Money

I am super excited to launch this series to the blog! The goal of this series is to share their story so that you, the reader, may learn and be inspired from their experiences – good and bad. We all come from different backgrounds and have different situations. Some of you are married, some are not, some with kids, some with blended families. Let’s show other women that any of these can work financially! So let's introduce our first female physician rockstar – Michelle.

Tell us about yourself:

I’m a 41 year old dual boarded family medicine physician and psychiatrist who is currently working full-time in administration in a community mental health position in Southern California. I am 9 years out of residency and my husband, a full time hospitalist, is 11 years out. We are raising our three young children (2, 5, 8) with considerable support from family, childcare and a housekeeper. I feel very lucky to have a stable and loving family unit since there was a time that my life was pretty chaotic. I had the unfortunate experience of getting married and divorced within a year during the first year of medical school. On the upside my ex and I shared no assets and no kids, so I was lucky to get a fresh start when I met my current husband “on the rebound” as they say. This time though I wanted to be really, really sure so we dated through medical school and residency before getting married. We started our family when I was just out of training at age 31. We soon found out that starting a family though with two overworked, somewhat old physicians isn’t always a romp in the sheets. We ended up needing IVF to conceive each of our three babies. The cost of IVF was staggering since it wasn’t covered by insurance. We learned early on in our attending careers that we were not going to be the stereotypical rich doctors. Between a combined total of $300K in student debt and baby-making costing $25K a pop, our finances were tighter than our incomes would suggest. We could have made the decision to move to a low cost area, but both my husband and I are committed to paying our sun tax to live in this beautiful city. To do so, we’ve had to embrace that budgeting and planning our finances is part of the deal. I’ve packaged our story here pretty neatly but there were many twists and turns to get us to where we are today. Having said that, I’m very happy with many of the life choices we made along the way. I’m a dual-trained FM/Psych physician and healthcare integration is all the rage these days. There have been many good career options for me and now I’m in a fairly well paying administrative position (for public sector work.) Although I’ve lost much of my idealism of my early years, most days I feel like I’m doing the best I can to contribute to my community and serve patients that are usually largely underserved.Did you graduate with student loans? How much & what are the interest rates?

I went to a private college on a partial athletic scholarship. The other half was fully supported by my parents. I had no debt out of college. I paid for a state medical school using loans and really wish I had been more mindful to take out less. i graduated with $130K in loans. I was one of the lucky ones to come out at the right time and consolidate to a 2.8% interest rate with T.H.E loans which were great to work with.How fast (or not) are you paying them off?

I chose a 30 year payment plan which in retrospect was ridiculous. I thought with interest rates so low I should do it that way and could always pay ahead. I wasn’t motivated to pay ahead until recently. On the upside working in the non-profit sector has afforded me many loan repayment opportunities. I’ve had 50K paid back tax free by State loan repayment and over the next 2 years will have another 15K paid back. I’ve stopped paying and just keep applying for loan repayment programs.Financial aspects of kids

When did you have them?

As I mentioned above we started having kids just after residency. I’ve done okay on my career trajectory however my maternity leaves have delayed raises and I lost out on advancement opportunities I really wanted. I was actually told by the COO (and she is female!) “We thought of you for that position, but then I figured with your young kids the timing wasn’t good.” I think she was trying to be thoughtful, but boy did that make me mad!Are you planning to fund their college expenses?

We have a Utah 529 plan for each of our three kids. We started funding them are early ages, but we really wish we would have started them even before they were born. We’d like to fully fund the equivalent of state tuition, but we are funding our retirement as the priority. We’re adding extra as we can to get to our goal.What are your child care expenses?

We spend a small fortune on childcare and extra help with everyday household upkeep. I’m possibly the least domestic person I know and I outsource everything I can. We have hired a woman who helps with the kids and the general household upkeep for 23 hours a week. I’m just a doctor and a mom. I definitely don’t keep house. I have arranged my life to dedicate my time to the roles I enjoy most. It costs an arm and a leg, but it is worthwhile so that I get the downtime I need. Our kids also go to daycare. I love the structure and consistency of the hours of daycare. I love that the kids have a social group and can make friends there.Are your kids in private or public school? What is the cost including after care if needed.

Our kids are in public school. We choose our home based on where there are good schools. The housing prices are higher but at least that money is invested in the house. I’ve never had a good sense that private school gave any real life advantages so I figure we’ll only consider private school if there is some special consideration along the way for one of our kids.Financial aspects of marriage

Are you married?

I joke around and say that my first marriage didn’t stick. It was over in a blink while my head was buried in my books while my ex-husband was off with one of his co-workers. I left the situation as fast as I could and just took a few belongings off to my own apartment on campus for $125 per month that my family paid for a few months, so I could sort it all out. That was the best decision of my life right there. I lost everything to gain everything I have now. I met my current husband in medical school – I've made a much better selection!Did you get a pre-nuptial or post-nuptial agreement?

We didn’t. We had no assets.

Do you and your husband agree on finances?

My husband and I were both raised in fairly affluent (upper-middle class) communities. However there was big difference in the way our parents talked about money. My husband's parents basically never wanted their kids to be worried about money and wanted their kids to know that they would always support them. My father-in-law lost his father at the age of 13 growing up in Iran and found himself fending for himself at a young age. Fortunately he was taken in by other family members, but the fear of poverty was something he never wanted his own kids to experience. My father by contrast, was very frugal and rarely spent money on extras though we knew we had money and lived in a nice area, with a nice house and good schools. I was told not to order a drink with dinner at restaurants since that was too expensive. I was told many times “We don’t have enough money for that.” So needless to say, my spending patterns are very different from my husband. It was never much of an issue because we both made good salaries and didn’t really understand or see that we weren’t saving for our future or the futures of our kids. It wasn’t until I sort of randomly fell upon our female physician finance Facebook group that I started learning how little I knew. We had been working with a fee-based Financial Advisor up until that point and not once had she pointed out that our spending patterns were awful and not once was she clear with us that we needed to save more than we were. Various members posted some links to the White Coat Investor and I’d have to say that was a pivotal moment in my financial life. At that time I ordered the book and really have been on a learning journey since. This is sort of where the rubber hit the road for my husband and I. Up until that point his spending didn’t worry me since I figured “We are doctors, we make good money, what’s to worry about.” I started learning about personal finance and then I started getting very concerned that my husband and I were not going to be able to retire until age 90 and our children would get little to no support for college. My husband wasn't very interested in personal finance and to this day he is not. We do have a very good relationship and he trusts my intelligence and general ability to navigate life. So when I started to explain that we were woefully behind in our retirement and college savings, he did believe me. The trouble is that he wasn’t very interested in changing his spending. So I started reading some articles about how to get your spouse on board with finances. I was able to get him to agree to once a month couples meeting about our finances. During the meeting I’d outline our finances and show him the various calculators showing where we needed to be. He started understanding that where we needed to make some changes. He still had no real interest in reading or doing our budget, etc. I asked him how did he think he could cut back his spending and he said “Well, when the money is gone I always stop.” Fortunately, he didn’t have an issue with credit card debt. So from this we came to the agreement that I’d manage our finances and that we’d get him a pre-paid debit card. We put a fixed amount of spending money on the card each month and when it is done he stops. All other family spending are driven by our budget which I created and maintain (shout out to the world’s best budget software YNAB!!) In 5 months time from starting YNAB and my husband’s debit card we were funding a lot more in our retirement accounts, contributing more to college accounts and our cash reserve has quadrupled. I think my husband secretly likes the security of knowing we are on track financially and that our kids will be well supported in college. [Wow! How inspiring is this!]If you are divorced – what have you learned financially from this, and what advice would you give to unmarried women planning to marry?

I learned that I was extremely lucky to have family support to get me out of a bad situation. My advice to all women married or not is never be in a situation where you don’t have your own access to emergency funds. I was a first year medical student living off of loans and had no emergency pot set aside for me to access.Are you the breadwinner?

No, we are equal financial partners.Have you experienced a financial catastrophe?

See my first marriage & divorce, above.

General Finances

What’s your FI (financial independence) number?

FI #: $4 million. My goal is to reduce our lifestyle consumption in hopes for the number to be lower. I want to live more simply but haven’t yet achieved that.Who handles the finances in your relationship? Are you DIY or do you have a financial advisor?

For years, I thought “handles the finances” meant who does the bills. And that answer would have been my husband. He still “does the bills” which these days means he sets up the accounts for automatic payments. These days though I understand finances so much better than I used to. I don’t manage the autopay as a part of doing the finances, but I can comfortably say that I do 90% of our financial planning. My husband does the taxes. We had a financial advisor for about 3 years and although I can credit her with introducing me ideas, I would have been way ahead of where I am now had I learned the information on my own or used a fee-only FA rather than a commission based FA that I used.What is your net worth?

Well, let me go peak at Personal Capital! If I take out my 529s, we have $500K not including equity in our home. The approximate the equity we have in our home minus the mortgage would probably be an additional $250K.How are you saving for FI/retirement?

My husband has a pension plan, 403(b) and 457(b). For years, we didn’t know that he wasn’t maximizing his space. When I looked last year and figured out that he wasn’t, we changed that to maximize the $36K (plus his pension contribution.) We are not yet funding Roth IRAs. We have his funds invested in a low fee target fund which is his lowest fee option. We make the allocation more aggressive by pushing out the retirement day. I currently have a pension plan, 401(a) and a 457(b). I am contributing $9K yearly to the pension, $41K into my 401(a). I’m not yet utilizing my 457(b) or funding a Roth IRA.One thing you wish you knew:

I wish someone would have told me that there are more bad FA than good ones. I really wish I would have found a good one from the start. I also wish someone would have told me that learning about this doesn’t make you greedy and money centric. It just means that you’ll be independent and not a burden to your children in future years to come. That’s not a selfish thing.Do you have insurance?

We have solid life insurance and umbrella insurance, but really have been risky about not taking out disability insurance. Our rational is that if my husband gets disabled we could manage on my incomes (which is realistic, finally.) And if I get disabled we can live on his. If we both get disabled we’re screwed. I feel comfortable without it for myself (even if I ended up single again) since I’m non-clinical and have an office job. Most office job folks just use their employer's disability insurance. My job isn’t any different than a lawyer or or other professional so I just don’t feel strongly about having job-specific policy now that i’m non-clinical.What does FI/retirement mean to you? What does it look like?

FI means that I don’t have to work any more. I imagine that when I hit this number I will reduce my hours to just the amount that I feel like working. Then I imagine I will want to stop all together if my kids have kids. I’m hoping to be a stay-at-home-grandma if my kids would like help with raising their own kids since I was a working mom. I’d love to be present for my grandkids and support the careers of my children.Do you give to charity? If so, where and why?

Not much just here and there for work and school fundraising events.Any parting words of wisdom?

We all carve out time in our busy lives for our priorities. I wish learning personal finance would have been higher on my priority list at a younger age. I had the notion that somehow learning about money was only of the money-hungry, superficial types. I wanted to be above that. In retrospect that was so naive.And … that's a wrap! If you're interested in doing this please send me an email – I'd love to hear from you!

I loved reading Michelle's story and I hope you did too. I was totally inspired about reading how she was able to take control of her and her husband's finances and get on track for financial freedom.]]> Read MoreEggy on the way, we've had to do some estate planning. I'll be honest: I found trying to understand and interpret estate planning and legalese way more challenging than learning personal finance. If you feel the same way, then you'll want to stay tuned for my series on estate planning in “plain English” starting with this post. Today, I'm going to discuss the estate plan basics and define some basic terms you need to become familiar with.

The Vocabulary of Estate Plan Basics

Below, you will find some of the most frequently used terms in estate planning. In addition to breaking them down in simplified English, there are also helpful links for additional reading.

Know Your Situation

Before we dive into the estate plan basics, the first thing you need to do is take inventory of yourself. Specifically, you need to understand your personal situation. Who exactly are you looking to protect? Someone who is single is going to have a very different estate plan than someone who is married with a blended family.

Let's start with me for an example. Our situation is more complicated than the common “(first) marriage with kids” scenario, meaning first marriage, no prior divorce and all the kids are theirs.

Our situation: We are not married. I've never been married. M has been married before and has a son from that marriage. Eggy will be our first child together. We do plan on getting married, just not in the near future.

We just finished drafting wills, power of attorney, living wills and healthcare proxies with a lawyer in NY. Please note and keep in mind that estate laws are state specific and some or all documents will need to be updated/redone if you move states and as your reach life milestones.

Last Will & Testament

All couples with minor children need a Last Will & Testament or Will. Why? Because in the Will you name a guardian in the (highly) unlikely event both you and your spouse pass before your kid(s) are adults. Otherwise the court makes that decision for you!

So, if you don't have a Will (and both spouses each need their own wills, they generally mirror each other), then you are basically saying you're OK with having the court decide guardianship for your minor children. I am pretty sure you wouldn't be OK with this.

You can also name a backup guardian in case the first named guardian cannot carry out the duties.

Executor

Your executor is also named in your Will. That is the person who will carry out the wishes of your Will. If you're single (kids or not), you'll want a Will unless you have little to no assets or only assets that bypass probate (discussed below).

Intestate

If you die without a Will, this is called intestate, and your “stuff” will be divided up according to state law.

Probate

Most Wills will needs to go through probate. Probate is the name of the legal process for settling a testator's (the deceased) estate.

The probate process involves a probate court, your named executor and a lawyer.

A lot of things do not need to go through probate, however. You may have heard that it is “good” to avoid probate. Probated wills incur costs against the estate – court fees, lawyer fees, executor fees (if applicable) and time.

Every state's probate process is different so you'll want to become familiar with the general probate process in your state. Retirement accounts (401(k)s, 403(b)s, IRAs, Roth IRAs, etc) DO NOT go through probate unless no beneficiary has been named. The same is true for bank accounts and life insurance proceeds.

Beneficiaries

Definitely make sure you have named your beneficiaries correctly. This is not as straightforward as it sounds.

For 99.9% of us, our spouse will be the primary beneficiary for all of these. In fact, if your spouse is not the primary beneficiary of your 401(k) (or a similar work qualified retirement plan), then you need notarized permission from your spouse to do so.

Let's say you have 2 children named Amy and Tom for the next example. The secondary or contingency beneficiary is logically 50/50 split between your two children.

Let's go a bit further and say Amy has 1 child and Tom has 2 children.

If, at the time of your death, Amy has passed as well, then guess what? All of it goes to Tom and Amy's child is effectively cut out of the estate. This is probably not what was intended. The intention was for Amy's share to pass on to her kid.

Per Stirpes

In order to do this, you need to name Amy and Tom and add the phrase per stirpes after their names. Per stirpes means that items are distributed to each family branch. Some states do this slightly differently so be sure to understand your state law on this.

Final Thoughts on Estate Plan Basics

Hopefully, the first post in this estate plan series took out some of the guesswork behind vocabulary that is often used with estate plan basics.

A much needed addition to the official documents is a “crib sheet” for your loved ones such as In Case of Emergency binder. In the meantime, check out this great book on estate planning:

[ Disclaimer: Please note that some of the links above are affiliate links. This means that I may receive a commission if you purchase through one of my links. I highly recommend all of the products & services because they are companies that I have found to be helpful and trustworthy. I use many of these products & services myself. ]

Read MoreView from my previous apartment in Williamsburg, Brooklyn, NY on Christmas Eve[/caption] It's definitely easier to attain financial independence (FI) faster when you live in a LCOL (low cost of living) with a high income. Is it out the window when you live in a HCOL (high cost of living) – like Brooklyn, NYC (where I live) or the San Francisco Bay Area? Of course not. But some thing(s) need to give if you want to reach it in a reasonable amount of time. So, how are we able to put away > $80,000 a year towards FI, pay down loans aggressively, be able to afford child care in this expensive city AND still be able to enjoy life? 1. We keep housing costs as low as possible This is probably the largest ticket item for those of us in a HCOL. A modern (meaning it includes a dishwasher and laundry in-unit) 2 bedroom apartment in a great part of Brooklyn will be a minimum of $4,000 for likely < 1,000 sq. ft. Manhattan? Try $5,000 and likely much more for any decent neighborhood. What about buying? Try $1 mill for a tiny 1 bedroom (again, if you're lucky) and upwards to $2 million+ for a 2+ bedroom apartment. That doesn't include the monthly maintenance fee. Want a parking spot? Extra.

“If you will live like no one else, later you can live like no one else.” – Dave Ramsey

I am not a huge fan of Dave Ramsey, but his basic mantras will serve most people very well. M and I live in a tiny apartment (730 sq ft). M owns this apartment and luckily bought in the early 2000s for a whopping down payment of < $20,000. No, there isn't a missing zero. It is a true two bedroom, one bathroom apartment. We have a dishwasher and our own laundry – which in NYC is a luxury. With the upcoming baby (and our bonus son that we have sporadically during the school year), many have told us that we have to upgrade. Nope. My brother and I attended high school living in a similar apartment (sharing a room). This won't be “forever” but we are doing our best to stay here until my student loans are paid off by end of 2020 or earlier. We will finish paying off M's car loan (I drive to work) in the next month or so leaving just the mortgage on his end. We street park (free). Our total housing costs (mortgage + taxes + condo fee) is ~5% of our 2017 annual gross income.

2. We chose a financially like-minded partner

Aka choose your spouse wisely. OK, so we didn't exactly do this on purpose, but sorta (at least on my end)? About 1-2 months into dating M, I asked him about his finances. Specifically, I asked him how much money he had in his retirement accounts and what debt(s) he had. I also knew that he wasn't a big spender. As things became more serious we discussed our shared financial goals for the present and future. We did this before we got engaged.

2. We make savings automatic

My 403(b) and 457(b), and his 403(b) contributions are automatically deducted from our paychecks. We never see the money. Since these are all pre-tax contributions, we don't really miss it vs. not doing this automatically and seeing if “we can afford to save.” We do our best to fund the Roth IRAs early in the year so we don't miss it and are not tempted to spend the money instead.

3. We (mostly) stick to a budget

I use YNAB to budget. I haven't added M's expenses yet but I am able to track our overall spending in eMoney (web based software we use with our FA). I've been using YNAB for over 2 years now. I was a spendaholic and this is my rehab.

4. We don't buy (much) stuff

We aren't minimalists, but we both agreed that stuff does not make us happy. We also don't have room for the stuff anyway (see above).

5. We have decided on the 1-2 things we really enjoy and don't hesitate to spend on it

Luckily, we both really enjoy eating out & cooking good food and traveling. Sure, we could nix all vacations and eat rice and beans until loans are paid off but it's important to enjoy life now too. We do try to meal plan for the week and we generally bring lunch to work. We budget for all of this.

[caption id="attachment_1137" align="aligncenter" width="402"] Lots of wristbands to get into Panorama 2016[/caption]

Lots of wristbands to get into Panorama 2016[/caption]

Another thing we both really enjoy is attending live concerts of our favorite bands (mainly indie pop/rock/some electronic). Luckily, NYC is almost always a stop on anyone's tour. Not to mention home of some of the big summer festivals. Confession: I have not paid for a single concert since M & I met. One of the big perks of M's job is free (and VIP) access to almost any concert we want to go to. We attended Panorama last summer. In the past several months, we have seen the Shins, the xx, Sigur Ros, Frightened Rabbit, M83, Tame Impala, Sia, the 1975s, Mumford and Sons, and Flume to name a few.

Bottom line – we live well below our means.

How are you making it in a HCOL? Comment below.

]]> Read More Last month I spelled out how we are investing our money in 2017. I mentioned there were some moving parts – namely, M was unemployed and we knew, at the time, that I was (newly) pregnant. Now, M has a job (yay!) and looks like this pregnancy will stick, so now we can do some real projections for 2017. Our asset allocation will remain the same.

This year our total “retirement” contributions will consist of:

This year our total “retirement” contributions will consist of:

- $18,000 my 403(b)

- $20,800 employer match + contribution into my 403(b). Currently 20% vested. 40% vested as of August 1, 2017 so actually $8,320

- $18,000 my 457(b)

- $5,500 my Roth IRA

- $18,000 his 403(b). No matching at this time

- $11,000 his Roth IRA (his first! For 2016 and 2017)

- Other sources:

- A very modest amount ~$1,000 into my solo-401(k). Yes this blog likely won't lose money this year 🙂

- ~$5,000 his solo-401(k) – he has some 1099 income this year

M and I are pleased to announce that we are expecting a baby boy this fall. We have nicknamed him “Eggy” – it means baby in Korean. As you know, you cannot exactly plan when you become pregnant. Honestly, we were not sure if things would happen au naturel due to my age so IVF was a possibility. Luckily my current job includes 3 cycles of IVF as a benefit but it is still not 100% covered. I know many ladies who have spent a small fortune on getting pregnant. So here are a few things I have learned, financially, about trying to get pregnant and trying to plan for leave and childcare:

- Insurance coverage: Make sure you know what your insurance plan will cover and not cover and what deductible you'll need to meet, if any. Even if your insurance says “maternity is covered,” it may not cover all the tests. My costs: $40 (co-pay for the first visit only) is what my total out of pocket costs will be, including the delivery. This assumes I use an ob-gyn within my health system (I am) and that I deliver at one of their hospitals (I plan to).

- Maternity Leave: Think about how long you'll want to take for leave and what leave, if any, will be paid. This is a highly personal decision, but I have yet to meet someone who said they took too much time off. Unfortunately, paid maternity leave is not the norm in the U.S. If you have unpaid leave at least you'll have approximately 9 months to save up for this. My leave: I get 6 weeks paid leave (at my base salary) or 8 weeks (c-section). I can also use unused vacation. I will have at least 2-3 weeks of unused vacation to get to at least 8 weeks paid. I am taking at least 3 months off. So that means at least 1 month unpaid, possibly more. Since I only really need ~60% of my take home base salary, this won't be a huge burden on us and we will have more than enough saved to cover this unpaid time.

- Maternity clothes: Unless you only wear stretchy pants and dresses, you'll need at least a few staples. I do wear scrubs a few times a week to work so I did not have to buy a whole new work wardrobe. Gap Maternity is pretty inexpensive and I was able to use a 20-40% off coupon when ordering online. It also helps that it'll be mostly warm weather during my pregnancy so I can keep wearing dresses.

- Baby stuff: I am totally cool with second-hand everything. And due to space limitations of an NYC apartment, we definitely do not want too much “stuff.” Between a baby shower, a very excited grandmother-to-be, M's sister's hand me downs – we should have most of the basics for almost free. I have even scored a free Mamaroo and Ergo carrier already. I won't be shopping at baby boutiques for clothes.

- Post-partum help: If you don't have family around you may want to look into outsourcing certain things (clean and cook, etc) so you can focus on mothering. Baby nurses and night nannies are common in NYC – definitely a luxury – but a savior when you're sleep-deprived. Post-partum doulas are also a great idea, especially for first time moms, to show you the ropes, help you ease into breastfeeding (most are breastfeeding certified counselors), and help you take care of you while you recover from delivery. The U.S. is a bit strange in that moms are expected to recover and go back to work ASAP. Too bad there aren't any post-partum spas here like Korea. My plans: M will take 2 weeks off to help. I'm planning on hiring a post-partum doula for a few sessions for the above reasons. After 2 weeks, I'll be with my mom for a few weeks – letting her carry out a Korean tradition of taking care of a new mom. Slightly modified as I'll be able to shower :).

- Childcare: This blog is geared towards female professionals, so most of us probably won't be stay at home moms. I'd be lying if I said I wasn't worried about the cost of childcare! The going rate in my neighborhood is ~ $17/hr for a nanny. At this time, I prefer having a nanny for the first 6-12 months after I return to work. The convenience of someone coming to us vs. one of us packing up the baby and walking to a daycare (at least a 10-15 min walk – won't be fun during winter). Also, babies and kids often get sick in daycare and although M's work is more flexible, we don't want to deal with that. Right now, we are planning to have a nanny for 40 hours a week over 4 days and my mom for 1 day a week and for backup. We are *gulp* preparing to spend at least $3,000 a month in childcare. Unfortunately, daycare isn't much cheaper and with the convenience and flexibility of a nanny, this was a no brainer for us. After 6 months or so, we will reassess.

- Saving for college: It's never too early to start saving for a little one's college. You may recall that I started a 529 last year in anticipation of starting a family. I get a small state tax break for funding one so it was a no brainer to get started.

I was almost a victim of identity theft.

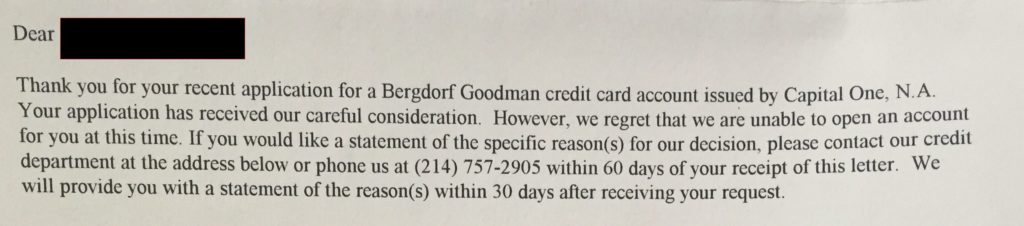

I did not apply for this card:

For those of you not familiar with Bergdorf Goodman – it is a high-end luxury department store in NYC – think Gucci, Prada, Chanel. Unfortunately, not a place I will be shopping at anytime soon.

I checked on Credit Karma and there it was – a hard inquiry on Equifax dated around the same time of the above letter from this department store. I also found another hard inquiry that I did not initiate. I took this opportunity to thoroughly review what accounts are open and make sure they were actually mine. Phew – all good. But I did find 3 old store cards that I haven't used in years. I went ahead and closed them.

I then froze my credit at all 3 agencies – Equifax, Transunion, and Experian.

What does freezing credit do? It prevents unauthorized use of your credit to open credit cards, mortgages, etc. unless you/they have your pin. This pin is issued when you freeze your credit. When you need to open a new card or mortgage you simply unfreeze or thaw your credit. Best if you call the bank or institution and find out which agency they will use first so you only need to thaw one agency. There may be a fee to thaw – but negligible compared to the headache and time needed to undo fraudulent activity.

So, even if someone does get your information they will not be able to open any lines of credit without this pin. Guard this pin! You will not be able to do anything without it. Make copies, upload to a secure cloud etc.

Freezing your credit has no impact on your credit score. Freezing and thawing credit is also state specific in terms of how long it will stay frozen and fees to freeze or thaw.

Check out this excellent freeze/thaw guide for links and info on how to easily freeze your credit. Please note that freezing credit does not affect a theft's ability to steal and use your actual credit card. Thankfully, this is much easier to deal with.

And, don't forget to freeze your children's credit! Yes the thieves are even going after them.

If you're eligible, you can take things further and obtain a pin from the IRS so that no one else can file in your name. Yes it happens, and I can assure you this is a much bigger PITA to deal with. Unfortunately, at this time, you need to be eligible to obtain one:

- You receive CP01A Notice containing your IP PIN, or

- You filed your federal tax return last year as a resident of Florida, Georgia or the District of Columbia, or

- You received an IRS letter inviting you to ‘opt-in' to get an IP PIN.

I am not eligible at this time. Hopefully the IRS will soon let anyone obtain a pin to protect themselves.

Read More

- Part 1 covered the license designations an FA can and should have.

- Next, Part 2 covered how FAs should get paid.

- Then, Part 3 explored what real financial planning is.

- In Part 5, I discuss why I fired mine.

Today is Part 4 – How to find and vet a financial planner. I will also share how I found and vetted mine.

How to Find a Financial Advisor

You want to find a financial advisor, but you've got a question. Where do I start?

A personal recommendation is always helpful, but you'll still need to do your own vetting.

Step 1 – Do Your Initial Vetting

If you're convinced that a fee-only FA is the only way to go, a good place to start is NAPFA – the National Association of Personal Financial Advisors. They are a leading organization of fee-only advisors. Now, just because someone isn't listed here does not mean they are not good. To make the list, members must:

- Be CFP’s

- Sign a pledge to serve as their clients’ fiduciary

- Submit a financial plan for review and approval (they are not rubber stamped)

- Complete 30 hours of approved CE annually

Now, what if there isn't anyone in your location?

In my opinion, your FA does not need to be local. You can conduct meetings in the comfort of your own home via video conference. Personally this seems much more convenient than scheduling in person meetings, but I do understand that some folks prefer the one-on-one meetings.

Many FAs also have a blog or a podcast. This is a great way to peruse their content and to see if their philosophy and personality meshes with you.

Step 2 – Review Form ADV

Let's say you have a few names of FAs. After browsing their website and reviewing their fee structure and what is included, you're now ready to for the next step. Review their Form ADV. Form ADV is the informational document that the SEC (Securities and Exchange Commission) requires all investment advisors to file and update annually. It contains a lot of information and you'll need to know what to look for.

My former FA wrote an excellent post on how to decipher a Form ADV. Go ahead, take your time to read it. Did your potential FA pass?

Step 3 – Set Up a Consultation

Now you're ready to set up a consultation. Almost all FAs will conduct a consultation for free. This is your chance to “meet” (virtually, phone call, or in person) and get your other questions answered.

Step 4 – Take Your Time

After this meeting you should have enough information to make a decision. Take your time – this decision will affect you – your net worth, positively or negatively.

What I Did to Find a Financial Advisor

Now that you know the basic steps, you're probably wondering how I found my financial advisor. I first heard of Johanna through the White Coat Investor Forums. I was a semi-active member and found her posts not only helpful but she clearly knew what she was talking about. When I found out she was going to be in NYC for a conference, I private messaged her if we could meet.

At that time, I was not really thinking of hiring her let alone any FA. But I wanted to take the opportunity since she was in town. So M and I got to meet her in person at one of my favorite bars in Brooklyn, Hotel Del Mano.

Afterwards, she sent us a copy of Nick Murray's Simple Wealth, Inevitable Wealth. I skimmed it. Then I had questions.

At this time, I did not know what a Form ADV was (nor did I know such a thing existed), but I knew that fee-only was the way to go.

I emailed her these questions:

Are you a fiduciary?

Yes and we sign a statement to that effect for every client.

Is the portfolio you recommend to your clients (I know you rec 1/6 each to 6 categories) also YOUR personal allocation?

We use this portfolio for myself, Michelle, my mom and my sons, along with the rest of our clients. I would not recommend something that I wouldn’t do for my own family.

How long have you been recommending this?

For the last 7 years, at least.

How long have you been doing this allocation for yourself?

Almost that long. Like some, I had trouble giving up on funds that I was in love with (YACKX, in particular). I finally got rid of the others except for YACKX and just worked it into the portfolio as part of my LC Value funds. As I tell Michelle, we eat our own cooking here and practice everything we tell our clients. (Well, I’m better at planning for my clients than I am for myself, but that’s a different story, kind of like the doctor who can’t quit smoking).

And what is the past performance of this?

I looked up the client who has been with us the longest and her average annual return is 10.31%. Of course, this has been during a bull market, with only 1 down year (2015 although 2016 hasn’t been exactly fabulous so far) so I can’t take a lot of credit. We don’t benchmark and we tell our clients to expect about 8% during the long term and to have no expectations during the short term (next 5 years).

How did you handle 2008?

I began my business in 2008/2009 (had only the CPA firm before that) and so I had only my own and kids’ funds in the bear. I did nothing different. However, I didn’t hear Nick Murray speak for the 1st time until (I think) 2009, and my world changed at that point.

Personally and for your clients, how did you handle clients who panicked and sold?

N/A.

Did you lose a lot of clients during this time?

N/A. Btw, I was investing for myself in the dot.com crash in 2000. I made all of the mistakes that could be made on my own account during that crash. Truthfully, I am so thankful that I have not done anything like that for our clients and never will. Unlike many investment advisors, we don’t experiment with our clients’ accounts.

Can you talk about the last 2 clients that left and why?

The only large client we have lost (about $400k) was 1.5 years ago. She decided to use the trust department of a bank because her family’s trust was there and she wanted to consolidate. A couple of years ago, a client (<$100k) moved to Edward Jones because her cousin owns the office. Because we handle SIMPLE plans for a few CPA clients, employees periodically leave and cash out, but it is a relief to lose a small account. We only handle these plans because the business owners have large accounts and as a convenience for them.

Tell me about a client that you let go and why?

I don’t know of any we’ve let go. We are extremely careful about who we work with and try to ensure that they deselect themselves by educating them on what we do at the beginning of a relationship.

Who is your ideal client?

Flat-fee doctor planning clients. We just started this model about 6 months ago and it is proving pretty popular. I like this (rather than our AUM model that the clients who started with us before this year are under) because it focuses on the plan and it doesn’t focus on performance, which is aligned with our values. Since we model the stock market, returns are going to be similar to long-term market returns.

How many do you take on a year?

Can’t say at this point. I’ve been bad about enforcing minimums in the past and we are going to have to let some clients go in the next year to focus on doctors. We are planning ahead to add another team member next year.

What will happen if something happens to you?

(Michelle is 16 years younger and the main reason I asked her to work with me and eventually become partner was for succession planning.

How long have you been doing this?

See above. I had been making recommendations to clients as a CPA for many years, but sending them to brokers. The reason I decided to become a CFP was because I did not like the way our CPA clients were treated and the results. I thought I could be a better advisor than what they were getting. When I first began, I did not know what fee-only was or how important it was to be a fiduciary. I found out soon after starting and knew I’d found my home (same as with Nick Murray).

Have you been sued by a client or have had any legal action against you from a client?

Never.

What is the average size portfolio you manage?

Around $75k because of all the SIMPLE accounts. Our sweet spot is $400k – $750k.

Smallest?

Because of the SIMPLEs, a few hundred dollars.

Largest?

Around $3M. Please note that the size of the portfolio is really not an issue except for AUM clients. With flat-fee planning, we concentrate on your plan and build a portfolio that will sustain the plan rather than the other way around. A portfolio is not a plan – big difference. Think about it – some people prefer to invest in their businesses or real estate as part of their retirement. Their stock market portfolios will be smaller, but they will not be “smaller” clients (actually more complicated).

What is the average length of a time a client stays with you?

I don’t have those figures. If we took out the SIMPLE accounts (which I have nothing to do with), it is pretty much since they have begun with us.

Are you able to provide any references that would be willing to talk to me?

Maybe. I guard my clients’ privacy and have only asked once for someone to give a referral. The prospect decided to keep managing his own money at the time (although he took a recommendation I made that kept him from making a huge mistake) so I bothered a busy client business owner needlessly.

I know you are not the biggest fan of Vanguard, so which funds do you prefer and why?

The funds we prefer are those that stick to the terms of their prospectuses and have really good managers. The prospectus is the rule book for how a fund manager or committee is to allocate the dollars that flow into and out of the fund and run the fund. Because we have such definite terms on our client portfolio allocation, it is important that we can trust the manager to play by the rules he was hired to follow. Not all do.

Have they outperformed similar funds in Vanguard?

I have no idea and I don’t care. We are not in a performance game. If we can mirror long-term market performance, using behavior management (which is most important – proper investing is really quite simple), then our clients will be quite successful. I hate to keep saying this, but low-cost funds do not guarantee you a successful portfolio.

The cost is but one aspect of investing. Yes, if everything else is equal, we will choose the lower cost fund. But a fund can’t simply hire a manager and tell him/her to keep the costs down and expect the fund to perform up to its peers. I think that is overemphasized on WCI and is actually a detriment to the investing results of many doc’s. It sets up a false premise – that cost is 90% of results. The examples that are given of the long-term extra costs of a fund that has a quarter of a point more cost over 20 years assume everything else is equal. It never is.

My job is not to outperform. Instead, my job is to ensure that our clients build optimal wealth over the long term given their resources, goals, and life events. It is a bit more complicated than “Let’s go to Vanguard and choose low-cost funds.” We use a few Vanguard funds, but I am not of the opinion that Vanguard is the absolute best fund family to the mutual exclusion of all others. That’s just not rational.

Does working with you/firm also include discrete events like death of a spouse? buying a home? etc? Or is that extra?

Clients never pay extra unless there is a reason to change the engagement and prices don’t go up without notice. Being someone’s financial planner means that I am integrated into his/her life. Everybody has a different path.

I mentor several people and was telling a young man yesterday that it is important to have processes that make planning consistent, keeps us accountable, and surpasses our clients’ expectations while maintaining the individual experience for each client. So, yes, specific life events are what I am here for. Everyone is unique – we don’t do cookie cutter planning here. Not every doctor is paying down student loans.

And finally, is there anything else you think I should know about you?

Like I yelled at my dog this morning? Seriously, there probably is. I’m not hiding anything, but I don’t know what else to tell you right now – may think of something later.

I will tell you that I’ve seen a lot of the crap that passes for financial planning out there and you could do a lot worse than to hire someone who has 35 years of experience as a CPA combined with 9 as a CFP who is also fee-only and works with doctors. I’m not even sure if I’ve run across myself before.

Actually, here’s something: you won’t work exclusively with me. You would work mostly with me, but you would also meet sometimes with Michelle. She trains clients how to use our software, eMoney, and handles all investing functions. And that’s a good thing because we back each other up. You should also know that we custody with TD Ameritrade (which is not the same as TD Bank).

Here is Our Process page. I’ve also attached a draft copy of our Expanded Agenda page. It’s not ready to go online yet but I thought you might find it useful to read. That’s it for now. Thanks for asking some good questions. I haven’t proofed for errors, so please be lenient lol. Let me know if you have any other questions.

Read More This is a guest post by Liz Stapleton. She is a recovering attorney and freelance writer focusing on personal finance, entrepreneurship, and issues facing lawyers. Since starting her personal finance blog, Less Debt More Wine in 2014, Liz has paid off all of her credit card debt (over $10k), raised her credit score from 640 to 800+, and paid off one of her many student loans.

I had written a post already on my own save vs. pay off loan debacle. Liz does a nice job guiding you on how to make your decision.

What to do when you want to save for your future, but you are still paying for your past?

After spending so many years in school to get a professional degree, chances are you are already behind on saving for retirement. At the same time, along with a big shiny degree, you have a ton of student loan debt that will hamper your ability to save.

The problem is time. As you know from your student loans, interest can make a big difference in what you owe, or in the case of saving what you earn. The longer your money is in a retirement account, the more time it will have to grow.

Unfortunately, the same goes for your debt, the longer you have it, the more you pay. So which should you focus on first?

Why You Should Prioritize Debt Repayment

I recommend prioritizing debt repayment for two reasons but also with some exceptions. First, the interest rate on your debt is likely higher than the amount of interest you would earn on any investments. Second, if you are on an income-driven repayment plan and are planning on loan forgiveness, you may be in for a big tax bill.

Debt Usually Costs You More

Interest rates for debt can vary widely. Student loans for professional degrees usually range from 6% – 8%. The return on retirement investments usually ranges from 5% – 8%. However, that is over the long term, and you never know what is going to happen with the market.

For example, if you have a student loan (one of many I’m sure) with a current balance of $50,000 and an interest rate of 8%, you are paying $4,000 in interest in a year. If you were to max out a 401(k) retirement account, meaning you contributed $18,000 and earned interest at 6%, you would earn $900 from interest.

While $900 is nothing to sneeze at, to prioritize saving at a lower or even equal interest rate would require you to pay to save.

Loan Forgiveness through Income-Driven Repayment Plans isn’t Forgiveness

As the current law stands, any forgiven amount after the repayment terms ends for income-driven repayment plans such as Income-Based Repayment, Income-Contingent Repayment, PAYE, and REPAYE is considered taxable income.

This means that if worst case scenario, your monthly payment does not even cover the amount of interest that accumulates each month, then your loans could be growing. If your loans grow for 20-25 years, you are going to be taxed as if you made potentially hundreds of thousands more.

There is one exception to the loan forgiveness tax bill, and that is Public Service Loan Forgiveness (PSLF). Under PSLF after 120 qualifying payments, your loans are forgiven and not considered taxable income.

Why You Shouldn’t Forgo Saving for Retirement Entirely During Debt Repayment

While it’s likely a good idea to prioritize debt repayment now, it doesn’t mean you shouldn’t set aside some money for retirement. There are three reasons you should save for retirement while paying off debt.

First, time is money, the longer your money sits in your retirement account, the more compound interest you will earn. Second, you could potentially save free money; many employer-sponsored retirement accounts offer matching contributions. Third, saving for retirement could lower your tax liability.

When it comes to compound interest, every little bit counts

Let’s say you put $100 per month towards retirement savings. If your investment of $1200 earns a conservative 5% then at the end of the year it will become $1,260. If you stopped contributing that $1,260 would turn into $1,531 after five years. In 15 years it would become $2,494, doubling your money. If you had kept contributing just $100 a month, you would have saved $28,389 after 15 years.

Even if you aren’t maxing out your retirement contribution during debt repayment, just a small monthly contribution done consistently can go a long way.

You Never Want to Lose Out On Free Money

If you have an employer-sponsored retirement account such as a 401(k), you should educate yourself on any matching contributions they are willing to make. For example, my old company used to match a 5% contribution 100%. If I put in $5, my company would put in $5. I essentially doubled my money just be contributing to my retirement account.

You Could Pay Less in Taxes

While it is true that you can deduct up to $2,500 of the interest you pay on your student loans from your taxes [Editor's note: Almost all doctors are over the income limit for this deduction]. You can lower your taxable income even more by saving for retirement. While there are lots of different retirement accounts (401k, 403b, TSP, IRA, Roth IRA, etc.), some of them are pre-tax contributions.

Pre-tax contributions allow you to put money that has not been taxed aside for your future in a retirement account. The government will tax those funds when you withdraw the funds from the account. If you make $75,000 per year and you put a total of $5,000 of pre-tax dollars into your 401(k) you will be taxed as if you earned $70,000.

The Exceptions to Prioritizing Debt Repayment

There are some circumstances where you might want to prioritize saving for retirement over paying off debt. For example, if your debt interest rates are in the 2%- 3% range your money might be better-used saving. Alternatively, if you can afford the loan’s standard repayment plan then paying that standard monthly payment and saving more for retirement will likely put you ahead on savings, without losing too much money to interest on your debt.

What do you think? Comment below.

]]>

I had written a post already on my own save vs. pay off loan debacle. Liz does a nice job guiding you on how to make your decision.

What to do when you want to save for your future, but you are still paying for your past?

After spending so many years in school to get a professional degree, chances are you are already behind on saving for retirement. At the same time, along with a big shiny degree, you have a ton of student loan debt that will hamper your ability to save.

The problem is time. As you know from your student loans, interest can make a big difference in what you owe, or in the case of saving what you earn. The longer your money is in a retirement account, the more time it will have to grow.

Unfortunately, the same goes for your debt, the longer you have it, the more you pay. So which should you focus on first?

Why You Should Prioritize Debt Repayment

I recommend prioritizing debt repayment for two reasons but also with some exceptions. First, the interest rate on your debt is likely higher than the amount of interest you would earn on any investments. Second, if you are on an income-driven repayment plan and are planning on loan forgiveness, you may be in for a big tax bill.

Debt Usually Costs You More

Interest rates for debt can vary widely. Student loans for professional degrees usually range from 6% – 8%. The return on retirement investments usually ranges from 5% – 8%. However, that is over the long term, and you never know what is going to happen with the market.

For example, if you have a student loan (one of many I’m sure) with a current balance of $50,000 and an interest rate of 8%, you are paying $4,000 in interest in a year. If you were to max out a 401(k) retirement account, meaning you contributed $18,000 and earned interest at 6%, you would earn $900 from interest.

While $900 is nothing to sneeze at, to prioritize saving at a lower or even equal interest rate would require you to pay to save.

Loan Forgiveness through Income-Driven Repayment Plans isn’t Forgiveness

As the current law stands, any forgiven amount after the repayment terms ends for income-driven repayment plans such as Income-Based Repayment, Income-Contingent Repayment, PAYE, and REPAYE is considered taxable income.

This means that if worst case scenario, your monthly payment does not even cover the amount of interest that accumulates each month, then your loans could be growing. If your loans grow for 20-25 years, you are going to be taxed as if you made potentially hundreds of thousands more.

There is one exception to the loan forgiveness tax bill, and that is Public Service Loan Forgiveness (PSLF). Under PSLF after 120 qualifying payments, your loans are forgiven and not considered taxable income.

Why You Shouldn’t Forgo Saving for Retirement Entirely During Debt Repayment

While it’s likely a good idea to prioritize debt repayment now, it doesn’t mean you shouldn’t set aside some money for retirement. There are three reasons you should save for retirement while paying off debt.

First, time is money, the longer your money sits in your retirement account, the more compound interest you will earn. Second, you could potentially save free money; many employer-sponsored retirement accounts offer matching contributions. Third, saving for retirement could lower your tax liability.

When it comes to compound interest, every little bit counts

Let’s say you put $100 per month towards retirement savings. If your investment of $1200 earns a conservative 5% then at the end of the year it will become $1,260. If you stopped contributing that $1,260 would turn into $1,531 after five years. In 15 years it would become $2,494, doubling your money. If you had kept contributing just $100 a month, you would have saved $28,389 after 15 years.

Even if you aren’t maxing out your retirement contribution during debt repayment, just a small monthly contribution done consistently can go a long way.

You Never Want to Lose Out On Free Money

If you have an employer-sponsored retirement account such as a 401(k), you should educate yourself on any matching contributions they are willing to make. For example, my old company used to match a 5% contribution 100%. If I put in $5, my company would put in $5. I essentially doubled my money just be contributing to my retirement account.

You Could Pay Less in Taxes

While it is true that you can deduct up to $2,500 of the interest you pay on your student loans from your taxes [Editor's note: Almost all doctors are over the income limit for this deduction]. You can lower your taxable income even more by saving for retirement. While there are lots of different retirement accounts (401k, 403b, TSP, IRA, Roth IRA, etc.), some of them are pre-tax contributions.

Pre-tax contributions allow you to put money that has not been taxed aside for your future in a retirement account. The government will tax those funds when you withdraw the funds from the account. If you make $75,000 per year and you put a total of $5,000 of pre-tax dollars into your 401(k) you will be taxed as if you earned $70,000.

The Exceptions to Prioritizing Debt Repayment

There are some circumstances where you might want to prioritize saving for retirement over paying off debt. For example, if your debt interest rates are in the 2%- 3% range your money might be better-used saving. Alternatively, if you can afford the loan’s standard repayment plan then paying that standard monthly payment and saving more for retirement will likely put you ahead on savings, without losing too much money to interest on your debt.

What do you think? Comment below.

]]>

Simple and absolutely delicious – rigatoni with fresh tomato sauce and eggplant – @ Planeta Winery, Sicily.[/caption]

Do you like to travel? We love to travel. Our “splurge” is travel and food – best if we combine the too. We budget for two big trips a year. We consider it pivotal to our happiness. We are not into budget travel anymore – too old for penny pinching like staying in hostels and such.

Last year we went to Sicily and Los Angeles + OC + Santa Maria wine country. I went to Toronto and Paris + Reims with girlfriends. I traveled to Washington, DC twice for CME conferences.

You may have heard about the Chase Sapphire Reserve Card. It came out last fall and instantly became the hot new travel card. I already had the Chase Sapphire Preferred and had racked up over 50,000 points. The Sapphire Reserve offered 100,000 bonus points so I opened one last September. Now, they offer 50,000 points, which is still a great deal. I'm not a credit card churner, but for folks who travel, a travel credit card is definitely worth having. This is assuming you won't go into credit debt. I pay the cards in full every month and leverage the credit to accumulate points. I rarely use cash.

You may balk at the $450 annual fee. The fee is really $150. You get $300 in travel credit (taxis, flights, hotels). You also get a credit for global entry. So the first year, the fee is essentially $0. I already have global entry which includes TSA Pre-Check. Dining and travel spending accumulate triple points. You also get Priority Pass Select membership. This is not that useful but better than no lounge access. Centurion lounge access with the Amex Platinum (M's travel card) rounds things out nicely.

[caption id="attachment_1009" align="aligncenter" width="268"] On the never ending journey for the perfect croissant – @ Du Pain et Des Idées, Paris, France[/caption]

One of the ways we are able to budget two big trips a year is by using one trip combined with CME. Many doctors have a CME fund with their job. It isn't quite enough to fully fund a pricey CME trip since the funds are also for my licensing and society fees.

Back in January, we went to Hawaii (Big Island and Kauai). I attended a conference on the Big Island. I used points for my round trip flight. M used his Amex Platinum points for his flight. The CME fund paid for hotel, rental car and most of our meals during the conference. We paid for the Kauai part on our own.

I have since accumulated > 150,000 points on the Sapphire Reserve card. We prefer to visit Europe during shoulder season if possible (less crowded). Last year, we went to Sicily in April. Weather was great and we barely ran into any tourists, let alone any Americans. Lodging was definitely cheaper since it was off-season and thankfully, food is quite reasonable (and delicious!) there. I managed to have a cannoli every day. Flights and hotels are often cheaper too during shoulder season. Not quite shoulder season but we just booked a trip to Paris in May. I booked 2 round-trip direct flights and 4 nights hotel for $94. The rest were paid with points. Our only expense will be food and local transportation. We won't be as frugal food-wise as Physician on Fire was on his recent trip there.

How do you make travel more affordable? Comment below.]]>

On the never ending journey for the perfect croissant – @ Du Pain et Des Idées, Paris, France[/caption]

One of the ways we are able to budget two big trips a year is by using one trip combined with CME. Many doctors have a CME fund with their job. It isn't quite enough to fully fund a pricey CME trip since the funds are also for my licensing and society fees.

Back in January, we went to Hawaii (Big Island and Kauai). I attended a conference on the Big Island. I used points for my round trip flight. M used his Amex Platinum points for his flight. The CME fund paid for hotel, rental car and most of our meals during the conference. We paid for the Kauai part on our own.

I have since accumulated > 150,000 points on the Sapphire Reserve card. We prefer to visit Europe during shoulder season if possible (less crowded). Last year, we went to Sicily in April. Weather was great and we barely ran into any tourists, let alone any Americans. Lodging was definitely cheaper since it was off-season and thankfully, food is quite reasonable (and delicious!) there. I managed to have a cannoli every day. Flights and hotels are often cheaper too during shoulder season. Not quite shoulder season but we just booked a trip to Paris in May. I booked 2 round-trip direct flights and 4 nights hotel for $94. The rest were paid with points. Our only expense will be food and local transportation. We won't be as frugal food-wise as Physician on Fire was on his recent trip there.

How do you make travel more affordable? Comment below.]]>

Do you give to charity? I'm embarrassed to say that I only very recently started giving. And it's not that much. But I am happy, maybe a tiny bit proud, that I finally started.

When I was a resident, I said “I'll give when I'm an attending.” That seemed logical – I wasn't making a lot and had student loans accumulating interest every day. Then I became an attending. Then I said “I'll give once I don't have so many loans” or “I'll give once I get some financial footing.”

Somewhere along the way I discovered Farnoosh Torabi's So Money podcast. I started with her inaugural podcast with guest Tony Robbins. One part really got to me:

People say, “When I'm rich, I'll give, they're lying. If you won't give a dime out of a dollar, there's no way you're gonna give a 100 million out of a billion, you're lying to yourself. But if you can do it today, the biggest thing that giving does, is it teaches your brain there's more than enough.

Right after I listened to that podcast, I made my first donation – I pledged to give a small amount quarterly to my alma mater Barnard College and specifically earmarked the funds for financial aid. I received generous financial aid in the form of grants and work-study and hope that my small contribution (which I will definitely increase soon) will help someone else attend.

For 2017 I made a modest goal to start with 1% of my base salary towards charity. Yes, this isn't a lot, but I am starting somewhere and hope to slowly increase as a % of my base salary. I made a separate category in YNAB as well.

I have also given small amounts to:

- Camp Discovery – a summer camp for kids with severe skin diseases

- KACFNY aka Korean American Community Foundation of NY

You'll notice my medical school is missing from the list. That will have to wait until the loans are paid off. I think that just only makes sense :).

Do you give? Why or why not? Who/what do you give to?

Read More