Money

before. But what about the new tax laws? Use this guide to learn everything you need to know to get started with a backdoor Coverdell ESA.

First things first. With the new tax law allowing one to withdraw $10,000 annually towards private school, you may think the ESA is no longer needed. Not so fast.

The ESA still makes sense to contribute to even if you're not sure if your child will attend private school. It becomes a 529 if he doesn't. Ideally, you would open both a Coverdell ESA and a 529 as soon as your child is born (or better yet, open the 529 before they are born).

If you plan to send your child to private school, then ideally you would frontload the 529 x 5 years or $150,000 ($30,000 x 5 years) to give the magic of compound interest a head start.

Still, that only gives you about 5 years if you send your child to private kindergarten. It's best if you give it more time to grow if you plan to use part of the 529 for private school.

Meanwhile the ESA account is growing (yes, it is limited to only $2,000 a year), but by the time Junior is in middle school or high school, the ESA account will have around $40,000 in it.

Using the 529 for private school is even more attractive when you have a state income tax deduction and you continue to contribute to it as you withdraw annually for private school.

Most private schools in the U.S. are well over $10,000 a year, so the ESA functions as a backup reserve of tax advantaged funds to use.

Backdoor Coverdell ESA Steps

Now, how do you actually open and fund a backdoor Coverdell ESA? Most physicians are well over the income limit. There are 3 basic steps:

Step 1: Open a UTMA account and fund it.

My suggested custodians for this account are etrade, TD Ameritrade, and Charles Schwab. None of these custodians charge a fee and many of you likely have an account already at one of them. You fund the UTMA with gifted money, so this goes towards the annual gift limit ($15,000 in 2018). Note, the gift does not need to come from you.

Step 2: Open a Coverdell ESA account.

Again, I recommend the same three custodians above. And I recommend you use the same custodian for both accounts for ease.

Step 3: Transfer money from the UTMA into the Coverdell ESA.

This is the “backdoor” way to fund the ESA since the UTMA is owned by your child.

Final Thoughts on Backdoor Coverdell ESAs

We chose TD Ameritrade for our UTMA and Coverdell ESA. Right now, we don't have a plan as to how much we will fund the UTMA in general and are mainly using it to contribute to the ESA.

We also don't know if we will choose public or private school yet. Eggy was born in late 2017, and we have funded both 2017 and 2018. You have until tax day to fund the ESA.

To give your savings a head start and to let compounding do some of the heavy lifting, get started with the first step of a backdoor Coverdell ESA today.

What do you think? Do you plan to open an ESA for your child?

Read MoreWhenever I saw posts from “other people” asking how to handle a windfall, I always thought “Wow, lucky them.” I never thought we would be in a position where I would need to read the Bogleheads article on How to Manage a Windfall or the White Coat Investor's version and how he personally handled his. I like how WCI puts windfalls into 3 categories:

- Spare Cash – around 10K-200K

- Enough to make you financially independent – 1-3 million

- Ridiculous Money (think lottery)

- First, we chose to pay off my student loans and become debt free. What a feeling!

- We bought a car in cash.

- We beefed up our emergency fund.

- Set aside money for new furniture for our new home.

- Frontloaded 529 for M's first son.

- Started Eggy's ESA.

- Started a taxable brokerage account at Vanguard.

Physician Wellness and Financial Literacy Conference aka the “White Coat Investor Conference” in Park City, UT. I got to meet WCI and many “online” friends that I had interacted with on Facebook, Messenger, and on the WCI Forums.

Jim opened the conference with “The State of Physician Financial Literacy.” He implored physicians to create the job we want now where we can work for a long time. Career longevity is more important vs. trying to “retire/reach FI ASAP.” As the conference unfolded we had two great lectures by my friend Nisha Mehta on physician burnout and what we can do about it. What I took away from the conference was to start an inquiry into what my ideal life would look like if money was not an issue. What changes can I make now to get there? (After all, I will not be FI for at least a decade.) And how feasible is it to create my ideal life now vs. “when I reach FI?“

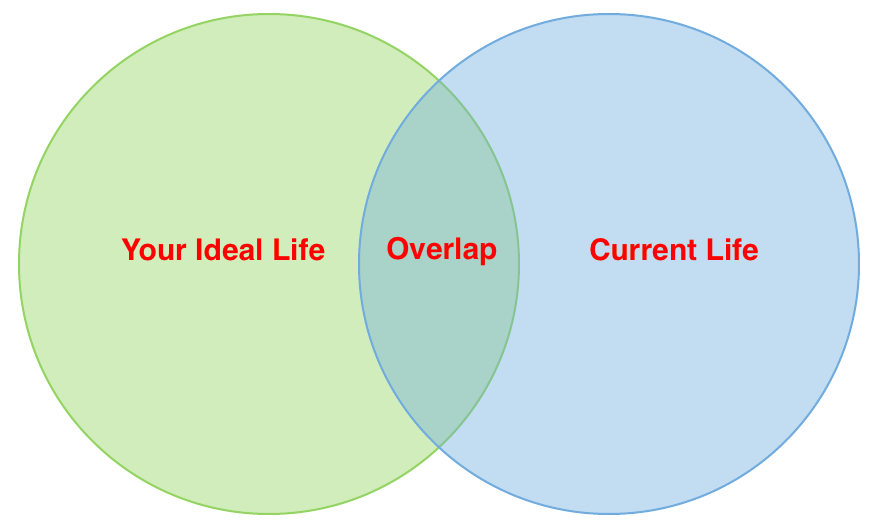

I subsequently stumbled upon this post by WCI where he presented a Venn Diagram as a visual to visualize the discrepancy between your actual life and ideal life. Obviously the higher the overlap the happier you will be. 60% is the % overlap to “be happy.”

Like WCI, I started thinking what my ideal life would like (the green circle on the left):

Like WCI, I started thinking what my ideal life would like (the green circle on the left):

- See patients 3 days a week with no weekends or holidays

- Walk to work or commute less than 15-20 minutes

- Start the work day after Eggy gets up and be home in time to play with him for a few hours before he goes to bed (and when he is older, start work after he goes to school and be able to pick him up from school)

- See no more than 4 patients an hour and run on time

- Work out 3 days a week

- Cook most meals for my family

- Have the freedom to take trips with my family 2-3 times a year

- Work on my blog ~ 10 hours a week to keep up with regular blog posts and such

- Since my current and ideal life has M & Eggy in it, I'd like M to also work 3-4 days a week and home by 4-5pm if he wishes to work that is.

- See patients 4 days a week with no weekends or holidays – Almost there!

- Commute 30-40 minutes by car – This is a HUGE improvement from my old job where the commute was 1-2 hrs each way

- 3 days a week I work 7-3pm – so I am up around 5:30am. Eggy gets up around 7:30am. 1 day a week I work 10-6pm so I get to spend part of the morning with him.

- The job is new so I am not fully booked yet but will likely schedule 6 patients an hour and I do generally run on time

- I work out 1-2 times a week

- Cooking has become almost non-existent

- We probably have the freedom to take trips but they need to be scheduled in advance and M's job isn't as flexible as mine

- Right now I struggle to put in regular time into the blog

- Right now, M works too much and works too late and for someone who isn't a physician is “on-call” quite a bit

Carrie, me and Jim[/caption]

Hear Carrie and I discuss our thoughts on the first Physician Wellness and Financial Literacy conference aka the WCI Conference. Obviously we got to meet Jim and lots of other awesome people. Jim actually went skiing with M along with some other docs. They skied Jupiter (double black diamond in case you were wondering) and survived. One of the highlights for me was meeting lots of ladies from online at the Women's Reception.

*podcast code*

I was also a speaker at the conference. My talk was titled “Balancing Work, Family and Finances.” I discussed:

- What's unique about being a Woman Physician

- Maternity Planning for the Physician Woman

- Estate Planning Basics

- Prenup Basics

Yeah … that was an ambitious amount of material to cover in less than 50 minutes! In retrospect, I should have nixed estate planning but I figured at least some of the participants would find it useful. So many folks neglect estate planning since it never seems urgent.

I could have spent the whole lecture discussing Women Physicians. Now that I am a mother I have serious respect for all my physician mom colleagues. We have two very difficult and demanding jobs in addition to running the household, balancing the checkbook, and making sure food is in the fridge. The first step to not going insane and burn out is to first acknowledge that it is completely unrealistic that you can “do it all.” I remember not too long ago an avalanche of articles about “having it all.” It's a myth! My main tip here was to not be afraid to outsource. Yet I meet so many physician moms in barely survival mode because many of us feel guilty. Cut it out.

I don't clean my home. Nor do I do laundry (rarely anyway). I do enjoy cooking but it's been tougher since Eggy came along. I also chose to work 4 days a week instead of 5. I chose a job where I have great support staff relieving me of duties that I don't truly have to do as the physician (basic charting, basic call backs etc).

I also discussed investing in your marriage especially after having children. Too many husbands and wives neglect this. Have a babysitting budget. Spend time with your partner without the kids weekly. Take kid-less vacations.

Happy parents, happy children, happy bank account

Would love to hear tips from you – what advice would you give to a new physician mom?]]>

Read More  If you're interested in learning more about finances and don't have the time or interest to wade through books, blogs, and online forums then this course is for you. I wish this course was available when I first got interested a few years ago. I had to read several books, read a ton of blog articles, and post a lot of questions online to learn what I know now.

When you finish the course, you’ll feel confident that:

If you're interested in learning more about finances and don't have the time or interest to wade through books, blogs, and online forums then this course is for you. I wish this course was available when I first got interested a few years ago. I had to read several books, read a ton of blog articles, and post a lot of questions online to learn what I know now.

When you finish the course, you’ll feel confident that:

- You have all the insurance you need at the best possible price and none of the insurance you don’t need

- You are managing your student loans the right way, maximizing the benefits of government programs, minimizing interest paid, and getting out of debt as soon as possible

- You are either capable of managing your investments yourself, or you are paying a competent advisor a fair price to do it for you

- You are saving enough money to reach your goals and can spend the rest on whatever you like without feeling guilty

- You aren’t paying any more taxes than you need to

- Your children and your assets will be taken care of if something should happen to you

- Your assets are protected from lawsuits as much as possible with a simple, straightforward, and inexpensive plan

- You have a written plan to follow that will guarantee your financial success

Click here to find out more details and to purchase with code: MATCHDAY18 for 15% off

As an affiliate for this course (the course is the same cost to you regardless of who you purchase from) I was able to take the course for free. It is quite comprehensive and I cannot think of a more time efficient way to learn this stuff. Have you taken the course? Comment below! ]]> Read Morepush presents are a thing. And it turns out that I got the best push present ever!

About a year ago, M asked me to marry him and promised to keep our net worth positive. At that time, I was dragging us down with my student loans.

Well, not anymore! M paid them off!

Yup, I no longer have student loans. Happy dance in order:

And, we are now officially DEBT FREE !!!!!!!!!!!!

The Case to Wait to Pay Off Debt

I hear people say all the time that you don't “need” to pay off low interest debt quickly. I see their point and I wasn't planning on paying off these loans for another 3 years. Right out of residency, I favored maxing out my tax advantaged retirement accounts over making extra payments towards my student loans.

Why No Debt Is the Best Push Present Ever

Despite this argument, having no debt really feels fantastic. And it comes with some really significant perks too.

Being debt free means:

- No extra monthly payments

- A lower monthly operating budget

- Any extra money we get goes to us, not debt

Final Thoughts on Being Debt Free

Existing loans and taking on new ones (mortgage, car loans, etc) give you the illusion that you can afford something you actually can't.

Like 0% interest car loans – trust me, they aren't doing that to be nice to you. They know you will buy a more expensive car on credit even if you aren't paying interest. After all, it's just another monthly payment, right?

Couples who pay off debt together stay together. Of course, not every couple might have the means or the desire to pay off debt in one fell swoop like this. The most important thing is to make sure that you're on the same page financially, or at least taking steps to get there. Having solid financial footing before bringing a baby into the world truly feels like the best push present.

Read More2018 is well underway. Last year, M and I had a good amount of tax advantaged retirement “pots” available to us along with some employer match and contributions:

- My 403(b) + generous employer match + contribution

- My 457(b)

- My cash balance plan

- My backdoor Roth IRA

- My solo-401(k)

- His 403(b)

- His Roth IRA

- His solo-401(k)

- My 401(k) + employer match

- My solo-401(k)

- My backdoor Roth IRA

- My HSA

- His 401(k) + employer match

- His Roth IRA (may need to backdoor it this year)

- His family HSA

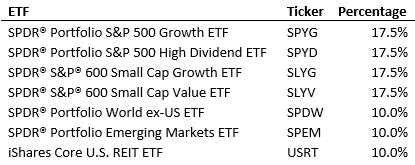

- Our taxable account

- 68% US stocks

- 17% Large cap growth, 17% Large cap value

- 17% Small cap growth, 17% Small cap value

- 24% International stocks

- 12% Large cap developed countries

- 12% Diversified emerging markets

- 8% US REITs

We will be opening our taxable account at Vanguard.

What do you think? Comment below!]]>

Read More

We will be opening our taxable account at Vanguard.

What do you think? Comment below!]]>

Read More

Having a baby and becoming a mom is stressful. There's no denying that. Planning for a maternity leave can be stressful, too. If you're expecting your first baby (or even a second or a third!), you might be wondering what a longer maternity leave looks like. Here's how I spent (and funded!) 16 weeks of maternity leave.

A Word About Stress

Everyone handles stress differently. No two births are the same. There are so many variables when it comes to maternity leaves.

For me, well, my leave was pretty stressful.

There was moving and almost dying along the way. At some point (OK, multiple points), I was overwhelmed and probably met criteria for postpartum anxiety. I spoke to a psychiatrist friend who pointed out that I pretty much experienced all the top life stressors except death of a loved one (and let's keep it that way!) within a 4 month period:

- New baby (especially the first one)

- Moving

- New Job

- Serious illness

She also pointed out that what's especially hard for new mothers is that no one is taking care of us. We are always taking care of baby (and spouse).

A Look at 16 Weeks of Maternity Leave

I feel lucky that my mother lives nearby enough and has been with us most weeks.

Breakfast of Champions – home cooked Korean food

So, I decided to give myself a pass on pretty much everything. For me, that meant a lot of stopping.

I stopped worrying about…

- Posting consistently on this blog.

- My new postpartum figure (well, kind of).

- Every single bit of what I was eating.

- Spending too much especially if it made my life easier during this time.

I am still trying to worry less about the not fully unpacked apartment.

Oh, and I finally figured out the biggest fallacy of “maternity leave” — nothing gets done despite not “going to work.”

Funding a Longer Maternity Leave

Throughout my leave, I was often asked how are we able to afford taking 16 weeks of mostly unpaid leave.

Let's back up and actually look at my leave. I took 16 weeks of leave, and it was only very partially paid. 6 weeks paid at my old base salary was all I got.

So how did we swing the full 16 weeks of maternity leave?

The answer is simple: We lived below our means, and we saved for it. Remember, you have about 9 months to save for maternity leave!

Let's go back to the idea of living below our means. In other words, we do not need our whole paycheck to get by. While I was pregnant, I stopped making extra payments to loans in favor of saving for this time.

Then, I had a cushion to pay for my maternity leave.

It definitely didn't feel good to watch my checking account balance only decrease during my leave, but seeing his face daily more than made up for it.

What are you looking at?

Final Thoughts on 16 Weeks of Maternity Leave

Isn't this what it's all about, Moms? I hope everyone about to have a baby can have the freedom to spend more than the typical 4-6 weeks of doctor maternity leave.

Look hard at your budget while your expecting, and see what you can do to save a bit extra. Even if you can't fund 16 weeks of leave, anything extra counts. You won't regret it.

What do you think of funding a longer leave? Comment below!]]>

Read MoreWelcome to another installment of Interviews with Real Female Physicians. The goal of this series is to share their story so that you, the reader, may learn and be inspired from their experiences – good and bad. We all come from different backgrounds and have different situations. Some of you are married, some are not, some with kids, some with blended families. Let’s show other women that any of these can work financially! So let's introduce our next woman physician rockstar – Leah.

Tell us about yourself:

People have a binary response to what I do, either “wow” or “eww”; there is no in between. Thankfully I have a wonderful partner in life who finds this binary response as funny as I do. I'm a forensic pathologist. What is not binary is that nearly everyone says that I am not what they had envisioned as a forensic pathologist, and that they would never have guessed what I do. I'm not weird, (by most standards), have a normal family life with my second husband, one girl, one boy, a dog, and a cat. Overall pretty balanced life. Of course, like nearly everybody else, it didn't start out that way. Most people consider me “Hispanic” although for me it wasn't a label I applied to myself, nor did I consider myself a “minority” until I moved to the “deep South”. It's all relative. I speak English and Spanish interchangeably, my baseball team was the Chicago Cubs before they were cool, and my favorite dessert is apple pie. Currently I live in a relatively expensive suburb to a coastal town thoughtfully referred by some locals as “Mount Plastic”. You get the idea. But when you are moving from the Caribbean to the mainland US and your only reference is the quality of the school zones as graded by the “internet”, that's where you end up. In an engineered neighborhood with cookie cutter homes and the best public school zones in town. No regrets, it was a great choice, and the neighbors are fantastic. I am absolutely certain I ended up in the right specialty, but it was entirely a happy accident thanks to not matching and the post match “scramble”, now “soap?”. I repeat, I did not plan to become a Forensic Pathologist (!), and it has been the best thing that could have happened to me. I was the happiest intern for the first 3 months of my pathology residency when I did my required autopsy rotations; I remember saying I could not believe they were paying me to do autopsies. They still are. I know I can do something else (PM &R and Gyn come to mind), but given the choice and knowing what I know now, I would never change my specialty. I love my work life balance, my open book specialty, being able to take time off whenever I want to participate in last minute school things, and all the interactions with amazing people that make up the law enforcement and death investigation systems, judges and juries. I honestly wish that more medical students knew about the fun side of pathology as a specialty, but if they were like me in medical school, it never has crossed their mind. Now, as an attending, 10 years out of residency, I make sure to reach out to as many medical students as I can to show them how fun Forensic Pathology can be.

Did you graduate with student loans? How much & what are the interest rates?

Again, I was lucky to go to subsidized state school – I graduated with $60K in loans. But in reality I had no idea what to do with medical school loans and would have left them as is. But my best friend told me right after med school (2003) I should consolidate and fix my interest rate because rates were historically low, so I did. It's good to listen to other people who are more financially savvy than us, even though she and I have vastly different financial habits and lifestyles. So my loans got converted to a 20 years fixed at 3.25% and I'm kicking myself because I possibly could have paid them off by now. The monthly payment is so low, that I have just been lazy I guess. Life happens and getting rid of a $200 payment is not high priority.Financial aspects of kids

When did you have them?

I had my daughter during 3rd year of medical school. I had planned for 4th year, but oh well, first year anniversary celebration. I was trying to avoid infertility issues that plagued my mother by having at least 1 kid before 30. My daughter ‘s arrival caused a 1 year delay in my medical school graduation date and my ex-husbands true colors to flourish as a sucky dad and partner. Divorced when she was 4. Met my second husband immediately, and my second child was born 8 1/2 years after my first. He was 6 weeks old when we moved permanently to the mainland. Today they are 7 and almost 16 years old. When we relocated, we moved to the expensive part of town of mainland US so kids could go to good public schools- saved me the 10K/year I was paying before I moved (for 1 kid), and now I happily pay my taxes to the county in exchange for public schools that have caring teachers. Day care/school for my youngest was transitorily expensive at $1400/month for 1 kid, year round, starting at 2 1/2 years, but that was only 3 years and now he's in public school. We tried a nanny briefly when our son was a baby but she moved away after a couple of months and my husband just sucked it up big time until the baby went to preschool and took care of him, even taking him on business trips. The economic relief came when he graduated to kindergarten. But now I face the other end of the child expense spectrum. My eldest is 1 year away from an early high school graduation and college, and her college fund is woefully underfunded. I feel it's too late, much too late to fund anything significant for her at this point, so we will approach this with a prayer for a good scholarship and thankfulness for her 4.6 weighted GPA. Learning from my mistakes, and in a much better position financially than when my daughter was growing up, I will fund my son's 529 much better; he is 10 years away from high school graduation so I should have time to do better. Didn't have a third kid because we could not afford to give it what we want to give our children time wise. Sometimes I'm wistful because I would have loved another child for my second husband, but he's clear he didn't want any more of the responsibility associated to their social agendas. Because he is the primary caretaking parent due to his work from home flexibility, he got his wish. I had previously decided no kids after 40 due to genetic risks, so by now at almost 42 it's no longer an option.Financial aspects of marriage

Are you married?

To marry or not to marry, that is the question. Most people do not know my second husband and I are not technically married, and this includes my youngest son. Socially we are. Legally, somewhere in the gray zone because this state recognizes common law marriage and it’s been 11 years, but if you get down to details, not technically married. Why? Taxes. Different tax habits (he files late, I file early), different tax bases (mainland US for me vs. back home for him), and the marriage penalty of higher taxes if we do. We have a few assets from before marriage that we keep separate and legally we would have to write a simple prenup for the old assets. Plus, having been really married before, divorce can be expensive, even when you share nothing but debt. My second husband and I do not have the same financial views or habits, and it took some balancing and compromise to get to a household budget. I'm a saver, he's a spender so he now gets to release his spending beast at the supermarket and costco instead of home depot and best buy. I splurge once a year during the back to school. I defer money (the maximum allowed contributions) into the retirement plans so we don't see that money; like it never existed. We make do with what's left over of the paycheck even if its a bit tight.Are you the breadwinner?

I'm the primary breadwinner. My husband makes enough to pay for dinner once in a while and pay for his IT business things back home. We have access to each other's personal accounts, but what is his is his, and what is mine is ours; honestly I don't have the time to do all the household things he does. He controls his IT business account and I have a personal account back home for receiving (or not) theoretical child support. That being said I monitor the spending closely for things that might not belong to us. I've seen horrific financial issues with identity theft so we are extremely vigilant that every single transaction is ours.Have you experienced a financial catastrophe?

Financial catastrophes are divorce, illness, or loss of a job (when your field is so specific that you aren't cross marketable locally). The more you have, the more expensive the catastrophe is, because of the higher holding costs associated to simply keeping a home, cars, boats, kids in private schools, insurance. The lower you live below your means, the easier it is to weather the unforeseen. Public school is free, no job no problem. Paid off cars only have registration/property tax: example my 1999 Lexus SUV with high mileage has a $6.00 yearly registration. I'm pretty sure I can scrounge this up from the change bucket. My newest “splurge” in a vehicle is a 2005 Lexus SUV, 12 years old, $56 yearly registration. Of course I can afford a new one, but why? This one takes me from point A to B exactly the same as a new one, and it still has all the bells and whistles. Having a safety net is important, the best one is the “emergency fund” and the second one is “enough insurance”. Rich family member works too. Keep your house payment affordable, your car payments paid off or affordable, and don't spend to keep up with the Joneses because the Joneses aren't going to pay your bills when TSHT Fan. That being said, I am not “loan averse” or debt averse. Long term holdings – house, car and education- are best paid off in the long run with future earnings that have less value. Loans are leverage, protect your credit and this will help you weather minor unforeseens and help you get ahead.

General Finances

What’s your FI (financial independence) number?

Our financial independence number is a moving target and will end up being when we both “had enough” of full time work – as long as primary house and vehicles are paid off and kids are out of college (around 2030). I will be 55 and hubby 58. We are thrifty to the extreme. Sale and clearance are our favorite words, along with consignment and second hand. We take used toys and kids clothes to second hand stores for purchase, sell used things on craigslist, save all the spare change into the emergency fund and have taught the kids to save their money.Who handles the finances in your relationship? Are you DIY or do you have a financial advisor?

We have a financial advisor that we like on a personal level. He did get us the fixed rate term life insurance we needed, advised us to open our own self managed 529 accounts (instead of advisor led), and uses computer software to model where we are at the time and what the projections will be. He sees us for free. I had to beg him to open a small IRA for me that I contribute to yearly, and don't mind paying him advisor fees on that amount since he is so available to us for answering all sorts of questions for free. Going with my husband was eye opening for the both of us, turned out we were much better off than we thought but still a long way from where we want to be.What is your net worth?

It may seem crazy but I don't want to know my net worth. Market value of assets fluctuates, as does retirement account values. My FA calculates it periodically but we don't pay attention to it much because it will be different in 6 months. We have grown it exponentially and not linearly as expected, mostly with self discipline and luck in real estate investments.How are you saving for FI/retirement?

We started late and have to catch up. We save a lot into retirement – basically every penny that we don't spend on basic living, because I'm saving for my husband and I, and you can technically finance the kids education better than your own retirement.One thing you wish you knew:

I don't really have financial failures or regrets other than getting roped into inheriting my grandparents timeshare. Say no to timeshares! We used it a few times and but bottom line it ends up being 10 times more expensive than paying for it per use. Right now I'm paying an agency thousands of dollars to get rid of it. Once I'm done it will be filed under “learning experience”.What does FI/retirement mean to you? What does it look like?

We are not “do nothing in retirement” people, so even in retirement we would both work to keep busy, just not out of financial necessity. We both have marketable skills for easy sideline jobs.Do you give to charity? If so, where and why?

What we can't sell, we donate. We are possibly the odd ones out in the “Joneses” club around here, on one hand living in a house worth now over half a million dollars yet quietly picking up what our neighbors toss out on the curb and donating it. There is no reason for a bike to end up in the landfill when a child somewhere else can use it. We also donate directly to the schools and to animal rescue programs, because what goes around comes around. We are truly blessed.Any parting words of wisdom?

To summarize, some debt is good (house in good neighborhood/school zone), some debt is bad (credit cards), safeguard your credit, live well below your means to be able to survive whatever life throws at you, have safety nets in place, prioritize retirement over education savings, don't be wasteful, and don't forget to count your blessings and be thankful. As Lennon said, Life is what happens while you're busy making other plans.And … that's a wrap! If you're interested in doing this please send me an email – I'd love to hear from you!

I loved reading Leah's story and I hope you did too.]]> Read MoreWelcome to another installment of Interviews with Real Female Physicians. The goal of this series is to share their story so that you, the reader, may learn and be inspired from their experiences – good and bad. We all come from different backgrounds and have different situations. Some of you are married, some are not, some with kids, some with blended families. Let’s show other women that any of these can work financially! So let's introduce our next woman physician heroine – Sharon .

Tell us about yourself:

Hi! My name is “Sharon”. I am a pediatric subspecialist in a private practice. I like my job, but at times I do feel tired. I feel like I wasn’t as exposed to other specialties in medical school that I might have pursued (like radiology). I am currently married and have one son. I love to draw and cook. I am Hispanic. I live in Central Florida, which in my opinion is very reasonable in terms of cost of living. I am currently an attending 6 years out of fellowship.Did you graduate with student loans? How much & what are the interest rates?

I graduated with student loans but I was very fortunate to go to a medical school in my native country which was more affordable than in the US. I went to a public university. My loan interest is 2.65%. My loans totaled $72K. I still owe about $16K. I was pretty aggressive initially paying off the higher interest loans and I am planning to pay them off completely this year.Financial aspects of kids

When did you have them?

I had my son 2 years ago, as an attending.Are you planning to fund their college expenses?

My son is 2 years old. I have a 529 through the state of Utah. I will help him as much as I can, but my goal right now is to have about $150K for college.What are your child care expenses?

My son has been in daycare since he was 12 weeks old. It was not an easy decision but I didn’t feel comfortable having a stranger in my home all day with my baby. His daycare is very good, close to my office and has cameras that I can monitor.Financial aspects of marriage

Are you married?

Yes I am married.Did you get a pre-nuptial or post-nuptial agreement?

Maybe it’s a cultural thing? Not common in our culture. I guess I would've like to have one.Do you and your husband agree on finances?

I am the primary breadwinner and I am the one that makes all of the financial decisions and plans for the future. He just agrees with everything I do. I make about 3 times what he makes. He realizes that and we have found that keeping our accounts separate works best for us.Have you experienced a financial catastrophe?

No, thank god!