Money

This is a guest post by Dr. Nisha Mehta. She writes and speaks about physician wellness. She will be a speaker at the first Physician Wellness and Financial Literacy conference taking place in Park City, Utah in March 2018. Follow her on Twitter at @nishamehtamd or on Facebook. Two articles that my readers will love by Nisha include You Know You're a Female Physician When and Babies and Medicine: On Choosing the Perfect Time. As someone who talks to many physicians about burnout and life in medicine, I find myself having a lot of discussions about the circumstances of people’s jobs. Almost inevitably, there comes a point in the conversation where someone expresses dissatisfaction about an aspect of their contract or an additional responsibility that was placed on them. As physicians, we’re groomed to take care of patients. During training, we don’t talk about compensation, work-life balance, or the business of medicine. In many ways, it’s actually frowned upon to do so, and our hierarchical systems discourage open conversation on these subjects. We also very rarely say ‘no’ during the course of our training, and this tendency stays with us for the remainder of our careers. Ultimately, these things hurt us. Physician burnout is multifactorial, and so much of its rise can be attributed to institutional and administrative factors and the changing healthcare landscape. We can’t predict the future, but there are certain steps that we can take to protect ourselves: 1. Don’t be afraid to ask uncomfortable questions. Yes, patient care always comes first, and I certainly don’t advocate a ‘me first’ mentality in the job interview process. However, although being a physician is a calling, it is also a job, and money and lifestyle do matter, not only for your own job satisfaction, but for that of your family. If there are things that are matter to you, such as how many weeks of vacation the partners get, how often you get to eat lunch, or how often you get called in on call, ask these questions. Hopefully, groups are upfront with you with answers, because it’s also in their best interest to recruit someone who will be happy within the framework of their group. If there are certain topics they are avoiding talking about, keep your antenna up and dig deeper. 2. Negotiate. Newsflash: groups expect you to negotiate, and almost always have some wiggle room built into their initial offer. I don’t care how competitive the job market is, if it’s academic or private, or how lucky you feel that they are even talking to you. As long as you do so tactfully, nobody is going to deny you a job for negotiating. This applies to salary, benefits, days off, protected academic time, restrictive covenants, malpractice tails, you name it. The worst they can say is no. If they’ve made you an offer, they’ve already made a decision that they like you, and you should feel comfortable asking. Before you do so, do your research and try and find out what others in the group have been able to negotiate. That will give you more power at the bargaining table, as well as alert you to things that you may have thought were non negotiable. Once you’ve agreed to something, you’ll have a hard time dropping it later, so have the conversations before you sign on the dotted line. 3. Network. The more people you know, the more you’ll hear through the grapevine. Although job boards and MGMA numbers are out there, the best jobs are often the ones that aren’t advertised, and survey numbers don’t do a great job of breaking down salaries by what job requirements are. Posting a job on a board or through a recruiter typically costs money, and groups are understandably more comfortable getting somebody who is a known entity. Finding a job through a contact gives added security on both sides. Even after you’ve taken a job, it’s a great idea to keep up with your connections. It will allow you to keep a pulse on the rest of the market, hear about what steps groups are taking, and what solutions they’ve come up with to problems you may be having. 4. Have a lawyer experienced in physician contracts review your contract. It’s amazing how many people do not have their contracts reviewed since they trust the people offering them the job. Many of those people regret it later. These lawyers have seen the problems caused by exclusions/inclusions in people’s contracts and will alert you to any red flags. Don’t fall under the, ‘well, this is the standard contract’ trap – group contracts are obviously set up to protect the employer and you should do the same for yourself. 5. Know your deal breakers and don’t be afraid to say ‘no’ or ask for additional compensation. This is the one I want to emphasize the most. Before and after contract negotiations, it is always in your employers best interest to get the most out of you, both financially and in workload. I think about it like this: when you call someone to your house for some work you need done, they aren’t shy about billing by the hour or even just to provide a quote. A lawyer isn’t timid about charging an hourly rate just to take a phone call. Why don’t physicians value their time more? We’ve put in a ton of time in training, and yet so much of what we do is uncompensated. Yes, there are things we do out of personal interest, such as teach residents or sit on professional committees, but there are typically a lot of responsibilities added to our plate that weren’t part of our original contract agreements. I’m not saying to say no to them all – but if there’s something that you know will make you unhappy or be a huge time sink, don’t take it on. At the very least, don’t take it on without asking what you get in return. If you flip the situation around and you were asking for more from your employer, I’m fairly certain there would be pushback on that end. If there is something that will actively make you unhappy on a regular basis, such as increasing the number of patients you have to see in a day or having to supervise a midlevel provider without any additional compensation, be willing to walk away from an existing job or wait for a better job in the job search. Of course, it’s important to keep in mind that you’ll ideally be working with your employer/colleagues for a long time, and this is not a confrontation. Good working relationships require some give and take, and there are some battles that are not worth fighting. But please, put some thought into figuring out which ones are, and in those cases, don’t be afraid to do it. Believe in your value and your skillset. If you don’t ask, you can be sure that you won’t get it. Any other negotiating tips physicians should know? Comment below!]]>

Read More

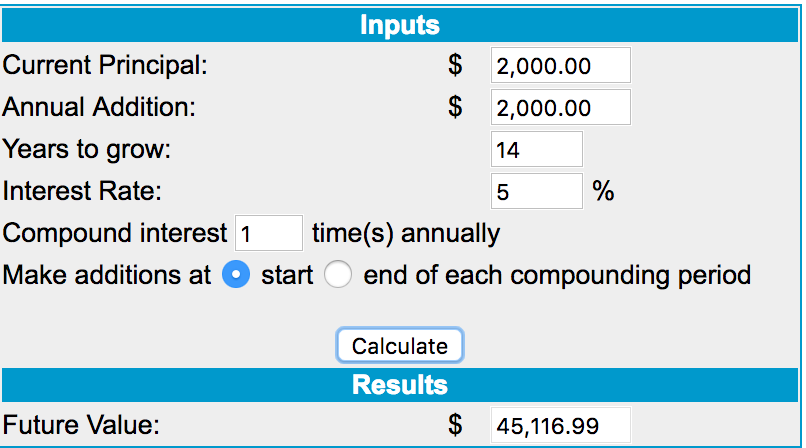

You likely already know that 529 plans allow you to save and invest money tax-free for college. Some states also give you a tax break incentive to contribute. But you may not be familiar with the Coverdell ESA.

What is an ESA?

The ESA is similar to the 529 plan in that you contribute after-tax money. It also grows tax free and is tax free on withdrawal if used for qualified educational expenses. Unlike the 529 account, you can purchase a computer with an ESA.

There are a few other key differences:

- There is no federal or state tax deduction for contributing to one

- The annual contribution limit is $2,000

- The ESA can be used for private school (pre-college) and college and graduate school

- There is a income limit to contribute to one: $110,000 single or $220,000 if filing a joint return*

The main reason to open is if you plan to send your kid(s) to private school. $2,000 a year does not sound like much. but if you start early and let compound interest do its magic,you might be surprised:

By the time your kiddo enters high school, you'll have a decent amount saved (depending on where you are – this may pay for 1 year of private high school in NYC …).

What about the income limit? There is a backdoor way of course. You won't be able to open one up yourself but your kiddo can!

How to do a Backdoor ESA to Save for Private School

You gift the money to your child usually through a UTMA account. The $2,000 counts towards the annual gift tax limits, so keep that in mind when you're also funding a 529.

In any given year, the beneficiary can only receive $2,000 a year towards an ESA. So unfortunately, Grandma can't open one for your kiddo and contribute an additional $2,000 annually.

Also, the money must be used by the time the beneficiary turns age 30. A tip is that the money can be rolled over to another beneficiary within the same family. So if you wanted more money for your kiddo over the $2,000 annual limit, you could fund another family member's ESA (they must younger than 30) and then roll it over in the future.

Where should you open a Coverdell ESA? As with any investment account, you want to minimize account and trade fees and have flexibility with how to invest the money.

At this time, I recommend etrade and TDA for no account fees and low to no cost trade fees to help you start to save for private school.

Final Thoughts on How to Save for Private School and Beyond

Using a combination of a 529 savings plan and a Coverdell ESA can help make the costs of private school, college, and beyond a bit more manageable. While it might not seem like enough, the earlier you start, the better. In fact, you can even open a 529 before your child is born. By taking the first step outlined here on the Backdoor Coverdell ESA, you can let compounding help you save for private school starting today!

Do you have an ESA? Comment below!]]>

Read MoreWelcome to another installment of Interviews with Real Female Physicians. The goal of this series is to share their story so that you, the reader, may learn and be inspired from their experiences – good and bad. We all come from different backgrounds and have different situations. Some of you are married, some are not, some with kids, some with blended families. Let’s show other women that any of these can work financially! So let's introduce our next woman physician rockstar – Laura.

Tell us about yourself:

I am a board-certified dermatologist practicing in Dallas, TX. I married my hubby (also an MD, same age) in 2008. We have 2 kids and a dog (our best behaved child…). I love running, reading, and travel. I live in urban Dallas, TX. My commute is 3 miles from my office, takes about 10 min door to door (not bad). I love where I live and work and feel grateful every single day. I have never lost sight of the fact that it is a rare privilege to become a doctor and even rarer to become a dermatologist. I feel very blessed. I teach medical students and residents and love sharing my knowledge with the next generation of dermatologists. I am a volunteer faculty member since 2009 and have lectured at national meetings since I graduated residency. I have always felt strongly about giving back to my field and advancing the specialty.Did you graduate with student loans?

I graduated with $110k in student debt from medical school. I did not have any debt from college because I had a large academic scholarship to a big public university and worked part time during college. The interest rate on the $110k was 1.6%. Yes, you are reading that number correctly. I paid it off in 1 year by continuing to live frugally after I graduated residency. My hubby went to private college and medical school in NY. He graduated with $280k worth of debt from undergraduate and graduate education. His loans were recently all paid off! His interest rate was around 2.8%. We have been finished with residency since 2009, so it took 8 years.Financial aspects of kids

When did you have them?

I had 2 kids after I finished residency. We utilize two 529 plans to fund their college education by 70%. The remainder we have set up in a brokerage account to fully fund the rest of their education. We had concerns about over funding if they decide on a Texas state school and didn’t want to face heavy penalties for withdrawing and not using the funds for education.What are your child care expenses?

We have a nanny who we pay $800 per week. She has been with us for the past 5 years. We plan to keep her until my oldest starts driving. She arrives early every day so my husband and I can get ready for work. She works approximately 40-45 hours per week. My husband is a partner in his group and takes a lot of call. I work 4 days per week. It is priceless knowing that she is there looking after them even when we aren’t there. We never considered day care because of our hectic and sometimes unpredictable schedules. My nanny is quite flexible and if I have to stay late because of patient care issues, she has no problems working late. My parents and my husband’s parents do not live close by.Are your kids in private or public school?

My children are both in a private pre-K and kindergarten. Cost for my youngest is $12,000 per year. Cost for the older is $17,000 per year.Financial aspects of marriage

Are you married?

I am married to my husband legally, with no prenuptial agreement. He and I were both dirt poor residents living paycheck to paycheck when we met. It was quite an amazing experience to travel the long road that we both have been through together. When I met him, he had a beat up Ford Taurus, with no mirrors and no air conditioning. We rolled down the windows back then. The car would bottom out when we went over a bump in the road and we were too poor to fix it. We have a joint account and separate accounts too. We are very open about finances and think almost exactly alike when it comes to finances. We meet with our financial advisor once a quarter and discuss the future openly. My husband was the breadwinner for the first 7 years of our marriage. Now – I am the breadwinner! Feels good. [caption id="attachment_1494" align="aligncenter" width="640"] Dallas skyline[/caption]

Dallas skyline[/caption]

General Finances

My financial priorities are: children's education, charity, paying off all debts, and living below our means. We use a financial advisor through Ameriprise. He charges 1% AUM (not including the 529s and variable universal life insurance policies x 2). He has been great. He has assisted with asset protection, wills, advance directives, and was very helpful in dealing with my personal accountant and practice accountants on various issues. We meet with him quarterly in person or via webinar.What is your net worth?

Our net worth: $2.6 million. This includes the $200k we have in VUL policies and equity in our home. We hope to keep saving and leave a legacy for our children.How are you saving for FI/retirement?

We max out our 401k(s)/profit sharing x 2. We are in a moderate aggressive portfolio with Ameriprise. We also have a joint brokerage that we contribute each month to ($5k per month per person). We have and max out a health savings account. We do $700 per month per child to the 529 plans. We superfund our VUL policy ($3500 per month per person). Anything in excess goes to paying off our mortgage. Our cars are paid off. Our home will be paid off in 2 years (by age 40), or shortly thereafter. We live in a modest, older home. Our mortgage is very affordable. We do not live beyond our means. We do not like debt or believe in having a lot of debt. I clip coupons and use the Target app. I shop sales.Do you have insurance?

We have two variable universal life insurance policies at 2 million each. We have disability insurance and business overhead insurance (for my practice). We have a 4 million umbrella policy through IDS Property Casualty Company. We have car insurance, homeowner’s insurance, also through IDS.What does FI/retirement mean to you?

Retirement to me means cutting back to 3 days per week…but I actually love what I do and could see myself working for many, many years. My husband and I would like to do mission work or healthcare work in underserved countries when our children are older (in college). We figure they always need doctors in underserved, impoverished countries. We would love to travel and help others with our skill set. God willing, I hope I stay healthy and be able to work for a long time!Do you give to charity?

Every year, we give to the Catholic church ($40,000+), Crohn's and Colitis society ($2,000-5,000), and this year plan to donate to the ASDS (American Society for Dermatologic Surgery) – looking to do a large donation.And … that's a wrap! If you're interested in doing this please send me an email – I'd love to hear from you!

Laura and her husband are on track for financial freedom. Note the common themes in this series on living below your means to achieve this.]]> Read More

In Part 1, I discussed things you should consider prior to becoming pregnant. Here is the rest.

You're Pregnant!

Congratulations! Don't panic. The good news is you have about 9 months to plan!

1. Get insurances NOW if you haven’t already for the above reasons. You may get a pregnancy exclusion but just get it and you can re-apply and get more later. Find out your OOP expenses for your health insurance if you have not already as well.

2. You'll need a basic will in place to name the guardian of your child should you pass and notify the guardians you choose. This often becomes a non-urgent to-do item after the baby is born unfortunately.

3. Retirement plans at work: If you’re taking unpaid leave or any leave, you’ll want to frontload your 403(b)/401(k)/457(b) so they are maxed out before you deliver. I recommend you frontload these accounts at least 2 months prior to your expected delivery date in case of a preterm delivery. Although this won't be a deal breaker, you'll also want to find out if and how frontloading affects employer matching if you get any.

4. If you haven't already, find out what steps need to be taken to take your maternity leave:

- First, you'll need to decide how many weeks you want to take off. This is a highly personal decision. I've yet to meet a woman who said they took too much time off.

- Depending on your employer, you may get completely unpaid leave or a combination of paid and unpaid leave. You may be responsible for paying your benefits during unpaid leave.

- If you can use your vacation days towards paid leave, hoard them!

- Finally, tell your boss or administrator so everyone at work can start planning for your leave and coverage gaps.

5. Think about childcare options. It comes down to daycare vs. nanny vs. stay at home partner.

- Daycare and nanny costs vary significantly based on location.

- In some cities (ahem, NYC), there can be up to a 1 year waiting list for young infants. I'm not sure how this works since no one can actually predict when they can become pregnant.

- I recommend you pay a nanny on the books. Not only is it illegal not to, but you open yourself up to a ton of liability by not doing so.

6. Think about whose medical insurance the newborn will go under – you or your partner. It may just end being the one where the pediatrician is in-network and convenient for you.

7. Start drawing up a list of things you'll need to buy for the baby:

- Distinguish between needs vs. wants. I recommend making 3 lists: need, really want, want. Keep in mind the need list is shorter than you think! There are fortunately or unfortunately tons of items to fit any budget. I recommend using the book Baby Bargains and the website Lucie's List to hone in on the items.

- Whether you end up having a baby shower or not, I would still create a registry. Close friends and family will ask and they will want to buy you a gift. You might as well receive items that you want! I used Baby List for my registry.

- Remember, you don't need a ton of stuff when the baby actually arrives. I recommend a wait and see approach to avoid a shopping craze.

- Don't forget that you'll need some stuff too! Maternity clothing, postpartum supplies, nursing clothing and nursing equipment. At this time, breast pumps are required to be covered by your insurance.

8. Start saving for stuff (above) and for unpaid leave if applicable. This is a good time to curb your regular spending to get ready for the baby and all the expenses that come with it. Remember, you'll need to save for monthly expenses, not total income replacement. I hope you are living below if not well below your means so it should not be as much as it sounds.

9. This is not a financial tip (well sort of), but I highly recommend that you and your partner take a babymoon. A great time to do this is in the beginning of your second trimester. The nausea and unrelenting fatigue of the first trimester are over and you are not inhibited by your growing belly yet. Your lives will never be the same (for the better!). Do not forget the primary relationship (your partner). I also recommend you plan and budget for weekly date nights sans baby.

10. Outsourcing. While you're probably a type A, can do-it-all mom-to-be, the reality is it gets harder to do this as your pregnancy progresses. Don't be afraid to start outsourcing things like cleaning, laundry, and even cooking so you can get much needed rest prior to baby. You may also need to hire help with the baby if you don't have good support or family nearby. Remember, outsourcing will make you happier.

11. Find local mommy groups. Not only are they a source for used, unused and sometimes free baby items, but they are a source of support during this exciting and sometimes anxiety-provoking time. Consider joining Physician Moms Group (PMG) on Facebook. There are also local PMG groups as well. Remember, at the end of day, you will figure out how make it work!

Thousands of physician moms already have! What I have done/am doing:

- My second life insurance policy went into effect just weeks before I became pregnant. I may have gestational diabetes (as of writing this blog post I failed the 1 hour glucose challenge). Boy am I glad I had my policies in place!

- My insurance paid for 6 pairs of compression stockings – highly recommend you get some! 20-30 mmHG is recommended. I got Sigvaris Eversheer calf-high socks.

- M and I took a babymoon to Paris when I was 20 weeks pregnant. We used credit card points for flights and hotel so we only had to pay for meals, local transport and shopping.

- I am the breadwinning partner. I am taking

1216 weeks of leave. I am fortunate that at least 8 weeks will be paid. I‘ll have up to 4 unpaid weeks of leave. We live below our means so the unpaid portion is totally manageable. I am also thinking about taking an additional 4 weeks to work part-time before going back full time. Again, living below our means gives us this option. - I am on a waiting list for daycare (yes they told me 1 year…). The daycare is

$2600a month. We are still considering a nanny while the baby is very young as well. - I have started outsourcing a few things and do not regret it!

Recommended books:

|

|

|---|

Editor's note: Stephanie has recorded a podcast over at the Hippocratic Hustle Podcast and speaks about Disability Insurance. Incredibly informative!

For those readers not familiar with your story, tell us how you went from being a practicing OBGYN to an insurance broker:

I was a practicing OB/GYN in a community hospital, and my patient was a lovely woman. But my patient was also well into labor, in extreme pain, and not acting like her everyday self. I had to enlist a team of four nurses to help me calm her down to ensure a safe delivery. When the baby’s heart rate fell, the situation became emergent. I reached in for the infant — and the panicked mom kicked me in my shoulder, twice. For seven months, I continued to work with a torn labrum, my pain increasing as my range of motion decreased. Despite diagnostic tests, physical exams and injections, my condition developed into adhesive capsulitis, or frozen shoulder. I had always prided myself on my physical and emotional strength and dexterity. Now, surgical equipment became too difficult to maneuver. Deliveries became too painful to bear. I had to stop practicing, and undergo surgery. To put it mildly, the procedure was not as successful as I’d hoped. The limited mobility I regained wasn’t enough for me to continue my profession as I knew it, and I soon came to realize my immediate future would not include operating or delivering babies. The career I’d worked so long and so hard on was slipping through my hands. I was devastated, heartbroken. I was also unprepared for the next hurdle. Unbeknownst to me, workman’s compensation and my hospital-provided physician disability insurance, the safety nets I’d taken for granted as a resident and attending, did not automatically go into effect to give me the stability I’d assumed they would. Insult added to injury when I, a mother of two and my family’s primary breadwinner, suddenly faced a terrifying new financial reality: My newfound disability meant my family could lose my income. Eventually, I had to go to court to fight for, and eventually receive, the benefits I knew were rightly mine. As I went through this struggle, I found myself answering more and more questions from colleagues who, like me, assumed they were protected by their hospital- or practice-provided disability insurance policies. My physician friends now saw that they, too, could become injured or ill, and they wanted to make sure what happened to me wouldn’t happen to them. I was happy to help other attendings and residents go through their policies’ fine print, ask the right questions, and direct them toward the coverage they needed. After all, healthcare providers are my people. Of course I’d help them out. That’s when a friend in the insurance business stepped up and suggested I turn this newfound expertise of mine into a new career. At first, I balked. I was a physician: I didn’t want to give that up.

But then, I realized that being a physician put me in a unique position: I knew medicine. I knew hospitals and medical practices. Now I know disability insurance for physicians and nurses, and could speak as a doctor to other doctors and healthcare providers to help them secure their careers.

My experiences, knowledge and background could serve to connect my peers with solid, reliable and affordable disability coverage, so they would never have to endure what I did. That’s where I am today. I’m still an OB/GYN. But I’m also a hands-on advocate for physicians. We take care of others. We absolutely must take care of ourselves. My mission? Empower and educate my friends in healthcare about disability insurance.

Do you miss practicing clinical medicine?

Absolutely! I still get upset on Fridays, which was my OR day. I miss celebrating the best days of people’s lives. I miss the relationships that I had with my patients. Helping girls and women understand their health and make educated decisions about their healthcare meant so much. I have kept up with my licensing and MOC to stay current in my knowledge, and still feel like I am a valuable knowledge source for women’s health.

Besides disability insurance, do you sell other insurances?

I do. I currently sell disability, life, and business overhead insurance. I believe that when I am helping physicians obtain disability insurance, making sure that their life insurance needs are also met, is very important. Many private practice owners are not even aware of business overhead insurance. What happens to your practice if you can not work? How are the lease, employees salaries, etc. going to get paid? Will you close the doors, hire a locums or replacement? Business overhead protects you for these circumstances.

How do you differ from other brokers?

My intimate knowledge of what it means to be a physician makes me different. I lived it. I am now living the life of a disabled physician. I am emotionally involved in this process. I understand from a medical perspective what the insurance carriers are looking for from an underwriting point of view. I can advocate for my clients in a way that most traditional agents/brokers are unable to do. I am coming from a unique place when I explain the different policy options. I care most about education. I want people to really understand the language, the nuances, and the differences between carriers. I am not happy unless I know that people are making truly educated decisions.

Any advice on how to choose a broker? What makes someone a good broker?

I think that you have to trust your gut. You need to feel confident in your choice; feel comfortable asking questions and receiving feedback. I believe that a good broker will offer you options, and explain them in detail. He/she should compare apples to apples and apples to oranges. You should not feel like there is any bias in what you are being told.

What are 3 things you see that physicians don’t understand about disability insurance?

1. What they have and don’t have from their employers. It is important to review the master copy of the policy. Is their salary or complete income covered? How long is it own occupation? What is the definition of disability? 2. Whether or not their benefits are taxable or non-taxable. Most group benefits are paid for by employers, and are therefore taxable income. However, if the employee contributes to the plan, it is a tax free benefit. That affects how much benefit he/she can qualify for with a private DI policy. Private benefits are a tax free benefit. 3. The different definitions of total disability. There are multiple definitions:

- The basic definition/modified own occupation – You are totally disabled if you can not perform your job, AND you are not gainfully employed.

- True own occupation/Regular occupation – You are totally disabled if you can not perform your job, REGARDLESS if you are gainfully employed in another occupation.

- Transitional occupation – You are totally disabled if you can not perform your job, regardless if you are gainfully employed in another occupation, until your income is that of your pre-disability earnings. There is a cap to how much you can earn. In CA, there are certain occupational classes that can not get true own occ with certain carriers. Several carriers will remove own occupation of they lower the benefit period, but will give the transitional definition.

You need to know what the definition is that you are purchasing!

What are 3 mistakes you see physicians make regarding disability insurance?

1. Waiting too long to purchase. I know how hard it is during training to conceive of paying for one more thing. However, it is the best time to purchase. You are the youngest you will ever be. You might qualify for a discounted rate that you will carry with you for the entirety of your career. You do not need to purchase the whole package- just get your foot in the door, and guarantee your future insurability. 2. Having colleagues write prescriptions. This is coming up a lot. There needs to be records; a paper trail. I understand professional courtesy, but the underwriters and companies do not see it that way. It is highly frowned upon, and is causing physicians to lose valuable insurance options. 3. Women not purchasing before they start family planning. The carriers will deny pregnancy coverage for all sorts of things. As an OBGYN, this is something I argue a lot! Miscarriages, infertility treatments, cesarean sections, etc .are all reasons for exclusion of pregnancy.

Anything else you would like to tell us?

Since entering this space, I have been able to help so many physicians (and non-physicians) obtain quality tailored policies. As trite as it may sound, I am really trying to clean up an industry that I believe has a long history of taking advantage of physicians. I hope you enjoyed learning a bit more about Stephanie!

Read MoreEarlier this year I announced my pregnancy and listed a few financial considerations along with it. Now that I am in the final stretch I thought I'd put together a financial checklist for those who are planning to have kids and for those who are currently pregnant! A few things that are unique to us physician women:

- Most of us won't become stay at home moms so will need to pay for high quality childcare or have a stay at home spouse/partner.

- Many of us do not get paid leave. This will definitely affect inflow and one must plan accordingly.

- Many of us are the breadwinning partner.

Ideally, certain things should be in place prior to becoming pregnant. So even if you're single and young I recommend you get some term life insurance now and disability insurance. You'll never be as young and healthy as now. Unfortunately, certain normal aspects of pregnancy such as a c-section, miscarriages and IVF are counted against you. Gestational diabetes, preeclampsia and postpartum hemorrhage can also ding you a few health classes as well.

As you know, there is never a right time to have kids but financially, the best time to have kids is as a medical student or resident. Why? You don't make much if at all so the income loss, if any, is minimal. Childcare can obviously be an issue financially in these lower income years. As an attending, every week you're not getting paid hurts that much more.

As an attending, you'll need to accept the fact that you will likely make less during pregnancy, during your leave, and even after your leave. This is due to how practices usually pay you and adjust your pay for time not seeing patients. Brace for impact.

As an attending, you'll need to accept the fact that you will likely make less during pregnancy, during your leave, and even after your leave. Click To TweetThings to think about before your first attempted pregnancy:

1. Before you sign that first attending job contract find out what happens when you take leave:

- Find out if you get any paid leave. Large hospital employers tend to have paid maternity leave by using a short term disability plan. Find out the terms of this. If you are pregnant prior to starting the job, you may not be eligible. You may also need to work there a certain amount of time prior to being eligible.

- Find out how taking leave affects your salary (if you need to make up a deficit for example) and find out how it will affect your bonus structure. Some employers will adjust target RVUs/collections and some don't – meaning you'll have to make up a sizeable deficit before you bonus again. There is a huge difference! I always recommend having a lawyer review your contract and definitely ask about this.

2. If you live in California, Rhode Island, and New Jersey, or New York (as of Jan 1, 2018), you may be eligible for state sponsored paid maternity leave. It won't replace your physician salary but it is definitely helpful!

3. Family Medical Leave Act (FMLA) – this federal law provides guaranteed job protection for 12 weeks (unpaid) to take care of your newborn. The 12 weeks can be taking at any time within 12 months of having your baby. To be eligible – you need to work for an employer with at least 50 employees and have worked there for at least 1 year. So this does not apply to small private practices.

4. As I mentioned above – get your term life insurance and disability insurances in order before your first attempted pregnancy. Otherwise, you may get a pregnancy exclusion, or worse, you develop gestational diabetes and your premiums double or more. Your partner should also get these insurances in order as well.

5. Health insurance – find out what your total OOP costs will be. This can range from $0 to several thousand. Definitely keep this in mind when looking at your medical insurance options. This is also another reason having children during residency is often cheaper – you work for a large hospital that often has great medical benefits for trainees. 6. Start hoarding vacation days to use towards paid leave if applicable.

Here is Part 2.

Recommended books:

|

|

|---|

Welcome to another installment of Interviews with Real Female Physicians. The goal of this series is to share their story so that you, the reader, may learn and be inspired from their experiences – good and bad. We all come from different backgrounds and have different situations. Some of you are married, some are not, some with kids, some with blended families. Let’s show other women that any of these can work financially! So let's introduce our next woman physician rockstar – Clarissa.

Tell us about yourself:

I am an Internal Medicine trained Hospitalist, mom of 2 preteens and married to my husband for over 10 years. I have been an attending for almost 12 years. I grew up in the South and have chosen to live there as well. I love to read and am finally in a place where time and finances are allowing a healthy travel life. I have always been on the frugal side and have managed to build some wealth this way but have really kicked it in gear this year (partly inspired by Doc Moms Finance Group on Facebook) to really make my money work for me and build wealth more quickly. In the past year, I've cut down on the shifts I have worked but have still been able to save more than I previously had by making smarter and more deliberate choices. I think was born to be an internist and have no qualms about the specialty I picked. I do like the flexibility of hospitalist work in that I can have some very intense periods of patient care and then be completely off. Its taken me awhile to find the right balance but I feel that I have found it in the past year. Having a spouse (or family or hired help) that can really dive in with the child care and housework is really a must for the hospitalist career to work for me. It does involve several weekends, holidays and evenings. I love the flexibility Internal Medicine gives to women even if you don't specialize. You have the most leverage if you can be per diem and don't depend on benefits. The hourly rate for hospitalist is very good and now that I found a schedule that works for me I have no regrets. I often tell medical students to pick a career where they feel the quality of their work and commitment while they are at work won't suffer if they plan to have kids. Although I work less, I am totally committed to my patients when I am in the hospital (this is the reason I picked a shift work type career). I live in a big city in the south. The cost of living is rising but much better than East coast or West coast and the lack of state income tax helps in reducing costs. I don't think I could work as little as I do if I was in a different HCOL area.Did you graduate with student loans?

I was very lucky in that my parents valued education above all else and my education was paid for. I went to a private undergraduate university but finished in 3 years with AP credit. I chose to go to a public state school which helped tremendously too (about 10K a year) . Because I had a certain amount budgeted for living expenses a year, I was careful with that money and often spent less than my colleagues that had loans because I was very debt averse. Knowing the advantage that no student loans gave me, one of my financial goals is to at least pay for the undergraduate education for my children.Financial aspects of kids

I had my first child as I was finishing my residency and my second 2 years after that. In some ways I would have liked to have more but circumstances had us stop at 2 . I also wasn't sure it would be feasible to fund the education of 3 children with my salary. Early on, we had a nanny which was a lifesaver for us. It probably cost us about $2000-2500 a month but the cost was much more reasonable than what I see people paying now. We did this for about 3-4 years. When we moved to our current city, our top priority was to be a great public school zone and we have managed to keep them in public school. This has been one of the number one ways that we have managed to build wealth. If it was the choice between a bad education and paying the cost, I would definitely pay but putting everything in place for them go to great public schools has paid off very well. On a side note, I think the pressure of lifestyle creep is less in the public school crowd (although can still be there if you live in an expensive area). As mentioned before, our intent is to pay for undergraduate education in full for both of our kids.Financial aspects of marriage

I have been married for almost 14 years. My husband and I married at the start of each of our careers. We didn't get a prenuptial agreement because we started out without any significant assets or previous children (first marriage for both). We are both similar in our philosophies– stay away from debt, live below our means and try to give generously when able. I handle 95 % of the finances because I enjoy it and it comes more naturally to me. Also as the primary breadwinner, I am more aware of what is coming in and going out. A few years ago, my husband made the decision to be a SAHD. He was unhappy with his work. Overall (after taxes, child care, etc) it didn't make a significant impact on our finances for him to stay. In general, he enjoys it and ideally, now that our kids are older, he would like some flexible contract work but it enhances both our quality of lives (and our kids) for him to be mainly a SAHD. There is less of a logistical headache with pick ups and summers and we can travel more with my flexible schedule. It definitely can be socially isolating for a man to be a SAHD but I think as more men choose this path, there will be more of a community and more get togethers. It can be emotionally hard to bear the burden of all the family's income but in the end I think the tradeoff is worth it for us. I think the only way it works is if both partners agree that it is the best arrangement.

Have you experienced a financial catastrophe?

My biggest mistake/catastrophe is that I should have signed up for disability insurance early in my career (like right out of residency) before I had any dings in my medical history. Even the most minor things can get you “blacklisted.” Luckily, I have a good policy through my employer but am limited in my job choices until I can become financially independent by my ability to get disability.General Finances

Who handles the finances in your relationship? Are you DIY or do you have a financial advisor?

I handle the finances in our relationship. We have met with advisors a couple of times in the past 5 years and adjusted our big picture accordingly (made sure we had wills, enough life insurance, started a taxable brokerage account) but I do the day to day stuff. Our invested money currently is either in targeted funds for retirement or college or in the Bogleheads portfolio. I keep it super simple.What is your net worth?

Our net worth at this point without 529s is about $850K, this includes equity in our home.How are you saving for FI/retirement?

For retirement, I have contributed max amounts to 403(b) for the past 10 years and get a fairly good match. I am just now wading into my hospital's 457(b) and a taxable brokerage account to augment. I will also be more diligent about yearly Backdoor Roth and spousal Roth IRAs. My 403(b) and Roth IRA is invested in a target fund. My taxable brokerage account is in a Bogleheads-type portfolio (40% bonds, 12% international and 48% total stock market) – it's more conservative because we may use it for short term issues as well . I rebalance the retirement accounts quarterly.One thing you wish you knew:

I waited a year before I started contributing to retirement during my first job and didn't contribute at all during residency so I missed out on free money with employer match that year. I also didn't invest in a Roth IRA like I should have. Other things I wish I had done is just taken a few hours to learn more about investments and expense ratios. We had money from previous jobs just sitting there doing nothing until we consolidated them all and put them in low fee accounts.Do you have insurance?

Long term disability is through my work and I bought a small supplemental policy when I left my job which is not great but is better than nothing. As of now, I thankfully have never had to use my policy.What does FI/retirement mean to you? What does it look like?

Financial independence to me means only working if I want to. I don't have a specific age but hope to get there at about age 55.Do you give to charity? If so, where and why?

We try to give at least $15-20K a year to charity – split between my church, fundraisers for reputable organizations my friends are involved in, Compassion International, kids' school and International Justice Mission. The reasons we give are multifold but from a religious perspective, we are called to tithe. Also, i feel that “to whom much has been given, much is expected.”Any parting words of wisdom?

It's been a great year of organization and growth for me in the past year (thanks to the invigorating and encouraging community of Doc Moms Financial Group). My top pieces of advice are: Get started early It's easy to let the details overwhelm you. In retrospect, I wish I had started putting money consistently away even if they weren't perfect investments (by this I mean, even just 1 moderately well performing index fund would have been better than letting money languish). Don't let perfect be the enemy of the good. Take the time and effort (not as much as you think) to consolidate accounts It really doesn't take that much time to consolidate accounts and it gives you a lot more insight/wisdom. This year, my husband consolidated all of his accounts into a new Roth IRA. I consolidated my Profit sharing accounts and 401(k)/403(b)s into either Vanguard or my current employer's 403(b). I think this was about 5 different accounts. The people on the receiving end are very helpful. We lost a lot of virtual gains by letting money sit in accounts that were not well invested and charged high fees. Live below your means We are overall pretty good about this but there is always room for improvement. Ignore what people around you are buying and doing. If you looked at my coworkers who have the most enviable lives, they are also the ones with the lowest net worth. It's not worth it. If you can control your costs, it gives you so much flexibility in how much you work, where you can travel, etc. Bargains aren't bargains if you don't need them I have been totally guilty of buying too much off the clearance rack. As a result, I give a lot of clothes away that still have tags on them. I am trying to embrace a more minimalistic mindset. The savings in cost and clutter are amazing. I highly recommend Joshua Becker's “Becoming Minimalist ” blog and Facebook page.And … that's a wrap! If you're interested in doing this please send me an email – I'd love to hear from you!

I loved reading Clarissa's story and I hope you did too. She's a pretty wise lady.]]> Read MoreYour top (financial) priority is your nuclear family.

I cannot overemphasize this enough. Please do not jeopardize the financial health of your nuclear family (your spouse + kids) or else you'll be that parent asking your kids for money. It's cyclic, so breaking that cycle by prioritizing your family's financial health is the first step in ending that cycle. If you decide that you are willing and able to help those outside of your family, you have to get your affairs in order first. It's that airplane analogy of putting on your oxygen mask first.

If you and your spouse agree to help, set some guidelines and boundaries

One of the terms and conditions should be complete transparency into their finances. You should be able to see how they are spending their money . You should have access to their credit card statements, bank statements, and other financial documents. I strongly recommend not giving them cash. Pay for things directly. For example, pay the bank directly for their mortgage or have groceries delivered. Helping financially irresponsible parents can wreak havoc on a marriage. This is definitely a topic to discuss with your partner before getting engaged. Remember – you made a vow with your spouse, not your parents.

Do not enable financially ill-prepared parents

It is very important that you do NOT give them straight cash or enable any poor financial behavior. It is akin to giving cash to a drug addict–they will just buy more drugs. In the case of your parents, getting cash from you will only help them in the short term. Eventually, they will run out and make their next financial mistake. This is the concept of economic outpatient care discussed in the Millionaire Next Door. Basically, when people get money freely, they often do not spend it wisely. Ironically, it's the folks that don't get money so easily that often do better in life. This situation can easily be reversed–having adult children who are fiscally irresponsible. All the more reason to start their financial education early.

You may be able to get a tax break by supporting your parents

Your parent does not have to live with you to be claimed as your dependent. Generally, if your parent’s taxable income is less than his/her personal exemption ($4,050 in 2017) and you provide more than half of your parent’s support, you can claim your parent.

Other requirements are:

- Your parent must be a citizen of the U.S., Mexico, or Canada, and

- Your parent cannot file a joint income tax return unless s/he has no income

On the other hand, if your parent lives with you and you pay for adult day care services while you work, you may qualify for the Child and Dependent Care Credit of up to $600 per person. If your parent qualifies as your dependent, you can deduct expenses you pay for their medical expenses, also. But let’s not kid ourselves – if you are a doctor reading this article, it’s likely that you’re going to get very little deduction for your dependents or for any medical expenses you pay because you earn too much!

You may be legally required to support your parents

This may come as a surprise to you but there is something called Filial Law in 29 states. Traditionally not enforced, it may be on the rise due to rising costs of long term care. A landmark case in Pennsylvania in 2012 set the tone when a nursing home successfully sued a son for his mother's care after she fled the country. Some states impose criminal penalties, or as in the case above, financial penalties. All states require that the court find that the parent is indigent or unable to financially provide for his/her support. The two main defenses against filial law are your financial circumstances and if there is evidence of parental neglect, abuse, or abandonment. Different laws define these terms differently. This is a law that we should all keep our eye on as the cost of long term care rises. Unfortunately (fortunately?), most of my readers won't be considered financially incompetent. If there is any concern you may need to foot the bill for an aging parent, definitely let your financial adviser (FA) know so they can help build scenarios and a plan for this.

Your parent might be suffering from abuse, even though s/he’s perfectly healthy

According to Nolo.com, the fastest growing form of elder abuse is financial fraud. If the fact that your formerly financially-secure parent is running out of money seems “off”, it is possible that a scammer has become involved. Read this article. If you don’t live nearby, your parent’s FA might be the best source of information you can have. (Note – a FA or CPA must get permission to report to another family member if we believe the client is being scammed. Client information is confidential, even to family members. Some FAs include a clause in their agreements for clients to list who we can contact if we notice unusual withdrawals.) If you don’t see your parent(s) often, consider talking to them and their FA to see if you can get written permission to share information.

Final Thoughts on Helping Financially Ill-Prepared Parents

Lots of things to consider here! Again, this is a difficult and emotionally charged topic. Take your time and know the laws that may apply to you. You may want to consult with an attorney that specializes in elder law for help when dealing with financially ill-prepared parents. The following books may help:

|

|

|---|---|

(These are affiliate links and I get a commission, at no extra cost to you.)

Read MoreNY Times questions to answer before marriage. First, congratulations on meeting someone special. Feels great, doesn't it? Now, wouldn't you want to make sure you have the best possible chance of making it? Well, I'm no John Gottman and I can't predict the likelihood your marriage will succeed, but I do know that some pre-marital financial planning can go a long way to ensure a happy marriage.

Remember, marriage is a legal contract and you are uniting assets, not just families. That means that you need pre-marital financial planning. Yes, even if you're in love. Truly.

I suspect many people avoid this topic for a number of reasons. It's not “romantic.” Or it doesn't feel that way at first.

I actually think it is romantic to talk finances. You are establishing a deeper layer of trust that happens when you fully disclose finances to each other. By making financial goals together as a couple, you envision the future together.

Let's talk about something truly unromantic. Imagine being that woman or man who is ill-prepared to deal with the financial consequences if things go south. Being stuck in a marriage where one party is spending everything, leaving the other to salvage whatever money is left. Perhaps, it even comes down to one person hiding assets. That is truly unromantic.

I will not be discussing prenups (but if you need a refresher, click here!) in this post, but these discussions are the foundation of creating one.

Question 2 of the aforementioned NY Times Questions is the focus:

Do we have a clear idea of each other’s financial obligations and goals, and do our ideas about spending and saving mesh?

Let's break it down further:

1. Money history

What did money mean to you growing up?

If you don't know how your partner grew up financially, this is a good time to find out. For example – did they ever have to worry about whether there was enough money for dinner? What money lessons, if any did they learn growing up? This is also a good time to start learning about each other's parents' and other family member finances that can affect you. This will be further delved into below.

2. Income

How much do you earn? Is this job stable? What are you career goals?

3. Financial obligations: Liabilities and Debt

Do you have debt – how much and what kind? How do you feel about having debt (debt tolerance)? What is your credit score? Have you ever filed for bankruptcy? If one of you owns a business – find out if you/your partner can be personally liable if sued. What are the business' assets and liabilities? If this is a second marriage and/or if there are children from a previous marriage or relationship:

Do you pay alimony? How much is left?

Do you pay child support? How much? When does this obligation end?

What is your financial obligation for funding their college and more?

If there is an ex-wife/husband: Any concerns that s/he will ask for more financial support?

I strongly recommend reading their divorce decree and parenting agreement.

4. Assets

Do you own property? What retirement and other accounts do you have and what are the current balances? How much do you contribute to these accounts yearly? What is your net worth?

5. Spending

How do you decide to make a large purchase? Do you budget? Do you have credit card debt?

6. Goals

What are your financial goals and by when?

This is a good time to really find out if you and your partner have even thought about “retirement” goals, or as I prefer to call it reaching financial independence.

7. Practical matters going forward

How will we handle finances together? Joint and/or separate checking accounts? Over what amount should we discuss making a large purchase? Will we jointly own future purchases of homes and other investments? How are we going to handle pre-marital assets and liabilities? Will they be jointly shared or remain separate?

8. Finances of parents

Are our parents (insert siblings and other potential family members here) financially stable? Is there a possibility they may need our help in the future? How do we feel about that?

As if it wasn't enough to discuss each other's finances, you need to know what the financial state of their parents and siblings are. This is semi-addressed in question 11 of the NY Times questions:

Do we value and respect each other’s parents, and is either of us concerned about whether the parents will interfere with the relationship?

Financially ill-prepared parents and family members are common. Not being on the same page on this topic can wreck havoc on a marriage. It's tough to be prepared for this, but having a conversation in advance can help.

So, did my partner and I go through a checklist? Not this systematically, but, I did ask him most of the above questions before we got engaged. I am fully aware of his assets and liabilities. I have read his divorce decree and parenting agreement. We did all of this to make sure that our relationship is on the same financial page.

Continuing Your Pre-Martial Financial Planning

If you're a female breadwinner, I highly suggest this book. You can also work with different counselors or therapists. Some people think that having an outside perspective can keep the emotions at bay, allowing you to better focus on your goals and dreams. No matter how you proceed with your pre-marital financial planning, it is important to start conversations and ask questions now. You might not think it's romantic, but it's a great way to say how much you love your partner.

What do you think? Comment below. ]]>