Marriage & Children

Most of the time I feel like I am running around like a chicken with my head cut off. Juggling being a dermatologist 4 days a week, mom to a toddler, fiancé and running this website (& podcasting !) can be challenging to say the least.

Wednesdays are my “day off” from seeing patients. I initially took Fridays off to have a 3 day weekend. But I found that with a new baby, traveling on the weekends stopped happening. I also found that many businesses and appointments I needed to do were difficult to schedule on Fridays either due to them closing early or being closed or Friday being so popular I could never get in. I also found that my patients wanted Friday appointments. I guess not too many dermatologists are open on Fridays.

So how do I spend my non-clinical week day? Here is how I spent it a few weeks ago.

6:30am Alarm goes off. I snooze too many times (Every Wednesday, my plan was to get up around 6am and do some writing for my blog before Jack wakes up. It has yet to happen.)

I finally get up around 7:30am. I make coffee.

I sit in front of my powerbook to see what I could work on writing wise by checking into Asana. I recently started using Asana to organize my whole life. Got this awesome tip from Travis of Student Loan Planner and Ryan Inman of Physician Wealth Services while I was at FinCon recently.

Jack starts cooing and babbling. He greets me standing in his crib. I change his diaper and bring him to dad who is still snoozing. They share some morning snuggles.

Jack starts cooing and babbling. He greets me standing in his crib. I change his diaper and bring him to dad who is still snoozing. They share some morning snuggles.

I make breakfast for Jack – 1 egg omelet with cheese, slices of oatmeal cake (from the Baby Lead Weaning Cookbook), sliced grapes and a cup of whole milk.

I skip breakfast as I do intermittent fasting most days.

8:45am I drop off Jack to daycare. His daycare is across the street – priceless.

I walk back home and half write a blog post, respond to some emails and comment on Facebook posts.

11:30am I head out to have lunch with Camilo of the Finance Twins. We met at FinCon and turns out we are both in Philadelphia. We chat about how we started our blogs and exchange ideas and tips for our budding businesses.

I uber back to my neighborhood for a 2:30pm dentist appointment. I get gently scolded for not flossing the back teeth. He suggests I use a waterpik.

I uber from the dentist to happy hour at Double Knot with a friend. In case you live in Philadelphia – this is the best happy hour deal in town.

I’m home by 6:30pm. Jack is eating dinner. Neither of us feel like cooking so it’s pizza night.

7:15pm Jack gets a bath. Then playtime with mom and dad. Bedtime for Jack is at 8pm.

Mom and dad time. I think I do some more work for the website but likely am just wasting time on Facebook.

Bedtime for me is around 10pm since I get up around 5:30am the next day and start seeing patients at 7am.

Hope you enjoyed this peak into a random day!]]>

Read Moreif any, for your kid(s)'s education & life is a personal decision. There is no simple answer. I don't recommend doing any of these if your finances are not in order. Remember, there is no such thing as a loan for retirement. My 1 year old already has 3 accounts and about to open a 4th. Why? To take full advantage of time and compound interest of course. Here they are in order of when we opened them.

1. 529 College Fund

529s are the king of college savings accounts. You contribute after-tax money in, it grows tax free, and you don't pay taxes on withdrawal. You may even get a state tax deduction for your contribution. You can also open one before your child is born! So if you know you're going to have children and get a decent state tax break like I did when I was living in NYC, it's not bad a idea to get one going. Where should you open one? Start with your own state's plan. If you get a state tax break you'll want to find out if you're limited to using your state's plan to qualify for a deduction or not. A few states, including my now home state of PA, allow you to use any state's plan. So, I've kept mine with NY which currently offers the lowest fee Vanguard funds. We currently invest it all in the Aggressive Growth Portfolio which consists of 70% Total Stock Market Index Fund and 30% Total International Stock Index Fund. If your state offers no tax deduction then I recommend NY, Utah, or Nevada's plan. Pick Nevada if you already invest in Vanguard and want to keep things clean. Don't overthink it, just pick one. And – make sure you select the direct plan and not the plan via a financial advisor which are loaded with extra fees. There is a penalty if you withdraw money for non-educational purposes. Because of this I recommend saving something like 70% in a 529 and the rest in either a UGMA/UTMA or your regular brokerage (aka taxable account). There is a special rule allowing parents to frontload 529s above the gift tax limits. You may frontload 5 years worth (5 x $15,000 or $30,000 = $75,000 or $150,000). For those that can swing this, this is a great way to get that money growing for college.2. UGMA (Uniform Gifts to Minors Act)

UGMA & UTMA are basically savings and/or investing accounts for your children. You own the account as a custodian until junior reaches the age of majority. This age is state dependent but usually ranges from ages 18-21. Once they reach this age the account belongs to them and you lose control. Since this is an asset your child owns it will be counted for college financial aid calculations. The money can be used for anything. On the flip side, interest, dividends & capital gains are taxed. The taxation recently changed with the new 2018 Tax Law and will be taxed like trusts (15% & 20% tax above $2,600 & $12,700 respectively). Previously, the first $2,100 of unearned income (interest, dividends & capital gains ) was not taxed.3. Coverdell ESA

Huh? That's the usual response I hear when I recommend this account for children. I already discussed how great ESAs and how you can fund one despite being over the income limit (kind of like the backdoor Roth IRA). You can only contribute $2,000 a year but over time (and compound interest) you can have a sizeable chunk of cash to use for either private school and college. Although there is a new ruling allowing up to $10,000 per year withdrawals from a 529 account for K-12, not all states have adopted this. I also don't recommend doing this unless 1) you get a nice state income tax deduction (like NY) and/or 2) you frontload your 529 at or near birth. Otherwise the money just won't have much time to grow if you keep withdrawing money from it. Unlike the 529 plan, you cannot open one before your child is born.4. Roth IRA

[caption id="attachment_2545" align="alignleft" width="351"] Jack's Korean Dol outfit[/caption]

We haven’t opened a Roth IRA yet but will before the end of this year. Children can open a Roth IRA if they have earned income. Chores around the house do not count. Babysitting and working for your business do. In Eggy’s case, he’s a print model for this website.

What, you think he let me use this photo for free? Nope.

A Roth IRA for your children via a family business is a win-win situation. You pay your child for work, you get a business deduction, he/she gets earned income and can open a Roth IRA. Once inside the Roth IRA, the money is never taxed again! Better yet – until he makes a sizeable income through the family business he won't pay federal and likely no state income taxes as well!

Now, the key is to pay your child a reasonable wage for the work. It won't pass the snuff test if I paid Eggy $5,500 for a few photos on this website.

A quick reminder to stay under the gift tax limits for total contributions to your children's 529, ESA, and UGMA/UTMA accounts. Currently, the gift tax limits are $15,000 or $30,000 for married couples. So, in other words, don't contribute more than $30,000 across the 3 accounts in a year. An exception to this is the 5 year frontloading exception for 529s.

We opened and kept his 529 in NY. His UGMA and ESA accounts are at TD Ameritrade. We plan to open his Roth IRA at TD Ameritade since Vanguard does not allow minor Roth IRAs.

What do you think? Comment below!

]]>

Read More

Jack's Korean Dol outfit[/caption]

We haven’t opened a Roth IRA yet but will before the end of this year. Children can open a Roth IRA if they have earned income. Chores around the house do not count. Babysitting and working for your business do. In Eggy’s case, he’s a print model for this website.

What, you think he let me use this photo for free? Nope.

A Roth IRA for your children via a family business is a win-win situation. You pay your child for work, you get a business deduction, he/she gets earned income and can open a Roth IRA. Once inside the Roth IRA, the money is never taxed again! Better yet – until he makes a sizeable income through the family business he won't pay federal and likely no state income taxes as well!

Now, the key is to pay your child a reasonable wage for the work. It won't pass the snuff test if I paid Eggy $5,500 for a few photos on this website.

A quick reminder to stay under the gift tax limits for total contributions to your children's 529, ESA, and UGMA/UTMA accounts. Currently, the gift tax limits are $15,000 or $30,000 for married couples. So, in other words, don't contribute more than $30,000 across the 3 accounts in a year. An exception to this is the 5 year frontloading exception for 529s.

We opened and kept his 529 in NY. His UGMA and ESA accounts are at TD Ameritrade. We plan to open his Roth IRA at TD Ameritade since Vanguard does not allow minor Roth IRAs.

What do you think? Comment below!

]]>

Read More

This is Part 2 of Making A Million Dollar 18-year Bet, a guest post by Platinum Sponsor Johanna Fox of Fox & Co. Wealth Managementt, a fee-only financial planning firm. Start as early as you can As Bonnie says, compound interest is the 8th wonder of the world – you want to make it work in your favor. If you can afford to begin at birth, choose the most aggressive portfolio possible and contribute at least enough to get your state’s annual income tax break. Learn the rules in your state, too: some states allow tax breaks for contributions to other states’ plans and the cutoff for contributions vary: 12/31 in some states and 4/15 in others. Even if you can only afford to fund a minimal amount at birth, start with something as long as you are not compromising your retirement goals. In the Varkeys’ case, assuming 7.5% average return, choices include (not considering the time value of money):

- Frontloading the 529 with $108,859 (because they are allowed to frontload $75k/person, they can split the gift and fully fund college). OOP savings = $384,801

- Contribute $27,500/yr to the baby’s 529 for 5 years. OOP savings = $351,660

- Make monthly contributions of $818/mo. for 20 years. OOP savings = $297,380

Use ESAs for lower grades

Our couple hopes to send their children to private high school. In this case, we recommend they add Coverdell Education Savings Accounts (ESAs) in addition to 529s. ESAs are often overlooked because:- Contributions are limited to $2k/yr per child and

- Those with income over $190k are phased out from contributing (but you can get around this).

Underfund your 529s and ESAs

This may sound contrary to the key principle “start as early as you can”, but please bear with me and it will make sense. My goal is to use up all of the money in your tax-blessed accounts. Otherwise, in general, you’ll pay a 10% penalty on funds you withdraw that are not used for approved education costs. There are exceptions to the 10% penalty, such as if a child gets a scholarship, but not for just having money left over. Of course, you can pass account leftovers down the line to younger siblings, and we plan to do that, but I’m trying to keep it simple – say, you don’t need as much because your children decide to start out at a community college or want to go to a state school with a best friend, or, even worse, follow a boyfriend or girlfriend there. How can you possibly plan for that? To mitigate that risk, we recommend that about 75% of projected expense goes into ESA/529s, with the remaining 25% going into a taxable investment portfolio. When following this recommendation, start the taxable account only after you have funded the 75% in 529/ESAs, which will maximize your tax-free funding. If you end up needing the taxable account, you’ll be able to take advantage of lower long-term capital gains and dividend rates. If you don’t need the taxable account for education, voila! Can you say “beach home?” So what about med/grad school – what should the Varkeys do? At this level of income with 3 children, they will probably need to raise their family in a LCOL area of the country, plan to work extra shifts for a few years (if that is an option), determine to be extremely frugal, or save to fund a less expensive college experience – after all, they are saving for 6 educations. Possibly forego the private high school. Or they could save only enough for 50% of med school (1.5 educations instead of 3.) Remember, planning is about prioritizing how to allocate limited resources to achieve your goals. We’re back to priorities – what are your priorities about lifestyle and education? It’s very important to get those figured out in the beginning rather than simply saving what’s left over in your bank account each month. For example, one of our clients in this very situation has opted to set aside enough for med school for one child using the 75%/25% rule. If one or both of the other two siblings also decide to be physicians, then we are planning to have enough saved in a taxable account to also send them. This couple lives fairly frugally and in a LCOL area.Finally, invest aggressively if you can self-fund

Here’s the way I look at it – if you can cash flow the early years, particularly private K – 12, then you should keep your savings invested in a well-diversified equity portfolio up until the time you need it. If the market is down, we would plan to pay cash for private high school in this situation. If the market is climbing, we’ll liquidate enough of the 529/ESAs to pay the tuition annually. The 75/25 rule comes in handy again to prevent you from over-saving. And, of course, you can allocate your own savings any way you want: 60/40, 80/20, and so forth. By thinking through your choices, resources, and priorities, and then following your plan, you will have a much clearer path to saving for huge expenses that seem too far away to even think about when your children are young. I hope this information has been helpful!]]> Read More… (or Smart ways to fund your children’s education) This is a guest post by Platinum Sponsor Johanna Fox of Fox & Co. Wealth Managementt, a fee-only financial planning firm. Until recently, she was also our financial planner. Saving for college is on the minds of most of our clients since around 75% either have young children, are pregnant, or both. The amount you need to save for education depends upon the choice of college, how many children you have, how much your funds grow, and the percentage of college, grad school and/or med school you want to fund. For a family with even two young children, you can easily looking at a need of $1M – $2M by the time they are ready to start college, especially if you plan to fund post-grad. Of course, that’s not even considering private school for K-12. Planning ahead and doing it right will both save taxes and increase your long-term net worth. But planning so far into the future for little creatures with minds of their own is a daunting and expensive challenge. To explain how to build an education savings plan for your own family, let’s review a case study. I’ve built a composite family, the Varkeys, using details from several clients’ plans:

- Dual physician family earning $680k/yr with children ages 2 and 6 plus another on the way

- Want to save enough for 4 years at Georgetown University, their dad’s alma mater, and maybe medical school.

- Hope to send children to private high school @$15k/yr/child.

- Student loans of $150k, refinanced @3.875%

- 2 mortgages: $850k on a $1.3M house and $450k on a rental duplex

- One spouse has access to a 401k and the other has access to a 403b/457b combo, and they both do annual backdoor Roth IRAs.

- And by the way: they hate debt

Prioritize

One of the biggest challenges of planning is prioritizing how to allocate limited resources to achieve your goals. The first rule in saving for education is not to sacrifice your own future: there are no scholarships for retirement and you will not be doing your children a favor by providing for nice educations at the expense of having to rely on them in retirement. However, you may be able to forego some retirement savings in the near term in favor of early education savings, and then get back on schedule. So, if your projections show that you will be able to skip a few years of 457b and backdoor Roth IRA contributions and have a few million dollars left at death, and that’s the only way you can fund your education accounts, then we might consider frontloading education to launch early tax-free growth and then return to maximizing all retirement space possible. Save for school or pay off debt? Since the debt feels so burdensome, I wouldn’t have a problem attacking the student loans heavily for 3 years but not the mortgage or rental interest. The reason is that student loan interest is not deductible, and lingering student loans are oppressive to many graduates because it represents nothing tangible. The interest on the mortgage is deductible as an itemized deduction and the interest on the rental will be deductible at some point – either when their rental begins to show a profit or when they sell it. And having tangible assets that are appreciating in value mitigates the emotional aspect of paying for “nothing”. Note: If you have access to an HSA, I would not forego contributing – ever (but that’s another article.)]]> Read MoreWelcome to another installment of Interviews with Real Female Physicians. The goal of this series is to share their story so that you, the reader, may learn and be inspired from their experiences – good and bad. We all come from different backgrounds and have different situations. Some of you are married, some are not, some with kids, some with blended families. Let’s show other women that any of these can work financially! So let's introduce our next woman physician rockstar –Teddi.

Tell us about yourself:

I’m almost 34 and am a community based academic Emergency Medicine attending. I’m from a blue-collar background in Oklahoma. Worked full time and moved out in high school and barely graduated. Became an ICU nurse. Applied to 1 med school and was accepted (University of Oklahoma), had a big chip on my shoulder, and went into General Surgery at Northwestern in Chicago. Met my husband who’s an academic Neuroradiologist while we were both in training. I found new perspective about the balance that I wanted in my life. I quit for that reason and many more. During my PGY3 going to PGY4 year I lucked out into a spot in emergency medicine at the same institution. I did not consider the financial impact at the time, but I ended up with shorter training, no fellowship and a specialty with reasonable pay. Now I’m loving my 0.8 FTE ER nocturnist life and have a little 3-year-old daughter. We live super local and frugally because I want riches and financial independence in like 3-5 years. I’ve been investing small amounts since college, but got really into personal finance as I finished my training. I like to learn absolutely everything about a subject, so definitely can be pushy with my excitement in my activities. I love to travel and traveled extensively, pre kiddo, but we all go somewhere on a plane every month or so. I love hosting elaborate get togethers, so am working towards a dream home as soon as I can convince my hubs. Cook at least 5 nights a week and am an avid city gardener. I’m not really crafty, but more of a person that thinks they can learn anything and don’t like to pay for something I can do myself. I think financial literacy is very important and we’ve been short changed during our medical training, so I try to get the word out as best I can.Did you graduate with student loans?

I had around $237,000 at 6.8% from medical school. Nursing school was essentially free. Had made several years headway into PSLF and was kicked out on a technicality that I didn’t understand at the time. I finished training in 2016. Spouse had around $300k at 1.8%. He finished training in 2012. We didn't even keep track at first as we paid them, but from late 2015 to NYE 2017, paid off all of the remainder of initial debt around $550,000.

Financial aspects of kids

When did you have them?

Had my daughter during my second year of Emergency Medicine residency (PGY-5), which was rough, and I wouldn't recommend. Planning on having a second, which will greatly affect our home capacity and probably child-care costs.Are you planning to fund their college expenses?

We plan on paying for most, if not all. I hated starting life so in debt. Started saving the annual max last year when our daughter was 2, so only have to save for another couple of big years, then we hope the market takes care of the rest.What are your child care expenses?

We pay $1300/mo. for 3 day a week daycare and then frequent babysitting.Financial aspects of marriage

Are you married?

Yes we are married.Did you get a pre-nuptial or post-nuptial agreement?

No, didn't even really consider it but both were in massive debt.Do you and your husband agree on finances?

We are both very motivated to see some money accumulate in our bank account, but do go about things differently. He found the blogger Mr. Money Mustache first, but was already an anti-consumer and rides his bike to work. My husband prefers to play it safe with investing, and is tough to make plans with since he could live in a shack and be a radiologist forever on a w2 salary. It helped to get used to living on a fraction of my spouse’s new attending paycheck while paying down loans and using my resident salary to help fund retirement accounts early. Then we saved 100% of my new income for over a year that I’ve been out of training.Have you experienced a financial catastrophe?

Our house caught fire my second year of EM residency, but we were able to spend about 50k above the 400k-600k insurance claim to renovate it to our liking. It was very stressful at the time, but no real financial hit. Two years of a gut renovation later- we have a great townhome.

General Finances

What’s your FI (financial independence) number?

We haven’t decided. I feel pretty financially independent now without debt other than our mortgage. Maybe around 2.5 mil if we wanted to quit working completely.Who handles the finances in your relationship? Are you DIY or do you have a financial advisor?

I handle the money and we have a CFP that sold us our insurance and disability, but doesn't manage our investment accounts. We also have a CFP/CPA that does our taxes and gives us annual strategy/pep talk that is extremely helpful.What is your net worth?

$1.1 million. We include retirement accounts and the equity that we’ve paid into our mortgagesHow are you saving for FI/retirement?

Other than destroying debt with gazelle intensity – we currently have two 401(k)s, two Roth IRAs and two 457(b)s plus I have a solo 401k. We both get almost the full employer match allowed. I started a custodial account last year that we contribute to after our 529 contribution goal is met. Then we have a taxable account that I contribute to every time I make a wise financial decision like cleaning my own house or grooming my dog, etc. 90% index funds plus individual stocks. I have one 6-unit rental property that was amazing income during residency but lately has been just breaking even. We also pay extra on our mortgage every month. Now that we are done with loans, we will be ramping up our FIRE savings to work however we find most enjoyable.One thing you wish you knew:

The power of compound interest. I had student loan money sitting in a no interest savings account for like 5 years, accumulating 6.8% interest in debt. I used the money for a fancy wedding, fancy cars and multiple European vacations before I thought about financial independence. You can never out earn bad spending habits!Do you have insurance?

We are probably over insured, and now have to figure out how to back down a little since our debt is more manageable. We have disability, life, auto and umbrella insurance.What does FI/retirement mean to you? What does it look like?

One, I love to entertain and hope to have a beautiful home somewhere that is probably not Chicago one day. Two, I would like to contribute more to the future of medicine and to support women advancing in politics. I think having money lets you be totally free.Do you give to charity? If so, where and why?

I got extra interested in personal finance around the time that our current president unexpectedly took office. I’ve been concerned about the decrease in public funding of charities, so right now I donate all the profit from one side gig to different charities each month. I hope to be able to make more meaningful change when I am done with the child-creating and wealth-building phase of my career. I don’t think our taxes are required to pay for everything, so I don’t mind funding some things privately.Any parting words of wisdom?

When considering a job, things that can be readily measured get too much attention, for example, salary and vacation time. Aspects that are hard to evaluate like an interesting work environment, stress and morale are more important. Have a longer, more productive career without burnout. You can live well in an expensive area if you balance a short commute and manageable job so that you don’t have to subcontract out all the adulting (cooking, cleaning, grocery shopping, parenting) of your life. My take is to skip the fancy car, house and country club but consider living somewhere great that your day-to-day is really full of vibrant people and activities.And … that's a wrap! If you're interested in doing this please send me an email – I'd love to hear from you!

I loved reading Teddi's story and I hope you did too. I couldn't agree more with her advice about seeking a long career without burnout.]]> Read Morebefore. But what about the new tax laws? Use this guide to learn everything you need to know to get started with a backdoor Coverdell ESA.

First things first. With the new tax law allowing one to withdraw $10,000 annually towards private school, you may think the ESA is no longer needed. Not so fast.

The ESA still makes sense to contribute to even if you're not sure if your child will attend private school. It becomes a 529 if he doesn't. Ideally, you would open both a Coverdell ESA and a 529 as soon as your child is born (or better yet, open the 529 before they are born).

If you plan to send your child to private school, then ideally you would frontload the 529 x 5 years or $150,000 ($30,000 x 5 years) to give the magic of compound interest a head start.

Still, that only gives you about 5 years if you send your child to private kindergarten. It's best if you give it more time to grow if you plan to use part of the 529 for private school.

Meanwhile the ESA account is growing (yes, it is limited to only $2,000 a year), but by the time Junior is in middle school or high school, the ESA account will have around $40,000 in it.

Using the 529 for private school is even more attractive when you have a state income tax deduction and you continue to contribute to it as you withdraw annually for private school.

Most private schools in the U.S. are well over $10,000 a year, so the ESA functions as a backup reserve of tax advantaged funds to use.

Backdoor Coverdell ESA Steps

Now, how do you actually open and fund a backdoor Coverdell ESA? Most physicians are well over the income limit. There are 3 basic steps:

Step 1: Open a UTMA account and fund it.

My suggested custodians for this account are etrade, TD Ameritrade, and Charles Schwab. None of these custodians charge a fee and many of you likely have an account already at one of them. You fund the UTMA with gifted money, so this goes towards the annual gift limit ($15,000 in 2018). Note, the gift does not need to come from you.

Step 2: Open a Coverdell ESA account.

Again, I recommend the same three custodians above. And I recommend you use the same custodian for both accounts for ease.

Step 3: Transfer money from the UTMA into the Coverdell ESA.

This is the “backdoor” way to fund the ESA since the UTMA is owned by your child.

Final Thoughts on Backdoor Coverdell ESAs

We chose TD Ameritrade for our UTMA and Coverdell ESA. Right now, we don't have a plan as to how much we will fund the UTMA in general and are mainly using it to contribute to the ESA.

We also don't know if we will choose public or private school yet. Eggy was born in late 2017, and we have funded both 2017 and 2018. You have until tax day to fund the ESA.

To give your savings a head start and to let compounding do some of the heavy lifting, get started with the first step of a backdoor Coverdell ESA today.

What do you think? Do you plan to open an ESA for your child?

Read More Physician Wellness and Financial Literacy Conference aka the “White Coat Investor Conference” in Park City, UT. I got to meet WCI and many “online” friends that I had interacted with on Facebook, Messenger, and on the WCI Forums.

Jim opened the conference with “The State of Physician Financial Literacy.” He implored physicians to create the job we want now where we can work for a long time. Career longevity is more important vs. trying to “retire/reach FI ASAP.” As the conference unfolded we had two great lectures by my friend Nisha Mehta on physician burnout and what we can do about it. What I took away from the conference was to start an inquiry into what my ideal life would look like if money was not an issue. What changes can I make now to get there? (After all, I will not be FI for at least a decade.) And how feasible is it to create my ideal life now vs. “when I reach FI?“

I subsequently stumbled upon this post by WCI where he presented a Venn Diagram as a visual to visualize the discrepancy between your actual life and ideal life. Obviously the higher the overlap the happier you will be. 60% is the % overlap to “be happy.”

Like WCI, I started thinking what my ideal life would like (the green circle on the left):

Like WCI, I started thinking what my ideal life would like (the green circle on the left):

- See patients 3 days a week with no weekends or holidays

- Walk to work or commute less than 15-20 minutes

- Start the work day after Eggy gets up and be home in time to play with him for a few hours before he goes to bed (and when he is older, start work after he goes to school and be able to pick him up from school)

- See no more than 4 patients an hour and run on time

- Work out 3 days a week

- Cook most meals for my family

- Have the freedom to take trips with my family 2-3 times a year

- Work on my blog ~ 10 hours a week to keep up with regular blog posts and such

- Since my current and ideal life has M & Eggy in it, I'd like M to also work 3-4 days a week and home by 4-5pm if he wishes to work that is.

- See patients 4 days a week with no weekends or holidays – Almost there!

- Commute 30-40 minutes by car – This is a HUGE improvement from my old job where the commute was 1-2 hrs each way

- 3 days a week I work 7-3pm – so I am up around 5:30am. Eggy gets up around 7:30am. 1 day a week I work 10-6pm so I get to spend part of the morning with him.

- The job is new so I am not fully booked yet but will likely schedule 6 patients an hour and I do generally run on time

- I work out 1-2 times a week

- Cooking has become almost non-existent

- We probably have the freedom to take trips but they need to be scheduled in advance and M's job isn't as flexible as mine

- Right now I struggle to put in regular time into the blog

- Right now, M works too much and works too late and for someone who isn't a physician is “on-call” quite a bit

Carrie, me and Jim[/caption]

Hear Carrie and I discuss our thoughts on the first Physician Wellness and Financial Literacy conference aka the WCI Conference. Obviously we got to meet Jim and lots of other awesome people. Jim actually went skiing with M along with some other docs. They skied Jupiter (double black diamond in case you were wondering) and survived. One of the highlights for me was meeting lots of ladies from online at the Women's Reception.

*podcast code*

I was also a speaker at the conference. My talk was titled “Balancing Work, Family and Finances.” I discussed:

- What's unique about being a Woman Physician

- Maternity Planning for the Physician Woman

- Estate Planning Basics

- Prenup Basics

Yeah … that was an ambitious amount of material to cover in less than 50 minutes! In retrospect, I should have nixed estate planning but I figured at least some of the participants would find it useful. So many folks neglect estate planning since it never seems urgent.

I could have spent the whole lecture discussing Women Physicians. Now that I am a mother I have serious respect for all my physician mom colleagues. We have two very difficult and demanding jobs in addition to running the household, balancing the checkbook, and making sure food is in the fridge. The first step to not going insane and burn out is to first acknowledge that it is completely unrealistic that you can “do it all.” I remember not too long ago an avalanche of articles about “having it all.” It's a myth! My main tip here was to not be afraid to outsource. Yet I meet so many physician moms in barely survival mode because many of us feel guilty. Cut it out.

I don't clean my home. Nor do I do laundry (rarely anyway). I do enjoy cooking but it's been tougher since Eggy came along. I also chose to work 4 days a week instead of 5. I chose a job where I have great support staff relieving me of duties that I don't truly have to do as the physician (basic charting, basic call backs etc).

I also discussed investing in your marriage especially after having children. Too many husbands and wives neglect this. Have a babysitting budget. Spend time with your partner without the kids weekly. Take kid-less vacations.

Happy parents, happy children, happy bank account

Would love to hear tips from you – what advice would you give to a new physician mom?]]>

Read Morepush presents are a thing. And it turns out that I got the best push present ever!

About a year ago, M asked me to marry him and promised to keep our net worth positive. At that time, I was dragging us down with my student loans.

Well, not anymore! M paid them off!

Yup, I no longer have student loans. Happy dance in order:

And, we are now officially DEBT FREE !!!!!!!!!!!!

The Case to Wait to Pay Off Debt

I hear people say all the time that you don't “need” to pay off low interest debt quickly. I see their point and I wasn't planning on paying off these loans for another 3 years. Right out of residency, I favored maxing out my tax advantaged retirement accounts over making extra payments towards my student loans.

Why No Debt Is the Best Push Present Ever

Despite this argument, having no debt really feels fantastic. And it comes with some really significant perks too.

Being debt free means:

- No extra monthly payments

- A lower monthly operating budget

- Any extra money we get goes to us, not debt

Final Thoughts on Being Debt Free

Existing loans and taking on new ones (mortgage, car loans, etc) give you the illusion that you can afford something you actually can't.

Like 0% interest car loans – trust me, they aren't doing that to be nice to you. They know you will buy a more expensive car on credit even if you aren't paying interest. After all, it's just another monthly payment, right?

Couples who pay off debt together stay together. Of course, not every couple might have the means or the desire to pay off debt in one fell swoop like this. The most important thing is to make sure that you're on the same page financially, or at least taking steps to get there. Having solid financial footing before bringing a baby into the world truly feels like the best push present.

Read More2018 is well underway. Last year, M and I had a good amount of tax advantaged retirement “pots” available to us along with some employer match and contributions:

- My 403(b) + generous employer match + contribution

- My 457(b)

- My cash balance plan

- My backdoor Roth IRA

- My solo-401(k)

- His 403(b)

- His Roth IRA

- His solo-401(k)

- My 401(k) + employer match

- My solo-401(k)

- My backdoor Roth IRA

- My HSA

- His 401(k) + employer match

- His Roth IRA (may need to backdoor it this year)

- His family HSA

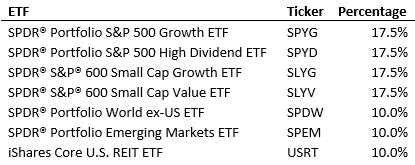

- Our taxable account

- 68% US stocks

- 17% Large cap growth, 17% Large cap value

- 17% Small cap growth, 17% Small cap value

- 24% International stocks

- 12% Large cap developed countries

- 12% Diversified emerging markets

- 8% US REITs

We will be opening our taxable account at Vanguard.

What do you think? Comment below!]]>

Read More

We will be opening our taxable account at Vanguard.

What do you think? Comment below!]]>

Read More

- « Previous

- 1

- 2

- 3

- 4

- Next »