Money

Dealing with student loans is difficult. Being a doctor with student loan debt can be particularly challenging. 76% of doctors graduate with debt, and the median is $192,000. This is a guest post by Travis Hornsby, creator of Student Loan Planner, where he offers one-on-one student loan advice. As female physicians with student loans, if you need help navigating them, contact him.

I got into helping people understand their student loans thanks to my beautiful and brilliant fiancée Christine. She’s a urogynecologist, and like most physicians, she was more focused on learning and caring for her patients than understanding arcane federal student loan rules. Unfortunately, female physicians earn less than their male counterparts. To help tip the scales back in favor of people like Christine, here’s how to maximize student loan strategy as a female physician.

I got into helping people understand their student loans thanks to my beautiful and brilliant fiancée Christine. She’s a urogynecologist, and like most physicians, she was more focused on learning and caring for her patients than understanding arcane federal student loan rules. Unfortunately, female physicians earn less than their male counterparts. To help tip the scales back in favor of people like Christine, here’s how to maximize student loan strategy as a female physician.

Tips for Female Physicians with Student Loans

First things first. Women doctors are more likely to be employees. That's a big advantage when it comes to student loans. About three-quarters of all women in medicine work as employees instead of in private practices. That means women are more likely working at not for profit hospitals than men. That’s why female physicians need to know about Public Service Loan Forgiveness (PSLF) like the back of their hand. Under PSLF, A doctor must work for 10 years in a not for profit setting. Most hospitals qualify. You must receive your actual paycheck from a not for profit entity too. Occasionally I’ve seen some hospitals that pay their physicians out of a private sector entity. That would cause you to lose your PSLF eligibility. Make sure that doesn’t happen to you when you become an attending. Your residency counts towards this 10-year period until PSLF forgiveness. If you play your cards right, you could pay $300-$500 a month on your loans during this period, which all counts towards the 10 years required under PSLF. Virtually all physicians who manage their loans the optimal way will graduate residency with 3-7 years of credit towards the 10 years they need. What happens when you become an attending?Keep Your Payments Low to Maximize Forgiveness

Under current rules, you can use either PAYE or IBR to cap what you must pay on your student debt. That means if you owe $150,000 in med school loans but start out at $200,000 as an attending, you can keep your payments at no higher than the standard 10-year monthly amount you had to pay when you left med school. Using this cap to your advantage, you could conceivably train for several years to become a surgeon, then cap your payments on 10-year standard repayment plan. That would allow you to pay a fraction of what you originally borrowed for medical school. A lot of my clients make payments based on the Income Based Repayment plan (IBR). If that describes you, you’re probably paying too much on your student debt. You should look into switching to Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE). The reason? You get to pay 10% of your income instead of 15% as with IBR.Make Sure Your Loans Qualify

Only Direct Federal student loans qualify for this forgiveness benefit. That covers most loans issued after 2010. If you happen to have loans from before this that are on the older FFEL loan program, you can consolidate them into a Direct loan. That consolidation makes them eligible for PSLF, but it also resets the repayment clock to zero. Make sure your loans don’t qualify for PSLF before submitting a consolidation request. Call your loan servicer and ask them what loans qualify for PSLF. They should be able to tell you.How Would This Work in Real Life?

Here’s an Example. Meet Jane. She’s a pediatric cardiologist. Her total length of training between residency and fellowship is six years. During that period, she’ll start out at $55,000 and end up at $70,000 in salary. When she becomes an attending, she’ll start at $225,000 and get inflation level raises after that. Jane has $300,000 in student loans. She doesn’t know what to do with such a large burden, but she’s passionate about medicine. In a perfect world, here’s how she would manage her student loans.Start paying on REPAYE as soon as possible

While in residency and fellowship, Jane can pay only a few hundred a month but receive interest subsidies of thousands of dollars a year. The reason is that REPAYE covers half of the leftover interest she doesn’t pay each month. Since she’s going for tax free loan forgiveness but also wants to keep the loan balance low just in case, REPAYE is probably a great option. A possible exception to that rule of thumb is if her spouse makes a lot more money than she does and then it’s worth talking to an expert.File the PSLF Certification form

After her first payment on REPAYE during training, Jane can submit the PSLF employment certification form. She should receive a response in a couple months showing her progress towards loan forgiveness. Once she’s being tracked for the program, she should resubmit this free form every year at least to create a well-documented paper trail.Minimize Taxable Income

Loan servicers calculate what Jane owes every month based on her taxable income. If she will receive forgiveness on her student loans then she wants to minimize what she pays wherever possible. The best way to do that is to save in pre-tax retirement accounts. She can use a pre-tax 403b plan to put away up to $18,000 per year, which will directly reduce what she has to pay towards her student loans.Here’s What the Numbers Look Like

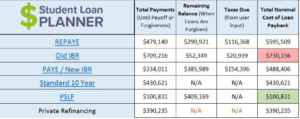

A few things might complicate this picture, particularly if Jane had a spouse who also earned an income. If a spouse has student debt then it doesn’t matter as much. However, if a spouse has no loans but a substantial income then it would be worthwhile to rerun these numbers using my calculator. So to review, Jane makes $55,000 at the beginning and $70,000 at the end of training. We’ll say she puts away $5,000 in her 403b during training and $18,000 as an attending. Her interest rate is 7%.

Jane borrowed $300,000, and she’s going to be able to pay just over $100,000 on her student loans and save a lot of money for retirement along the way. Student loan interest is generally not tax deductible except for a small amount at low incomes. That means over that 10 years, Jane receives a benefit worth about $20,000 annually after tax for optimizing her student loans. On a before tax basis, that benefit is more like $30,000 in salary value. That’s a great benefit considering many people enjoy working at academic hospitals over private practices.

So to review, Jane makes $55,000 at the beginning and $70,000 at the end of training. We’ll say she puts away $5,000 in her 403b during training and $18,000 as an attending. Her interest rate is 7%.

Jane borrowed $300,000, and she’s going to be able to pay just over $100,000 on her student loans and save a lot of money for retirement along the way. Student loan interest is generally not tax deductible except for a small amount at low incomes. That means over that 10 years, Jane receives a benefit worth about $20,000 annually after tax for optimizing her student loans. On a before tax basis, that benefit is more like $30,000 in salary value. That’s a great benefit considering many people enjoy working at academic hospitals over private practices.

What if Jane Wanted to Start a Family?

One cool feature of the PSLF program is that payments made while on maternity leave count towards the 10 years of payments needed for forgiveness. If Jane worked at an academic hospital, she could take off up to three months per birth and if she makes payments on REPAYE, PAYE, or IBR, she gets credit towards tax free loan forgiveness. As I mentioned, if Jane had a spouse, then that could make things a bit more complex. Keep in mind you’re married for the entire year for tax purposes once you submit your marriage certificate. I’ve met many couples who have three to four years of credit towards PSLF while they’re planning their wedding. If Jane had fallen into this category, she could probably count on at least a year for the student loan servicers to incorporate her spouse’s income into the payment calculation. If she uses PAYE once she gets married if that’s in her life plan, she can cap the required payment at no more than what’s required under the 10-year Standard plan. That capping feature allows most physicians to qualify for substantial loan forgiveness even if they’re a high-income surgeon like my fiancée.Plan for PSLF, but Prepare for an Alternative Plan Just in Case

If you’re in training right now, there’s no harm in tracking progress towards loan forgiveness on the PSLF program. If you decide to go private practice, you can refinance and get a lower interest rate with a private lender. If you decide to stay with a hospital, it will probably be a not for profit employer. You might as well set yourself up for this benefit as it’s worth tens of thousands if not hundreds of thousands of dollars. In case PSLF gets repealed, which is probably not going to happen for folks who already have loans, you’ll owe less by using an intentional strategy for loan repayment. Female physicians with student loans like my fiancée Christine deserve a fair shake. Hopefully, you’ll take advantage of free content on Miss Bonnie MD’s blog and my site Student Loan Planner to save every dollar you deserve. If you wanted help coming up with a loan repayment strategy, I’d love to help.]]>

Read More

Female physicians with student loans like my fiancée Christine deserve a fair shake. Hopefully, you’ll take advantage of free content on Miss Bonnie MD’s blog and my site Student Loan Planner to save every dollar you deserve. If you wanted help coming up with a loan repayment strategy, I’d love to help.]]>

Read More

YNAB aka You Need a Budget. I bought this in Dec 2014 on some Christmas sale when it was still only available in the desktop version. Now it is a fancier web driven app.

Before using YNAB, I, like many, was a regular ol' excel spreadsheet gal. I made myself feel good by having all the budget categories add up nicely to my monthly paycheck. If you recall, I never saved any money and always ran out of money before the next paycheck.

My spending kind of went like this – do I have money in my checking account? Yes, I'll spend it. Meanwhile, I wasn't paying attention to the other categories I needed to set aside money for. I needed some serious help!

YNAB is not super easy to use right out of the box. I can almost promise you that you'll have some growing pains. The good news is that YNAB has a robust support center and tons of educational videos and webinars to teach you how to use their software optimally. When I switched from YNAB desktop to web version, they changed a few rules and I was emailing with their support team quite a bit.

My first few months with YNAB were interesting. I still went over budget, but each month got better and better. I slowly re-trained my spending habits. Remember that $20,000 credit card debt I used to have? Not only is it gone but I pay my cards IN FULL every month.

I can also confidently say today that I no longer go over budget and am saving quite a bit of money now (becoming an attending helped that part for sure). Learning how to use YNAB efficiently helped quite a bit as well.

Living within your budget revolves around clarity of the budget presentation and self-discipline. YNAB is a vital tool with which I feel I am able to keep disciplined and focused.

People ask all the time whether they should use YNAB vs. Mint. They are completely different programs. It really depends on what your needs are. If you are already great at spending within your means and budget (if you have one) – then Mint is a good option for you.

Mint gives you a snapshot of how you did. If you need serious help (like I did) and need to literally re-train yourself about budgeting and spending, then there is nothing better out there than YNAB.

YNAB is forward and proactive budgeting. You will know whether you can actually afford something in real time and not worry that your money will be taken away from other necessary categories. YNAB focuses on your cash flow. You can also add loans and investments for tracking purposes, but I don’t believe this function works too well. I’d recommend sticking to what YNAB was made for – cash flow. I use Personal Capital to get a more complete snapshot for all my accounts. We use eMoney with our FA as well.

I hope you're in a better place than I was when I first started YNAB. Even if you are I’d recommend checking it out. It is free for the first 34 days. Use this link to get 1 month free.

Read MoreMonet's lilies @ Musée de l'Orangerie, Paris, France[/caption] This is a very frequent question and topic on the finance blogs. I like how the White Coat Investor made a nice and easy to follow order of things. Basically pay off any consumer debt and other high interest loans first. Then he prioritizes saving for retirement over lower interest loans. Then in this post he says most docs should have their loans paid off within 5 years of graduating. I've struggled with how fast I should be paying off my student loans. If I really wanted to, I could wipe them out in 3 years (possibly less with bonuses) but would require more than a decent amount of sacrifice. How awesome would it be to be student loan free in < 3 years? I've changed my mind countless times about this. At least I was maxing out all of my available tax-advantaged accounts while flip-flopping. Currently, I fully fund my job's 403(b) (+ generous employer contribution), 457(b), and a backdoor Roth IRA. This amounts to $62,300 this year. I don't have a taxable account yet. I think for the average physician (although even this definition is quickly changing) who becomes an attending physician around age 30 (and funded a Roth IRA during residency) the WCI's general plan is a good one to follow. For folks like me however, who became an attending much later in life (38)- I've lost valuable time. Remember, time is a huge part of how compound interest works. If you have less time, then you need more money (saved) to make up for it. The same could be said for folks who have children and other priorities that require money. This late in the game, brute savings is what will get me to financial independence. Instead of the suggested 20% saved for docs, I need to save at least 30%. I recently took advantage of First Republic Bank's amazingly low interest rates for student loan refinancing. This forced me into a 5 year maximum pay off period with a fixed interest rate of 2.25%. I'm ok with that. I also have another $80K loan with my mom and will pay this off in < 5 years. What am I doing with my “extra” cashflow? Saving. We hope to start a family soon and will need to pay for childcare and the kid him/herself. NYC daycare can be between $2,000-$3,000 a month easily! We also need to beef up our emergency fund with more at stake. M and I have picked $5 million as our FI number. We probably don't need that much. I prefer to save more, just in case, to be prepared for medical costs, possible long term care etc. Picking $5 million puts us in the position to help our children and our parents too if need arises and still remain secure. We want to get there in 20 years (2037) or less. Not a small feat. The first milestone – the first million – is set for June 1, 2023. I'll let you know how that's going year to year. What do you think? How fast are you paying off your loans? Have you picked your FI number? Comment below.]]>

Read MoreThis is part 3 in a series of posts on Financial Advisors.

Part 1 covered the license designations an FA can and should have. Part 2 covered how FAs should get paid. Part 4 – How to find and vet a financial advisor Part 5 – I fired my financial advisor Today, we’re going to discuss another area of confusion – when you think you want a financial advisor but what you really need is a financial planner. Wait, aren’t they the same thing? All financial planners are financial advisors. But very few financial advisors (FAs) are financial planners (FPs). Most FAs don’t do much but manage your retirement funds. A financial planner incorporates your savings and retirement funds into your overall plan, but only as one of the necessary components needed to help you meet your goals. In other words, your portfolio is not a financial plan! The term Financial Advisor is part of the problem. Most people are looking for a Financial Planner, not an FA. It’s partially semantics, but most FAs seem to be mainly portfolio managers ± commissioned salesmen. Building a proper portfolio and managing it is actually quite simple and takes little time once a year once set up. Really. It boggles me that people are paying someone 1% or more to do this and nothing else. OK, so maybe you don’t understand how to invest (index funds, stocks, real estate, etc.) – you won’t do badly by following a simple portfolio that the Bogleheads recommends or try one of these portfolios until you learn more. Let’s look at it in familiar terms:

- A typical financial advisor is like a doctor who always writes the same prescription to every patient. No history, no vitals, no work up and no follow up.

- A financial planner, on the other hand, never prescribes without a complete history (your money history and habits – your psychology) and work-up. Expect to spend the first several meetings with your FP to delve into you and your goals and then together, develop the right plan for you.

To break it down into more detail, what can you expect when you hire a fee-only financial planner? Here is what s/he will do for you:

- Clarify goals. Sure, we all want to retire at some point but, what about between now and your retirement? What happens after you retire? What does “being retired” mean to you? A financial planner will help you have these conversations and ask the “what if?” questions such as “What kind of lifestyle do you plan in retirement?”, “How much do you plan to save for your kids’ college?”, “Do you plan to work part-time at some point?” and so forth.

- Coordinate your financial decisions with your taxes. A financial planner, especially one who is a CPA, is trained to help you minimize taxes as they include tax planning in your ongoing plan.

- Make sure your assets are PROTECTED. This includes a review of not just your insurance policies but a discussion about other areas in your life that may be exposed, such as side businesses, your legal documents, things your kids may be involved in, property, etc.

- Discuss your cash flow (a fancy term for budgeting). If you find that you and your significant other are having trouble seeing eye-to-eye with your spending habits, having an impartial planner to mediate can help you work on a realistic spending plan. Seeing as many arguments between significant others revolve around money this also will help the longer-term health of your relationship.

- Help you adjust for course corrections. How often does living in the now distract one from their goals? Financial planning is not a report you get once a year. Your planner is engaged in your life so that when you get pregnant, change jobs, buy a new house, move your parents into assisted living, etc. your planner is there to adjust your projections and help you absorb the impact on both your short- and long-term plans. This allows you to make course corrections early when it can make the most difference for the long term. Taking a few extra shifts now or driving your car a couple of years longer while you’re in your 30s and 40s is a lot easier to swallow than finding out you’re way behind on your retirement goals when you’re bumping up on age 60!

- Remind you of your goals when you start to veer off course. Almost all (or ALL?) investing mistakes are due to behavior (selling during market corrections for example) and having an FP there to stop you is priceless. Almost all of us will want to veer off course at some point.

- See into the future! Yes, a financial planner will take a look at how you are spending your money today, your goals, your savings habits, your work habits and your retirement benefits and project your chances of being able to have that bungalow on the beach with the little umbrella drink at age 55. Sure, it’s an educated guess, but having a guide is very motivating.

- You and the FP will create a financial plan that will guide you on decisions. Of course, the plan is dynamic and will change over time. Circumstances and goals change more often than you think.

To sum things up, a good financial planner will go over your financial house with a fine-toothed comb. Real financial planning is not cheap and you must be willing to dedicate time and energy to the process – it is your money and your future, after all! I consider full service financial planning a luxury service. I see a lot of people asking isolated questions such as “Should I max out my 401(k) or pay down my loans?” “Should I pay down my student loans first or buy a home?” This is a symptom that there is no financial plan. They are asking for a temporary Band-Aid instead of a true assessment of their needs and a well thought out prescription or financial plan. A good FP will teach you as well instead of blindly taking care of your finances. You need to have a baseline knowledge base to get the most out of this relationship. Here is a sample start-up agenda that a good FP will go through with you. Next, is the the next part of this series. What do you think? Did you know that financial planners did all this and more?

Read More 44 million borrowers owe over $1.5 trillion as of 2019. And we know medical school loans are especially high. So how do you take off some of the pressure? Look for better interest rates! If you live near First Republic Bank, you can use them to refinance for a better student loan rate. Here's how I took advantage of what First Republic Bank offers and how you can do the same, plus snag $200!

How to Refinance with First Republic Bank

First things first. Check your location. Do you live in one of the cities marked above?- New York City

- Greenwich, CT

- Portland, OR

- Palm Beach, FL

- Various cities in Northern and Southern Calfornia

OK, so what's the catch?

You must:- Live near a physical branch.

- Meet their salary requirements and may need a certain % of your debt liquid in your main checking account.

- Open a checking account with them and use it as your main checking. That means your main source of income must be direct deposited there.

- Maintain a minimum balance of $3,500 a month and you must auto-debit the loan payment from this account.

- Pass a credit check.

More Considerations When You Refinance with First Republic Bank

- The minimum loan is $40,000 and the maximum is $300,000.

- Their checking account refunds ATM fees!

- They will refund you up to 2% of paid interest if you pay back the loan in 2 years!

- If you get approved for this loan but move away from a physical branch, this does not affect the loan as long as you keep your primary checking account with them.

How Do I Get Started?

This is an amazing deal if you meet their requirements. If you're ready to take the plunge, contact Kerry Berchtold at kberchtold at firstrepublic dot com or 339-235-0419. Don’t forget to mention Miss Bonnie MD to get your $200 once you’re approved!Final Thoughts on Refinancing with First Republic Bank

In March 2017, First Republic Bank approved my refinance! I chose the 5-year term at 2.25% fixed for $88,000 of my loans. My strategy was to”force” myself into a 5-year repayment, since I do my best financially when things are automated. If you're ready to tackle your student loans and you want to refinance to lower your interest rates, reach out to First Republic Bank today.]]> Read More

Part 1 covered the license designations an FA can and should have.

Part 3 – What's the difference between a financial advisor and planner?

Part 4 – How to find and vet a financial advisor

Part 5 – I fired my financial advisor

Today we’re going to talk about how FAs get paid. If you have an FA and you don’t know where every cent of your FA’s pay is coming from, then you may have a problem. In fact, I doubt you are working with a fee-only FA since they are in the minority.

Fee-only and fee-based sound almost identical – and the industry is counting on you not to know the difference! Fee-based FAs can be compensated by the client (you) but also by commissions from selling insurance products and/or loaded funds and/or referral kickbacks for referring you to another professional such as an insurance agent, etc. Fee-based financial advisors can be motivated to make recommendations that make them more money.

Common sense, right? In other words, fee-based FAs are not held to a fiduciary standard. Please note that just because an FA is fee-based does not mean they are “bad.” The analogy here is how most physicians are paid. As a dermatologist I do make more money if I do more procedures on you, but that doesn't mean I will just for my financial interest.

So, what is the fiduciary standard? It’s like the Hippocratic Oath for FAs: an oath that they (the FA) will put your interests ahead of theirs. By being a fiduciary they must disclose to you any potential conflict(s) of interest and be transparent about how they are paid. In contrast, fee-only FAs, are paid by only you, the client.

A fee-only FA cannot get paid by selling you insurance products or loaded mutual funds. These FAs are true “fiduciary” advisors. Fee-only FAs should always be willing to sign an agreement stating they are a fiduciary and will always act as a fiduciary in any financial transactions with you.

A good way to ensure a potential FA is fee-only is to see if they are a member of NAPFA, the National Association of Personal Financial Advisors. NAPFA is the most recognized national organization of true fee-only FAs. To qualify for NAPFA membership, the applicant must submit a financial plan for review, take an oath to be a fiduciary in all client relationships, and comply with annual continuing education requirements.

Not all true fee-only advisors are NAPFA members, but all NAPFA members are true fee-only advisors. If you are vetting an advisor who is not a member of NAPFA, simply ask your prospective advisor to just sign a fiduciary agreement. NAPFA has a template on their website that you can use.

Remember, no one will care more about your money than you. Next in Part 3, we'll go over what real FAs do.

Do you know how your Financial Advisor is paid?

Read MoreThis is Part 1 of a 5 part series on Financial Advisors:

Part 2 – “What the F? – fee-only vs. fee-based and the fiduciary”

Part 3 – What's the difference between a financial advisor and planner?

Part 4 – How to find and vet a financial advisor

Part 5 – I fired my financial advisor

There is a lot of confusion and distrust around Financial Advisors. It doesn’t help that there are several reasons why your beliefs are justified.

First, anyone can call themselves a Financial Advisor. Did you know that? I can. You can. Just tell people you are and people will believe you. OK, well isn’t there a license real FAs need to get? Sort of. In some ways, this is one of the most highly regulated professional fields you can find. But people have found ways to get around the regulations, and that is what you need to understand. There are over 100 official “license” designations and “financial advisor” is not one of those designations, just a description that anybody can use to describe themselves.

It’s not that different from non-dermatologists calling themselves dermatologists. In fact, there are doctors who trained in family medicine or internal medicine who literally take a test and pay a fee to get a bogus certification without formal training. How can the public really know the difference since both can say they are “board certified”?

The American Board of Dermatology (ABD) is the official body certifying dermatologists. This requires 4 years of formal residency training (after successful completion of medical school) followed by a board certification exam. Like all other specialities, annual continuing education and other measures are required to maintain certification. Throughout residency I had to prove I attained certain milestones and underwent biannual evaluations to ensure I would practice dermatology safely. Again, unless you are a “real” physician, how can you possibly know the difference?

There is no official “Financial Advisor board.” Some, just like the sham dermatology board I mentioned above, simply require a test and a fee. Some don’t even require a test! The good news is that there are only 3 that I believe really matter.

- Certified Financial Planner™ or CFP®

This is probably the most recognized certification for financial planners. The CFP® Board of Standards governs CFPs. A CFP requires: a college degree, completion of a series of courses that cover 6 areas of planning and ethics, 3 years of experience in financial planning, passing a background check and passing a 10 hour exam. Just like doctors, CFPs must complete annual continuing education and renew their licenses every 2 years. The CFP emphasizes the importance of the financial plan in addition to managing investments.

- Chartered Financial Consultant or ChFC

ChFCs was introduced as an alternative to CFPs for insurance-focused professionals. The main difference between ChFCs and CFPs is that ChFCs do not need to have a college degree or pass a comprehensive exam. This is a popular designation for insurance professionals.

- Certified Public Accountant/Personal Finance Specialist or CPA/PFS

A CPA in good standing can get the companion designation PFS by completing 75 hours of personal finance education and experience, passing an exam, and paying a fee.

Stay tuned for Part 2 – “What the F? – fee-only vs. fee-based and the fiduciary”.

Read MoreIf you work for a large healthcare provider, you may have access to a 457(b) retirement account in addition to a 401(k)/403(b). Are you using it? Maybe yes, maybe no. You might want to use your hospital's 457(b).

Here's why:

The Benefits of Your Hospital's 457(b)

- Tax benefits! With your hospital's 457(b), you can invest an additional tax deferred $19,000 annually (in 2019). This escalates to $24,000 annually if you are over 50. Why do this? This lowers your taxable income. Like a 401(k), you pay income tax when you withdraw. Some 457(b)s even offer a Roth option.

- Flexibility! In addition, you can withdraw this money before age 59.5. This is great if you are planning early retirement. Why? Unlike the 401(k)/403(b)/and most IRAs, you'll have access to your money earlier.

Understanding The Types of 457(b)s

There are 2 types of 457(b)s and it's important to know which type your employer offers. There are governmental (or public) and non-governmental (or private) 457(b)s.

Governmental 457(b) Options

If you have a governmental 457(b), this is a “no-brainer”. You should use it if you need more tax advantaged space to save in. Of course, this also depends on if the plan costs and fund choices are agreeable. Public 457(b)s can be rolled over into an IRA or 403(b)/401K(k) when you leave the job.

Private 457(b) Options

Private 457(b)s are different story. The money you deposit technically belongs to your employer and can be used to pay off employer's creditors. This is only an issue if your hospital goes under. A good way to see if your hospital is afloat is to check their credit rating. I know this sounds scary but as far as I know, no one has lost their 457(b).

Exploring Your Hospital 457(b) Plan Options

The next step is to find out what the distribution options (if there are any) are when you leave the job.

Some plans make you take out one lump sum on separation. This is a lousy option, and I would hesitate using it.

You want multiple options. Preferably, you can defer distribution until retirement age and take money over time to control your taxable income. The main “con” of a private 457(b) is that you can only roll it into another private 457(b). Another catch is this. Your new private 457(b) would have to accept rollovers, and they don't have to.

Your best bet is to always get a copy of your employer's 457(b) plan as details can differ widely.

Final Thoughts on Your Hospital's 457(b) Plan

A 457(b) is a way to have access to your money before age 59.5 besides a taxable account

Your retirement savings plan should include different types of accounts to diversify. A 457(b) is a way to have access to your money before age 59.5 besides a taxable account.

I am using my hospital's private 457(b) account. I almost maxed it out last year ($16K) and will be maxing it out this year. My 457(b) plan is low cost and has a limited fund list but does include some basic Vanguard funds. Fortunately, the distribution options are very flexible so upon leaving this job, I can defer distribution until retirement age.

Since this post went live, I left the hospital job. I chose to cash out my 457(b) despite being able to leave it there indefinitely. Why? I wanted total control over the money. Yes I paid income taxes on it. I promptly deposited the check into my Vanguard taxable brokerage account. With the changing and unstable landscape of medicine, I do not want to depend on the hospital staying afloat.

No matter where you are in your career or where you are on your retirement journey, inquire about your 457(b) plan that your hospital offers. You might be able to get your hands on some serious tax-time benefits and add more flexibility to your retirement plan.

Does your job offer a 457(b)? Do you use it? Why or why not?

Read MoreApologies for the hiatus. I was in Hawaii for CME and play. I also got engaged! The above quote is what M said to me (after he promised some other important things like love and happiness).

There are 3 major things in life to insure against – death, disability, and divorce a.k.a. (term) life insurance, disability insurance, and the pre-nuptial agreement AND making sure you and your partner are compatible, especially when it comes to money. Everyone agrees on the first two, but so many neglect the last. People simply think they won't get divorced – it's everyone else. Unfortunately, statistics show otherwise.

The internet has several articles on the leading causes of divorce, but let's look at this one from the Huffington Post. Finances is #7, but #4 “Not having a shared vision of success” includes financial goals too. In any case, I think everyone can agree that being on the same page money-wise is an area that couples need to agree on.

Love feels great, but ultimately a successful marriage is based on much more than that. The NY Times' questions to ask before marrying has finances as the second question:

“Do we have a clear idea of each other’s financial obligations and goals, and do our ideas about spending and saving mesh?”

Around the third month of dating M I asked him how much money he had saved for retirement and what debt he had. I divulged mine as well. We talked about our shared goals like to work in jobs we enjoy, take two big trips a year, live partially abroad in the future, etc. In fact, we drew up an IPS or Investment Policy Statement. OK, I drafted it and he approved it :).

And, I'll let you take a look at our first draft from a few months ago as an example. This document was the culmination of M and I discussing our goals as a couple. We have also discussed how we feel about financial obligations to our parents should that arise.

We recently hired a financial advisor in prep for combining our finances. I realize most of the finance blogs out there promote DIY and I was more than comfortable doing that for myself. I felt more was at stake with managing our finances. I'm also no spring chicken so we don't have much wiggle room for big mistakes – we have ambitious financial goals.

By the way, we did all of the questions in that NY Times article.

And finally, we have discussed the terms of a pre-nuptial agreement, stay tuned for that.

What do you think? How financially compatible are you with your partner? What questions did you wish you asked?

Read MoreA great thing to do if you know you want kid(s) and are able to is to start funding their college account now.

Why? The cost of college tuition has been outpacing inflation at an astronomical rate. I started college in 1995 at Barnard College in NYC. Tuition at that time was ~ $20,000. 2016-2017 tuition is $48,614. That's over a 200% increase in tuition in about 20 years. I qualified for financial aid and only had $16,000 in loans when I graduated in 1999. Lucky indeed.

Of course, medical school was a different story and that tacked on another $150,000 in loans, but knowing how much other students graduate with now (> $300K !), I still consider myself quite lucky. I qualified for financial aid at Columbia and received a half tuition grant ($20K) and took out only Stafford loans and a private loan from Columbia funded by alumni.

The noose I feel around my neck from these loans is enough for me to want to not have this (entire) burden for my (future) kid(s). So much so that I started a 529 account NY in 2016. A 529 account is an account that you contribute post-tax dollars into that grows tax -free and can be withdrawn tax-free if used for qualified educational expenses. Kind of like a Roth IRA for education (which btw, you CAN use your Roth IRA for qualified educational expenses, but it should not be earmarked as such!) There are numerous 529 accounts and they are state sponsored.

NY is one of the states that allows a state income tax deduction on 529 plans (up to $5,000 per year). You can also benefit from this tax break even if you live outside of NY as long as you have NY income. So I am currently funding this account up to the state income tax max deduction per year. I expect that in about 5 years, I'll be able to increase that to $10,000 per year. I should have anywhere between $150,000-$250,000 in that account once said kid attends college. Time is on my side. Note that the annual limit to contribute to a 529 is limited to $14K per person or $28K per married couple to avoid possible gift taxes and for 529s, you can actually front load the account 5 years at a time.

I do not feel the need to fully fund their college education. Mainly because I may not be able to due to my late start at my own savings (as far as I know, there is no such thing as retirement loans) and I do want my kid to be grateful and have “skin in the game” for their education. I do not think most people appreciate things given to them for free. M and I also feel strongly that unless our kid gains acceptance to a top private school (aka Columbia, NOT Colgate) then they can go to state school.

Edit: You'll need to name yourself as the beneficiary until the kid is born.

Do you have a 529 account for your kid(s)? Are you planning on fully funding their college education?

Read More