dad. Bedtime for Jack is at 8pm.

Mom and dad time. I think I do some more work for the website but likely am just wasting time on Facebook.

Bedtime for me is around 10pm since I get up around 5:30am the next day and start seeing patients at 7am.

Hope you enjoyed this peak into a random day!]]>

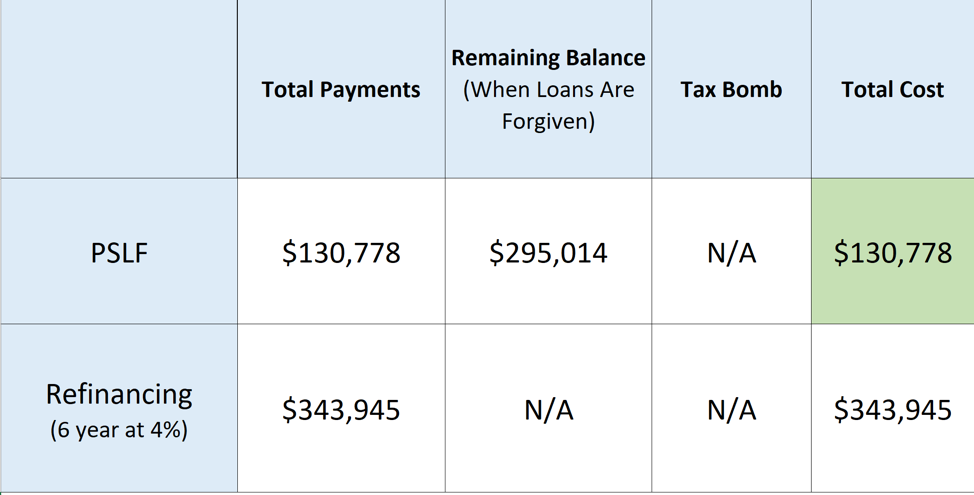

Read MoreThis is the guest post by Travis Hornsby of Student Loan Planner. He's an expert in student loans and is married to a physician. Today, he's stopping by to discuss how PSLF might impact your career choices as a physician. Check out Travis’ ultimate (and free) student loan calculator here. If you’d like to learn more, check out how you can get student loan help here. Many new physicians are planning their lives around the PSLF program. They’re terrified if anything happens to this program, and they’re afraid of working part-time or switching jobs to a private practice. You know the old saying “don’t let the tail wag the dog”? Physicians can and should be choosing their career paths and their employers based on their passions, not their finances or PSLF. To see why, it helps to take a look at the math.

Why Physicians Should Leave Training with Lots of Credit Towards Loan Forgiveness

Unless you are positive you want to go to private practice, you should not refinance your student loans as a resident. The reason is because REPAYE will give you subsidies and cover part of your interest while you’re still in training. That’s why I see REPAYE being a good in-between option if you’re unsure if you want to work private practice or at a not-for-profit hospital once you’re an attending. My wife is a urogynecologist. She had a lot of issues with our loan servicer FedLoan Servicing, so we weren’t able to go for loan forgiveness. That’s one of the main reasons I started Student Loan Planner. That said, the physician graduating today should be leaving training with between three and seven years of credit towards Public Service Loan Forgiveness on average. That’s because most residencies and fellowships take place at qualifying employers.How Much is PSLF Actually Worth to an Attending Physician?

If you get a great job in private practice like Miss Bonnie MD, then pay off your debt quickly and refinance. However, pretend you are a rising OBGYN attending looking for a job. You have two options, one is a private practice paying $250,000 and the other is a giant university health care system paying $220,000. Let’s say you have $300,000 of med school loans. How much is the value of PSLF in this case? You’d spread the PSLF value over six years, since you’d be leaving training with four years of credit. Hence, the difference in payments is a bit over $213,000. Divide that by 6 (you need 6 more years as an attending to get PSLF), and you’d have an after-tax PSLF value of $35,500. You would need to adjust this for pretax salary value to see how much this benefit is worth.

To pick a round number, let’s say after adjusting for taxes, $35,500 a year in take-home pay benefit for PSLF is worth $50,000 in salary.

Hence, a $220,000 salary in the not-for-profit world would be equivalent to a $270,000 salary in private practice.

Since the private practice salary was $250,000 in this example, the extra value you get from PSLF is only about 20k a year.

Would you take a job that paid an additional 20k per year if there was something about it you didn’t like that much? Probably not.

Hence, the difference in payments is a bit over $213,000. Divide that by 6 (you need 6 more years as an attending to get PSLF), and you’d have an after-tax PSLF value of $35,500. You would need to adjust this for pretax salary value to see how much this benefit is worth.

To pick a round number, let’s say after adjusting for taxes, $35,500 a year in take-home pay benefit for PSLF is worth $50,000 in salary.

Hence, a $220,000 salary in the not-for-profit world would be equivalent to a $270,000 salary in private practice.

Since the private practice salary was $250,000 in this example, the extra value you get from PSLF is only about 20k a year.

Would you take a job that paid an additional 20k per year if there was something about it you didn’t like that much? Probably not.

Working Part-Time vs Full-Time as a Physician

Another thing to keep in mind is as a PSLF eligible physician, you don’t lose your credit if you decide to reduce your hours temporarily. You can even gain credit while on maternity leave for example (3 months per calendar year). Additionally, you could even go for the 20-25 year version of loan forgiveness if you were in a lower paying specialty and desired part-time hours for an extended period of time. If you decided to be full time again, you could pick up from where you left off on the PSLF clock. Don’t feel like if you don’t rush and get PSLF that it’s going away. It’s way too enshrined in loan promissory notes to be going anywhere in the near future.Get a Plan for Your Med School Student Debt

Miss Bonnie MD has paid off her student debt, and if you want to be like her, you’re going to need a plan. You could refinance it or go for forgiveness, but you better hope you’re making the right choice. Too many physicians are making decisions casually about the biggest financial decision they’ll make besides retirement and buying a home. Once you’ve got a solid plan in place, you can relax and focus on making your career all you want it to be. If you prefer not to spend time reading books on med school debt, then we’d certainly love to help you make a custom student loan plan. Regardless of whether you choose the Do It Yourself option or get a professional to help you, please pursue the path in medicine that you truly want. You shouldn’t feel pressure to work at a not for profit hospital just to get loan forgiveness anymore than you should work at a private practice just because it pays more money.Final Thoughts on PSLF and Med School Career Choices

Medicine is too rife with burnout and stress not to be in an employment situation where you can be happy with the results you’re getting for your patients. If that’s not the case, just make sure you know what you’re doing with your student loans and switch employers. Some huge percent of the physician workforce changes jobs in the first few years of practice. Take charge of your life and career and don’t let student debt or the promise of PSLF hold you back.]]> Read Moreif any, for your kid(s)'s education & life is a personal decision. There is no simple answer. I don't recommend doing any of these if your finances are not in order. Remember, there is no such thing as a loan for retirement. My 1 year old already has 3 accounts and about to open a 4th. Why? To take full advantage of time and compound interest of course. Here they are in order of when we opened them.

1. 529 College Fund

529s are the king of college savings accounts. You contribute after-tax money in, it grows tax free, and you don't pay taxes on withdrawal. You may even get a state tax deduction for your contribution. You can also open one before your child is born! So if you know you're going to have children and get a decent state tax break like I did when I was living in NYC, it's not bad a idea to get one going. Where should you open one? Start with your own state's plan. If you get a state tax break you'll want to find out if you're limited to using your state's plan to qualify for a deduction or not. A few states, including my now home state of PA, allow you to use any state's plan. So, I've kept mine with NY which currently offers the lowest fee Vanguard funds. We currently invest it all in the Aggressive Growth Portfolio which consists of 70% Total Stock Market Index Fund and 30% Total International Stock Index Fund. If your state offers no tax deduction then I recommend NY, Utah, or Nevada's plan. Pick Nevada if you already invest in Vanguard and want to keep things clean. Don't overthink it, just pick one. And – make sure you select the direct plan and not the plan via a financial advisor which are loaded with extra fees. There is a penalty if you withdraw money for non-educational purposes. Because of this I recommend saving something like 70% in a 529 and the rest in either a UGMA/UTMA or your regular brokerage (aka taxable account). There is a special rule allowing parents to frontload 529s above the gift tax limits. You may frontload 5 years worth (5 x $15,000 or $30,000 = $75,000 or $150,000). For those that can swing this, this is a great way to get that money growing for college.2. UGMA (Uniform Gifts to Minors Act)

UGMA & UTMA are basically savings and/or investing accounts for your children. You own the account as a custodian until junior reaches the age of majority. This age is state dependent but usually ranges from ages 18-21. Once they reach this age the account belongs to them and you lose control. Since this is an asset your child owns it will be counted for college financial aid calculations. The money can be used for anything. On the flip side, interest, dividends & capital gains are taxed. The taxation recently changed with the new 2018 Tax Law and will be taxed like trusts (15% & 20% tax above $2,600 & $12,700 respectively). Previously, the first $2,100 of unearned income (interest, dividends & capital gains ) was not taxed.3. Coverdell ESA

Huh? That's the usual response I hear when I recommend this account for children. I already discussed how great ESAs and how you can fund one despite being over the income limit (kind of like the backdoor Roth IRA). You can only contribute $2,000 a year but over time (and compound interest) you can have a sizeable chunk of cash to use for either private school and college. Although there is a new ruling allowing up to $10,000 per year withdrawals from a 529 account for K-12, not all states have adopted this. I also don't recommend doing this unless 1) you get a nice state income tax deduction (like NY) and/or 2) you frontload your 529 at or near birth. Otherwise the money just won't have much time to grow if you keep withdrawing money from it. Unlike the 529 plan, you cannot open one before your child is born.4. Roth IRA

[caption id="attachment_2545" align="alignleft" width="351"] Jack's Korean Dol outfit[/caption]

We haven’t opened a Roth IRA yet but will before the end of this year. Children can open a Roth IRA if they have earned income. Chores around the house do not count. Babysitting and working for your business do. In Eggy’s case, he’s a print model for this website.

What, you think he let me use this photo for free? Nope.

A Roth IRA for your children via a family business is a win-win situation. You pay your child for work, you get a business deduction, he/she gets earned income and can open a Roth IRA. Once inside the Roth IRA, the money is never taxed again! Better yet – until he makes a sizeable income through the family business he won't pay federal and likely no state income taxes as well!

Now, the key is to pay your child a reasonable wage for the work. It won't pass the snuff test if I paid Eggy $5,500 for a few photos on this website.

A quick reminder to stay under the gift tax limits for total contributions to your children's 529, ESA, and UGMA/UTMA accounts. Currently, the gift tax limits are $15,000 or $30,000 for married couples. So, in other words, don't contribute more than $30,000 across the 3 accounts in a year. An exception to this is the 5 year frontloading exception for 529s.

We opened and kept his 529 in NY. His UGMA and ESA accounts are at TD Ameritrade. We plan to open his Roth IRA at TD Ameritade since Vanguard does not allow minor Roth IRAs.

What do you think? Comment below!

]]>

Read More

Jack's Korean Dol outfit[/caption]

We haven’t opened a Roth IRA yet but will before the end of this year. Children can open a Roth IRA if they have earned income. Chores around the house do not count. Babysitting and working for your business do. In Eggy’s case, he’s a print model for this website.

What, you think he let me use this photo for free? Nope.

A Roth IRA for your children via a family business is a win-win situation. You pay your child for work, you get a business deduction, he/she gets earned income and can open a Roth IRA. Once inside the Roth IRA, the money is never taxed again! Better yet – until he makes a sizeable income through the family business he won't pay federal and likely no state income taxes as well!

Now, the key is to pay your child a reasonable wage for the work. It won't pass the snuff test if I paid Eggy $5,500 for a few photos on this website.

A quick reminder to stay under the gift tax limits for total contributions to your children's 529, ESA, and UGMA/UTMA accounts. Currently, the gift tax limits are $15,000 or $30,000 for married couples. So, in other words, don't contribute more than $30,000 across the 3 accounts in a year. An exception to this is the 5 year frontloading exception for 529s.

We opened and kept his 529 in NY. His UGMA and ESA accounts are at TD Ameritrade. We plan to open his Roth IRA at TD Ameritade since Vanguard does not allow minor Roth IRAs.

What do you think? Comment below!

]]>

Read More