Financial Advisors

This is a repost of last year's financial tips, updated for 2019!

Can you believe the year is almost over? With just a few short months to tie up most financial loose ends, here are some year end financial tips you'll be sure you won't want to miss.

Check out the companion podcast (from 2018) over at the Hippocratic Hustle!

Be Sure To Max Out Tax Advantaged Retirement Accounts

… If that was one of your financial goals.

You may be surprised to learn that we no longer max out all of my available tax advantaged accounts as of this year. Our 2019 goals for tax advantaged retirement accounts were to max out our HSAs and Roth IRAs and get the free match from our employers.

Hopefully you've already set up your work retirement accounts to max out along the year (aka dollar cost averaging). Or better yet, you front loaded them and are done for the year! Here are the accounts you may want to double check:

Work retirement accounts

Work retirement accounts such as 401(k), 403(b), and 457(b) generally have a deadline of by your last paycheck of the year. It can also take 1-2 pay cycles for any changes you make to your contributions–so do this ASAP if you need to increase your contributions. Don't forget to reset this in January unless you want to front load the accounts.

Roth IRA

Don't forget to fund your Roth IRA! Most physicians will need to backdoor it. You do have until Tax Day in April 2020 to fund it, however, it is cleaner if you do the IRA contribution & conversion this calendar year. This is due to how you fill out Form 8606 with your taxes.

Here's the short version of how Form 8606 works: You report the contribution to the traditional IRA on the tax year (2019), but you report the conversion (from traditional IRA to Roth IRA) in the actual year you did it. So for example, if you wait till January 2020 to backdoor for tax year 2019, you'll have to report this transaction on Form 8606 in 2019 and 2020. Not a big deal, but you'll need to keep track of that or make sure your CPA does for you.

Solo-401(k)

Are you self employed or do you have a side hustle? There are two things to know:

- You have until 1/15/20 to contribute your employee contributions.

- Then, you have until tax day April for the employer contributions for the solo-401(k).

If you don't have a solo-401(k) but want to, you have until 12/31/19 to open one – so get on it!

SEP-IRA

If you're a procrastinator, then you'll need to open a SEP-IRA. You have until tax day extension in October 2020 to open and fund one for tax year 2019.

HSA

If you're lucky to have access to a Health Savings Account (HSA) and are using it as a Stealth IRA, you have until Tax Day in April 2020 to fund one. Most folks will fund one via paycheck through work. I self fund it and contributed to it in one lump sum at Lively. Don't forget to invest the money inside the HSA as well. Lively custodies with TD Ameritrade.

Take Advantage of Tax Loss Harvesting

Tax Loss Harvesting (TLH) is a way to capture losses in your taxable or regular brokerage account to reduce your tax burden. The current limit of losses you can claim on your tax return is $3,000. You can carry forward losses > $3,000 to use into future tax returns as well.

Speaking of investments, make sure you know when to rebalance your portfolio. I recommend doing this once a year and definitely not more than twice a year. Pick an annual date to do this.

Be Smart About Charitable Donations

The new Tax Law (as of 2018) makes it more difficult to itemize deductions since the standard deduction is much higher. Hopefully no one donates just for the tax write off. The best way to donate and get a tax break is to lump your donations every other year (or more) so that you are able to itemize deductions.

A great way to do this is to open and fund a Donor Advised Fund (DAF). Why? You take the tax write off the year you contribute to the fund, then you're free to donate to any charity you'd like without having to keep track and save receipts for tax day. You can also donate anonymously very easily via a DAF.

Use FSA Money

Don't forget to use up your Flexible Spending Account(s). Some plans will let you carry forward up to $500 to the following year. However, most of the plans are “use it or lose it.” Your plan can also offer a two and a half month grace period (March 15).

Bottom line – read the fine print of your FSA plan. The same applies for Dependent Care FSA plans. I wonder where the lost money goes – anyone know?

Start or Review Your Estate Planning

There is no end of year deadline for this per se … however this ends up being an non-urgent item on the to-do list for many people.

Create A Will

If you're reading this and you do not have a will – what are you waiting for? Perhaps you elected a legal plan through your employer and the deadline to use it or lose it is coming up. If you are married and/or have children, having a will is a must to elect a guardian in case of your early demise. Otherwise the state will pick for you.

Secure and Safely Share Account Access

Along these lines, if you or your partner passes, do you have access to his/her accounts, logins and passwords? First, you'll want to make sure you have Power Of Attorney. This is not valid upon death but many things can happen where you'll need access to accounts legally.

For password and secure digital document management I recommend a program like Lastpass. For most folks, the family plan will be appropriate. This allows the whole family to use Lastpass to manage passwords. Lastpass can also generate secure passwords (you're not using the same password for all your logins, right?).

You can also use it as a secure digital vault – I upload copies of important documents such as driver's licenses, passports, social security cards, life insurance policies and other insurance policies. I essentially use it as a digital death book.

For those that prefer the paper route for this, check out Mama Fish Save's ICE binder – In Case of Emergency. This is a templated PDF that guides you into documenting all the things you'll want your loved ones to have access to when you pass.

Smart End Of The Year Financial Tips

Make a plan to implement these tips before the end of the year. That way, you'll finish 2019 strong. With only a few short months left in this calendar year, make today the day that you get started.

You can also sign up to grab your guide to the 4 Steps to Creating Wealth. After all, who doesn't want to start the year wealthier?

Read MoreThis is a guest post by Letizia of Semi-Retired MD. She and her husband are both physicians and financially independent, in part, from investing in direct real estate. Their website is chock full of amazing information on how to choose the right investment property.

Investing in real estate can seem overwhelming at first. Where should I start looking for properties? How do I know if a property is a “good” deal? Who can help me through the process? Real estate investing, however, is not as difficult as it first may initially appear. You know much more about real estate investing than you think you do.

Most people have had experiences with renting and buying their own apartments and homes. These types of experiences, when combined with focused reading and supportive mentors, can make a plunge into real estate investing relatively easy and successful, even for a newbie.

In this post, I cover some of the reasons that direct-ownership of real estate investments is such an attractive way to build true wealth. I also provide you with simple guidelines for how you can take the first few steps towards becoming a successful real estate investor as you work to become financially independent. By the time you’re done reading this, you will know how to start working towards achieving financial freedom for you and your family by owning your own rental properties.

Do I need to own rental properties? Can’t I just buy real estate stocks?

There are numerous ways to invest in real estate. On one end of the scale is the most passive form of real estate investment, Real Estate Investment Trusts (REITs), which are traded much like mutual funds. REITs are followed on the scale by less-passive forms including syndications and finally by direct-ownership of rental income-producing properties.

In this article, I concentrate on the direct-ownership of rental properties. I do this because this type of real estate investing will get you to financial freedom the fastest. This is not to say you should not consider more passive forms of real estate investing on the path to becoming financially independent if it suits your risk-profile, interest and/or time restrictions. Just understand that some of the benefits of real estate investing discussed below do not apply to less-passive forms of real estate activities.

Do I have time for this?

We all know women often shoulder much of the the burden of unpaid work in the household. So why should you add the responsibility of real estate investing to that load? Why not leave it to your significant other?

First, once you learn how to successfully invest in real estate, your skills and knowledge will never be lost. You will always know how to bring in money for your family using real estate investing no matter what happens. We’ve all seen the stories of women losing their significant others, becoming sick themselves and going through horrible divorces. I, myself, have been through a divorce. And like others, I had to face the question of how I was going to support myself and my family.

As doctors, we can often fall back on our jobs when things like this happen, but wouldn’t it be better if we had our jobs, $100K in semi-passive income coming in each year from our real estate properties AND we felt confident that we could run the business (and even expand it)?

Isn’t owning rental properties a lot of work?

It’s true – direct-ownership of real estate property is not 100% passive. You have to manage the property managers; you have to manage the bookkeeper. There’s work involved with buying and selling properties. However, the amount of work for the earned income is disproportionate.

You can work a couple of hours a month and earn tens of thousands of dollars. And, over time, you can make your real estate business more and more passive by putting in place systems and people to manage most of the day-to-day issues. I’d argue it’s worth learning to make money this way so you never have to make financial decisions (or family or personal decisions) out of the fear you won’t be able to support yourself and your children.

How can real estate help me become financially independent?

In my mind, there are three main reasons you should start using real estate investment properties as a vehicle to propel yourself to financial freedom.

# 1. Wealth Building

We recently analyzed our real estate portfolio and found that we, on average, have a greater than 25% return on our real estate investments. How do we do this?

- Leverage: when you own investment property, you also make money on the bank’s loaned money as well as your own. That’s the power of using leverage.

- Cashflow: cashflow is the amount of money you make each month after all the expenses are paid. It’s the rent that actually goes into your pocket. Cashflow is the extra income source that can allow you to cut back at your clinical job or allow you to weather a particularly difficult financial month (or year).

- Equity Paydown: when you buy a property right, your renters pay down your mortgage each month, thus making you money a third way: equity paydown. Equity paydown grows each year as your mortgage payments become less interest and more principal.

- Property Appreciation: by the nature of the real estate market, your investment property will usually gain market value (appreciate) over time.

- Rent Appreciation: this is the amount that you can increase rent rates per year. It usually ranges on the order of 2-3% percent per year, which, over ten years can mean that your property’s rent increases 85%!

- Forced Appreciation: in addition to market-controlled rent appreciation, you also can increase a property’s value by improving it and then increasing rents proportionally (or disproportionately), which is called forced appreciation.

And, finally, there’s tax savings, which we will discuss more below.

#2. Control

When you put your money into REITs or the stock market or even into syndications, you lose most of your control. You cannot control if the CEO of a company is going to embezzle money. Also, you cannot control if the general partners of a syndication are going to make good financial decisions. You can only hope and trust in others to manage your money well.

In comparison, when you directly own investments, they belong to you. You can control how they are managed. You are the decision-maker. In fact, you are the CEO. You can make changes that add to the bottom line, which, in this case, ends up directly in you and your family’s pocket.

# 3. Tax Benefits

The tax benefits of direct-ownership can be substantial. While these may not initially be your primary driver to get into real estate, they really should be at the top of your list. They can significantly reduce a typical physician's tax burden.

One of the main reasons the tax advantages of owning real estate is so great is because the government allows you to depreciate at minimum 1/27th of the value of your property (the building, not the land) each year. This means that over the course of 27.5 years, your property value becomes $0 (and, remember, you’ve only paid probably 20-30% down, so you’re actually collecting depreciation on the bank’s money as well as your own). What this means in practice is that you make money through cashflow each year but it looks like you are actually losing money (paper losses).

Depreciation, when combined with the write-offs you make on improvements/rehab and the fact you don’t pay payroll taxes on your earnings, means that making $100K in real estate is equivalent of making closer to $140K at your job.

How do I even start investing?

Now that we’ve covered some of the benefits of investing in real estate, let’s tackle how you can actually get started to building your business. The first step is to educate yourself. You need to understand the basics. When you are presented with a property, you can run the numbers and know if it is a good deal. It is not a good idea to rely on others to tell you if something is a good purchase since they may have competing interests.

Read and Listen

When we first started real estate investing, we found a couple of books extremely useful. Rich Dad, Poor Dad by Robert Kiyosaki gave us the “why” of why we needed to expand beyond just relying on our 1040 incomes for the rest of our lives. Then we used books like Real Estate Millionaire Investor by Gary Keller to explore the hows. Over the years we’ve also added in podcasts, like Bigger Pockets, which give us both motivation and useful information by learning about other’s stories. [ Editor's note: Also check Paula Pant's Afford Anything podcast ]

Know the Numbers

One of the keys is when you’re educating yourself, make sure you find a good cash on cash calculator (you can get ours in our Facebook Group). That way, you you can plug the numbers in for deals you come across to determine if they meet your criteria. You should have a minimum cash on cash you are willing to accept from a property. This keeps you from buying properties that are not going to bring in money each month.

Connect with Others

Another important step is to network with other investors. By networking, you have people who can connect you with their resources and offer advice when you’re not sure what to do. Experienced investors have come across a lot of weird situations. Instead of reinventing the wheel yourself and making avoidable mistakes, why not take advantage of collective experience and knowledge and help yourself grow faster with less risk?

You can find investors in a variety of ways. You might try any of these:

- Connect at meetups.

- Join local Facebook groups such as REI MD.

- Read real estate investment-focused blogs.

Build your Team

Another key step is to find yourself an investment real estate agent. This is not just any real estate agent. Instead, find someone who specializes in working with investors and who ideally owns his or her own investment properties.

In addition to finding you deals, an investor agent should be able to help you build the rest of your team like your property manager and your general contractor, since he/she has used and vetted these same people for his/her properties.

Harness the Power of Women

Now, I know I’m biased here, but I do believe that women are uniquely positioned to be successful in real estate investing. Many of us run our family’s finances. We organize the details of our family’s schedules. Plus, we do all the planning and packing when we go on trips. We manage a lot of relationships. And all of us are awesome at multitasking.

We bring all of these skills to the table when we enter the market as real estate investors looking to become financially independent. The key is just to get started in educating yourself and building your team so that you can work towards building financial independence for yourself and your family today.

Want to learn more?

Explore our blog at Semi-Retired MD or join our facebook group.

Read Morepaid off my student loans earlier this year. But I finally took the plunge into real estate syndications, and I wanted to share how that unfolded.

Where I Started

As I mentioned, when I first got started with my financial goals and plans, I was laser-focused on my student loans. This is the first year I opened up a regular brokerage account at Vanguard. Up until now, I've been resisting all the advice to learn more about real estate and get some money in the game. Like many of you, learning about finances is a journey and requires continuing education. What's great about being in this physician finance space is having access to folks who have experience with real estate investing. But, even with offers of direct mentoring to buy my first rental property, there was also this fear of the unknown. I was filled with thoughts like, “Ugh, it seems so complicated and a lot of work,” and that kept me from taking that first step. Then I discovered real estate syndication and decided to take another look.

Real Estate Syndications for Dummies

First, what is a syndicate? A syndicate is a way for multiple investors to pool their money into an entity to purchase real estate. Why? This allows them to invest in much bigger properties than any individual investor could do on her own. Think large apartment buildings, self-storage facilities, senior resident living homes – these are examples of commercial real estate.

Sponsors and Investors in Real Estate Syndications

Syndicates consist of a sponsor and investors. The sponsor is the one person or company that has experience and manages the deal on behalf of the investors. They generally have skin in the game too, often putting up between 5-20% of the total equity. The investors are people like you and me who would like to invest in this type of real estate, but prefer to be a passive investor, or what’s called a limited partner. Syndications are generally set up as an LLC and the investor owns an interest in the LLC. Let me back up a bit, though. You may be wondering why these seem “new” – at least I did. Up until recently, general solicitation for private offerings was prohibited (meaning no public advertising of securities to investors – like through the internet). You basically had to know someone–a friend, a neighbor, and so on–who did these deals. That’s where the term “country club” equity comes from. The JOBS Act of 2012 relaxed general solicitation rules as long as certain conditions were met, including that each investor is accredited. An accredited investor is an investor who meets 1 of the following criteria:

- She has annual income of at least $200,000 for the last two years with the expectation of earning at least $200,000 in the current year or

- If she's married, they have a combined income of at least $300,000 each year for the last two years with the expectation of earning at least $300,000 in the current year or

- She has a net worth of at least $1 million, excluding her primary residence, either individually or jointly with her spouse.

As you can see, many physicians will qualify to be an accredited investor a few years after residency.

The Pros and Cons of Real Estate Syndications

Investing in real estate syndications is relatively passive, making it attractive for busy folks like us. Like all investments, however, the investor should do their own due diligence and understand what they are investing in. Another attractive feature of this type of investment is its favorable tax treatment. Real estate sponsors can use depreciation to offset income and reduce the amount of current taxes on cash distributions. The taxes can be deferred until the property is sold, at which point gains on the sale would be taxed at a lower capital gains rate versus ordinary income rates. These tax benefits are passed on to investors in a real estate syndication. Investing in real estate also provides increased diversification, given that real estate has a low correlation with other major asset classes like stocks and bonds. There are other important considerations to investing in real estate syndications. A major con is the illiquidity of the investment as the money is often tied up for several years. You cannot just sell your part of the investment if you want to. You'll have to wait until the property is sold. You also don't own any actual real estate outright; you own a share. For a real estate newbie like me, investing in syndications is the perfect introduction to real estate. Put some skin in the game and learn along the way in a relatively passive way. Trusting the sponsor is paramount. So one may ask, how do I know if I can trust a sponsor? There is no easy answer. Spend time talking to sponsors and asking about their experience in putting together deals. A vetted introduction by someone you trust is probably how most people start.

How I Got Started with Syndications

So whom did I ask when I was ready? My friend Dr. Peter Kim at Passive Income MD. He introduced me to Alpha Investing. What I love about Alpha Investing is that you'll always talk to a senior partner of the firm. They are a private group of experienced investors with strong relationships with high-quality sponsors. Alpha Investing aggregates investments from its members into a syndicate and invests into sponsor projects. This structure allows members to access exclusive real estate projects at significantly reduced minimum investments. So I jumped in. I invested in an equity deal through Alpha Investing where the sponsor acquired a $260 million high-rise 20 miles outside of the heart of Manhattan.

Are you ready to jump in? Alpha Investing is an invitation-only private capital network but readers of Wealthy Mom MD can request access here.

[ Disclosure: This blog post contains affiliate links. If you click through and use a service or purchase a product, I may receive a commission at no extra cost to you. Thank you for your support. ]

Is there anything that surprised you about real estate syndications? Have you made real estate part of your portfolio?

Read Moreif any, for your kid(s)'s education & life is a personal decision. There is no simple answer. I don't recommend doing any of these if your finances are not in order. Remember, there is no such thing as a loan for retirement. My 1 year old already has 3 accounts and about to open a 4th. Why? To take full advantage of time and compound interest of course. Here they are in order of when we opened them.

1. 529 College Fund

529s are the king of college savings accounts. You contribute after-tax money in, it grows tax free, and you don't pay taxes on withdrawal. You may even get a state tax deduction for your contribution. You can also open one before your child is born! So if you know you're going to have children and get a decent state tax break like I did when I was living in NYC, it's not bad a idea to get one going. Where should you open one? Start with your own state's plan. If you get a state tax break you'll want to find out if you're limited to using your state's plan to qualify for a deduction or not. A few states, including my now home state of PA, allow you to use any state's plan. So, I've kept mine with NY which currently offers the lowest fee Vanguard funds. We currently invest it all in the Aggressive Growth Portfolio which consists of 70% Total Stock Market Index Fund and 30% Total International Stock Index Fund. If your state offers no tax deduction then I recommend NY, Utah, or Nevada's plan. Pick Nevada if you already invest in Vanguard and want to keep things clean. Don't overthink it, just pick one. And – make sure you select the direct plan and not the plan via a financial advisor which are loaded with extra fees. There is a penalty if you withdraw money for non-educational purposes. Because of this I recommend saving something like 70% in a 529 and the rest in either a UGMA/UTMA or your regular brokerage (aka taxable account). There is a special rule allowing parents to frontload 529s above the gift tax limits. You may frontload 5 years worth (5 x $15,000 or $30,000 = $75,000 or $150,000). For those that can swing this, this is a great way to get that money growing for college.2. UGMA (Uniform Gifts to Minors Act)

UGMA & UTMA are basically savings and/or investing accounts for your children. You own the account as a custodian until junior reaches the age of majority. This age is state dependent but usually ranges from ages 18-21. Once they reach this age the account belongs to them and you lose control. Since this is an asset your child owns it will be counted for college financial aid calculations. The money can be used for anything. On the flip side, interest, dividends & capital gains are taxed. The taxation recently changed with the new 2018 Tax Law and will be taxed like trusts (15% & 20% tax above $2,600 & $12,700 respectively). Previously, the first $2,100 of unearned income (interest, dividends & capital gains ) was not taxed.3. Coverdell ESA

Huh? That's the usual response I hear when I recommend this account for children. I already discussed how great ESAs and how you can fund one despite being over the income limit (kind of like the backdoor Roth IRA). You can only contribute $2,000 a year but over time (and compound interest) you can have a sizeable chunk of cash to use for either private school and college. Although there is a new ruling allowing up to $10,000 per year withdrawals from a 529 account for K-12, not all states have adopted this. I also don't recommend doing this unless 1) you get a nice state income tax deduction (like NY) and/or 2) you frontload your 529 at or near birth. Otherwise the money just won't have much time to grow if you keep withdrawing money from it. Unlike the 529 plan, you cannot open one before your child is born.4. Roth IRA

[caption id="attachment_2545" align="alignleft" width="351"] Jack's Korean Dol outfit[/caption]

We haven’t opened a Roth IRA yet but will before the end of this year. Children can open a Roth IRA if they have earned income. Chores around the house do not count. Babysitting and working for your business do. In Eggy’s case, he’s a print model for this website.

What, you think he let me use this photo for free? Nope.

A Roth IRA for your children via a family business is a win-win situation. You pay your child for work, you get a business deduction, he/she gets earned income and can open a Roth IRA. Once inside the Roth IRA, the money is never taxed again! Better yet – until he makes a sizeable income through the family business he won't pay federal and likely no state income taxes as well!

Now, the key is to pay your child a reasonable wage for the work. It won't pass the snuff test if I paid Eggy $5,500 for a few photos on this website.

A quick reminder to stay under the gift tax limits for total contributions to your children's 529, ESA, and UGMA/UTMA accounts. Currently, the gift tax limits are $15,000 or $30,000 for married couples. So, in other words, don't contribute more than $30,000 across the 3 accounts in a year. An exception to this is the 5 year frontloading exception for 529s.

We opened and kept his 529 in NY. His UGMA and ESA accounts are at TD Ameritrade. We plan to open his Roth IRA at TD Ameritade since Vanguard does not allow minor Roth IRAs.

What do you think? Comment below!

]]>

Read More

Jack's Korean Dol outfit[/caption]

We haven’t opened a Roth IRA yet but will before the end of this year. Children can open a Roth IRA if they have earned income. Chores around the house do not count. Babysitting and working for your business do. In Eggy’s case, he’s a print model for this website.

What, you think he let me use this photo for free? Nope.

A Roth IRA for your children via a family business is a win-win situation. You pay your child for work, you get a business deduction, he/she gets earned income and can open a Roth IRA. Once inside the Roth IRA, the money is never taxed again! Better yet – until he makes a sizeable income through the family business he won't pay federal and likely no state income taxes as well!

Now, the key is to pay your child a reasonable wage for the work. It won't pass the snuff test if I paid Eggy $5,500 for a few photos on this website.

A quick reminder to stay under the gift tax limits for total contributions to your children's 529, ESA, and UGMA/UTMA accounts. Currently, the gift tax limits are $15,000 or $30,000 for married couples. So, in other words, don't contribute more than $30,000 across the 3 accounts in a year. An exception to this is the 5 year frontloading exception for 529s.

We opened and kept his 529 in NY. His UGMA and ESA accounts are at TD Ameritrade. We plan to open his Roth IRA at TD Ameritade since Vanguard does not allow minor Roth IRAs.

What do you think? Comment below!

]]>

Read More

If you're interested in learning more about finances and don't have the time or interest to wade through books, blogs, and online forums then this course is for you. I wish this course was available when I first got interested a few years ago. I had to read several books, read a ton of blog articles, and post a lot of questions online to learn what I know now.

When you finish the course, you’ll feel confident that:

If you're interested in learning more about finances and don't have the time or interest to wade through books, blogs, and online forums then this course is for you. I wish this course was available when I first got interested a few years ago. I had to read several books, read a ton of blog articles, and post a lot of questions online to learn what I know now.

When you finish the course, you’ll feel confident that:

- You have all the insurance you need at the best possible price and none of the insurance you don’t need

- You are managing your student loans the right way, maximizing the benefits of government programs, minimizing interest paid, and getting out of debt as soon as possible

- You are either capable of managing your investments yourself, or you are paying a competent advisor a fair price to do it for you

- You are saving enough money to reach your goals and can spend the rest on whatever you like without feeling guilty

- You aren’t paying any more taxes than you need to

- Your children and your assets will be taken care of if something should happen to you

- Your assets are protected from lawsuits as much as possible with a simple, straightforward, and inexpensive plan

- You have a written plan to follow that will guarantee your financial success

Click here to find out more details and to purchase with code: MATCHDAY18 for 15% off

As an affiliate for this course (the course is the same cost to you regardless of who you purchase from) I was able to take the course for free. It is quite comprehensive and I cannot think of a more time efficient way to learn this stuff. Have you taken the course? Comment below! ]]> Read More2018 is well underway. Last year, M and I had a good amount of tax advantaged retirement “pots” available to us along with some employer match and contributions:

- My 403(b) + generous employer match + contribution

- My 457(b)

- My cash balance plan

- My backdoor Roth IRA

- My solo-401(k)

- His 403(b)

- His Roth IRA

- His solo-401(k)

- My 401(k) + employer match

- My solo-401(k)

- My backdoor Roth IRA

- My HSA

- His 401(k) + employer match

- His Roth IRA (may need to backdoor it this year)

- His family HSA

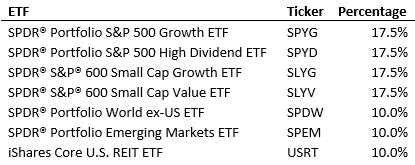

- Our taxable account

- 68% US stocks

- 17% Large cap growth, 17% Large cap value

- 17% Small cap growth, 17% Small cap value

- 24% International stocks

- 12% Large cap developed countries

- 12% Diversified emerging markets

- 8% US REITs

We will be opening our taxable account at Vanguard.

What do you think? Comment below!]]>

Read More

We will be opening our taxable account at Vanguard.

What do you think? Comment below!]]>

Read More

Before any big change in your life (hello, moving!), it's important to get your finances in order. We consider the cost of a move, and we compare our current salary with our future position. But what about saving for your future? It's probably not on your mind when you're thinking about moving. But for my recent move, a Mega Backdoor Roth IRA was something important to consider.

our move to a MCOL. I had less than 2 months before my planned maternity leave to figure out how to make sure I was maximizing benefits, particularly my work-sponsored retirement accounts.

My Work-Sponsored Retirement Accounts

To recap, here are the retirement accounts I have through work:

- 403(b) – I max out my contribution at $18,000 and receive a generous employer contribution + match. I am currently 40% vested in employer contributions.

- Private 457(b) – I max out my contribution at $18,000. There is no employer contribution.

- Cash Balance Plan (aka small pension) – Unfortunately, I am 0% vested, so I will lose it all.

In addition to these work retirement accounts, my Roth IRA for 2017 was funded in January.

Planning Ahead for a Move

Since the leave was planned well before our move to a MCOL, I had already increased contributions to my work's 403(b) and 457(b) so that my contributions would be maxed out by the end of September.

I was unable to get a straight answer from HR if I can continue to make contributions when short term disability pay kicked in for my maternity pay, so I played it safe. I also could not get a straight answer if I would continue to get employer contributions plus the match match if I front loaded the 403(b) and 457(b).

Thankfully, the employer contributions + match have continued!

Now, I will be separating from my job (I am employed until the end of December), some things will change. I am starting a new job in 2018 that only offers a 401(k). That means I'm losing my 457(b) and cash pension plan.

Because of that, I decided to take advantage of the Mega Backdoor Roth IRA (linked to excellent article by Mad Fientist).

What is a Mega Backdoor Roth IRA?

You might be wondering what exactly is a Mega Backdoor Roth IRA?

It is the ability to contribute an additional $36,000 a year into a Roth IRA. This is in addition to the regular or backdoor Roth IRA of $5,500 annually.

I knew this was an option through my work's 403(b) since they allow non-Roth after-tax contributions (aka NRATs). This is not the same as being able to contribute to a Roth 403(b) or 401(k). These contributions are in addition to my $18,000 employee contribution. You can contribute NRATs up to the total limit of $54,000 (for 2017).

Obviously, I want the free employer contribution + match, so I am limited to contributing an extra ~ $15,000 in after-tax contributions. But if you have no employer contribution then you can contribute the difference of $54,000 less $18,000, or up to $36,000.

Understanding Mega Backdoor Roths and Taxes

One caveat is that you want your plan to allow in-service distributions, meaning that you can move the NRAT portion of your 403(b) or 401(k) out of the account and into your Roth IRA. Some plans let you do this quarterly or annually. Mine only allows this upon job separation.

This is not a deal breaker, but this means that I will owe taxes on the gains only. One will still owe taxes on the gains with a quarterly or annual in-service distribution, but it will have less time to make gains, so they should be minimal.

Why This Money Move Was Right Before Our Move

I did not contribute to this in the past since I'm still paying down student loans. But now that I am leaving and losing a good amount of tax-advantaged space with the new job. It made sense to “fill up” this bucket before my move.

Final Thoughts on Mega Backdoor Roth IRAs

To summarize, here is how to tell if you are eligible for a Mega Backdoor Roth IRA. Ask yourself these questions:

- Does your plan allow non-Roth after-tax contributions?

- Does your plan allow in-service distributions? How often?

- If yes to both – you are lucky! And have an additional potential $36,000 to contribute to your Roth IRA

If you're eligible to contribute or you want more information about a Mega Backdoor Roth, make sure you swing by the Mad Fientist's article. Whether a Mega Backdoor Roth is the right financial move for you or not, before you move to a new city or simply change jobs, make sure that you think about your future money situation, too.

Have you heard of the Mega Backdoor Roth IRA? Comment below!]]>

Read More

I've estimated that these mistakes have cost me at least $350,000. Meaning that if I didn't make them, I'd have at least that much more money saved. Big sigh.

Here are the biggest financial mistakes I've made and survived to date:

#1. Cashing out my old work's 401(k) plan & selling company stock

I started a coveted job at Morgan Stanley in 1999 right after college. It was the height of the tech boom. My starting salary was $50,000 + a small guaranteed bonus. (I made the same as a resident in 2012!) My first 6 months was in London with all expenses paid.

I was an ex-pat there – meaning I was paid my U.S. salary but received free housing (picture beautiful 2 bedroom, 2 bath furnished apartment with marble bathtub, heated towel stand across the street from Hyde Park, neighboring the Grosvenor House) and a generous cash per diem. I did not have to spend any of my actual salary to live in London.

Now I don't totally regret this part – I was able to explore Europe on the weekends – weekend trips to Paris, Spain, Amsterdam. Priceless. Back then, friends and family from NYC could visit me in London for less than $400 roundtrip.

Plus, I had access to a 401(k) plan for the four years I worked there. I'm pretty sure I didn't max it out, but I still had a nice chunk in that account.

Still, I cashed it out in 2004. Yup, it gets worse. In addition to a company match, we also got free stock as part of our retirement plan. I sold it.

#2. Barely saving despite high earnings as a 22 year old

I listed my starting salary in mistake #1. About 1 year later, I got a $22,000 raise and a $25,000 bonus. This meant I hit 6 figures at the tender age of 23.

My only wish is that I had some savings to show for that! I lived paycheck to paycheck despite a high income. I guess I can blame NYC.

#3. Racking up $20,000 in credit card debt before starting dermatology residency

Yeah …. someone went a little nuts during intern year in NYC. I had awesome clothes, though. I paid it all off before graduating residency. Thankfully, I no longer carry any credit card debt and pay off cards in full every month.

#4. Not funding a Roth IRA until 2014

The Roth IRA was enacted in 1997. I've been earning money since at least 1992, so I'm not even counting opportunities to fund a regular IRA prior to that!

I actually never heard of the Roth IRA until sometime during residency so I feign ignorance prior to that. I couldn't imagine forking over $5,500 a year as a resident, but I totally could have. This is especially true because I moonlighted most of residency.

#5. Not paying off student loans during residency

Every year during internship and residency I meticulously applied for deferment or forbearance on my student loans. Isn't that what everyone does? Apparently not.

By the end of residency in 2015, I had almost $50,000 of interest capitalized onto my loans.

Surviving My Biggest Financial Mistakes

You can always earn more income, but you can't create more time. That's why some of these financial mistakes really sting.

Despite these awesome mistakes, I should be able to reach Financial Independence within 15-20 years and pre-Financial Independence within 10 years or less.

Feel free to share your mistakes below!]]>

Read Moreevery physician (especially women!) should strive for financial independence (FI) or pFI in a reasonable amount of time.

Why?

1. Carve out the dream job

How many physicians do you know are not happy with their current job but can't walk away because, well, they need the money? The answer is probably a lot.

In fact, one frightening survey said only 6 percent of doctors are happy with their jobs. Yikes!

Attaining pFI or FI gives you the ability to work on the terms that make you happy. It gives you the ability to walk away from a job that isn't working for you. I don't know about you, but I'd love to see less patients per hour and spend quality time with them instead of being rushed so that I meet “my numbers.”

2. Go part time!

Many women physicians would love to work less and spend more time with their families. Or spend time on other priorities. Attaining pFI gives you that ability. This is definitely one of the main drivers for us.

3. Stay flexible when life throws you that curveball

I hear a lot of “I love what I do and will work until I die” among physicians. Not so fast. Your goals and priorities will likely change as you get older. And sometimes, you don't have a choice.

A close family member needs extra care or passes. Your child has special needs or other needs that require your time and attention. Being FI gives you the freedom and ability to take the time you want to address whatever life may throw at you.

4. Enjoy your freedom

To me, FI means total freedom. We have become so used to debt that we are numb to it. We think of debt as “just another monthly payment.”

Final Thoughts on Women Physicians and Financial Independence

Looking over these top four reasons that women physicians should pursue financial independence, it's hard to believe you might have ever thought FIRE wasn't for you. If you're just getting started, no worries. Even if you've made financial mistakes in the past, you can still reach FIRE. To get started, calculate your net worth and check out the other FI resources on this blog to see how the start of your FIRE journey stacks up.

What do you think? Why is financial independence important to you? Comment below! ]]>

Read Morethe many benefits of a solo 401(k) and the necessary conditions for opening one. So now you're convinced you need to open one. Here are answers to some common questions you might have about starting a solo 401(k).

What about the SEP-IRA?

Before you decide on starting a solo 401(K), let's discuss another retirement account.

You may have heard about the SEP-IRA (or just SEP) as another retirement account option for the very small business. The SEP-IRA has the same contribution limits as the solo-K, but contributions are made by the employER only. Additionally, SEP-IRAs do not allow for Roth contributions.

While you can contribute the same amount to a SEP as you can to a solo-K, having a SEP-IRA (since it is a pre-tax IRA) will prevent you from contributing, tax free, to a backdoor Roth IRA.

So, why would you open a SEP-IRA instead of a solo-K?

The main reason is that a SEP can be opened after the calendar year for which it applies. You can wait until your tax due date, including extensions (around October 15th), to open and fund a SEP-IRA.

For example, you have until 10/15/19 (with an extension!) to open and fund a SEP for 2018. (Even if you have already filed your 2017 return and didn’t know this rule, you still have time to amend your return and open a SEP for 2017!)

By contrast, you must open a solo-k by the end of the calendar year it is for. A very minor reason to open a SEP over a solo-K is that the paperwork to open a SEP is simpler. But don't do it just because you're lazy!

Contributions to either a Solo-K or a SEP are based on net profits adjusted by FICA taxes (Social Security + Medicare taxes). The contributions to a Solo-K and a SEP are the same if you have already made your $19k employee contribution at work. Otherwise, you can add what remains of your employee contribution, up to $19k/$25k to the maximum Solo-K contribution.

What should I consider before starting a solo 401(k)?

There are a few good solo 401(k) choices with low to no fee plan options. They differ mainly in:

- Fees: Some are free, some are not.

- Traditional vs. Roth employee contributions: Not all will offer the Roth option.

- Rollovers: Not all will accept rollovers from old IRAs, 403(b)s, 401(k)s. This is a deal breaker, in my opinion, since the ability to do this is one of the great reasons to have one.

Thankfully, someone else already did a great and thorough review on the most popular solo-K options.

Where should I open my solo-K?

Here are my top 3 picks:

- TD Ameritrade: Offers a Roth option. Has a good list of commission-free ETFs including many Vanguard ones. M has his solo-K here and I plan to open one here too.

- E-trade: Offers a Roth option. Lots of free funds.

- Fidelity: No Roth option. Lots of free funds and ETFs.

All of these accept rollovers of old IRAs, 401(k)s. Some offer loans (which I don't recommend ever doing), too.

At this time, I do not recommend opening a solo-K at Vanguard for two main reasons: they do not accept rollovers (deal breaker) and you can only invest in their investor share class funds. These funds have a higher expense ratio than their admiral class fund or ETF equivalents. They also charge a $20 fee per fund in the account annually until you reach a balance of $50K.

Final Thoughts on Starting a Solo 401(k)

For many of us, starting a solo 401(k) is the right money move.

If you're still not sure, review the impressive benefits of a solo 401(K) and determine if you qualify. But maybe you're already wanting to get started. Today is the perfect day to create that investment account.

Follow the steps outlined above and then drop us a note below to let us know how the process went. Your future self will thank you for not putting this off any longer!

Do you have a SEP or a solo-K? Are you planning on starting a solo 401(k)? Comment below!]]>

Read More